The transformation is already in progress.

Big banks no longer observe blockchain through the windows. They are smack down trying to reconstruct the flow of money.

Lloyds Banking Group and Barclays take blockchain out of theory and into live financial plumbing this week. These cannot be pilot experiments hidden in innovation labs. They are actual movements that portend a more fundamental change in the manner deposits, settlements and payments are run. (europawire)

The concept of tokenised money can no longer be described as crypto buzzword. It is emerging as a banking strategy.

And that changes everything.

Banks are no longer watching blockchain. Lloyds and Barclays are using it to move real money. (Image Source: Monetum)

What’s Happening Right Now

Money is being tokenised on blockchain networks by banks to enhance speed, transparency, and programmability.

Lloyds is concentrating on tokenised deposits, where the physical bank money is represented as blockchain tokens but which are still controlled in their entirety. Barclays supports infrastructure of stablecoins payments that facilitates faster and more efficient movement between institutions.

This is not concerning the replacement of banks. It is about upgrading them.

Money moves within minutes as opposed to legacy rails which require days to clear. Banks acquire programmable financial logic as opposed to inflexible systems. Transactions are processed almost instantly instead of being delayed during the reconciliation process.

The financial system is being silently remodeled.

Why This Moment Matters

Over the years, blockchain adoption was stranding at the fringes of the traditional finance.

Regulation, risk, and complexity were mentioned by the banks. Crypto went viral but institutions were skeptical.

That caution is fading.

The modern banking systems are attacked on all sides. The rate of cross-border payments is slow. Settlement costs stay high. The challengers in the fintech industry provide enhanced user experiences. Transparency is required by regulators.

A number of these issues are addressed by tokenisation simultaneously.

It enables the banks to maintain control and obtain blockchain efficiency.

And this now being proved not of theory by Lloyds and Barclays.

Getting a Straightforward View of Tokenised Money

Tokenised money is stored as digital tokens and stored in a blockchain that represent real funds.

The tokens are represented by real fiat money in the possession of a bank. The value does not float. It does not speculate. It remains fixed to real deposits.

This matters.

And tokenised deposits, unlike cryptocurrencies, are held within existing banking systems. They are still regulated, compliant and under consumer protection.

Imagine software acquiring money.

It becomes traceable. Programmable. Instantly transferable.

The balance stays real. The rails become digital.

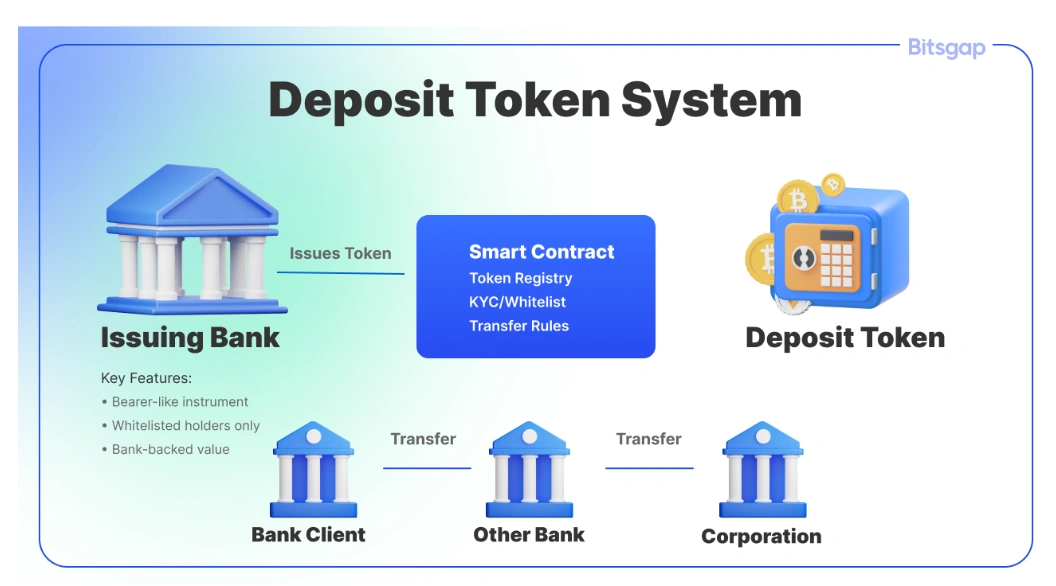

Stablecoins vs Tokenised Deposits

These two tend to merge, however, banks do not consider them as one thing.

Tokenised deposits

- Issued by regulated banks

- Completely secured by customer deposits.

- Burial as part of current banking systems.

- Institutional and enterprise designed.

Stablecoins

- Frequently published by non-governmental organizations.

- Pegged to fiat currencies

- Practiced in crypto markets.

- Compromise to greater regulatory inspection.

Lloyds is a bank that is inclined to tokenised deposits. Barclays considers stablecoin settlement infrastructure.

Different paths. Same destination.

Banks separate tokenised deposits from stablecoins. Lloyds chooses one path. Barclays takes another. (Image Source: Bitsgap)

Banks separate tokenised deposits from stablecoins. Lloyds chooses one path. Barclays takes another. (Image Source: Bitsgap)

The Case Behind Lloyds Investing in Tokenised Deposits

Hype is not something that Lloyds Banking Group is pursuing. It lays emphasis on infrastructure.

Making deposits tokenised enables Lloyds to change the core banking operations without leaving the regulation.

Such a strategy opens up a number of benefits.

Payments settle faster. Management of liquidity is enhanced. Automation reduces errors. Conditional transfers are made possible through smart contracts.

Visualize mortgage funds being automatically released once conditions have been met. Or corporate payments making the instant goods come.

This does not make it futuristic. It is already being tested.

Lloyds does not place blockchain in the position of a disruptor, but instead, it is on the upgrade layer.

That distinction matters.

For Lloyds, tokenised deposits are infrastructure, not hype. They modernise banking systems while staying within regulation. (Image Source: CoinTrust)

For Lloyds, tokenised deposits are infrastructure, not hype. They modernise banking systems while staying within regulation. (Image Source: CoinTrust)

The Push of the Stablecoin Settlement and Barclays

Barclays makes a complementary move.

The bank empowers cross institution payment infrastructure by sponsoring the stablecoin settlement providers. This action aims at disparities in the process of settling an obligation between the banks.

The existing systems are dependent upon several intermediaries. They cost time and money.

This process is compressed by blockchain.

Under steady-coin settlement layers, institutions value transfer, and this is final and transparent.

Barclays realizes that financial future involves interoperable digital money networks. It is strategic to take advantage of that early support.

It is not speaking of crypto users at retail level. It deals with wholesale finance.

Why Banks Move Now, Not Later

Timing matters.

Several forces converge.

Regulators become more precise in regards to digital asset structures. Blockchain technology is out of the early experimentation phase. There is faster adoption within the enterprise. Competition intensifies.

The cost of delay is also experienced in banks.

Faster rails are constructed by fintech companies. Market share is taken by payment startups. Cryto platforms demonstrate the appearance of real time settlement.

Slow systems can no longer be tolerated by traditional banks.

A regulated direction is available through tokenisation.

It does not need to give up trust in order to innovate.

The Programmable Money Transforms the Behaviour of Finance

The tokenised money does not work by moving faster.

It behaves differently.

Computable money adheres to code rules. Payments are automatic in cases where conditions are met. Checks of compliance are done in real time. Audit trails are not changed.

This changes the manner in which the financial contracts are functioning.

Commerce finance is made easier. Corporate treasury gets accuracy. Supply chains match payments with delivery.

Money becomes responsive.

Such a responsiveness transforms finance into dynamism.

Tokenised money is programmable: payments trigger automatically, compliance runs in real time, and finance becomes dynamic. (Image Source: Medium)

Tokenised money is programmable: payments trigger automatically, compliance runs in real time, and finance becomes dynamic. (Image Source: Medium)

The Implication of This to Businesses

In the case of businesses, the rewards are short-term.

Cash flow is enhanced by the faster settlement speeds. Reconciliation costs fall. Transparency rises.

Minor inefficiencies are multiplied into enormous efficiency.

The transactions across borders are made easier. Risks in terms of foreign exchange are minimized. The liquidity is made manageable.

Companies do not have to wait days to get money.

These work almost in real-time.

The Implication of This to the Common Customer

Customers at the retail level might not see blockchain.

Yet they will experience the influence.

Faster payments. Fewer errors. Better digital services. Smarter financial products.

In the background, the banks simplify processes.

At the front end, customers have smoother experiences.

This is the process of infrastructure innovation. Quiet. Incremental. Transformative.

The Silent Mergence of Crypto and Banking

Years of crypto and bank tension had been experienced.

Now they converge.

Banks embrace blockchain but not the crypto volatility. Crypto infrastructure acquires institutional validity.

The distinction between controlled finance and decentralised innovation fades away.

This does not end crypto.

It validates the technology.

The Reason Why This Trend Transforms Financial Power

The tokenised money moves the financial authority.

Portfolio is more important than frameworks. It is more about speed than scale. It is more of the programmability than the tradition.

Early adaptability of banks puts them at an advantage.

The ones that postpone are doomed to irrelevance.

Lloyds and Barclays prefer to be at the forefront.

Others will follow.

World First: The Real Deal with the Gilt Purchase of Lloyds

Early in January 2026, Lloyds Banking Group made what many analysts say was a landmark in regulated digital finance: the UK purchased its first government bond, or gilt, through tokenised deposits on a public blockchain.

Lloyds presented digital descriptions of sterling deposits directly in the Canton Network, a public blockchain that is privacy-conscious and regulatory-compliant. The tokens were used to purchase a UK gilt on Archax, a regulated digital assets exchange, after which settlement was moved back into the normal bank accounts.

This sale was not a record-breaker. It demonstrates that regulated bank money can act as a native on blockchain infrastructure without loss of fundamental protection systems such as interest and deposit protection.

That is enormous as far as institutional finance is concerned.

This is not a crypto experiment. It is genuine fiat money running on distributed books, which allows real-time settlement with openness and automation advantages traditionally proposed by blockchain but rarely achieved at scale in regulated markets.

Tokenised Money and Infrastructure: What is Different Now

A Cryptocurrency Backbone, not an Add-on.

During the initial stages of blockchain implementation, banks experimented with proofs-of-concept on licensed or internal ledgers. We now see the mainstream financial products being deployed on public blockchain infrastructure.

The blockchain that the transaction of Lloyds took place in, the Canton Network, is not a closed bank ledger. It is a network that is permitted by the public, yet allows access to the financial institutions under some form of control, while upholding regulatory standards.

The difference between the decentralised technologies and traditional finance is this dual identity, which is public accessibility and controlled measures.

Banks are developing shared rails as opposed to siloed systems. That means:

- Interoperable tokenised deposits.

- Programmable settlement logic.

- Automated compliance

- And computerization of physical values (e.g., government bonds)

Even whilst always being attached to the regulatory frameworks that protect customers.

This is not just innovation. It is institutional development.

Barclays Makes a Tactical Firm Foray into Stablecoin Settlement

Although Lloyds is causing ripples in the tokenisation of deposits, Barclays took a complementary route by investing in a firm constructing the rails that may support a wider tokenised money platform.

Barclays also invested Ubyx, an American startup building a clearing and settlement layer of tokenised fiat and regulated stablecoins.

This action will be the first direct investment that Barclays makes in a stablecoin-infrastructure business and a milestone of change in terms of how the bank interacts with the technology of digital money.

The platform of Ubyx aims to balance tokens issued by various banks and stablecoin providers in a single settlement. It will seek to ensure that the digital money can be interoperable among issuers, platforms and institutions without compromising on regulatory compliance.

To put it plainly:

When the tokenised money is what Lloyds is demonstrating, Barclays is putting the pipes and plumbing in place that will ensure the money is tied in everywhere.

It is a practice that most experienced financial technologists feel is really important, which is to establish infrastructure and then scale deployment.

While Lloyds showcases tokenised deposits, Barclays invests in Ubyx to build the infrastructure that will make digital money interoperable and scalable. (Image Source: TradingView)

While Lloyds showcases tokenised deposits, Barclays invests in Ubyx to build the infrastructure that will make digital money interoperable and scalable. (Image Source: TradingView)

The Reason Banking Giants Are All Tilting to Blockchain Now

So what’s changed?

Converging pressures, which drive this sudden turn, are many.

Regulatory Transparency Is on the Upslope

Governments and central banks are abandoning scepticism in favor of systematic structures of digital money. Regulators in the UK are in the process of piloting tokenised sterling deposit programmes that engage a variety of large lenders.

The same tendency is reflected in the world: the regulators of the EU and Asia are investigating the means of putting the digital assets into the scope of existing financial regulations instead of the outskirts, which allows banks to be more innovative.

Easier rules minimize the institutional risk and promote increased involvement.

Fintech and Decentralised Finance Competitive Pressure

The conventional banks are under fierce pressure from the control of fintech startups and decentralised platforms that might be faster. These competitors, however, have access to regulated, insured money, which is the case with the majority of them.

The benefit of tokenisation switches. It enables banks to hold on to trust and regulatory shields and embrace speed and automation previously the prerogative of fintech and crypto.

Efficiency Gains in Operation are Irreversible

Whereas previously, settlement took days, now, when tokenised, it takes seconds. Manual reconciliation is supplanted with smart contract logic. Treasury functions are made programmable.

These benefits are not desired by banks, but they are necessitated.

Dynamics of Regulatory and Compliance: The Dynamics of Balancing

Although there is mounting pressure, the banks are alarmingly conscious of the fact that such technologies should exist within the confines of regulation.

Retail cryptocurrencies are not similar to tokenised deposits and regulated stablecoins in the following ways:

- Fiat currency supports them 1:1.

- They are placed in the current balance sheets of the banks.

- They are still under compliance and deposit guarantees.

That is why projects such as tokenised deposit transactions at Lloyds utilise permissioned public networks and why financial institutions are particularly interested in controlled digital money, and not unregulated crypto.

Regulators, both within the UK and the EU (as well as the global standard-setters), still pay attention to:

- Operational risk

- Cybersecurity

- Anti-money-laundering (AML) security.

- Consumer protections

The banks know that unchecked decentralisation is not what is desired. Instead, it is aiming at digital transformation under a compliant framework.

Implications on a Global Scale: A New Financial Environment

The effects of this movement go way beyond the UK or Europe. The effects of tokenised money may be:

Cross-Border Payments Easy settlement and fewer middlemen would drastically cut the cost and time of international transfers – the scourge of international business.

Liquidity and Treasury Management. The tokenised cash could be held by both corporations and banks, whereby payment can be made 24/7, enhancing efficiency as well as decreasing the working capital friction.

Collateral Management and Financial Markets Programmable collateral can be tokenised assets, which minimise settlement risk and open up new financing structures.

Inclusive Financial Services. Inclusive financial services are offered by banks and other financial institutions to the poor, the homeless, and the elderly. Onboarding and lowering infrastructure costs for digital financial services in emerging markets may become more possible with tokenised money.

Potential Threats and Obstacles in the Future

In spite of the optimism, there are still a number of hurdles.

Interoperability: Various blockchains and token standards require shared frameworks to communicate with each other. Otherwise ,tokenised money runs the risk of being reduced to silos.

Attack Surfaces and Security Cybersecurity threats have new vectors brought by blockchain systems. Banks need to guarantee the existence of strong protections, which should be at par or even more, as per the current standards.

Regulatory Evolution Regulations on tokenised assets, stablecoins and digital money are yet to be characterised. The existence of unequal rules in different jurisdictions can impede global interoperability.

Adoption Curve: As institutional adoption gains momentum, consumers and enterprise adoption differ. Trust-building and education are still necessary.

Future Projections: The Future of Tokenised Money

Broad Enterprise Adoption In the coming 18-24 months, there will be additional institutional pilots and live transactions involving tokenised bank money in other parts of the world, such as Europe, Asia Pacific and North America.

New Settlement Networks Investment in core infrastructure, such as Ubyx, is an indication that the banks would like clearing and settlement systems to be developed on digital money (rather than legacy solutions).

Computerized Finance Goes Mainstream. Smart contracts are not going to resolve only trades. They will computerize compliance, dynamic pricing, conditional payments, and other complicated financial reasoning formerly the prerogative of custom-made systems.

The Existence of Central Bank Digital Currencies (CBDCs) and Tokenised Deposits Coexists. The addition of tokenised bank money to CBDCs – digital substitutes to sovereign currencies – will most likely coexist to form layered digital financial ecosystems. Tech in central banks: An automated supplement of market-driven tokenised deposits.

Also Read: Will Bitcoin Go Above $100,000 in 2026? Key Scenarios Unveiled

Conclusion: A Financing Breakthrough

The gilt purchase of Lloyds and strategic investment in settlement infrastructure by Barclays are not one-off events. They signify a general shift in mainstream finance’s perception of blockchain.

The story has changed to include crypto speculation in digital money infrastructure, where regulated banks no longer regard blockchain as a fringe technology, but rather as a technology.

The concept of tokenised money, be it deposits, programmable financial instruments, or stablecoin settlement, is no longer speculative. It is turning into financial plumbing.

And with more institutions constructing infrastructure, combining public blockchains, and working on interoperable standards, the financial ecosystem will have turned into what it takes to make all the money digital, and everything that regulators insist on.

That is why the blockchain shift in the banking industry is important not only to businesses but also to consumers, regulators, and the financial system of the whole world.

Frequently Asked Questions (FAQ)

- What is tokenised money in banking?

Ans: Tokenised money is a blockchain-based representation of real bank money. It allows faster transactions while remaining fully regulated. - Do cryptocurrencies correspond to tokenised deposits?

Ans: No. Unlike volatile cryptocurrencies, tokenised deposits are backed by real bank funds and operate within regulatory frameworks. - Why are banks embracing blockchain now?

Ans: Banks adopt blockchain due to clearer regulations, maturing technology, competitive pressure, and the need for faster settlements. - Does this impact regular banking customers?

Ans: Yes, indirectly. Customers benefit from faster payments, improved online services, and fewer transaction delays. - Is blockchain safe to use in banking?

Ans: Yes. Banks operate blockchain in permissioned or regulated environments with high security and compliance controls. - What is the difference between a tokenised deposit and a stablecoin?

Ans: Tokenised deposits are issued by regulated banks and fully backed by customer funds. Stablecoins may be pegged to reserves but lack the regulatory oversight and deposit protections of banks. - Can regular customers create tokenised deposits?

Ans: Currently, most tokenised deposits target institutional use. Retail applications may emerge as infrastructure matures. - Is it safe to conduct bank transactions on blockchain?

Ans: Yes, when executed on approved, permissioned networks with security standards equal to traditional banking. - Will these technologies replace traditional banking systems?

Ans: Not immediately. They enhance and upgrade existing systems to improve speed, transparency, and programmability. - When will tokenised money become commonplace?

Ans: Institutional adoption is accelerating. Widespread public use could occur in 3–5 years, depending on regulation and network interoperability.