What is driving the recent USD/JPY surge?

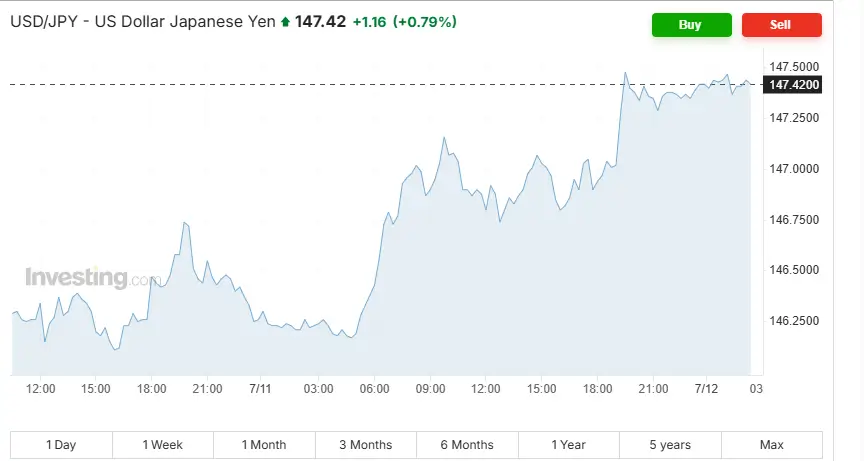

Seeing USD/JPY go on a big upward run this week, testing the highs close to 147.40, the best there in several weeks, the movement followed after a set of stronger-than-expected U.S. jobs data, hawkish Fed remarks, and renewed U.S. tariff threats against Japanese exports.

The sentiment towards the dollar quickly changed, catapulting the pair upwards after it had pared sideways in the preceding sessions. Strong U.S. Nonfarm Payrolls helped give fresh vigour to the dollar; meanwhile, rising political tensions brought in risk-off flows to its advantage at the expense of the yen. Carry trades based on interest rate differentials still remain the dominant backdrop.

USD/JPY surges as strong dollar meets Fed caution and Japan trade tensions.

How did U.S. economic data influence the trend?

Positive employment data for June signalled continued strength in the labour market. The nonfarm payroll number stood at 147,000, somewhat above consensus expectations of 110,000. Unemployment went down slightly to 4.1%, while wages remained flat. All of this strengthened the market view that the Fed could now afford to delay its next cut.

Consequently, the U.S. Dollar Index (DXY) went above the 97.45 mark, a level last seen about two weeks ago. The more robust greenback thus gave fresh impetus to USD/JPY, which had already been gaining momentum from last week’s bounce off key support at 144.65.

Investors scaled back bets on a September rate cut, causing Treasury yields to rise.

The 10-year yield stood around 4.3%, increasing the attractiveness of USD holdings versus lower-yielding currencies like the Japanese yen.

What are markets expecting from the Fed minutes?

Attention is now set on the release of the Federal Reserve’s meeting minutes for June. Markets expect that these minutes will elucidate the officials’ stance on inflation and recession risk. More cautious notes focusing on the necessity of further data before easing would cement the present USD strength.

In recent talks, Fed policymakers have maintained that they are “encouraged but not yet convinced” that inflation is on the path to a 2% target. The market is closely watching whether one or two rate cuts could be possible this year or whether they may well be delayed until 2026.

So much hangs on whether the tone of the minutes might act as a key near-term trigger for the USD/JPY pair.

How are technical levels shaping USD/JPY movement?

From the technical viewpoint, several major resistance zones have been cleared by the pair. The 147.14 level, a key Fibonacci retracement, was broken earlier in this week. And the pair is now pushing toward the 147.60–148.00 range that saw highs in June.

If the next break-up from the area is successful, it is set to ignite another buying, with its sights set on 148.65, and then 150.00, a round number and psychological resistance.

Conversely, a failed rally finds initial support near 146.20, with stronger support stemming from 144.65, the 50-day simple moving average. Technical momentum remains in favour of buyers, particularly while yields stay firm.

Could tariffs escalate USD/JPY movement?

Yes. New U.S. trade actions have triggered concerns about Japan-U.S. relations. The proposed tariff of 25% against Japanese automotive and technology imports would well damage the export sector and the GDP of Japan. These measures are ushered in by the Trump administration, and the implementation is scheduled for August 1, unless trade talks can resolve the issues.

Until now, the Japanese government has refrained from retaliating and officially commented that negotiations are ongoing. The yen is a typical safe-haven currency. However, the trade conflict is directed straight at Japan, which instead translates into yen weakening as investors reprice Japan-specific risks.

Could weak data or a dovish Fed tone reverse the rally?

Potentially. The current upmove in USD/JPY is attached to economic divergence. Should the U.S. data, such as CPI or weekly jobless claims, disappoint, it could turn expectations on their head. If Fed minutes or remarks lean dovish, one could see money exiting long dollar positions.

In which case, USD/JPY can slip below 146.20 or give a test at 145.00 again. Some may say that the Bank of Japan may feel compelled to intervene if the pair nears 150.00, as it did in late 2022.

Investor Outlook

- The interest rate differential: With the Fed’s benchmark rate presently near 5.25%-5.50%, the pressure on the yen is sustained by a near-zero rate in Japan.

- The September-Cut Odds: The CME FedWatch Tool has just reduced the forecast for a 25-bp cut in September to 63%, and this is down from 81% only two weeks ago.

- And Bond Yield Flows: High yield U.S. Treasury continues attracting foreign capital into dollars, especially against currencies with a low yield.

- Tariff Impact: Increasing political tension regarding Japanese imports introduces a layer of uncertainty with a downward pressure on the yen.

- Risk Bias: Unless the U.S. Fed turns dovish or economic data weakens considerably, USD/JPY is arguably set to remain on the upside.

Also Read: NZD/USD retreats after testing 0.6045 resistance

USD/JPY Outlook: Uptrend Intact, but Risks Ahead

In contrast, good employment data and solid Treasury yields amid a delay in the Fed’s rate reductions act as tailwinds, while threatened tariff action from the U.S. exerts pressure against the yen in further strengthening the momentum for the pair. Fed minutes and Japan’s answer to trade actions could, however, switch the prevailing mood.

- The next resistance above at 148.00 is slated to promote further upside momentum.

- Japan-U.S. tariff frictions lend downside risk for the yen.

- Traders are searching for direction from the Fed minutes and yields in the bond market.

While momentum favours the dollar, caution would be quite beneficial, as volatility may return in a quick snap.