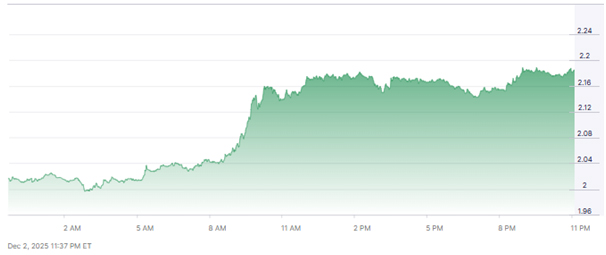

In a remarkable event, spot-ETFs that are associated with XRP witnessed a considerable inflow of US$89.65 million in one day. This influx surpassed the inflows into BTC-spot ETFs and highlighted the great interest of the institutions.

The inflows were in tandem with a significant change where the global asset manager, Vanguard, changed its mind and allowed third-party crypto ETFs of third parties on its platform.

Such a policy change means that Vanguard’s brokerage customers can now access the regulated ETFs that hold XRP, along with Bitcoin and Ethereum. The action diminishes the hurdles for the regular investors and brings about a larger investment pool for exposure to XRP.

XRP spot-ETFs surged after Vanguard enabled broader access.

Why Does Vanguard’s Decision Matter For XRP?

Vanguard has under its management assets worth trillions and a client base spanning 10s of millions globally. When such clients are allowed the trading of crypto-spot ETFs, it is indeed as if the doors for a fresh influx of both institutional and retail money into the likes of XRP have been thrown open by the Vanguard.

The change could very much alter the price by demand route, directly benefiting XRP as an increasing number of investors get the risk-free exposure through the use of ETFs. The familiarity of brokerage channels might very well influence the decision of investors to invest in crypto who otherwise would have nothing to do with it through direct exchanges.

Bullish Medium-Term Outlook Looks Promising

Thanks to wide-ranging ETF access, the price of XRP in the medium term looks positive. Among the factors contributing to this are the anticipated cuts in the Federal Reserve’s interest rates and the clearer-than-ever regulatory environment for crypto.

The price levels of about US$2.35 in the near future do not seem to be unrealistic, as by that time, inflows will have reached and more investors will have joined the procession. If the momentum continues, a rise to US$3.00 within weeks would not be impossible. More of the institutional buying on the back of the lower supply could mean the price going up and sustained gains being backed.

XRP outlook strengthens as ETF access boosts medium-term momentum.

What Risks Could Undermine The Rally?

Still, there are some risks, although optimism is present. Central banks’ interest-rate policy changes, i.e., macroeconomic factors, are capable of disturbing that sentiment. If the inflow of ETFs slows, or if the economy suffers broader setbacks or regulation issues, then XRP might move down to the support zones of US$1.82–1.83 again.

Along with the market, cryptocurrency sentiments will be the force that will either lift up or drag the rally down. It is also possible that the gains will be stopped or reversed if the resistance in the US$2.35–2.50 range withstands.

How Do Technical Signals And Supply Dynamics Look Currently?

The on-chain data illustrates that there has been a downward trend in the reserves of XRP held by exchanges as the tokens have been either moved into ETF vaults or cold storage. The reduction of reserves on traditional exchanges is the result of such a movement. The demand for ETFs, coupled with the supply squeeze, has resulted in the price going up.

Moreover, the technical charts indicate a bullish divergence, which is quite often a sign of reversal between price and momentum indicators. If XRP manages to break through the resistance areas that are nearest it, then the higher levels will be a reality.

XRP supply drops, ETFs rise, signalling bullish technical momentum.

What Could XRP’s Price Outlook Be Into 2025?

In the medium term, XRP could reach the price point of US$3.00 if the ETF inflows do not stop and macro conditions are still favourable. A rally with strength upwards is defined partly by the institutional demand, technical breakouts, and global liquidity remaining stable.

However, the difficulty in predicting the movement direction makes it necessary for the investors to be careful. Being able to identify risk with defined support levels is still a wise approach as XRP goes through this crucial moment.

Also Read: XRP Price News: Crypto Market Rebounds With Bitcoin Price $89K

Frequently Asked Questions

Q1. What is the “Vanguard effect” on XRP?

The “Vanguard effect” means that the impact of Vanguard allowing its customers to invest in regulated crypto-spot ETFs directly. That way, XRP gets to be traded by a very large group of investors, both institutional and retail, through a common brokerage platform, thus the notice and the demand for the coin are rising.

Q2. Could XRP’s price still drop even with all the good news around it?

It is possible. If the state of the economy worsens, the inflow of money into ETFs stops or the price resistance is not broken, then the price of XRP can go down to the $1.82-$1.83 range. Rallies triggered by the ETF are still closely tied to the prevailing investor sentiment.

Q3. What price would the investors be observing if the rally continues?

Bullish forces could push the XRP price to $2.35 resistance in the short term and potentially even to $3.00 in the medium term if investor demand through ETFs continues strong, and resistance is broken.

Q4. Is this article financial advice?

Not at all. This article provides an analysis based on recent happenings and public data. It is highly recommended that investors perform their own research and assess their personal risk tolerance before making any investment.