Golden Cross Triggers Massive Profit-Taking Frenzy

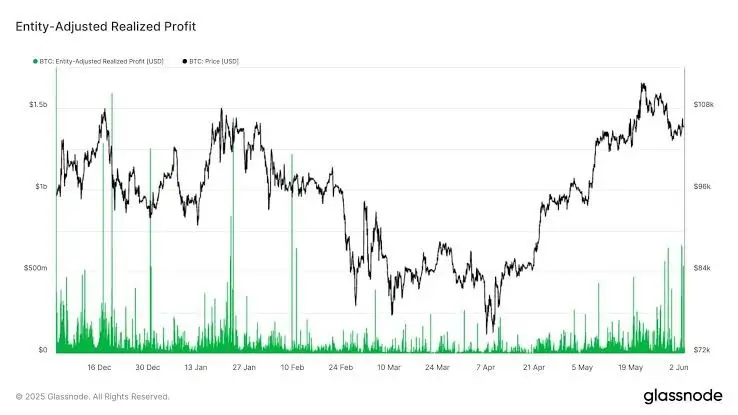

Bitcoin has ignited excitement in the crypto sphere once more—this time not solely for its rising price, but due to a powerful surge in profit-taking. Recent on-chain data reveals that realised profits peaked at over $500 million per hour, with traders capitalising on the appearance of a golden cross—a bullish technical pattern often linked with upward momentum.

While the golden cross, where the 50-day moving average crosses above the 200-day average, typically signals continued gains, the current market response was swift and surprising. Rather than buying in, many cashed out.

Golden Cross Sparks Intense Wave of Bitcoin Profit-Taking ( Image Source: CoinDesk )

Golden Cross Ignites Optimism, Followed by Heavy Exits

Bitcoin’s charts recently displayed textbook bullishness. The golden cross sparked speculation of another major rally, with BTC prices approaching record highs. But that optimism quickly turned into a wave of exits.

In the hours that followed, blockchain data highlighted a stunning trend: profit-taking exploded, with large and small investors alike offloading holdings. At several points, hourly realised profits surpassed half a billion dollars.

What looked like a rally quickly turned into a strategic retreat.

Why Are Traders Selling Now?

The surge in sell-offs isn’t random—it’s tactical. Despite the bullish golden cross, several key drivers prompted this sudden wave of withdrawals:

- Overheated Indicators: RSI and other tools signalled overbought conditions.

- Global Economic Concerns: Uncertainty around inflation and interest rates urged caution.

- Whale Movements: Large BTC holders began shifting assets, often a prelude to broader market action.

The takeaway? Traders are increasingly viewing golden crosses as prime exit points, not just entries.

Also Read: Best Cryptos Under $1: Hidden Gems with High Growth Potential in 2025

$500M Hourly Withdrawals Reveal Market Psychology

On-chain metrics tell a compelling story. For several consecutive hours, realised profits soared past $500 million—a clear indication of coordinated exits by major players. But it wasn’t just institutions. Retail wallets joined in too, spurred by social media chatter and fears of peaking prices.

This shift suggests a broader market behaviour pattern: fear of losing profits outweighs the fear of missing out.

Golden Cross: Bullish Signal or Strategic Sell Trigger?

Traditionally, golden crosses have marked the start of extended bullish phases. But in today’s fast-moving, sentiment-driven environment, they’re increasingly being interpreted as short-term profit cues.

With trading bots and algorithmic systems recognising and acting on these indicators, golden crosses can inadvertently spark waves of selling. The result? A transformation in how investors respond to signals—they’re now just as likely to exit on a bullish flag as they are to enter.

Beyond the Charts: The Human Element

This isn’t just about technical analysis. Bitcoin has evolved into a globally integrated asset. From Australian tradies checking charts during lunch breaks to institutional investors managing reserves, BTC touches millions of lives.

The recent sell-off is a reflection of deeply human behaviour: lock in gains while the getting’s good.

The ghosts of past crashes—2022, 2023—linger in traders’ minds. This time, they’re playing smarter, exiting earlier.

Short-Term Dip, Long-Term Health?

Naturally, BTC’s price dipped slightly following the sell-off, and several altcoins experienced corrections as well. However, this doesn’t appear to be panic selling. Trading volumes remained strong, and many investors believe this is a healthy correction in a maturing market.

Capital rotated into more stable assets, and liquidity remained robust—a positive sign for future growth.

Whale Moves and Market Liquidity

Whale wallets were central to this story. While many moved BTC to exchanges, not all were dumping. Several redirected funds into Ethereum and stablecoins, suggesting strategic reallocations rather than full exits.

Whale Activity and Its Impact on Market Liquidity ( Image Source: El Dorado )

Such actions carry significant weight, as large holders shape market liquidity and volatility. Retail traders would do well to observe these moves closely—it’s often less about the charts and more about who’s trading.

Expert Analysis: Mixed Technical Signals

Market analysts remain cautiously optimistic but note that technical indicators are flashing mixed signals:

- RSI is hovering around overbought levels.

- MACD remains bullish, though divergence is appearing.

- Fibonacci retracement suggests BTC is testing key pullback zones.

“Bitcoin’s golden cross still implies long-term bullishness,” says Lachlan Moss, a crypto analyst based in Sydney. “But the heavy profit-taking shows smart money is cashing in on the hype. The volume doesn’t lie.”

Retail Strategy: Pause, Don’t Panic

For retail traders, the key now is not to react emotionally. The current profit-taking may simply represent a market reset rather than a bearish reversal.

Instead of rushing in or out, investors may benefit from strategies like dollar-cost averaging (DCA), staying liquid, and tracking real-time sentiment indicators like exchange inflows/outflows or the Fear & Greed Index.

Bitcoin’s Global Reach and Local Impacts

Different regions are reacting in different ways. In Australia and the broader Asia-Pacific, interest in crypto remains steady. Local exchanges report continued user sign-ups and strong engagement with Bitcoin-related financial products.

Meanwhile, the U.S. remains laser-focused on ETF flows, and Europe is navigating regulatory clarity. Globally, Bitcoin continues to prove its resilience as a maturing asset class.

Upcoming Factors to Watch

Several key developments could shape Bitcoin’s next move:

- Macroeconomic data – Inflation and interest rate releases from major economies.

- ETF activity – Institutional buy/sell signals.

- Exchange balances – Are traders withdrawing or depositing BTC?

- Whale behaviour – Continued rotation or reaccumulation?

Final Word: A Market Maturing in Real Time

The golden cross delivered a bullish technical setup—but the market responded with strategic selling. That contrast speaks volumes about how far Bitcoin has come.

With $500 million in hourly realised profits, this isn’t panic. It’s precision. Investors are quicker, more strategic, and more cautious.

For anyone watching this play out—whether seasoned crypto native or curious newcomer—this event is a clear lesson in market psychology. Bitcoin reflects not just market trends, but human emotion.

And if there’s one constant in crypto—it’s change. Always be ready for it.