Funding Milestone Marks Next Phase of Yalgoo Development

Tempest Minerals (ASX:TEM) has successfully raised $605,553 through a recently closed entitlement offer, strengthening its financial position to progress exploration at the Yalgoo Project in Western Australia. The capital raise reflects investor confidence in the project’s potential and underscores ongoing interest in early-stage mineral assets within one of Australia’s most promising exploration corridors.

The raise was supported through the issuance of 151.39 million new shares at a price of $0.004 per share, comprising 127.35 million entitlement shares and an additional 24.04 million shortfall shares, which were swiftly taken up—highlighting strong shareholder participation.

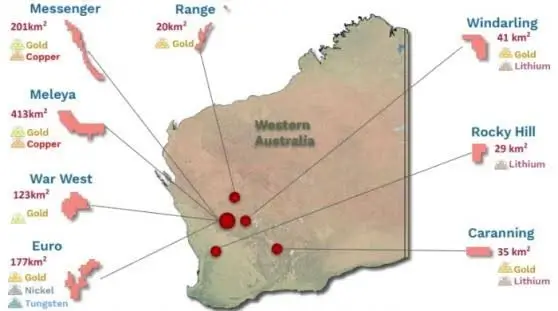

Tenement location of Tempest Minerals’ Yalgoo Project, Western Australia.

Source: Tempest Minerals Investor Presentation

Tempest Yalgoo Capital Raise: What It Means

The successful funding round, spearheaded by Cygnet Capital as lead manager, is a key step in advancing mineral exploration activities across the Yalgoo region. The proceeds will primarily be used to fund drilling, geological surveys, and regional target testing as Tempest looks to define new resource opportunities within its large tenement package.

“We’re grateful for the continued support of our shareholders,” said Managing Director Don Smith. “This capital raise enables us to keep pushing forward with high-impact exploration at Yalgoo, where early-stage results have already indicated significant potential.”

The Tempest Yalgoo capital raise comes at a time when junior explorers are facing challenging market conditions, making the company’s ability to attract participation especially noteworthy.

Cygnet Capital’s Role and Structure of the Offer

Cygnet Capital played a pivotal role in managing the offer, ensuring an efficient allocation of both entitlement and shortfall shares. The entitlement offer gave eligible shareholders the opportunity to purchase three new shares for every four held, encouraging wider retail investor involvement.

The issuance was priced attractively at $0.004, reflecting market sensitivity while allowing for potential upside as the Yalgoo Project progresses. The offer closed fully subscribed, with the 24.04 million shortfall shares demonstrating unmet demand among existing and new investors.

Drill rig operating within Tempest Minerals’ Yalgoo exploration zone.

Source: Tempest Minerals

The Yalgoo Project: WA’s Underrated Frontier

Located in Western Australia’s Yalgoo region, Tempest’s project spans a vast and geologically diverse area known for historic base and precious metal occurrences. The company has steadily expanded its footprint over the past two years and is now moving toward more targeted drilling across defined anomalies.

Initial fieldwork has confirmed the presence of multiple mineralised zones, with geophysical surveys suggesting potential for copper, gold, and rare earth elements. The latest capital injection will enable more aggressive campaign work, including deeper drilling and resource delineation.

Yalgoo has seen a resurgence of interest in recent months, with several ASX-listed explorers reporting new discoveries and extensions. Tempest’s activity aligns with this regional momentum and positions it to contribute meaningfully to the exploration narrative in WA.

Map of active exploration projects near Tempest’s tenement in the Yalgoo region.

Source: Investing News Network

ASX:TEM Performance and Market Sentiment

The market has responded cautiously but positively to the raise. While ASX:TEM shares remain near historical lows, analysts note that successfully funding a grassroots exploration program without over-dilution is a commendable move in current market conditions.

Tempest’s ability to attract more than $600,000 in fresh capital—despite broader headwinds in junior mining—is seen as a signal of stakeholder belief in the long-term vision of the company’s leadership and project pipeline.

Also Read: Perseus Mining Reveals Bold Five-Year Gold Production Outlook

Looking Ahead: What’s Next for Tempest?

With funding now secured, Tempest is expected to ramp up its 2025 drilling program at Yalgoo. Key deliverables over the next two quarters include:

- Completion of target prioritisation using recent geophysical data

- Mobilisation of field teams for RC and diamond drilling

- Preliminary metallurgical sampling and environmental baseline studies

- Quarterly updates on drilling results and potential resource modelling

If successful, these steps could lay the groundwork for a maiden resource estimate, setting Tempest up for potential joint ventures or larger capital raises down the line.

Conclusion: A Measured Step Forward in a Tough Market

The Tempest Yalgoo capital raise may be modest in dollar value, but it carries strategic weight. It reflects careful financial planning, strong shareholder alignment, and a disciplined approach to high-risk, high-reward mineral exploration.

In a market where many juniors struggle to gain traction, Tempest’s ability to fund meaningful exploration activity without excessive dilution or overpromising is a positive signal for stakeholders and a boost to confidence in WA’s emerging mining stories.