Coinbase stock (NASDAQ: COIN) is treading just beneath a significant resistance level, drawing the gaze of traders and investors alike. With renewed energy sweeping through crypto markets, COIN is once again in the spotlight—teetering at a zone that could act as a springboard for its next rally.

Currently, Coinbase is consolidating near the $235 mark—an area that’s historically proven to be a ceiling for upward moves. Analysts highlight this price band as pivotal. If COIN manages to break through it with conviction, it could unlock substantial upside and bolster broader sentiment for crypto-related equities.

Coinbase Eyes Breakout: Key Levels to Watch ( Image Source: Trading News )

What’s Fueling COIN’s Momentum?

COIN’s recent price action reflects an upswing in broader crypto sentiment. Bitcoin’s stability above the $65,000 threshold and a rise in exchange-traded fund (ETF) inflows are helping revive enthusiasm across the digital asset ecosystem. As the only pure-play crypto exchange listed on the NASDAQ, Coinbase serves as a clear indicator of institutional attitudes toward crypto.

However, Coinbase’s rally isn’t just about market optimism—it’s also being driven by technical momentum that’s capturing trader attention.

Chart Signals: Consolidation in a Narrow Band

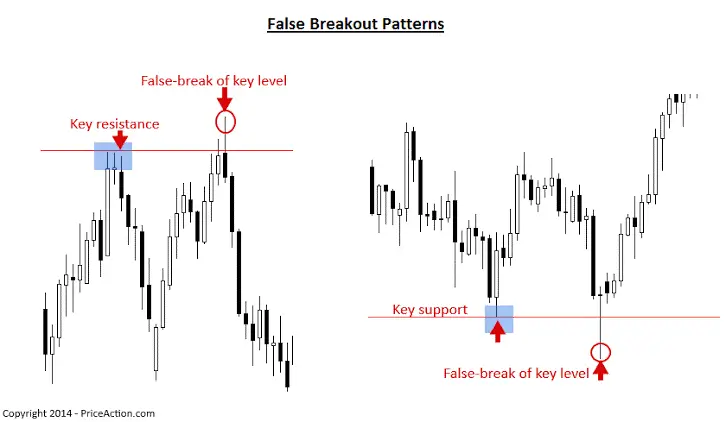

Technical analysts note that COIN has been range-bound between $200 and $235, with repeated bounces at the lower end and resistance at the upper. This sideways pattern has persisted for weeks, suggesting that a significant breakout or breakdown is likely just around the corner.

The current setup resembles a tightening coil, with traders eyeing the $235 level as the breakout trigger. Should this threshold be breached, the stock could climb toward the $250–$260 region. On the other hand, rejection from this level could result in a pullback to around $210—or potentially lower if broader tech sentiment sours.

COIN ranges between $200–$235, hinting at a breakout ( Image Source: PriceAction )

Wall Street Watching Closely

Market analysts are honing in on several key indicators. Rising trading volume and narrowing Bollinger Bands are often seen as signs of an impending breakout. Many strategists believe COIN could capitalise on crypto’s momentum, particularly as regulatory concerns begin to ease and altcoins show signs of life.

Options markets also reveal a heightened appetite for volatility. Open interest in COIN call options is climbing—hinting that investors are betting on significant upside in the near term.

Still, market participants remain cautious. Broader macroeconomic risks—from central bank commentary to inflation surprises—could temper the bullish narrative. Yet, the overall tone for now appears optimistic.

Institutions Driving the Trend

Although Coinbase remains popular among retail investors, institutional activity appears to be the real catalyst behind its recent gains. With more fund managers exploring crypto as part of diversified portfolios, COIN presents an accessible entry point that aligns with traditional equity investment frameworks.

The stock’s correlation with Bitcoin remains strong, although not one-to-one. This means that during bullish phases, COIN often leads due to leverage, liquidity, and speculation. On the flip side, COIN often underperforms during market downturns. This dynamic creates opportunities—but also calls for careful timing.

Why a Breakout Could Matter Beyond the Chart

A breakout above $235 wouldn’t just be a technical move—it would send a broader message to the market. It would suggest that institutional interest in crypto-linked equities is accelerating. It would also indicate growing confidence in the infrastructure underpinning the digital asset space.

For retail investors, it could reignite enthusiasm and lead to a wave of buying, fuelled by FOMO. For Wall Street analysts, it could justify raising price targets. And for Coinbase itself, a rising stock price could provide leverage for strategic investments, new product launches, or even global expansion efforts.

Key Signals to Track

Key elements sharp investors are closely monitoring:

- $235 Breakout Zone: A strong daily close above this level could prompt algorithmic buying and spark fresh momentum.

- Trading Volume: A surge in volume alongside a breakout would validate the move.

- Macro Conditions: Keep an eye on economic data, Fed commentary, and broader tech sector trends.

- Crypto Price Action: Movements in Bitcoin, Ethereum, and major altcoins could directly influence COIN’s trajectory.

- Options Market Trends: Spikes in call buying or implied volatility may point to insider positioning or increased market conviction.

Bottom Line: Coinbase Is More Than Just a Ticker

Coinbase is more than just a business—it stands at the crossroads of traditional finance and emerging digital technology. It’s a bellwether for how Wall Street is approaching crypto, and its movements often foreshadow broader trends.

The present chart pattern signals an approaching turning point. If the stock breaks above the well-watched $235 barrier, it could lead the charge in a wider crypto stock rally. Traders and investors—both seasoned and new—would do well to keep COIN on their radar.

Stay sharp. Watch the levels. A decisive breakout may not just confirm a technical pattern—it could define the next chapter in crypto equities.