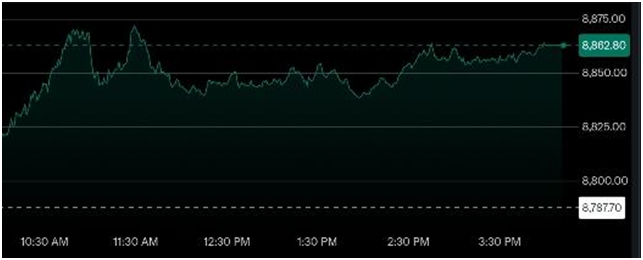

The ASX 200 witnessed a surge of 0.9 per cent to touch the 8,863 level. The broader markets, represented by the All Ordinaries, also rose 0.8 per cent to 9,148 points. The rally was mainly on the back of banking shares, with the Commonwealth Bank (CBA) giving a 2.2 per cent gain.

The insurance stocks followed through, with IAG rising 1.7 per cent. Meanwhile, CSL was up 3.0 per cent in comfort following the all-clear on potential US tariffs on pharmaceutical imports. Analysts believe the bounce was on strong investor sentiment across a wide range of sectors, particularly financials and healthcare.

Despite early weakness on Monday, the market moved higher on the back of stabilising signals from the global markets. In the view of many, Monday’s performance marks a considerable step towards regaining confidence in Australian equities.

ASX 200 jumps 0.9% to 8,863; All Ordinaries up 0.8% at 9,148

Gold surge supports Australian stock market news

A new high in gold prices had it trading at $3,811 per ounce. Such a surge saw gold shares going up on the ASX while defensive and resource stocks were moving marginally upwards.

On the contrary, BHP, Rio Tinto, and Fortescue gave up 1-2 per cent due to downbeat commodity prices and iron ore tumbling in China. South32 avoided the losses and stayed stable. Uranium miners, such as Paladin, slipped 2.4 per cent, while coal miners, including Whitehaven, declined 3.4 per cent. In contrast, energy major Woodside rose 0.4 per cent on the back of high oil prices.

The stellar performance of the gold counters has underlined a safe-haven shift amid global uncertainties. While investors consider this rally as proof of Australia standing tall in the gold market and commodity sectors.

What is the outlook for interest rates?

The RBA is expected to keep the cash rate at 3.60 per cent by tomorrow. Presently, markets are unwilling to entertain any probability of a cut. Yet analysts warn that economic agents might reconsider when inflationary pressures emerge, likely in time for the November meeting.

The outlook for interest rates is pertinent to Henry’s domains, such as real estate, consumer discretionary, and financial sectors. Short-term trading would receive clarity from the RBA, and investors would keenly monitor all indicators. Any unforeseen surprise from the bank will trigger volatility in the ASX, despite the wide-based uplift today.

International signals boost ASX market sentiment

Markets gained on new fiscal stimulus measures and the easing of foreign bond investment restrictions by the Chinese central bank. Hong Kong rallied 2.0 per cent, with Shanghai up 1.8 per cent. US futures expect modest gains, with S&P 500 futures up 0.4 per cent.

At last week’s closing, the S&P 500 was +0.6 per cent; the Dow, +0.7 per cent; and the Nasdaq, +0.4 per cent.. And the positive international cues have spread confidence across Australian sectors. Analysts say that global fiscal signals have grown increasingly important for directing the domestic investor.

Will tariff concerns derail the ASX market rebound?

Tariff risks remain relevant, despite optimistic hope. The CSL rebound got catalysed when concern over possible US pharmaceutical tariffs grew. While shares in the company rose 3.0 per cent today, analysts warn that tariffs could press down profit margins, if ever implemented.

But such an impact may perhaps be alleviated through supply chain restructuring, and certain exemptions may be applicable too. Investors are concerned about trade tensions – political in effect – which may affect industrial and resource sectors.

The ASX market so far continues to rebound, but geopolitical developments remain a serious thing to be kept in consideration.

CSL shares rebound 3% on tariff concerns, but analysts caution profit margin risks

The ASX rebound appears stronger than expected

Monday witnessed a rally of broad participation. Evidence proving that the rebound of the ASX markets is established. Gains were made by banks, healthcare, and gold miners, while the energy and coal sectors lagged. Both defensive and growth stocks move up, showing the market is very balanced.

Now investors are looking at tomorrow’s RBA decision for direction. International developments, especially those coming out of China and the US, will continue to shape sentiment. Today’s performance has again instilled confidence in the resilience of Australian equities through a period of global uncertainty.

Also Read: AUD/USD Outlook RBA Cut Likely After Soft CPI

Frequently Asked Questions

Q1: What was behind today’s ASX financial markets news?

Bank strength, CSL recovery, and gold surged and lifted the ASX.

Q2: Is the ASX market rebound clear?

Indeed, gains were broad across sectors, tariff, and inflation risks notwithstanding.

Q3: What about interest rates in Australia?

The RBA is expected to keep rates on hold at 3.6 per cent, with potential cuts later in November.

Q4: How would international signals affect Australian stock market news?

Local sentiment is influenced by global cues such as Chinese stimulus and US futures.