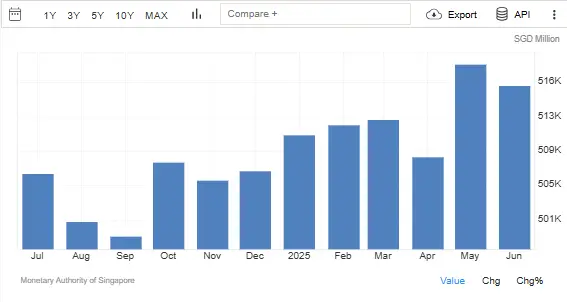

In June 2025, the Singapore forex reserves surpassed forecasts, hence further reinforcing the power of the city-state with its financial muscle. This money lies in the reserve $515.8 billion by the MAS, whereas the experts forecasted it to be around $510 billion. In true Fox fashion, it is marginally below May’s figure of $518.1 billion, representing resilience among global economic knockbacks.

Analysts see this as a confirmation that the monetary framework of Singapore is solid while global uncertainties keep growing. Forex reserves are foreign currency assets held by a bank of a country. These include government bonds, treasury notes, and securities of other countries.

What Are Forex Reserves and Why Do They Matter?

Forex reserves can stabilise a nation’s currency from becoming unstable at the time of serving its foreign debt obligations; they also support national monetary policies.

In Singapore, a healthy level of reserves would strengthen confidence in the Singapore dollar and hence discourage capital outflow.

Reserves also remain paramount for mopping up any excessive volatility to its currency and thus sustaining the nation’s open trade economy.

Forex reserves help stabilise currency and debt policy

Singapore’s Forex Position Remains Strong Despite Minor Dip

At $515.8 billion, the June numbers were more than market forecasts, although there was a slight dip from May’s $518.1 billion. The consistent performance shows that Singapore’s economic fundamentals remain intact, with the significant trade surplus and the country’s commendable financial governance.

Maintaining high reserves amidst global volatility speaks very well of the MAS policy toolkit. Forex reserves topped expectations, therefore reinforcing Singapore’s position as a safe investment destination.

Why Did Reserves Slip Slightly from May?

The fall from May’s figure is regarded as marginal and hence non-alarming to market participants. Minor fluctuations in forex reserves are on the cards, mostly arising from either the change in the valuation of foreign currencies or from global market movements.

Sometimes, a decline could occur because of central bank-driven intervention or outflows by foreign investments. MAS is known to tweak portfolio composition on a regular basis to factor in shifts in economic trends or risk profiles. Regardless of the decrease, on the other hand, the overshoot keeps investor sentiment strongly positive.

How Do Strong Forex Reserves Affect Singapore’s Markets?

Such a stronger reserves position bolsters bullish sentiments across financial markets, more particularly in the stock and bond markets. If a country maintains high reserves, it will be viewed from a macroeconomic standpoint as stable and having a low currency risk. Such a view prompts both local and foreign-type investors to plough into local equities and fixed-income instruments.

Hence, for Singapore, the outcome is likely to make sectors such as banking, infrastructure, and real estate more attractive. These sectors are often termed the major beneficiaries of economic stability and foreign capital inflows.

Will Investor Sentiment in Singapore Improve Further?

Investor confidence is already seeing suggestive signs of improvement, said the fund managers tracking the Singapore Exchange (SGX). Analysts believe Singapore’s ability to outshine forex expectations may herald increased institutional flow in the next few weeks.

Blue-chip stocks may benefit from strong fiscal indicators of the country, more so those with regional exposure. A strong reserve base also ensures that Singapore is cushioned from global risks in the form of rising interest rates or geopolitical instability. This lends Singapore an equally attractive destination for conservative long-term capital.

Singapore’s Global Position Grows Stronger

The Singapore forex reserves have surpassed expectations not only in nominal terms but also in symbolic value. It signals the country’s continued ascent as a regional financial hub capable of handling capital flows across borders. It could be said that Singapore is gaining amidst capital flight and currency pressure faced by other economies.

Beginning with the fiscally conservative and given the timely regulation, it is known in other regional financial circles. Higher reserves mean MAS can be more flexible in policy without big hits in interest rate adjustments.

What’s Next for Singapore’s Economy?

With reserves still holding above expectations, the foreign fund will assist and make Singapore less vulnerable to external shocks and, hence, economic shocks. Areas related to international trade, financial services, and infrastructure facilities are expected to rise in the second half of 2025. The city-state also holds very high credit ratings, has very low public debt, and constantly runs a current account surplus.

In its firming up against rising reserves, these factors significantly enhance the macroeconomic standing of Singapore as an investment draw. Upcoming GDP and inflation figures will be crucial to market watchers in further confirming the economic track of Singapore.

Also Read: Russia Targets Illegal Miners with New National Registry

Conclusion: A Strong Signal Amid Global Uncertainty

The June 2025 foreign reserves figure sends a very clear signal to the world investors — the fundamentals are solid. Though there was a marginal weekly downtick, the forex reserves beat the forecast, which again speaks to the stability and policy credibility of Singapore. As the world experiences rising macroeconomic pressures, very few countries combine security, transparency, and long-term growth potential like Singapore.

The formidable reserves position strengthens MAS to be able to better defend the currency as well as strategically manage capital flow. For a longer-term investment in an economy deemed reasonably resilient, Singapore remains a frontrunner in the Asia-Pacific.

Confidence is gradually rising in terms of their outlook that offers exposure to Singapore; they could look at equities, bonds, or strategic real estate. Hence, it would probably be fair to state that from a macroeconomic perspective, the city-state is not just weathering the global turbulence but thriving.