October set in with a highly bullish moment for the crypto markets as another sharp rally had taken place across altcoins and Bitcoin. The unparalleled Bitcoin feat of breaching the $124,000 highs lent further credence to a rich raft of the cryptocurrency rallying across sectors, especially meme and AI-linked tokens. Another top performer that enjoyed an envious spotlight was AIC with standout multi-fold gains.

What’s Driving The Crypto Price Surge October 2025?

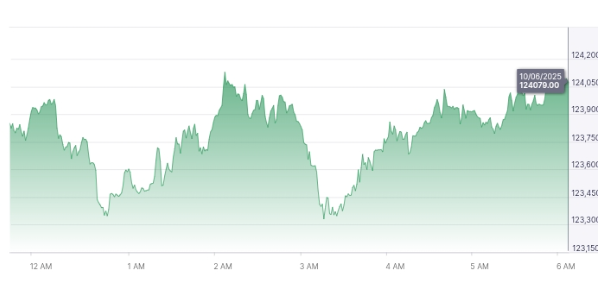

October saw an accumulation of factors triggering this upswing. For one, Bitcoin busting through that $124,000 barrier gave an immense boost to market sentiment. Altcoin buyers, including those targeting meme coins and AI-based tokens, suddenly found greener pastures.

Another worthy cause of rallying was macroeconomic factors. A weakening dollar encouraged risk-on trades, thereby bolstering confidence among tech adopters. Sentiment changed to upward after months of sideways trading.

Another major heavy-lifting factor has been that of the bitcoin spot ETFs in the United States. Data reveal that these ETFs could have seen net inflows ranging from US$3.2 to 4.5 billion last week alone. This cash flow coming on behalf of institutions strongly signalled that a structural basis for the market is still in place. The liquidity that comes from the ETFs usually cascades into the altcoin scene, thereby causing altcoin gains to be multiplied several-fold.

Bitcoin surpasses $124,000, giving markets a significant confidence boost

AIC Cryptocurrency Update: Why Is AIC Surging?

In this rally, AIC is by far the most striking story. AIC has rallied ~14% in the last 24 hours and stands at ~78% for the weekly level. Hence, it makes the list of the best 10-level week performers.

It is the decision by the developers, deliberate and strategic, that sparked AIC’s sharp rise. The team announced a seven-figure buyback and burn program recently, showing their commitment to the long-term value of their token. The program witnessed extremely heavy promotion on X (formerly Twitter), which further consolidated the confidence of buyers in the supply-side economics of the Token.

Burning of tokens tampers with the circulating supply and often increases price momentum if demand is firm. The token gets some benefits from hype around AI in both tech and finance since AIC is an AI-associated project.

Market watchers say that the rally suggests that AIC attracts not only speculative energy but also structural confidence into its roadmap. For-thinking investors keen to diversify, AIC has emerged as the main subject during this October rally.

How Do SPX And FARTCOIN Fit Into The Rally?

Like the AIC, other altcoins have put on a notable performance. SPX rose by nearly 11% in 24 hours and about 55% over the week. Such a rally probably resulted in Coinbase listing, which enhanced liquidity and exposure.

FARTCOIN pushed upward by some 12% to hit US$0.70. Although quite often called a meme coin, the value of community strength and the ability to capture attention have kept it afloat.

That said, SPX, AIC, and FARTCOIN are a testament to how thematic tokens, be it meme or AI related, still have capital citizens. So while all these coins operate on distinct narratives, they are working in tandem toward increased liquidity during this rally of the crypto markets.

SPX surged 11% in 24 hours, 55% weekly, boosted by Coinbase

What Risks Could Slow The Cryptocurrency Market Rally?

Despite the rosy outlook, there are some risks looming on the horizon. Inflows into the US Bitcoin ETFs may not hold up at current levels. A cutback would impede the onward flow of liquidity into the market. A strengthening dollar will also reduce the draw for risk assets like cryptocurrencies.

Regulation also comes into play. Unhelpful regulation and enforcement actions will deter sentiment in no time. Investors are aware that there can be a very large, quick pullback after a fast price acceleration in a crypto rally.

AIC is specifically weighed by the need to maintain breathtakingly strong fundamentals over the long term. The burn campaign holds the near-term price action, but future growth lies in adoption and utility; if the big AI narrative loses steam, the gains might soften.

Can The Crypto Price Surge in October 2025 Continue?

The sustainability of this rally rests on two pillars: consistent liquidity inflows and strong narratives. In the meantime, with Bitcoin’s strength and institutional participation, momentum continues to hold up solidly.

AIC could, therefore, proceed with gains from its buyback program as laid out. SPX and FARTCOIN can benefit further from exchange listings and community engagement. Volatility will be high and corrections will, therefore, occur, though.

This duality presents investors with an opportunity and a warning. Outsize gains can be made on momentum, but risk management is paramount. As October advances, the market will thus be tested on whether enthusiasm can carry through or if resistance will stop progress.

AIC may gain from buybacks; SPX and FARTCOIN benefit, volatility expected

The Bigger Picture: A Broad Cryptocurrency Market Rally

The cryptocurrency market is joining the larger trend driven by behaviour based on liquidity and narratives. To that effect, we have seen speculative capital rushing to AI tokens and meme coins, altogether more than base-layer chains.UU The anchoring factor is Bitcoin, where flows from the ETF have lifted sentiments across altcoins.

The rise of AIC shows how strong tokenomics, joined with a strong narrative power, can give an unusual market performance. Yet, these markets also highlight peculiarities in cryptocurrency trading, where fortunes change in a flash.

Also Read: Bitcoin Breaks $120K As Altcoin Season Gains Momentum

FAQs

Q1: What triggered the crypto price surge in October 2025?

A1: The proliferation rally was triggered due to the breakout of Bitcoin and strong ETF inflows alongside the weakening of the US dollar.

Q2: Why is AIC outperforming other tokens?

A2: AIC is outperforming other tokens because of the announced seven-figure buyback and burn, thereby uplifting the tokenomics and the confidence around it.

Q3: Are meme coins like FARTCOIN still relevant?

A3: Yes. During a rally, meme coins derive franchise from community sustenance and speculative energy.

Q4: Could this rally reverse quickly?

A4: Yes. A volatile market, coupled with regulation or a decline in ETF inflows, could trigger a sharp pullback.