Sino-Metals Leach Zambia, a Chinese-owned copper firm, is facing global scrutiny. Now, environmental activists, along with contractors hired to manage the cleanup, claim that the company is covering up the magnitude of a toxic spill in the Kafue River in Zambia. All of this turns the spotlight on the kind of due diligence and investor risks one can expect in the copper industry in Africa.

Chinese-owned Sino-Metals Leach Zambia faces rising global scrutiny

What triggered the Zambia toxic spill?

On February 18, 2025, a tailing dam used by Sino-Metals breached. The breach unleashed approximately 50 million litres of acidic and toxic waste into the Kafue River. This river is very important to Zambia’s economy and serves as a source of water supply to many people. The spill caused the immediate depletion of fish stocks and caused damage to crops, not to mention the disruption of farming.

The spill caused a major disruption to the supply of clean water in Zambia’s Kitwe city. Close to 700,000 people were affected and many of them lost access to clean water. Even with the disruption of agriculture and water, it is still considered one of the worst environmental disasters to have occurred in Zambia during the previous decades. The disruption also led to the forced closure of several schools and hospitals.

Did Sino-Metals conceal pollution data?

Drizit Environmental, a cleanup contractor from South Africa, has stated that the disaster was purposefully minimized. The firm was brought in to look into the matter. Their two-month investigation concluded that approximately 1.5 million tons of hazardous waste had made its way into the river, a number that is close to 30 times the amount Sino-Metals openly acknowledged.

Drizit provided some initial findings. Still, Sino-Metals terminated Drizit’s contract one day before the submission of the final report, accusing Drizit of an agreement violation. Such claims are strongly contested by environmental organizations and the local population, who, rather, believe it was an effort to suppress damaging information.

The supposed cover-up by the Chinese mining company has intensified demonstrations and demands for openness. Analysts caution that the consequences on public health in the distant future might be grave as well, since cancer and birth defects are associated with heavy metals such as arsenic, uranium, and cyanide.

Drizit Environmental claims disaster impact was deliberately downplayed

How are authorities responding to the toxic spill?

Authorities in Zambia swiftly coordinated a response. The military poured hundreds of tonnes of lime into the Kafue River. This compound countered the acidity but failed to eliminate heavy metals. Officials claim the river is no longer unsafe, but a great deal of people are hesitant to believe this.

The U.S. Embassy in Lusaka issued an alarming notification. It instructed the public to stay away from the zones and activated an evacuation order for its employees. The Embassy pointed to the threats of uranium, cyanide, and other toxins. An investigation with international oversight is now being demanded by human rights organizations.

Enforcement of promised accountability is bound to be weak, as critics point out, since the Government hasn’t made any steps towards its enforcement. The government has promised that the attackers will be held accountable, Yet Zambia’s dependence on Chinese mining and other forms of investments is yet another reason to regulate enforcement.

Is China’s copper dominance increasing risks?

Zambia is the second-largest producer of copper on the African continent. What’s more, the country is instrumental to the success of China’s Belt and Road Initiative. Several of their enterprises now have control over the important copper mines, one of the most prominent being Sino-Metals Leach Zambia. The government aims to meet its targets which include producing 3 million tonnes of copper per year by 2031. The demand for copper is increasing worldwide because of electric vehicles, renewable energy, and even grid infrastructure, all of which are fuelled by the Zambia toxic spill. However, the Zambia toxic spill highlights the risks of rapid mining expansion.

Environmentalists warn that weak oversight and poor waste management could undermine both public health and investor confidence. China’s reputation in Africa may also suffer if the allegations of a cover-up prove true.

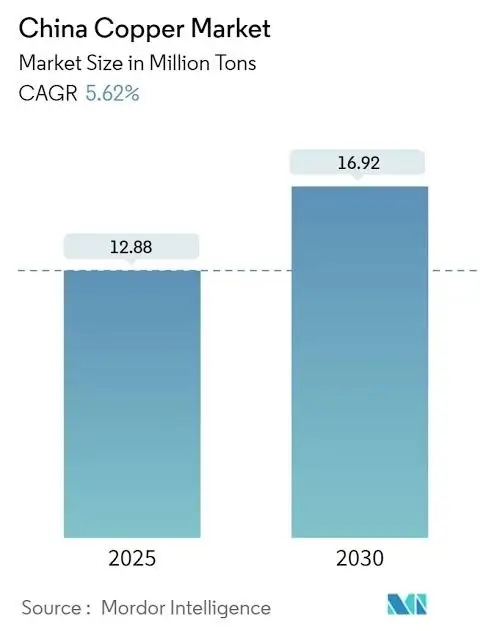

China Copper Market Share Forecast

What does the Zambia toxic spill mean for investors?

New risks are emerging. There is a chance that cleanup costs could escalate quickly if Drizit’s assessment is validated by independent reviewers. The lawsuits alongside possible insurance claims and regulatory fines posed to Sino-Metals could materialize. Global funds focusing on ESG (Environmental, Social, Governance) investing could make cuts to their holdings as well.

Nevertheless, the copper demand is still steady. Zambia’s production targets continue to draw support from the global green technology sectors. Investors continue to balance the risk against the potential rewards. The damage to their reputation may cause a restriction on future funding. Companies connected to the calamity may see their share prices fall, even if just for a short period.

Could investor confidence in Sino-Metals collapse?

Zambia’s Sino-Metals Leach Company has categorically denied the recent waste concealment claims against it. It attacked the credibility of the claims, claiming it had complied with all reporting requirements. The incongruent data provided by Drizit, however, raises questions. All of this is under the strict watch of investors as official investigations proceed.

A cover-up, if substantiated by the regulators, could wreck investor confidence very quickly. There are already a lot of negative implications to the Zambian mining sector, revolving around the cover-up claims against the Chinese mining enterprises. Major investors in the global sector show reluctance in financing projects with lingering environmental issues.

At the moment, Zambia continues to be an important supplier of copper. Still, the toxic spill underlines the persistent conflict between aggressive mineral exploitation and eco-friendly methods.

Also Read: EACON Pushes Mining Autonomy to New Heights at Julong Copper Mine

FAQs

Q1: What caused the Zambia toxic spill?

A: Toxic waste entered the Kafue River on 18 February 2025 due to the failure of a tailings dam at Sino-Metals Leach Zambia.

Q2: Why are pollution concealment allegations emerging?

A: Drizit, the cleanup company, discovered that the waste volumes were much larger than what Sino-Metals disclosed. The contract was terminated before the report was completed.

Q3: What risks do investors face?

A: Increased cleanup expenses, regulatory penalties, and reputational damages might reduce returns even in an environment of elevated copper prices.

Q4: How might the spill affect Zambia’s copper goals?

A: While production targets remain, environmental backlash may slow new project approvals and increase regulatory scrutiny.