A New Chapter for Critical Minerals in Western Australia

Wyloo has officially partnered with Hastings Technology Metals to fast-track development of the Yangibana project in Western Australia’s Gascoyne region—a move being hailed as a pivotal moment for Australia’s green energy supply chain.

In a landmark $135 million transaction, Wyloo Joins will take a 30% stake in Yangibana via a two-part investment: issuing $135 million in exchangeable notes and making a $7.4 million cash payment. This investment will form a 60:40 joint venture (JV), with Wyloo holding a pathway to increase its stake to 70% based on project milestones.

The deal not only reinforces Wyloo’s commitment to critical minerals but also accelerates Hastings’ roadmap toward finalising a Stage 1 beneficiation plant and a Stage 2 hydrometallurgical plant.

Why Yangibana Matters in the Energy Transition

The Yangibana project has long been viewed as a cornerstone of Australia’s rare earth ambitions. Its high-grade neodymium and praseodymium (NdPr) deposits are essential in the manufacturing of EV motors and wind turbine magnets—technologies central to the global energy transition.

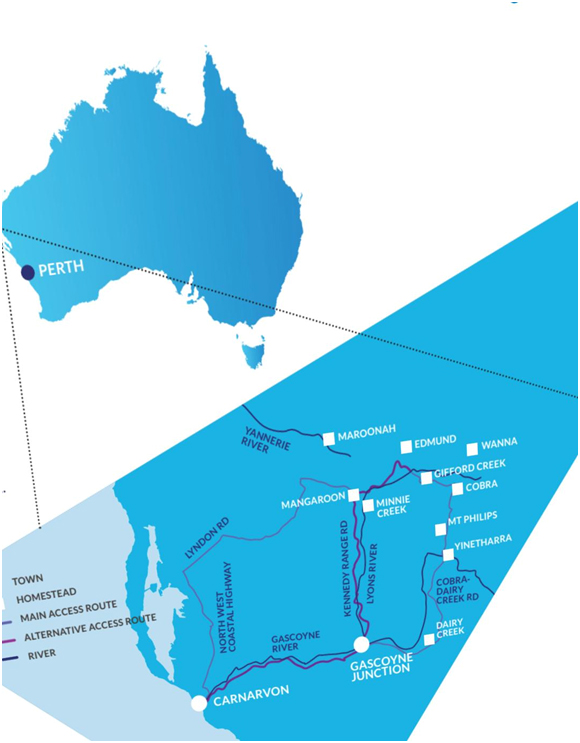

The project is located on Native Title land in the remote Gascoyne region, and development has been carried out in close consultation with Traditional Owners.

Map showing Yangibana Project location in Gascoyne, WA – Source: Hastings Technology Metals

Inside the Deal: Wyloo’s Strategic Entry

Under the agreement, Wyloo Joins will invest via a combination of $135 million in exchangeable notes and a $7.4 million direct payment. This structure allows Wyloo Joins to convert the notes into equity upon completion of shareholder approval and satisfaction of regulatory conditions.

Hastings retains management of early works but will hand over operational leadership once the JV is formed.

This isn’t just a financial transaction—Wyloo Joins brings technical depth, project execution capability, and ESG focus, aligning closely with the Federal Government’s push for sovereign supply chains of critical minerals.

Focus on Two-Stage Development

Development of the Yangibana project will occur in two stages:

– Stage 1: Beneficiation Plant – Will produce a high-grade rare earth concentrate onsite in the Gascoyne region.

– Stage 2: Hydrometallurgical Plant – Will process concentrate into mixed rare earth carbonate, with proposed construction in Onslow or another downstream hub.

Hastings anticipates a final investment decision (FID) shortly after the JV is formed, with concentrate production targeted for late 2025.

Leadership Commentary: Luca Giacovazzi on the Future

Wyloo Joins CEO Luca Giacovazzi emphasised the strategic nature of this deal:

“Yangibana is more than just a mining project—it’s a blueprint for how Australia can lead the world in the responsible sourcing and processing of critical minerals.”

He further stressed the importance of strong community relationships and working closely with Traditional Owners to ensure long-term social licence.

Commitment to Community and ESG

Both Wyloo Joins and Hastings have reiterated their commitment to Traditional Owner partnerships, local job creation, and transparent ESG reporting. Community consultations held during the pre-FID phase have resulted in agreements on environmental stewardship and employment frameworks.

Community engagement session with Traditional Owners – Source: Hastings ESG Report

Global Rare Earth Market Context

The Yangibana-Wyloo Joins joint venture arrives at a critical juncture for the rare earth sector globally. With over 80% of the world’s rare earth processing capacity currently controlled by China, there is an urgent push from Western economies to diversify supply sources.

Australia, with its stable regulatory environment and rich resource base, is well-positioned to become a leader in the ethical sourcing of critical minerals. Projects like Yangibana are essential to this shift and signal growing investor appetite for vertically integrated, low-emission supply chains.

Rare earth supply dependency chart – Source: IEA/Statista

Processing Technologies and ESG Advantages

One of the most significant aspects of the Yangibana project is its modern approach to processing. By dividing the operation into a Stage 1 beneficiation plant and Stage 2 hydrometallurgical facility, Hastings aims to reduce environmental impact while increasing operational efficiency.

Innovations include dry tailings handling, closed-loop reagent recovery, and a commitment to energy-efficient design. These enhancements are not just environmentally sound—they also align with what downstream users like EV and wind turbine manufacturers are demanding from suppliers.

Strategic Implications for Wyloo and Australia

For Wyloo Joins, this move is part of a broader play to dominate Australia’s critical minerals sector. With prior investments in nickel and battery metals, its push into rare earths reflects a strategic alignment with national goals of clean energy leadership.

This deal may also inspire other private and public investors to co-fund infrastructure needed for rare earth processing, including utilities and transport corridors—critical elements in remote regions like the Gascoyne.

What Happens Next: Regulatory and Market Impacts

Shareholder approval is expected in Q3 2025, with environmental and state regulatory conditions tracking positively. Upon approval, Wyloo may increase its stake from 30% to 70% by funding the full Stage 1 capex.

This partnership signals growing investor confidence in the long-term demand for rare earths amid intensifying global decarbonisation goals.