The US Securities and Exchange Commission (SEC) has voted to approve the utilization of in-kind redemptions in spot Bitcoin and Ethereum exchange-traded funds (ETFs). The move paves the way for approved participants to build and redeem ETF shares in place of underlying crypto, like Ethereum or Bitcoin, instead of cash, and thereby simplify trade and bring crypto ETFs in sync with conventional commodity fund practice.

This is a great accomplishment under new SEC leadership and proof of opening arms for new digital assets in institutional finance.

SEC gives green light for crypto ETFs to offer in-kind redemptions, boosting liquidity and investor flexibility ( Image Source: Bloomberg )

What Are In-Kind Redemptions?

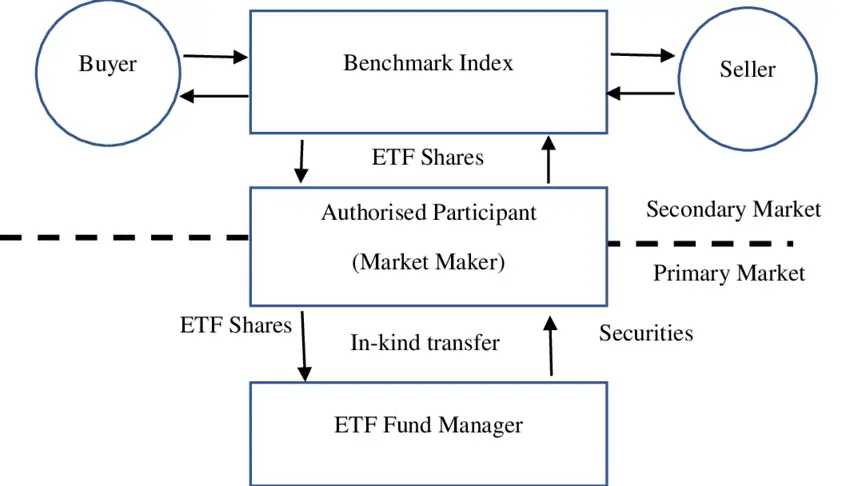

In-kind redemptions allow the most significant investors to redeem ETF shares for underlying Bitcoin or Ethereum securities in kind instead of redeeming them initially for cash. The innovation prevents the ETF managers from selling crypto assets upon redemptions and thereby prevents market slippage, reduces tax implications, and makes the fund more efficient overall.

Smaller markets view in-kind arrangements as only one component of commodity ETFs like those on gold or oil. Applying the same thinking to digital asset ETFs will bring newer offerings nearer to conventional investment benchmarks.

JUST IN: The SEC has granted accelerated approval for proposed rule changes from to allow in-kind creations and redemptions for crypto ETFs.

That means market makers can deliver or receive actual crypto instead of cash – a big shift toward treating crypto ETFs like traditional… pic.twitter.com/ppTtqGeOxw

— FinancialPress.com (@FinancialPress_) July 29, 2025

Why This Matters to Institutional Investors

Partly, institutional investors have also been reluctant to crypto ETFs because of operational inefficiencies and the cash cost associated with redemptions. By allowing in-kind functionality, the SEC is removing a major disincentive for large-size investors like pension funds, hedge funds, and insurance companies.

For firms carrying out huge amounts of trades, direct cryptocurrency trading reduces capital gains tax, has simplicity in execution, and tightens price matching between the ETFs and base assets.

Ethereum ETFs Gain Greater Interest

Subsequent to this regulatory milestone, institutionally-sponsored Ethereum-based ETFs have also seen high levels of institutional trading. Ethereum funds have seen a series of consecutive net inflows in recent weeks as solid demand was evident even as other crypto prices were volatile.

The price of Ethereum has been quite steady in the area of US$3,800 as investors are optimistic about the long-term prospects of Ethereum, particularly with the potential for increased functionality and tax benefit through ETFs.

The new rule also benefits Bitcoin ETFs, which are already well-liked among institutional asset managers and financial advisors because they are gaining support. With the in-kind redemptions, the funds are expected to offer institutional and retail investors competitive pricing, improved liquidity, and trading convenience experiences.

Analysts are projecting fund flows and business volumes to rise in the coming months as confidence in the new ETF product space increases.

SEC’s Regulatory Approach Is Changing

The policy shift is part of a broader re-alignment of the SEC’s regulatory agenda for crypto assets. The Commission under Chairman Paul Atkins has been advocating for more pragmatic, market-oriented rules for crypto products on par with traditional products.

The in-kind redemption blessing is just one of a few pieces of a much larger mosaic. The SEC is entertaining trading more ETF options strategies, larger position limits, and even hybrid-asset ETPs that conglomerate Bitcoin and Ethereum into one fund wrapper.

This bet-forwarding step demonstrates the SEC’s growing embrace of the next generation of financial products, many of which are blockchain-enabled.

NEW: SEC Chair Paul Atkins says crypto policy will be shaped through public rulemaking using notice and comment rather than enforcement. pic.twitter.com/Nco5pZ7vGn

— Cointelegraph (@Cointelegraph) June 4, 2025

Global Context: The U.S. Leads

While the SEC move is new to the U.S. markets, it is interesting to point out that Hong Kong has already launched in-kind redemption facilities for its domestic crypto ETFs. In Europe, there is also outcry about in-kind regimes being applied in the likes of MiCA and the EU’s handling of distributed ledger technology.

Switzerland and other budget-minded governments will follow suit, although their timelines will extend past 2026 and later. America is already ahead of the game as far as institutional crypto ETF functionality in the global marketplace is concerned.

What This Mean for ETF Mechanics

The main advantages of in-kind redemptions are:

- Increased Tax Efficiency: Capital gains tax does not need to be paid by investors until the underlying cryptocurrency is actually redeemed.

- Less Operation Friction: Avoids the process of exchanging holdings to settle.

- Improved Price Parity: More closely aligns ETF share prices and the value of the underlying asset, minimizing differences.

Illustration showing how an ETF functions in the financial market ( Image Source: ResearchGate )

These features are most attractive to institutional investors who are cost and time sensitive to trade size and execution.

Considerations and Risks

For as well as the new mechanism is, however, it is not without its weaknesses too. Excessive redemptions in cryptocurrency, open custody security, congestion on the blockchain, and front-running by large market-making trades are some of them.

The SEC has mitigated some of these risks by conducting business practice reviews in fund notices, but that is what the ETF sponsors have to ensure – strict internal controls and openness procedures.

Also Read: Bitmain Opens First US Factory as Crypto Landscape Evolves

What to Watch Over the Next Few Months

The following are the key metrics investors and analysts will be watching:

- Direction and magnitude of in-kind redemptions

- Institutional policy shifts on in-kind redemptions under MiCA and other regimes

- Net inflow trends in Bitcoin and Ethereum ETFs

- Performance of blended-asset crypto ETPs

These key metrics will dictate the speed with which the in-kind model becomes the de facto standard for crypto ETFs.

Final Word

SEC permission for in-kind redemptions of Ethereum and Bitcoin ETFs is not technical housekeeping, it’s an institutional investor go-ahead that money in digital currencies is maturing.

With the regulatory landscape maturing and infrastructure building up, crypto-based ETFs are increasingly scalable, less expensive, and better aligned with serious market participants’ requirements. This driving momentum lends legitimacy to crypto in the view of global finance and results in broader institutional adoption.