Institutional Bitcoin ETF Holdings Dip for the First Time Since Launch

In the first quarter of 2025, institutional investors in the United States reduced their holdings in Bitcoin exchange-traded funds (ETFs) — a first since spot Bitcoin ETFs were introduced in early 2024. The figures were released in a report by digital asset investment firm CoinShares, based on data filed with the U.S. Securities and Exchange Commission (SEC).

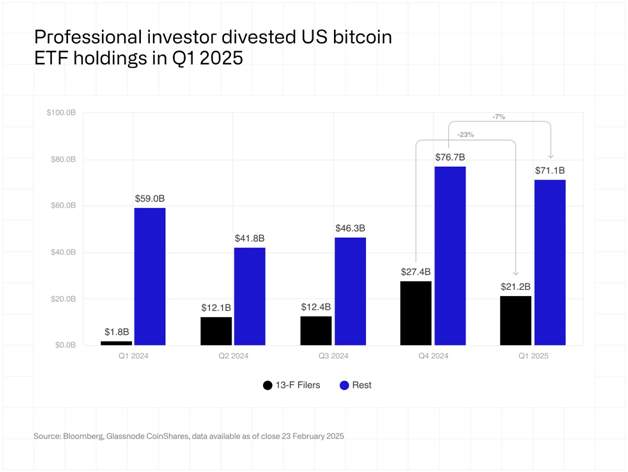

According to the report, institutional exposure to Bitcoin ETFs dropped from $27.4 billion at the end of 2024 to $21.2 billion by the close of March 2025. This represents a decline of 23% over the three-month period.

CoinShares attributed a large portion of this decrease to a decline in Bitcoin’s market value, which fell by 11% during the same timeframe. The drop in ETF values was not solely due to falling prices, however, as some investors reduced their actual holdings, suggesting that both valuation changes and asset sales played a role.

Image 1: Source (CoinShares)

Shift in Institutional Participation

Each quarter, investment managers who oversee over USD $100 million are required to report their securities positions to the SEC. These reports provide insight into trends in professional investment activity. The latest filings reflect the first significant retreat by institutions since U.S. regulators approved spot Bitcoin ETFs in January 2024.

While the overall Bitcoin ETF market in the U.S. declined by around 12% over the quarter—falling to $92.3 billion in total assets—holdings among institutional investors decreased more sharply. As a result, their share of the market reduced from 26.3% in the previous quarter to 22.9% by the end of March.

James Butterfill, Head of Research at CoinShares, noted that this drop should not be seen as institutional rejection of Bitcoin. Instead, it reflects market rebalancing and profit-taking by short-term traders, particularly hedge funds. At the same time, longer-term investors such as advisory firms increased their exposure, showing signs of continued interest in digital assets despite market fluctuations.

Hedge Funds Pull Back as Advisors Step Up

Breaking down institutional activity further reveals that hedge funds made the most significant reductions in Bitcoin ETF holdings. This group decreased their exposure by nearly a third over the quarter. Many were previously engaging in a market-neutral strategy known as the “basis trade,” which involved exploiting price differences between spot Bitcoin and futures contracts. As the gap between spot and futures prices narrowed, the appeal of this trade diminished, prompting a shift out of these positions.

In contrast, financial advisory firms increased their Bitcoin holdings when measured in actual BTC terms. This indicates that they were not deterred by the dip in price and, in many cases, saw it as an opportunity to gradually increase client exposure to Bitcoin. By the end of March, advisors represented 50% of institutional Bitcoin ETF holdings reported in the SEC filings. Hedge funds followed with 32%, down from 41% the previous quarter.

These filings also show that advisory firms now make up the vast majority of reporting institutions—81% of all SEC filers for Bitcoin ETFs—highlighting their growing presence in this space.

Institutions Adjust Strategies, but Interest Remains

A number of major investment firms increased their positions in Bitcoin ETFs despite the broader decline. BlackRock, one of the world’s largest asset managers, reported new holdings worth $217 million. Goldman Sachs and Macquarie Group also boosted their positions, investing an additional $206 million and $136 million respectively. Meanwhile, Brown University added $5 million, and Abu Dhabi’s sovereign wealth fund, Mubadala, raised its allocation to $411 million.

However, several other institutions moved in the opposite direction. The Wisconsin state pension board liquidated its entire position of $323 million. Hedge fund Millennium Management cut its exposure by $980 million, while Bracebridge Capital exited its position of $335 million. Other notable reductions came from VanEck, which decreased by $349 million, and Jericho Capital, which trimmed its stake by $380 million.

Image 2 Bitcoin (Source: Unsplash)

Despite the mixed activity, three ETFs continued to dominate institutional preferences. The iShares Bitcoin Trust (IBIT), managed by BlackRock, remains the top choice, with $12.7 billion in institutional holdings. Fidelity’s Bitcoin fund (FBTC) and Grayscale’s Bitcoin Trust (GBTC) follow, with $3.6 billion and $2.2 billion held by institutions, respectively.

Outside the ETF market, corporate interest in Bitcoin continued to grow. CoinShares data show that direct Bitcoin holdings by companies rose from 1.68 million BTC at the start of 2025 to 1.98 million BTC by mid-May. That’s an increase of nearly 19% year-to-date, as more firms adopt Bitcoin as a long-term asset on their balance sheets.

While institutional ETF exposure saw a quarterly dip of 12.8%, corporate accumulation suggests that interest in Bitcoin is still spreading across different segments of the market. According to Butterfill, this divergence is largely due to hedge funds adjusting short-term strategies, while other investors continue to take a longer-term view.

Read Also: JPMorgan to Accept Bitcoin ETFs as Loan Collateral

Advisory firms, in particular, are steadily incorporating Bitcoin into diversified portfolios. CoinShares believes institutional adoption will accelerate further as regulation becomes more consistent, and as knowledge and approval frameworks within financial firms develop.