The recent rise in Bitcoin’s price in Australia has been primarily driven by the institutional adoption, which is the main reason for the increase in the price of the cryptocurrency. Up to now, financial institutions, superannuation funds and major investment firms have started seeing Bitcoin as one of their portfolios.

This development is a clear indication of the digitisation of the asset and the shift towards Western-style asset management in the country. Market analysts believe that with the growing institutional participation, the market’s credibility has been strengthened, thus attracting both retail and corporate investors.

This process of getting rid of the uncertainty surrounding the regulations is also making the country the centre of attention for cryptocurrency investment.

Institutional adoption drives Bitcoin price rise among Australian investors.

What Is Driving Bitcoin Price Growth?

The spike in the price of Bitcoin is directly connected with the rising demand from the institutional side. The banks and super funds in Australia are introducing Bitcoin in their decks as a part of their diversification strategy, which is a clear sign of digital assets being increasingly accepted.

The experts say that institutions bring in long-term stability, which diminishes the volatility that is usually associated with cryptocurrency markets. The market turnover has also seen an increase, with $2.5 billion traded lately, and thus, it is an indication of major activity and interest.

Some market analysts believe that the online transactions adopting institutions are giving the BTC/USD price rise a push, and they are also encouraging wider market participation. The more the institutions invade these financial markets, the more Bitcoin will be encountered as a part of mainstream finance.

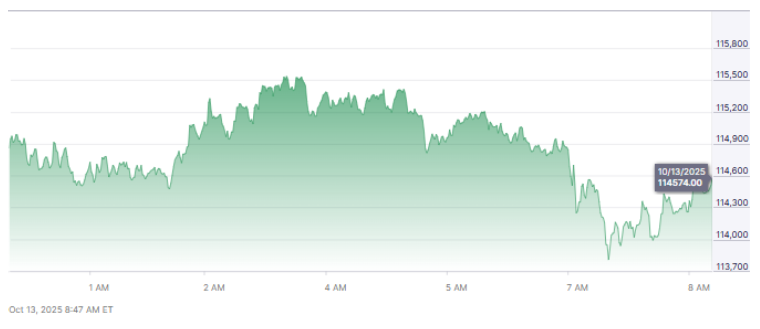

Bitcoin Hits New Highs Despite Minor Dip

Bitcoin made a sharp rise, peaked at $122,600 during the day and then closed at $112,980.28; thus, the decline was small, only 7.19%. However, although the price went down, the market was still alive and kicking, the strong institutional support and increasing.

Adoption throughout Australia is the main reason for this. It has been predicted that if the current trends persist, Bitcoin could rise to $140,709.93 in the next six months. Analysts have stated that the demand from institutions is the main cause of these gains, thus confirming Bitcoin’s status as the coveted investment asset.

Such major price movements will make Bitcoin a great part of the Australian portfolios in 2025, giving complementary economic growth and acting the insurance against the fluctuations in traditional markets.

How Are Institutions Shaping Crypto Investment Trends?

The presence of institutions in the market is gradually changing the investment styles in Australia and even the rest of the world. Bitcoin, the digital asset, is now one of the components of the diversified portfolio and the volatility of the traditional market is thus reduced.

The superannuation funds and major financial institutions are the major players that are facilitating this integration, which is a sign of the long-term profitability of the cryptocurrency market. The analysts believe that the retail investors’ adoption of crypto is being driven by the influx, and at the same time, the innovation in financial products is being promoted.

The country’s institutions are proving that digital asset integration is not a one-time event but a financial strategy. The backing of the institutions and the availability of the necessary market infrastructure are the factors that together create a more developed and stable cryptocurrency ecosystem.

Regulatory Clarity Enhances Investor Confidence.

Australia’s changing regulatory framework has a major impact on the whole Bitcoin adoption process, playing a really important support role. The regulations for the exchanges and platforms dealing with cryptocurrency are clearly defined, and that gives the investors the necessary confidence and transparency to make their investment decisions.

The institutions are assured of the safety of their investments in Bitcoin through the imposition of high security and compliance requirements. Experts from the industry are of the opinion that the regulations contribute to the strengthening of the market in the long run, which, thus, attracts more institutions to take part.

Besides, regulatory clarity is what helps Australia to be on the same level as other countries in the world when it comes to winning the international investors who are looking for crypto markets that are secure and regulated. By offering a framework that allows for both innovation and oversight, the regulators are actually making it possible for Bitcoin and other cryptocurrencies to grow in a supportive environment.

Australia’s evolving crypto regulations boost investor confidence and support Bitcoin adoption.

What Is The Future Outlook For Bitcoin in Australia in 2025?

It is cashless, and Bitcoin’s acceptance and incorporation into Australia’s financial system develop hand in hand with its expected growing influence. Besides, this gradual acceptance of institutions signals that the market is going to be stable over the long term and that the process of integrating cryptocurrency into traditional finance will continue.

The demand for Bitcoin has great potential to go up because trading infrastructure and access are going to be vastly improved by platforms. Market analysts expect Bitcoin to be a featured item in investment portfolios and foresee the possibility of its price reaching new heights by 2025.

The factors such as constant clarity in regulations, involvement of investors from institutions and advancements in technology are expected to be the main drivers of the further growth of Bitcoin. The acceptance of Bitcoin in Australia could also dictate the direction of global markets; thus, the country keeps up its image as a digital asset progressive hub.

FAQs

- What are the key factors behind the rise in Bitcoin price in Australia?

The demand and trust are increasing because the banks and superannuation funds are adopting it on a large scale.

- What is the role of the institutions in the cryptocurrency market?

They are stabilising, diversifying, and facilitating the adoption of digital assets by the investors.

- What is the prediction for Bitcoin Australia 2025?

Institutional participation, clear regulations, and acceptance in mainstream finance will be the anticipated trends.

- In what ways does regulation influence the morale of investors?

Newer guidelines make the situation clearer, safeguard investors, and create a positive atmosphere for the use of digital assets.