Source: Reuters

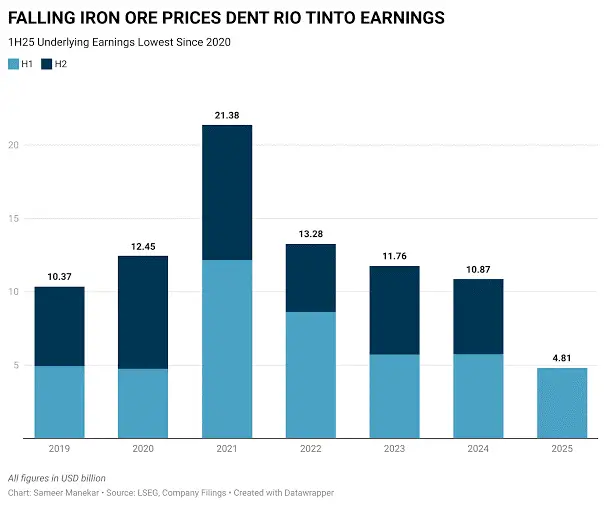

In the most unexpected twist, Rio Tinto confirmed that lowering iron ore prices and weather-related interruptions in Western Australia forced its half-year profits into the lowest level in five years. Rio Tinto’s surprise twist comes as an eye-opener to investors and nations relying on Australia’s biggest miner.

Profits Fall, Diversification Becomes Necessary

Source: Reuters

Rio’s numbers reported a steady 16% fall in underlying profit to a record low of US$4.8 billion in 2020. Earnings before interest, tax and depreciation fell to US$11.5 billion. Guilty: a two-pronged attack of iron ore price declines (13% down) and cyclone shutdowns that affected the Pilbara.

But it wasn’t a total loss. Rio’s aluminium and copper businesses made more than they usually do, which gave some clue about the firm’s continued diversification into growth metals.

From Iron Age to Battery Age: Big Strategy Moves

Credit: Bloomberg

Not even the former CEO, Jakob Stausholm, was ambiguous: “The future is copper, lithium, and low-carbon steel—not just iron ore exports.” During his tenure at Rio, the group has gone on an investing spree in copper developments abroad, such as a joint venture to develop lithium in South America and development within its current copper assets.

And with Simon Trott in charge, anticipate a tight lid on the purse strings from now on and more investment in cleaner technology metals—the kind that power renewable energy grids and EV batteries.

Pilbara Disruptions Reveal Structural Weaknesses

Exports from Rio’s Western Australian iron ore plants were slowed by cyclones that were later in the season than they normally were, cutting shipping volumes by about 5%. Increased restocking and haulage costs cut margins.

Iron was bulletproof once—now it’s brittle. One thing is certain, however, and that’s the weather isn’t the only risk; price volatility highlights every flaw.

Iron No Longer the Star: Opportunities in Copper Fields

Rapid change the economics are. Copper is the darling of Rio and its cluster these days. With world electrification, the demand of copper on the traction side is a reality. Rio is betting that its lithium, copper, and aluminum investments will throw up profits for the coming years—and this month’s figures show the reason why diversification is not a choice but survival.

It is in the Mining Towns: Unspoken Fears and Adjustments

Take a walk in Pilbara towns like Karratha or Newman and you’ll hear a mixture of anxiety and pragmatism. Truck drivers, technicians, caterers—many rely on steady iron volumes. They were hit with billboards saying iron is still king; now they’re being told to adapt.

That anxiety seeps into rural fetes, cafes and roadhouses: embroidered tee-shirts with “Our town lives on ore,” yet conversation at the edge veered towards technical abilities, green training and copper camps in the distance.

Investor Buzz: Caution Intermingled with Curiosity

Rio’s stock price fell around 1.3% today on Australian markets. Don’t panic. Caution—and tweak. Experts recognize short-term hedonism waning but long-term potential if the company delivers. The message is clear: investors are seeking wagering on green metals, not merely iron coal rolls.

Why This Changes Everything

Several giant ideas that first come to mind:

- Iron ore is no longer Rio’s sole driver—or Australia’s.

- Australia’s mining plan needs to change; international investors and strategic thinkers see.

What to Watch For

- The August shake-up in leadership and Trott’s first public confrontation.

- New fiscal outlooks in the following quarter’s report—copper and lithium, in specific.

- Development in Canberra policy on electrification and critical minerals.

- Drilling updates on WA and Chile copper and lithium targets.

Final Thought: Mining’s Forced New Chapter

Rio’s most recent profits are a conclusion and a starting point. No longer inextricably tied to iron ore domination, it now has to deal with a world where storm paths, price fluctuations and sustainability strategies require versatility.

For employees, farmers, shareholders and small communities, the tale is not yet done—it’s playing catch-up. Australia’s mining tale is adapting, and newspaper headlines today talk of a ten-year change coming in six months’ time.

It’s not about numbers—it’s about survival, strategy, and identity.