Shandong Gold Group, one of China’s leading state-owned gold producers, is accelerating its overseas ambitions with a new US$100 million perpetual bond issue. This marks the group’s second major dollar-denominated capital raise in under a month, following a US$300 million bond launched in early June. The twin offerings underscore an increasingly assertive strategy by Chinese miners to expand their gold holdings amid a global capital rush into precious metals.

Shandong Gold mine operations. Source: TMAC Resources

China’s Strategic Push into Global Gold

With gold prices hovering above US$2,300/oz and global economic uncertainty elevating the appeal of safe-haven assets, Chinese state miners are positioning themselves to become global leaders in gold acquisition, production, and trading. Shandong’s move follows similar efforts by Zijin Mining and China National Gold, who have deployed capital across Asia, Africa, and South America. Rather than only funding domestic expansion, these new bonds are being used to target international joint ventures, technology upgrades, and innovations like gold streaming.

How the Bond Works—and Why Investors Are Buying

Unlike conventional loans, Shandong’s latest US$100 million offering is a perpetual bond—meaning it has no maturity date. The company pays periodic interest but doesn’t have to repay the principal unless it chooses to. This offers institutional investors consistent returns, while giving Shandong long-term capital without overloading short-term debt. The bond is expected to attract yield-focused investors in Asia and the Middle East, especially those bullish on commodity-backed securities.

What It Means for the Global Mining Sector

Chinese miners, once primarily domestically focused, are now reshaping global mining finance. Their state-backed capital access, diplomatic partnerships, and production scale allow them to compete with major Western producers. This trend is shifting the balance of influence in global gold ownership and supply chains, with implications for pricing control, downstream refining, and market regulation.

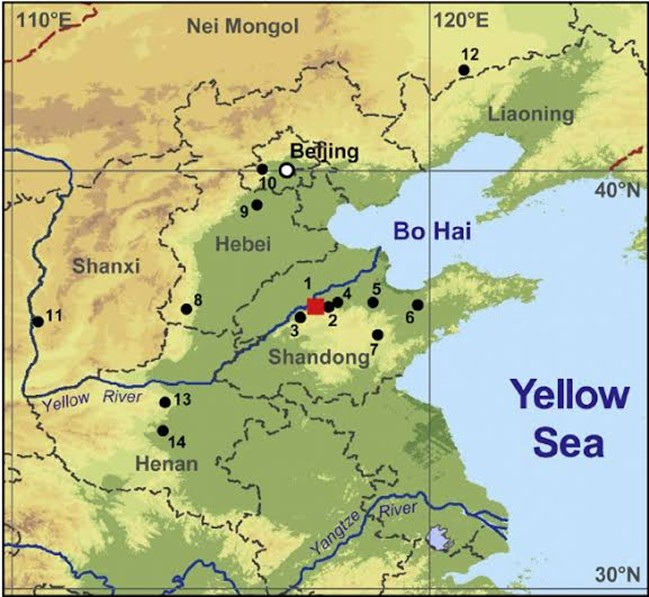

Map showing Shandong Gold’s overseas projects and partnerships. (ResearchGate)

Inside China’s 2025 Gold Playbook

2025 is becoming a breakout year for gold. With central banks increasing reserves and exploration slowing globally, prices remain strong. Shandong’s filings show plans to invest in high-grade, underdeveloped regions in sub-Saharan Africa and Southeast Asia. The company is also exploring digital trading and blockchain platforms to support international gold transactions and improve supply transparency.

The Rise of State-Owned Mining Finance Models

Chinese state-owned enterprises (SOEs) are increasingly relying on capital market instruments—such as perpetual bonds, syndicated loans, and asset-backed securities—to fund international expansion. Shandong Gold’s latest bond move reflects a wider shift in how state miners approach long-term funding:

- Lower perceived risk due to government backing allows for competitive interest rates.

- Perpetual bonds offer long-term flexibility, ideal for mining projects with delayed revenue onset.

- SOEs leverage policy banks and bilateral trade relationships to secure better terms for cross-border mining ventures.

This financial model is distinct from the equity-heavy strategies pursued by many Australian and Canadian juniors, who often dilute heavily before reaching production. China’s approach suggests a focus not just on asset control, but on financial sovereignty over the mining value chain.

Capital vs. Control: China’s Long Game in Gold

Unlike Western miners that often prioritize shareholder value and quarterly returns, Chinese SOEs are executing a longer game—one focused on strategic control of future-facing commodities. Here’s how that plays out in the gold market:

- Resource security: Gold is not just a commodity but a hedge against currency shocks and geopolitical shifts.

- Reserves diversification: China has ramped up central bank gold buying to reduce USD exposure.

- Supply chain integration: From mining to refining to vault storage and digital trading, Chinese firms are seeking vertical control.

This approach is likely to impact global trade patterns, particularly in Asia and Africa, where Chinese capital is now a dominant force behind gold exploration and development projects.

Chart: China’s Growing Share of Global Gold Deals (2020–2025)

| Year | Deal Volume (US$ Billion) | % of Global Gold M&A |

| 2020 | 2.1 | 12% |

| 2021 | 3.4 | 16% |

| 2022 | 4.7 | 20% |

| 2023 | 5.5 | 23% |

| 2024 | 7.2 | 27% |

| 2025* | 8.9 (est.) | 30% (est.) |

Estimates based on S&P Global and Asian Metals Research data projections.

Conclusion: Beyond the Bond—Redefining Gold Ownership

Shandong Gold’s twin bond issuances aren’t just about financing—they reflect a long-term vision of influence. As Chinese state miners build their gold portfolios, they are redefining who leads in production, trade, and value capture. In 2025, the real gold rush is not just underground—but across capital markets, geopolitical alliances, and emerging commodity strategies.