Australia’s Quiet Leap in Critical Minerals

In a significant step for Australia’s critical minerals sector, Everest Metals Corporation (EMC) has announced an industry-defining development at its Mt Edon project in Western Australia. The announcement marks what could be considered an Australian rubidium breakthrough, with test work confirming a 97% recovery rate for rubidium oxide from pegmatite samples.

While lithium, tantalum, and rare earths have dominated headlines, rubidium—a relatively obscure alkali metal—has been quietly carving out its strategic relevance in advanced technologies, quantum computing, and defence applications. EMC’s advancement places Australia at the frontier of this evolving market.

Mt Edon’s Rubidium Resource: By the Numbers

The Mt Edon resource boasts 3.6 million tonnes of pegmatite ore, containing 0.22% rubidium oxide—figures that already position the site among the richest known rubidium deposits in the country. Situated in the Paynes Find Greenstone Belt, the project is strategically placed within a geologically favourable corridor also known for lithium and caesium occurrences.

In conjunction with engineering consultants, EMC recently completed an engineering scoping study which validated the feasibility of rubidium extraction and confirmed the viability of scaling operations. The 97% recovery rate achieved through laboratory processing not only validates the geology but sets a new benchmark for rubidium extraction globally.

Aerial view of Mt Edon exploration site, Western Australia—home to one of the richest rubidium oxide deposits in the country.

Source: [Everest Metals Official Site]

Why Rubidium Now?

Unlike lithium or cobalt, rubidium has largely remained under the radar in Australia’s mining narrative. However, its applications—from atomic clocks and infrared optics to high-performance glass and electronics—are seeing increased demand. As the global push for next-generation computing and precise military tech grows, rubidium’s niche appeal is shifting into broader strategic value.

Until now, much of the world’s rubidium supply has been dominated by China. EMC’s discovery is therefore not just a mineralogical feat—it’s a geopolitical development, potentially reducing Western dependence on a single dominant supplier.

Technical Triumph: Extraction Efficiency and Market Readiness

Achieving a 97% rubidium recovery rate is no minor milestone. It speaks to the compatibility of Mt Edon’s mineralogy with existing extraction technologies. More importantly, it reduces technical risk for investors and opens the door to downstream opportunities.

EMC is already planning further metallurgical studies, with a pre-feasibility report expected within the next 12 months. The engineering scoping study outlines scalable pathways, including co-recovery of lithium and tantalum, creating multi-mineral revenue streams that enhance the project’s economics.

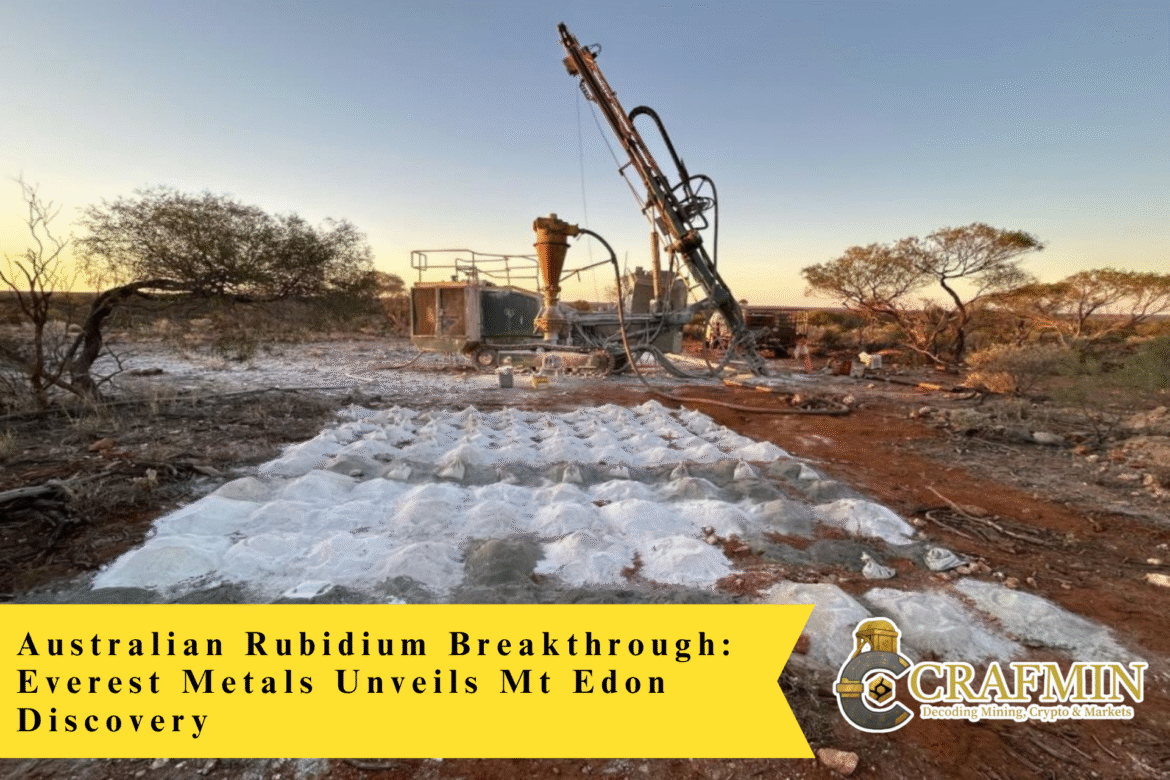

Rubidium-bearing pegmatite sample extracted from Mt Edon site.

Source: Everest Metals

A Fresh Perspective: Rubidium and the Critical Mineral Renaissance

What sets this story apart is not just the mineral—but the context. In a world racing towards technological superiority and energy transformation, Australia’s ability to offer niche critical minerals like rubidium is becoming a national asset.

While lithium remains a volume-driven market, rubidium is value-driven—produced in smaller quantities but commanding significantly higher margins. EMC’s work at Mt Edon opens the door for Australia to lead not just in EV supply chains, but also in satellite communications, defence optics, and quantum sensing—fields expected to grow exponentially by 2030.

Visualisation of rubidium’s role in atomic clocks and future quantum systems.

Source: MDPI

Conclusion: Beyond the Usual Elements

The Australian rubidium breakthrough at Mt Edon exemplifies the changing face of Australia’s resource sector. It’s no longer just about bulk exports of iron ore and lithium—it’s about precision, speciality, and global influence.

EMC’s work has added rubidium to Australian’s critical mineral conversation, and with continued technical success and government support, the Mt Edon project could be the starting point for a new class of strategic mining ventures.

This isn’t just a win for EMC—it’s a win for the broader narrative of what mining in Australian can become: smart, strategic, and globally relevant.