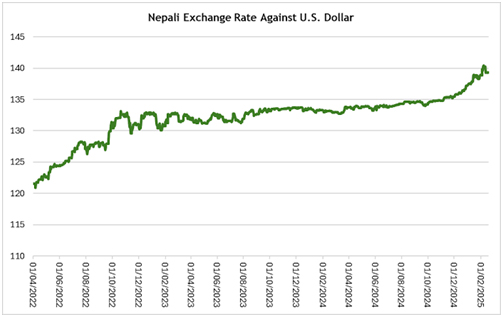

The American dollar continues to ascend in Nepal’s foreign exchange market, with the buying price of USD going up above NPR 133 and the selling price of USD nearly NPR 134. The trend is worrying for policy makers, remittance-receiving families, and traders too.

Let’s see more closely what’s happening, why it’s so important at this point, and how it might change—all in plain, fascinating detail.

First off, the global backdrop is strong. The Federal Reserve in the US is signaling another round of interest rate rises to rein in inflation. That tends to push the dollar higher across global markets. Nepal isn’t immune. The rising USD buying rate in Kathmandu reflects this broader ripple.

Locally, demand for USD has grown sharply. Companies importing goods—everything from electronics to pharmaceuticals—are competing hard for a diminishing pool of foreign currency. At the same time, tourism earnings and remittance flows haven’t kept pace. That gap is tightening supply, giving the greenback even more power.

Meanwhile, speculation about the Nepal Rastra Bank (NRB) plays a part. Traders are keeping a close eye for any hint of intervention: dumping USD reserves might stabilise the market, while tightening dollar rates could push the NPR even lower.

The US Dollar’s Climb in Nepal: Causes and Consequences ( Image Source: The Farsight Nepal )

Who Feels the Impact?

1. Importers and Retailers

Tiny electronics shops and local wholesalers are among the hardest hit. They often quote in NPR but settle payments in USD. As rates jump, their costs increase dramatically. Some can absorb it temporarily—others pass it on to customers, bringing higher prices across grocery aisles and showrooms.

2. Households Relying on Remittances

Millions of Nepalis live off remittances sent from abroad. A stronger USD might seem like a win, but with each dollar yielding fewer rupees—thanks to rising USD selling rates—families actually receive less NPR. That shrinks budgets for essentials like schooling, housing, or healthcare.

3. Forex Traders and Speculators

For seasoned forex operators, a rising dollar means opportunity. Those tracking fleeting USD to NPR shifts can profit from timing authority announcements or repatriation cycles. But the stakes are high: a surprise NRB rate change could snatch away gains in minutes.

The Human Angle: Faces Behind the Numbers

Take Anjali, a garment business owner in Bhaktapur. Every month, she orders cloth from the US. Stage one: hopeful pricing at NPR 130 per USD. Now? Paying NPR 133.50—even small orders balloon in cost. Margins have shrunk, and she’s had to raise shirt prices to keep afloat.

Then there’s Santosh, an accountant whose cousin in Ohio sends money monthly. They used to get around NPR 19,800 per USD. That’s slipped to NPR 19,600. It may not sound huge—but across a year, that’s a meaningful drop in family income.

These stories illustrate the ripple effect of forex numbers: they’re not just rates, they’re real money in people’s pockets.

Also Read: AUD/USD Outlook RBA Cut Likely After Soft CPI

NRB’s Role: Watchful Eye or Action Time?

The Nepal Rastra Bank can step in by selling USD reserves or adjusting interest rates. But every move has consequences.

If NRB dumps reserves, it can stabilise the rupee—but it also chips away at official reserve buffers. Raise interest rates to crowd out USD demand? That could squeeze borrowers and slow business.

Ultimately, the NRB must balance price stability and economic velocity. Their next move will signal confidence—or concern—about exchange rate direction.

What Forex Observers Are Watching

Forex experts aren’t waiting. They’re eyeing three key areas:

Global Policy Announcements

Every Fed statement, economic report, or inflation update in the US now lands like currency news in Kathmandu. Traders adjust instantly, and those holding USD–NPR positions can win—or lose—quickly.

Domestic Forex Liquidity Levels

When remittances peak—such as before festivals—USD supply increases and buys some ripple relief. But quieter months mean tighter supply and sharper rate increases. Traders there are counting these cycles.

Import Demand Trends

June through August often highlight heavy buying seasons—school supplies, machinery, electronics. That demand injects continuous need for USD, keeping the rupee under sustained pressure.

Action Plan for Stakeholders

For Importers

Consider hedging your USD requirements now. Using forward contracts or currency options could lock in rates and help soften potential shocks as the dollar continues to rise.

For Remittance Receivers

Timing matters. Watch for when the USD buying rate dips angling toward 132 or lower. Even a small fluctuation can boost net NPR you get each month.

For Casual Forex Observers

Download a reliable forex app with live USD–NPR quotes. Stay alert—VOIP messages or Telegram bots can ping you the second rates shift. The market moves fast; awareness matters.

What’s Coming Up

Federal Reserve meetings are around the corner. Any hint of fresh US tightening will lift the dollar further. That means USD selling rate in Kathmandu could screen near NPR 135 soon.

Locally, the NRB has scheduled its quarterly policy meeting in late July. Traders expect a subtle tone—maybe verbal reassurance rather than immediate rate intervention.

Remittance data for June and early July may offer relief if inflows surge. But that alone won’t be enough to offset rising global pressures.

Final Take

The US dollar appreciation trend in Nepal is not a one-week story—it’s a multi-front shift with global policy, local demand and timing playing a role. For importers, it’s a cost warning. For money receivers, a squeeze on household budgets. And for the forex-savvy, a field of opportunity—if timing and risk controls are in place.

If you’re in business, sending money home, or just watching the forex scene, now is the moment to stay alert. Track the NRB’s next steps, follow Fed announcements closely, and take simple steps—like hedging or timing remittances—to hold your ground in a shifting currency landscape.