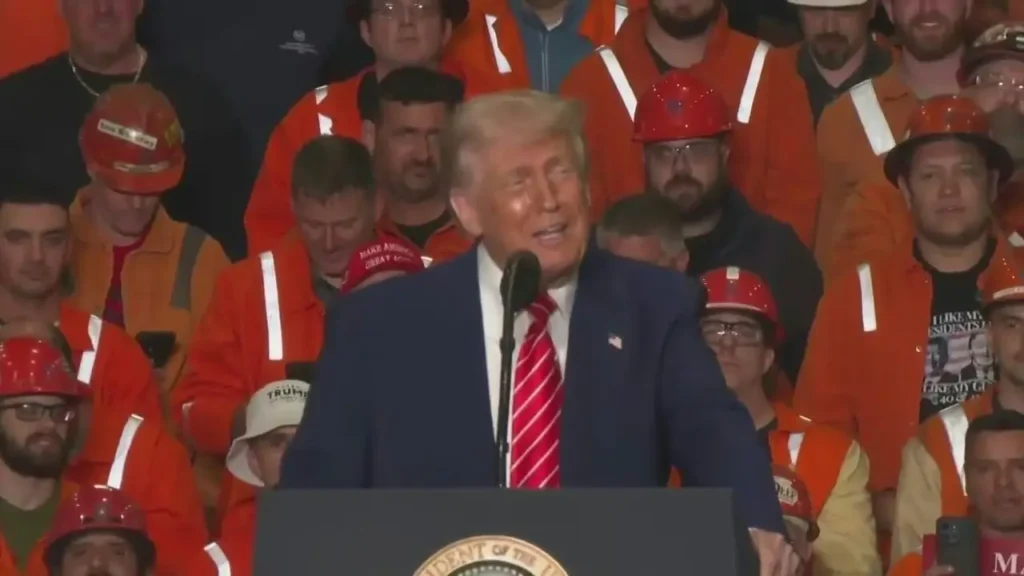

US President Donald Trump announces increased tariffs at a steelworkers rally. Credit: KDKA

In a decision already reverberating through global trade networks, former U.S. President Donald Trump has revealed a plan to hike import tariffs on steel and aluminium to 50% — doubling the existing rate and reigniting economic tensions with key allies like Australia. This decision, effective from June 4, 2025, has drawn sharp criticism from Australia’s Trade Minister, Don Farrell, who labeled the tariffs as “unjustified” and “not the act of a friend.”

Australia’s Stance on the Tariffs

Don Farrell expressed deep concern over the potential economic ramifications of the increased tariffs. Farrell warned that the tariff increase could deal a blow to both economies, describing the move as unwarranted and contrary to the spirit of long-standing partnership.

Prime Minister Anthony Albanese echoed Farrell’s sentiments, describing the tariffs as “disappointing” and asserting that they are “entirely unjustified.” He further commented that the decision “is against the spirit of our two nations’ enduring friendship.”

Economic Implications for Australia

While Australia’s exports of steel and aluminium to the US are relatively modest—accounting for about 2.5% of US aluminium imports—the tariffs could still have significant impacts on Australian producers.

BlueScope Steel, Australia’s largest steelmaker, experienced a surge in its share prices by up to 9.4% following the tariff announcement. This increase is attributed to BlueScope’s substantial operations in North America, including the North Star mill in Ohio, which could benefit from higher US steel prices resulting from the tariffs.

BlueScope Steel’s North Star mill in Ohio. Source: BlueScope

U.S. Reaction: Mixed Cheers and Concerns

In the United States, the reaction to Trump’s 50% steel and aluminium tariffs has been far from unified.

Domestic steel and aluminium producers, particularly in states like Pennsylvania and Ohio, have welcomed the move. Industry lobbyists such as the American Iron and Steel Institute have praised Trump for “prioritizing American metal,” calling the tariffs a necessary shield against foreign dumping.

But outside the manufacturing belt, economic analysts and trade experts are sounding alarms. Several economists have likened the new tariff regime to economic self-harm, arguing that it could trigger retaliatory tariffs, drive up domestic input costs, and eventually backfire on American consumers.

“This is not a protection policy; this is a distortion policy,” said trade policy analyst Maxine Crowley in an X (formerly Twitter) post that has since gone viral.

Global Consequences: Trade War 2.0?

With Trump once again positioning himself as a protectionist candidate ahead of the 2026 US elections, many are seeing this move as a signal of his future trade agenda — one that could strain not only relations with Australia, but with Europe, Canada, and Japan as well.

Already, European leaders have called emergency meetings to reassess transatlantic trade commitments. Australian ministers are reportedly reaching out to counterparts in the UK and India to shore up alternative trade pathways in the event the tariffs are sustained.

“This could trigger the second wave of global tariff escalation we narrowly avoided in 2018,” said a former WTO official speaking on background.

European officials have begun urgent consultations to review their trade position with the U.S., amid growing uncertainty over the ripple effects of the new tariffs. Australian ministers are reportedly reaching out to counterparts in the UK and India to shore up alternative trade pathways in the event the tariffs are sustained.

“This could trigger the second wave of global tariff escalation we narrowly avoided in 2018,” said a former WTO official speaking on background.

For smaller economies like Australia, which pride themselves on free trade agreements, the move feels like a betrayal — not only of trust but of long-standing economic partnerships.

The Domestic Consequences for the U.S.

While the short-term beneficiaries in the U.S. may include politically significant industrial states, the broader picture looks murkier.

- Construction firms fear soaring input costs

- Automakers predict delays and rising prices

- Exporters brace for counter-tariffs on agricultural and tech goods

If the tariffs persist, analysts say the U.S. could face a scenario where the cost of building bridges, cars, and homes spikes dramatically — while job gains in metal manufacturing remain modest at best.

More critically, inflation, which had begun to cool in early 2025, may reignite under the pressure of artificially high commodity costs, putting the Federal Reserve in a bind ahead of the next rate review.

Australia’s Long-Term Dilemma

For Australia, the impact goes beyond export losses. The tariffs have renewed a hard conversation: Should the country remain so reliant on U.S. goodwill?

Already, there’s growing appetite to deepen ties with India and Southeast Asia — a pivot that was already in motion but may now accelerate.

“Trump’s move might push Australia to de-Americanise parts of its economic identity,” said Dr. Leila Tan from the Australian Institute of International Affairs. “That would have geopolitical ripples far beyond steel.”

This tension arrives at a time when Australia is also considering critical mineral cooperation with the U.S. — a collaboration that may now face renewed uncertainty.

Also Read: Why the USA and Australia Are Doubling Down on Rare Earth Exploration in 2025

Looking Ahead

As the implementation date for the increased tariffs approaches, Australia continues to engage in diplomatic efforts to address the issue. The government remains committed to advocating for the removal of the tariffs and to exploring alternative markets to mitigate potential economic impacts.

The situation underscores the complexities of international trade and the importance of maintaining strong bilateral relationships. Australia’s response to the tariffs will likely play a crucial role in shaping the future dynamics of its trade relations with the United States.

A Risky Political Gamble

The Trump steel aluminium tariffs 2025 are more than just numbers on a spreadsheet. They are a political bet, a foreign policy signal, and a test of economic durability — for both the U.S. and its allies.

In America, it may score points in Rust Belt states. In Australia, it risks undermining one of the most stable and mutually beneficial trade relationships in the Pacific.

Whether these tariffs remain a campaign tactic or morph into long-term trade policy will define how countries like Australia — and companies like BlueScope — navigate the next chapter of a fractured global economy.