Data centres built to fuel the AI explosion are already reshaping how electricity and water networks function. Global data centre electricity demand will more than double by 2030, driven primarily by AI loads, and regional grid operators are meeting the challenge with new regulations, capacity limits and near-term planning battles.

Throughout the regions, the plants not only generate electricity load but also generally pull in freshwater to cool, occasionally from already-stressed supply regions. The result: policy conundrums, public protest and a stampede by utilities and tech firms to balance expansion with dependability.

AI’s boom is straining power grids and water supplies. (Image Source: FinTech Weekly)

Why It Matters Now

AI models grow in bulk size. Training and inference of giant models of today are done on proprietary chips and racks that draw a surge of much higher power than ageing servers. The immediate consequence: peak power surges wherever data centre clusters drop, sometimes ahead of grid expansion rates. That gives us two problems: more expensive electricity locally and a genuine risk of supply constrained at peak.

Policy makers already do. Belgium is considering fresh regulation for allocation to prevent data centres from flooding other companies with space on the grid, a telling indicator that the boom is hitting public infrastructure capacity.

The Numbers That Frame The Argument

Global energy institutions and specialists give us a sharp picture of the challenge:

- The International Energy Agency forecasts that data-centre electricity consumption could more than double by 2030 to around 945 TWh a year, the same level of electricity consumed by a large country. Artificial intelligence is powering the expansion.

- Global aggregate data centre consumption in 2023 has been put at around 300–380 TWh, and the direction is toward increasing consumption with AI installations.

- In countries like the United States, experts warn that data centres are an increasingly dominant portion of national power consumption and an issue of where that power gets tapped and how quickly grids need to expand.

(These headline figures account for only half of what is propelling policy action and why utilities and planners now regard data centre projects as long-lead infrastructure undertakings of highest priority.)

Actual-World Impacts: Expense, Reliability And Regional Trade-Offs

When a campus of AI requires tens or even hundreds of megawatts, utility planners must weigh whether to promote such expansion or limit it to make room for industry, residents and small businesses. In other places, data centres pushed demand so high in certain regions that they rewrote electricity markets and pushed up wholesale prices that could be passed on to customers.

Water utilisation for cooling is divisive at the neighbourhood community level. There is a predisposition for new cooling technology towards evaporative or water-friendly chillers. Even when national water amounts are constrained, neighbourhood withdrawals can strain municipal resources, especially in drought-designated or desert locations. The authors report considerable withdrawals near clusters of centres and advise prudence in location and cooling decisions. (asce)

Real-World Impacts: Cost, Reliability, and Regional Trade-offs (Image Source: Energy Informatics – SpringerOpen)

The Industry Solution: Efficiency, Renewables And Self-Generation

Technology companies point to solutions to minimise impacts: more efficient servers and processors, liquid cooling, off-peak loads, and long-term renewable power contracts or on-site generation. Companies also purchase existing power purchase contracts and upgrade the grid. Efficiencies can’t keep up with the arithmetic: more efficient AI machines will outstrip per-unit efficiency improvements.

Where access to the grid is unguaranteed, companies look to self-supply or co-construction of gas or nuclear plants unpopular but a sign of increasing risk perceptions. Private supply is unpopular with critics to the extent that it is said to circumvent public planning and pre-empt the clean-energy transition if it ties up fossil fuel capital. (iea)

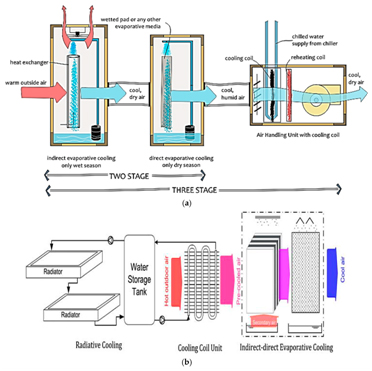

Cooling Options: The Water–Energy Trade-Off

- Cooling design is a trade-off: water-based systems are extremely electricity-efficient but water-hungry; air cooling is less electricity-hungry but uses little or no direct water. In water-poor regions, that trade-off is severe. Studies show data-centre water withdrawals are tiny on the large scale but dire on the local scale and new centres tend to get constructed in water-stress high locations.

- Some of the choices: closed-loop systems, reclaimed water, hybrid cooling that relies on thermal energy storage and uses water only at peak heat. But all are expensive and complex and developers weigh them against the bottom line of speeding AI adoption.

Data centres in Scotland used about 4,500 cubic meters of water in 2021 but by 2025, that number had exploded to over 18,000. That’s a fourfold jump in just four years. It sounds like a lot, and it is but to really understand why it matters, you have to look at what’s driving it… pic.twitter.com/xBH6kiJHru

— StockMarket.News (@_Investinq) October 21, 2025

Who’s Pushing Back And How Governments Are Responding

Cities and grid operators now call for transparency: speculative build-out limits, planned upgrades, and project timing. Belgium’s proposal to establish data-centre capacity as a stand-alone category is one such short-term policy reaction; it would stop speculative projects from dominating grid allocation.

Moratoria, tighter permits or requests for obvious grid upgrades before granting large projects are under consideration by some other cities. Energy and environment authorities urge full disclosure of electricity and water use so that the public can weigh benefits against local costs. Secret consumption is an enduring complaint of environmentalists and some regulators.

Field Story

Small rural towns in Europe and America that were once warehouses and centres of distribution now have queues of blinking server halls. For the councils, the payoff is restored rates and jobs; for residents, the cost is summer water rationing and brownouts during high-demand periods. The war plays out at planning hearings where residents and energy engineers fight over whether the local grid can accommodate it or if the centre must wait until lines and substations are upgraded.

What Can Regulators And Companies Do: A Brief Checklist

- Disclosing water and electricity usage is a requirement for granting permits.

- Impose grid-upgrade promises or staged-in power availability to avoid “first-come, first-served” capacity grabs.

- Encourage the use of reclaimed water, closed-loop cooling or dry cooling in dry climates.

- Sync renewables and storage growth with data-centre development planning permits so that rising load doesn’t delay the energy shift.

Tech Fixes: Industry Fights Load And Heat

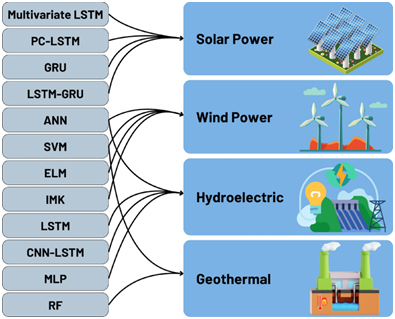

Data-centre managers don’t sit idly by as grids struggle. They invest in three broad categories: hardware optimisation, cooling infrastructure, and intelligent software scheduling. Each saves energy or shifts it away from peaks; each entails trade-offs.

First, chips and servers become more efficient. New accelerators provide much more compute per watt than previous racks. As hardware retires, replacements do more with the same power. Compute demand goes up faster than efficiency improvements, though, so efficiency is needed but not sufficient.

Second, cooling is changing rapidly. Liquid cooling is moving from early adoption to mainstream in hyperscale data centres. By circulating fluid through hot components, operators dissipate heat much more efficiently than air. That reduces energy needed for fans and chillers and enables providers to pack more compute in the same area. It also affects the water–energy trade-off since some liquid systems use water or need additional thermal management loops, but engineers design closed loops, utilise reclaimed water or hybrid systems that extract water only at peak heat.

Third, software does matter. Operators now schedule workloads between data centres and time zones. Training runs that are non-essential move to off-hours or sites that have surplus renewable capacity. Providers also attempt “thermal-aware” scheduling to load servers so as to avoid hotspots and peak grid load. These methods can shave peaks, flattening demand on stretched substations.

The New Economics: Who Underwrites The New Power And Water

When a hyperscaler requires 100 MW of capacity, building the data centre is just the start. Utilities may require new transmission lines, substations and transformers. They are multi-million dollar, multi-year upgrades.

Who pays? Three models emerge:

- Developer-financed upgrades: The centre’s developer pays for local grid work to speed connection. That shifts bargaining power to large tech companies.

- Socialised upgrades: Utilities and governments pass the cost on to ratepayers. That benefits locals and applicants but is politically unpopular: families may be compelled to pay to facilitate growth for a foreign tech company.

- Hybrid transactions: Corporations buy long-term power purchase agreements and invest in community grid initiatives; governments sometimes include incentives for renewables or storage within the build.

- There are winners and losers for each model: Private finance leverages speed but can undermine long-term public planning. Socialisation lowers entry barriers but risks public alienation if citizens don’t see short-term benefits. Hybrid transactions can align interests provided enforceable commitments exist.

AI’s power boom raises the question: who pays the bill? (Image Source: Data Centre Knowledge)

Case Studies: How Places Respond

Belgium: A Turning Point

Belgium spells out the constraints: With several projects competing for limited capacity, the grid operator advises placing data centres in a special class to retain capacity and keep out speculators. That policy recognises that too many projects in one spot hurt local capacity and public interest. (devdiscourse)

US And Northern Virginia Hubs

Northern Virginia clusters illustrate how pressure concentrates: Alarm bells ring over local transmission, water use and higher wholesale prices. Utilities occasionally throttle new connections or ask for phased roll-outs to avoid overwhelming local grids. (publicpower)

Hyperscalers Constructing Own Supply

Some tech firms subscribe to massive generation contracts, from renewables and storage through to firm gas or even nuclear deals. They do so to provide stability and carbon accounting, but the moves complicate public planning and can lock sites into fossil assets unless addressed.

Cooling Trade-Offs Revisited: Water, Heat And Reuse

Engineers today compare cooling systems on a holistic measure: energy use plus water footprint plus local ecosystem impact. Humid, water-rich climates make evaporative or water-cooling cheap and effective. Dry regions favour closed-loop or dry liquid cooling to eliminate water risk at the expense of energy or capital expenditure. Sea water or reclaimed water cooling can mitigate freshwater shortages, but logistics and permits complicate.

Policy should require transparent disclosure of water usage and invite developers to offer low-impact alternatives when local resources become strained. This aligns site development with local circumstances, not corporate whim.

Data centre cooling must balance energy, water, and local impact. (Image Source: MDPI)

Grid Reaction And The Storage Turn

When big loads congregate, grids shift in three supporting directions: more renewables, more storage, and improved demand management. Renewables alone cannot solve timing mismatches. Solar peaks during the day, but data-centre peaks can coincide with business hours or heavy training sessions. Without storage, peaks won’t always be met by renewables.

Battery storage is worth it. Paired storage allows sites to shave short-term peaks and sell ancillary services. Storage generates a commercial value stream selling grid services when not needed by the data centre.

Demand flexibility matters. Some operators sign contracts where utilities can shave non-critical loads in emergencies or offer incentives for moving heavy loads off-peak. That flexibility becomes a marketable commodity for grid resilience.

Also Read: The Agentic AI Revolution: Hype to Factory Floor

Who Gains And Who Foots The Bill?

- Winners: large cloud providers (economies of scale), regions with cheap renewables, and providers of next-generation cooling and storage technology.

- Losers: local communities and small businesses near clustered development without bargaining power; urban areas with higher water stress; and ratepayers if costs are socialised without a net local advantage.

That imbalance provokes political pushback. When regions find priority accorded to select firms, citizens demand stronger regulation. Belgium’s ring-fencing of data-centre distribution typifies this public-interest correction.

Policy Playbook: What Governments Must Do Now

Regulators and planners can act today not just for fairness, but to protect system stability and the energy transition.

- Transparent capacity planning: Treat data-centre capacity as a reserved category with well-defined policies for staging and allocation.

- Forced full environmental disclosure: Require applicants to submit estimated electricity use and water, cooling plan, and grid-upgrade plan reports as mandatory information to the public before granting permits.

- Demand binding upgrade commitments: Permit only if developers commit to legally and financially binding undertakings on grid works or phased connections contingent on realised load growth.

- Incentivise flexibility: Impose tariffs or market rules that favour load shifting, storage, and grid services from data centres. Compensate for flexibility.

- Save water resources: Ban freshwater cooling in water-deficient regions or require reclaimed water and closed-loop cooling. Give priority to local water security in planning.

- Local benefit agreements: Force developers to provide local infrastructure, training and community funds, not just tax dollars. That ensures benefit sharing with hosting communities.

Australia-Specific Note: What To Watch Out For Here

Australia hosts data centres and competes for hyperscaler investment. Three local realities policymakers must account for are:

- Grid mix and geography: Regions of high-renewable potential have the potential to deliver low-carbon power, but transmission is usually the limiting factor. Generation and the ability to ship power to load centres need to be factored into site choices.

- Water stress: Australia faces intermittent water shortages across much of the country. Air-cooled designs or recycled supply must be enforced where appropriate. Licences should require aggressive water-use planning.

- Community consent: Australians value preservation of local amenity and environment. Special benefit packages and obvious local advantages will facilitate approvals and reduce political risk.

Australian governments can prepare for growth: deliver priority grid-investment locations and green procurement policy that steers new development to areas where renewables and storage are already established or planned.

A Practical Path Forward

- Map capacity before permits: Issue realistic maps of available local transmission and water capacity. Do not accept a project unless the map shows the headroom needed or until upgrades are paid for.

- Partner connection and delivery: Approve power in tranches. If a developer seeks 100 MW, approve 20–40 MW first and issue more once local works are finished and the real load is known.

- Price responsiveness: Structure tariffs to incentivise shifting compute or selling grid services. Shop for the cheapest, cleanest options.

- Need environmental transparency: Public dashboards must publish expected and actual energy and water use, cooling methods and carbon reporting.

- Defend local interests: Insist on local benefit agreements: skills training, infrastructure investment and auditable community spend.

These actions secure reliability, justice and the energy transition while facilitating responsible growth.

Conclusion: Powering Intelligence Responsibly

The rapid expansion of AI is reshaping industries, economies, and the very fabric of modern life. Yet, behind every chatbot, autonomous system, and algorithm lies a growing physical demand, one that stretches power grids, consumes vast amounts of water, and challenges global sustainability goals.

Balancing this digital ambition with environmental responsibility is no longer optional; it’s imperative. Governments, tech firms, and utilities must now collaborate to create energy-efficient systems, invest in renewables, and design smarter cooling technologies that match the intelligence of the models they power.

The AI revolution will continue to accelerate, but the real measure of its success may lie not in how powerful machines become but in how wisely humanity manages the power they consume.

Frequently Asked Questions

- Q: What is the present electricity demand of data centres?

A: Rough, but the latest estimates of the world’s data-centre power use are in hundreds of TWh annually (estimates of 300–380 TWh for 2023), with fast development expected because of AI. Projections show enormous increases by 2030. - Q: Will AI make power shortages more likely?

A: If infrastructure in the grids lags behind demand and many centres open in the same location, local bottlenecks and more costly prices are unavoidable. Anecdotal and technical evidence point to grid stress without diligent planning and investment. - Q: Are data centres using a lot of freshwater?

A: Direct consumption is vast in certain densified locales. While nationwide figures look minor, extractions in more stressed locations can be supply-tearing. More recent data centres are being constructed in locations that experience higher water stress. - Q: Will efficiency gains bridge the gap?

A: Efficiency savings assist, but because each new generation of AI hardware requires more computing, aggregate demand could still experience the familiar rebound effect. Policy and planning are therefore still essential. - Q: What have been the government policy responses?

A: Responses include capacity categorisation, new development moratoria, decreased permits, and new grid planning necessities imposed. Recent moves by regulators show governments are adjusting rules to protect public infrastructure. - Q: Is the projection of data-centre demand certain?

Projections rely on assumptions about hardware efficiency, policy and workload growth. Some scenarios double consumption by 2030, but outcomes vary. Even conservative projections demand significant planning. - Q: Won’t renewables take care of this?

Renewables help, but they require storage and transmission to solve timing. Coordinated planning of renewables, storage and lines is essential to meet aggregated new loads. - Q: Is liquid cooling the silver bullet?

Liquid cooling reduces electrical cooling loads and enables higher-density computing. It is becoming popular in hyperscale construction. Some liquid systems use water; in water-scarce areas, closed systems, recycled water, or dry cooling are better. - Q: Can data centres benefit the grid?

With batteries and flexible contracts, data centres can provide grid services such as demand shifting and frequency response, and even store capacity if markets incentivise and value those services. - Q: Are blackouts something communities need to worry about?

Risk is highest where many heavy loads connect at once without parallel upgrades. Proper permitting, staged connections and flexibility contracts reduce that risk. Recent moves by grid managers show regulators are increasingly attentive.