Fed revises policy to drop reputational risk scrutiny

The US Federal Reserve has removed reputational risk from bank oversight guidelines, attracting renewed interest from the crypto industry. This change follows accusations of discriminatory debanking practices targeting over 30 tech and crypto companies since 2023. The central bank confirmed its intention to replace vague reputation standards with focused financial risk assessments in supervision. It also plans to train examiners and standardise this policy across all banks under its oversight in collaboration with other regulators.

Operation Chokepoint 2.0 drew major industry backlash

Operation Chokepoint 2.0 saw several crypto-friendly businesses lose banking access, particularly after the collapse of key US institutions. These firms argued that regulators exploited reputational risk to justify opaque enforcement targeting the digital asset industry. The decision to eliminate such scrutiny is viewed as a policy reversal and a necessary step to restore industry credibility. Crypto debanking policy had drawn concern from US lawmakers who argued that unfair practices had stifled innovation.

Operation Chokepoint 2.0

Fed confirms banks must still manage real financial risks

Despite the updated approach, the Fed reaffirmed that banks must maintain robust risk frameworks aligned with current legal requirements. The reputational risk definition had included threats from bad press that could trigger revenue loss, litigation or customer decline. While that language will no longer guide supervisors, banks remain free to evaluate reputation factors in internal governance. The Fed clarified that this policy change does not limit individual banks from voluntarily assessing reputational issues.

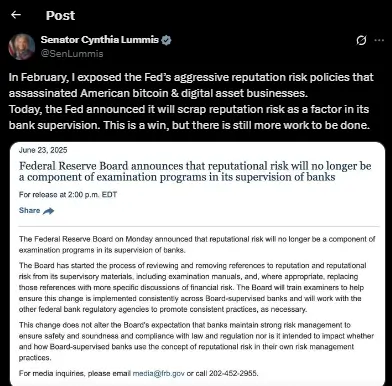

Crypto sector sees regulatory shift as positive breakthrough

The change is being celebrated by crypto advocates and industry leaders who see it as restoring fairness to financial access. US Senator Cynthia Lummis said these policies “assassinated” Bitcoin and crypto firms, and praised the Fed’s new direction. Rob Nichols from the American Bankers Association welcomed the move saying supervision will now be more consistent and transparent. He emphasised that financial institutions should base decisions on market fundamentals rather than regulatory subjectivity.

Other US regulators easing stance on crypto activities

The Fed’s update follows similar shifts by other US bodies rolling back restrictions on crypto operations and services. In May, the Office of the Comptroller of the Currency confirmed that banks are permitted to provide crypto services or collaborate with crypto firms. Additionally, the Federal Deposit Insurance Corporation issued a March note allowing institutions to engage in digital asset activities. These shifts reflect growing regulatory acceptance of the industry amid demand for innovation and investor protections.

Also Read: Samson Mow Pushes for European Bitcoin Adoption Following Invitation from French Politician

Critics raise concerns about oversight quality and transparency

Not everyone agrees with the decision to abandon reputational review in bank supervision, with some calling it risky. Opponents argue it could erode safeguards and increase systemic vulnerabilities by overlooking non-financial red flags. Others warn it could give rise to unchecked practices under the guise of free-market principles and institutional independence. Still, the overall tone from crypto and financial leaders remains optimistic as traditional gatekeeping appears to be receding.

Fed crypto reputational risk shift seen as crypto win

This regulatory shift is widely regarded as a significant win for the crypto sector in its fight against discriminatory practices. The Fed’s removal of reputational risk from its supervision model signals a broader realignment in crypto-banking dynamics. With banking access restored, crypto firms stand to gain renewed operational confidence and improved capital flow for future growth. As other regulators align in easing policies, the US may regain its leadership role in enabling crypto innovation. This evolution in regulatory posture signals a more mature balance between managing risk and embracing digital economy opportunities.