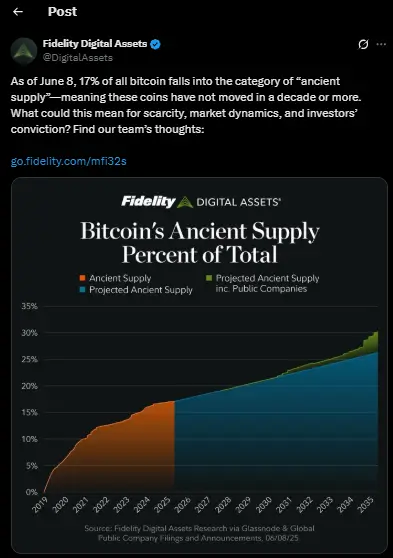

For the first time ever, Bitcoin’s dormant supply is increasing more rapidly than new BTC created through mining. This shift highlights a major turning point in Bitcoin supply dynamics, according to Fidelity Digital Assets’ June 18 report. It reflects increasing conviction among long-term holders and a reshaping of Bitcoin’s scarcity narrative in real-time. As of June 8, 566 BTC per day now moves into the “ancient supply” category—wallets inactive for ten years or more. It now surpasses the post-halving issuance rate, which has declined to only 450 BTC generated each day.

BTC Issuance Falls Behind Long-Term Accumulation

Following the April 2024 halving, Bitcoin’s block reward was cut in half, slowing its overall issuance rate. Since then, BTC issuance has dropped to 450 coins daily, while dormant wallet accumulation has continued to accelerate. Fidelity reports that 566 BTC are now added each day to the long-term holding pool, showing higher conviction levels. This shift signals a powerful change in market structure, driven by long-term investors rather than speculative short-term traders. Such strong Bitcoin accumulation data suggests growing confidence in BTC as a store of value among key market participants.

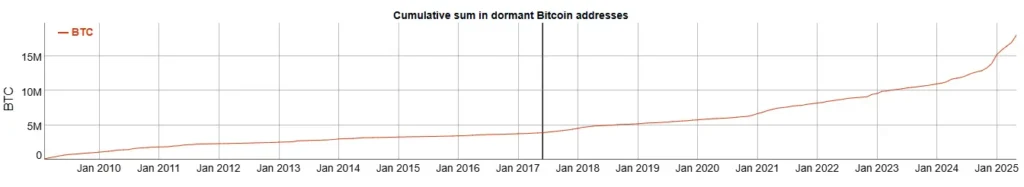

Cumulative sum in dormant Bitcoin addresses

Dormant Bitcoin Wallets Reflect High Conviction or Loss

Dormant Bitcoin wallets—those inactive for over ten years—typically reflect strong conviction or permanently lost access. At present, more than 3.4 million BTC remain unmoved for a decade, accounting for over 17% of total supply.This includes early-mined coins and wallets linked to Satoshi Nakamoto, the first known ten-year holder as of January 2019. Whether lost or held deliberately, this portion of Bitcoin remains out of circulation, tightening available supply significantly. This Bitcoin dormant supply has grown consistently since 2019, declining on fewer than 3% of days over the past six years.

Institutional Holdings Add to Bitcoin Dormant Supply

Institutional investors are playing a growing role in long-term Bitcoin holding trends, adding to supply concentration. Fidelity data shows that as of June 8, 27 publicly listed companies hold over 800,000 BTC combined. These holdings often stay locked in cold storage for extended periods, contributing to the increase in dormant Bitcoin wallets. Such entities are less likely to react to short-term volatility, reinforcing the long-term supply tightness in the market. If this trend continues, dormant supply could reach 30% of all circulating BTC by the year 2035, analysts suggest.

Short-Term Volatility Still Impacts Long-Term Holders

Despite the strong trend, even long-term holders are not immune to market uncertainty or macroeconomic shifts. Since the 2024 U.S. election, ancient supply has declined 10% of days—four times more than the historic average. Among five-year holders, this volatility is higher, with 39% of days showing net outflows since early 2025. These sell-offs have contributed to recent price fluctuations and signal that conviction can be tested in uncertain markets. Its dormant supply remains a key indicator, but it is not the sole driver of short- or medium-term price direction.

Price Impact Depends on Scarcity and Market Demand

Bitcoin’s scarcity is only one piece of the price equation; demand must also be considered in price movement analysis. When BTC issuance slows and supply held by strong hands increases, the conditions favour upward price pressure. If institutional demand and ETF inflows pick up further, Bitcoin could see sustained gains driven by limited new supply. However, without strong demand from new entrants, scarcity alone may not lead to significant upward price momentum. Long-term holding trends support price stability, but broader investor sentiment still plays a vital role in future rallies.

Conclusion

The growth of Bitcoin dormant supply outpacing issuance marks a major milestone in BTC’s monetary evolution. With more coins held for ten years or longer and fewer being created, scarcity continues to define Bitcoin’s identity. While some volatility among long-term holders remains, overall accumulation suggests rising trust in Bitcoin’s long-term value. As institutional interest grows and issuance declines, market dynamics increasingly favour those with long-term conviction.