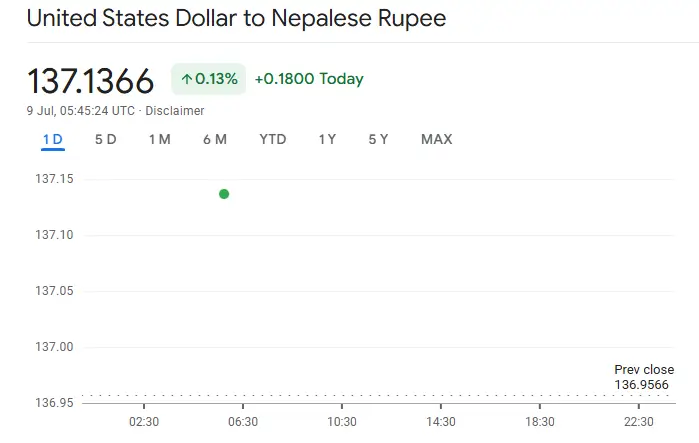

The Nepal Rastra Bank (NRB) has released the updated foreign exchange rates with a slight mark: the USD rate in Nepal goes down. The USD buying rate is Rs. 136.82, whereas the selling rate is Rs. 137.42. It depicts a similar trend as a decrease from Tuesday’s buying and selling rates of Rs. 137.07 and Rs. 137.67, respectively.

Although this is a very minor decline, a USD/NPR rate stagger might bring many implications to the economy of Nepal, particularly for the sectors dependent on imports, remittances, and foreign investment.

Nepal Rastra Bank headquarters in Baluwatar, Kathmandu, where foreign exchange policy decisions are finalised

Why Has the USD Rate Dropped in Nepal?

This drop in the United States dollar exchange rate vis-à-vis the Nepali rupee can be explained in many ways. Having something to do with the forex policies set by the NRB, recent macroeconomic realities, and international monetary decisions.

- Steady Forex Reserves: According to NRB, foreign exchange reserves have lately been higher with increased remittance inflows and tourist receipts.

- Reduced Import Pressure: With global oil prices falling, the dollar purchases for import payments might also have decreased.

- Global Dollar Movements: Internationally, the US dollar has shown some signs of stabilisation or so-called mild depreciation amid speculations on the Federal Reserve’s fine-tuning of policies.

With these factors also interacting with Nepal’s monetary policy adjustments, the USD/NPR rate may have slightly adjusted.

What Are the Latest Exchange Rates for Major Currencies?

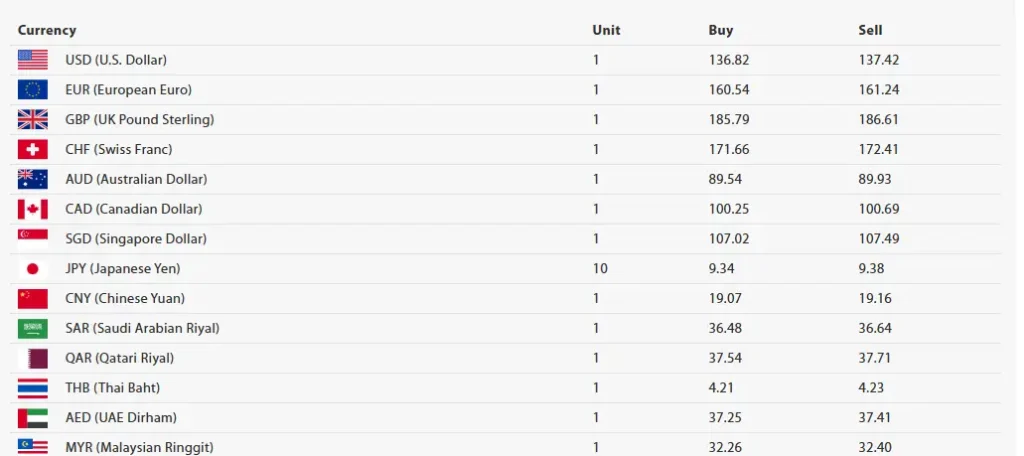

In association with USD, the Nepal Rastra Bank has updated the exchange rates for other major foreign currencies, following an almost stable trend. Below are the key rates prevailing as of today:

- Euro (EUR): Rs. 160.54 (buying) / Rs. 161.24 (selling)

- British Pound (GBP): Rs. 185.79 / Rs. 186.61

- Swiss Franc (CHF): Rs. 171.66 / Rs. 172.41

- Australian Dollar (AUD): Rs. 89.54 / Rs. 89.93

- Canadian Dollar (CAD): Rs. 100.25 / Rs. 100.69

- Singapore Dollar (SGD): Rs. 107.02 / Rs. 107.49

These rates account for very small ones-if any-at their slightest, indicating a relatively stable forex environment with no major fluctuations across the most traded global currencies.

How Do These Forex Rates Impact the Public?

A USD/NPR rate fluctuation might appear trifling on the neck of perception, yet the several facets of public life and business in Nepal can be affected very severely.

- Importers: Slightly lower USD rates make the imported goods cheaper, mainly electronics, vehicles, and industrial machinery.

- Remittance Recipients: Families receiving remittances in USD may slightly feel the lowering of the dollar value in INR payouts.

- Travellers: It is a bit of relief for Nepali travellers and students intending to pursue higher studies abroad to get a little drop in dollar rates.

- Tour Operators: Exchange fluctuations can alter the price of services for tourists, thereby affecting domestic travel agencies and tour guides.

Understanding how these slight movements play out is quite essential, more so with an economy such as Nepal, where foreign exchange inflows assume a pivotal role.

Are Asian and Gulf Currencies Stable?

Yes, along with it, the latest update issued by the NRB also shows the stability in rates for the Asian and Middle Eastern currencies, vital to Nepal given the volume of trade and remittance activities from these regions:

- Chinese Yuan: Rs. 19.07 (buying)/Rs. 19.16 (selling)

- Japanese Yen (10 Units): Rs. 9.34 / Rs. 9.38

- Saudi Riyal (SAR): Rs. 36.48 / Rs. 36.64

- Qatari Riyal (QAR): Rs. 37.54 / Rs. 37.71

- UAE Dirham (AED): Rs. 37.25 / Rs. 37.41

- Omani Riyal (OMR): Rs. 355.59 / Rs. 356.94

- Kuwaiti Dinar (KWD): Rs. 447.87 / Rs. 449.83

- Indian Rupee (INR-100 Unit): Rs. 160.00 / Rs. 160.15

These steady rates are beneficial for Nepalese workers in the Gulf and for import-export businesses transacting with these countries.

Should Businesses Be Worried About Volatility?

While it is advised that businesses remain concerned yet not apprehensive, one should note that minor fluctuations in currency rates are usual in any open economy. However, foreign-trade- or international-services-oriented enterprises should continue to:

- Monitor daily updates from NRB

- Hedge currency risks if possible

- Use weekly exchange rate averages while estimating costs

According to the Nepal Rastra Bank statement, commercial banks can quote slightly different rates, which may change within a day based on market demand and international financial developments.

Also Read: Russia Targets Illegal Miners with New National Registry

What Comes Next for Nepal’s Forex Market?

Balancing the twin objectives of currency stability and market flexibility will be an important job for the NRB in the future. In pursuit of stabilising monetary flows and encouraging economic growth, the central bank might further adjust the rate corridor, recently announced under the revised interest rate corridor system.

With the implementation of programmes to boost formal remittance channels and eliminate uncalled-for dollar imports, Nepal seems intent on keeping a good forex outlook in the short to medium term.