The future of the Company is highly debated, especially with the recent claims about MicroStrategy’s forced selling of Bitcoin if the price declines. Some critics have even suggested that the firm’s leveraged position might cause liquidation, while others are saying that its debt structure could compel the Company to sell during price swings. The issue is, of course, not black and white and is still up for discussion as it deeply affects the Company’s future direction.

MicroStrategy’s future remains disputed amid claims of forced Bitcoin liquidation risks.

What Does Arca CIO Jeff Dorman Say About Forced Seller Risk?

Dorman, Arca’s Chief Investment Officer, is among those who know how to read the situation and remains quite optimistic about it. He says the fears of a Company getting liquidated are overstated as he touts MicroStrategy’s strong fundamentals.

He also points out that the Company does not have any debt terms mandating the sale of the digital asset. Furthermore, he argues that the market is misreading the financial stability of the Company. Dorman feels that the theory of a forced seller does not quite match the Company’s real situation.

How Does Ownership Structure Mitigate Liquidation Risk?

There are no restrictions on MicroStrategy’s debt that are linked to Bitcoin prices. Dorman points this out as the main factor that takes away the risk of a being liquidated automatically.

He further emphasizes that the Company’s software business is still creating profits, which, in turn, allows the Company to pay off its interest without having to sell Bitcoin. Lastly, he brings in the matter of lender attitudes, stating that lenders typically opt for extending the loan term rather than demanding repayment.

MicroStrategy faces no Bitcoin-linked debt risks, supported by profits and flexible lenders.

Why Debt Terms And Cash Flow Matter Here

There are no restrictions on MicroStrategy’s debt that are linked to Bitcoin prices. Dorman points this out as the main factor that takes away the risk of a being liquidated automatically.

He further emphasizes that the Company’s software business is still creating profits, which, in turn, allows the Company to pay off its interest without having to sell Bitcoin. Lastly, he brings in the matter of lender attitudes, stating that lenders typically opt for extending the loan term rather than demanding repayment.

MicroStrategy Forced Seller Risk Dismissed — What Do Market Metrics Show?

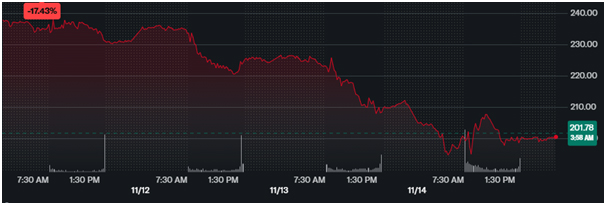

The market data presents to us a somewhat confusing picture. Year to date, MicroStrategy shares of Class A have plunged 33.42 per cent. This situation is quite alarming, but to a certain extent, it can even be termed as panic.

The diluted net asset value of the market is around 1.06 times. The above comments imply that the shares are priced only a tiny bit over the conservative value backed by Bitcoin. The market is taking a risk and showing no signs of it being a forced sale scenario. Dorman argues that this strengthens his position that the fears are inflated.

MicroStrategy shares drop sharply, yet valuation stays near steady diluted NAV.

What Are The Implications For Bitcoin Investors And MSTR Stakeholders?

The discussion regarding Bitcoin investors is more about the market than anything else. According to Dorman, MicroStrategy no longer plays the part of the key marginal buyer. He is of the opinion that the ETFs have taken over the inflows and the MicroStrategy Company is thus less powerful.

For the shareholders, the issues of governance and debt management are now at the forefront. Dorman is of the view that investors should take into account the operations aspect of the Company, not just their Bitcoin exposure. He уверен that МикроСтратедж still has a solid strategic control and a steady cash flow.

How Could Market Sentiment Influence MicroStrategy’s Future Moves?

Market sentiment has a significant influence on MicroStrategy’s perception of its strategy. The volatility that comes with the rise of prices and values in the cryptocurrency market often causes speculation about forced selling despite the fact that the fundamentals are unchanged.

According to the experts, the narratives that are driven by sentiment can easily dominate the financial realities. Dorman recommends that the investors should keep the emotions apart from the data.

He points out that the strong governance and predictable cash flow allow MicroStrategy to remain on the market swings. He further states that the sentiment might change very fast, but the organization’s long-term strategy is still being upheld.

What Does This Debate Mean For Institutional Crypto Confidence?

The debate about MicroStrategy’s risk profile is also linked to the confidence of the institutions in the crypto market. The large asset managers take a close look at companies like MicroStrategy in order to determine their strength in times of pressure. Dorman considers the Company’s ability to survive through criticism as a reinforcement of the institutional trust.

He goes on to say that the rejection of the risk of forced seller indicates the presence of mature corporate standards in the crypto sector. This could lead to the establishment of strong institutional inflows and sustained interest in Bitcoin-linked strategies. He mentions that the clear governance and transparent debt structures are the factors that play a critical role in building long-term confidence.

FAQs

Q1: Is MicroStrategy at risk of a forced Bitcoin sale?

Dorman says no and he dismisses the claim.

Q2: Why is Saylor’s ownership important?

It barricades activist pressure and disallows forced selling.

Q3: Do MicroStrategy’s debts necessitate Bitcoin liquidation?

Dorman says there are no such terms in any debt contracts.

Q4: What does the mNAV multiple indicate?

It shows shares sit only slightly above Bitcoin-backed value.