The postponement of the US Market Structure Bill, which was XRP’s main supporter, caused the coin to drop in price, since it was viewed negatively by the traders. This legislative failure hit investor sentiment very hard and brought about the immediate decline of digital assets all over the world.

The bill, which aimed at improving the infrastructure for crypto payments and adoption, had its delay cast a shadow over the market. The price of XRP fell under the threshold of the major support levels; thus, traders’ caution was reflected. Investors’ speculation about the effects of institutional adoption being delayed resulted in slow market activity.

The latest news about XRP being the hottest topic in the crypto market reveals that the delay in clearing the market has reduced liquidity and that market enthusiasm has been temporarily dampened. The analysts indicate that these legislative delays might change the trading behaviour in the near future, as investors will be hesitant to take large positions before they are fully committed.

XRP fell as the US bill delay hurt sentiment.

What Is The Impact Of the BoJ Rate Outlook On XRP?

XRP reversed its trend because of the outlook for the Bank of Japan’s rate to rise, and the yields in Japan went up sharply. The Bank of Japan signalled that it might shrink its accommodative stance, thus increasing expectations of an upfront rate hike.

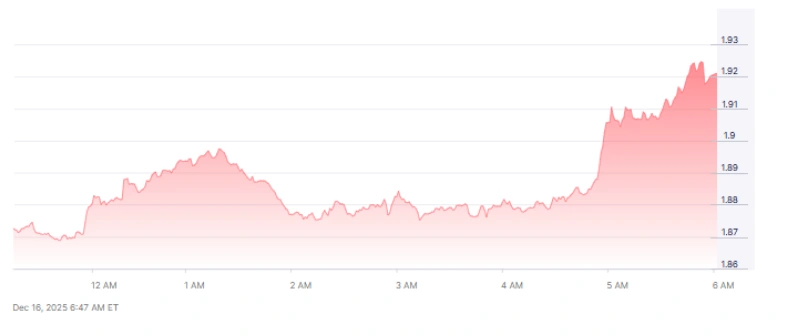

The yields on ten-year Japanese government bonds (JGB) were almost 2%, which put pressure on riskier investments like cryptocurrencies. The relationship between the prices of XRP and JGB yields indicates that when the rates go up, the demand for speculative assets goes down accordingly.

The further narrowing of the US-Japan rate gap made holding crypto less attractive. Investors feared that the rise in yields would cause a drying up of liquidity across the world’s markets, which was adding to the pressure of the stalled payment legislation and trading policy on XRP prices. Now, traders are watching the BoJ’s signals very closely for the next possible market direction.

What Are The Key Drivers Behind This Move?

Several factors occurred together to cause the decline of XRP. The rise in Japanese bond yields caused immediate macro pressure. The speculations regarding the risk assets led to the fear of a 25-basis-point signal, which weakened the lighter ones.

The crypto market was mainly affected by the macroeconomic conditions, and hence, XRP was very volatile. Besides, the payment structuring bill delay caused the investors to have a bearish sentiment in the short term. The technical analysis displayed shortcomings below critical support levels, indicating possible reversals.

The price of XRP went down below $1.90, which was a warning to traders who pay attention to key psychological limitInvestors feared that although the short-term trend is bearish, the medium-term signals are mixed. When there is a stabilisation in the macroeconomic conditions or if there is a resumption in the institutional adoption, the momentum might swing.

Rising Japanese yields and risk fears drove XRP down.

Delays In Payment Structuring Bill Heighten Risk

The stagnation of the Market Structure Bill not only delayed the investor’s confidence in crypto integration but also in payments. The traders were expecting the bill to not only clarify the regulations but also to support the wider acceptance of XRP.

The postponement of the bill stopped the progress made by the institutions, thus leaving XRP prone to short-term sell-down. It is the market players who regard these delays as hurdles for the payment service and adoption of digital assets. Continuing uncertainty has resulted in more cautious trading practices.

Although the long-term adoption scenario is still there, the crypto market has already reacted with increased risk sentiment due to the immediate impact. Before the investors are ready to make any considerable commitments, they will look for signs of progress in the legislature. This market situation reveals how much the prices of XRP are affected by the regulations and the overall economy.

Technical Levels Show Near-Term Resistances

In a technical sense, XRP is currently confronted with short-term difficulties as a result of the recent downtrend. The coin fell below crucial exponential moving averages, which is a signal of a bearish market.

The new support levels are at $1.82 and $1.75, and resistance is in the vicinity of $2.20 and above. If sell-downce goes down to $1.75 or lower, it can cause more declines, but if it breaks through $2.0, the short-term selling pressure could be eased. Investors are carefully watching these levels for any indication of a momentum change.

The short-term indicators like RSI and MACD are pointing to consolidation, but there is still a chance of volatility. Traders are using the technical levels for their near-term trading strategies, and they are giving these levels a lot of importance.

XRP faces short-term bearish pressure below key averages.

Medium-Term Outlook Remains Mixed But Constructive

Medium term still holds opportunities, cautiously positive despite pressure from the downside recently. Ripple has been pushing for legislation that would be crypto-friendly, and thus, more people would use the coin. There may be further support from institutional money and spot ETF flows in the market, which, along with strong demand, will cause the price to rise.

If the market conditions stabilise, analysts say that price targets above $2.35 are possible within a few weeks. The global acceptance of digital currencies could actually be a cushion against macro volatility.

On the other hand, changes in legislation and economic policies that create uncertainty could drive investors out of the market. It is always a good practice for investors to keep a close eye on both technical and fundamental indicators before making any decision.

Also Read: XRP Price Forecast 2025: Vanguard Shift Ignites New Demand

Frequently Asked Questions

Q1: What is the reason for the XRP price decrease at this time?

XRP has lost its value because of payment delays and the overall market pressure from the Bank of Japan’s interest rate forecasts.

Q2: What impact does the BoJ outlook have on XRP?

The rising yields and the anticipation of monetary policy tightening, in turn, lessen the risk appetite in the crypto markets, leading to a drop in XRP price.

Q3: What price levels are crucial for XRP?

Support is located close to $1.82 and $1.75; on the other hand, resistance is at approximately $2.20. Overstepping these levels is what dictates the trends.

Q4: Is the long-term forecast optimistic?

Undoubtedly, if legislation and institutional interest keep increasing, then medium-term sentiment remains positive.