The NZD/USD pair is retreating after testing the resistance of 0.6045. The Kiwi had shown initial strength, but selling pressure had started building after hitting technical obstacles. Despite the slide, the pair was able to hold above the psychologically significant 0.6000 level, denoting underlying support for the Kiwi.

Bulls briefly lifted NZD/USD on Fed cut hopes, but strong U.S. data soon reversed gains. Geopolitical tensions and firm macro numbers boosted the dollar, capping Kiwi momentum quickly. Now the pair is trading near 0.6012, down 0.25% for the day.

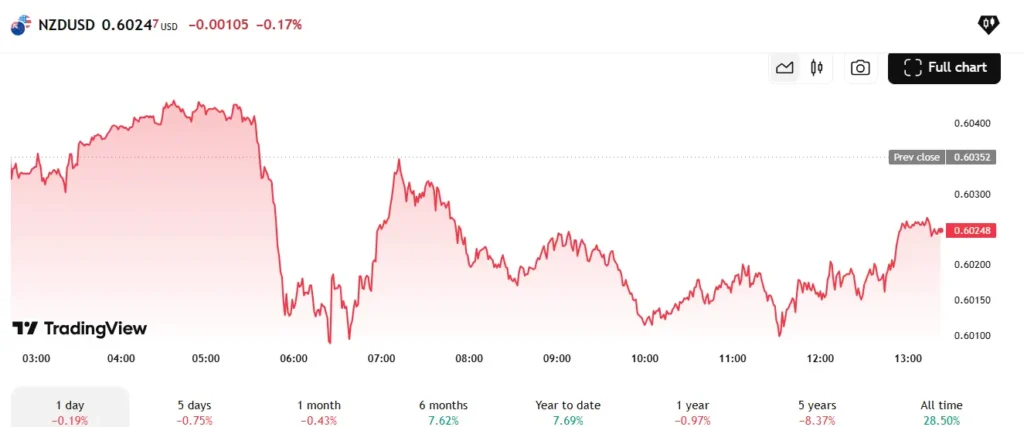

NZD/USD dips to 0.6024, down 0.17%, as firmer USD pressures Kiwi amid risk-off sentiment.

Why is the USD gaining strength?

The dollar took the upper hand, slamming down expectations for the Federal Reserve to cut rates. Revived hopes of policy tightening surfaced from strong U.S. employment data and sticky inflation. Weekly jobless claims fell to 227,000 from an expected rise.

June non-farm payrolls increased by 206,000, over the consensus of 190,000. This set of encouraging job numbers buoyed Fed confidence and capped any immediate dovish tilt. This change in sentiment acted as a lift for the U.S. dollar, dragging NZD/USD down in the process.

How do U.S. tariffs and trade wars affect NZD/USD?

Exported Canadian products with tariffs at 35%, and copper and brass imports at a 50% discount. View announcement from the President brought panic to the global markets. Investors went to the relative safety of the greenback from “risk” assets, including the Kiwi dollar. Such renewed versions of the trade wars provide an ambience of risk aversion, more so on Asia-Pacific currencies.

Countries such as New Zealand that run open exports get stuck in trade frictions. Incidents like these may create new levels of tension that may keep the pressure on NZD against USD.

RBNZ’s neutral stance supports NZD

The Reserve Bank of New Zealand (RBNZ) has kept the cash rate at 3.25%, as per expectations. While there has been some softening in inflation, it is too early to think about cutting rates, the RBNZ stated. This period of no change in policy favours stability and further cements the Kiwi in the short term.

Hence, this cautious forward guidance leaves little room for upside in the kiwi. Markets are practically not pricing any easing before early 2026. While this includes downside risk for NZD, it also detracts from any rallying ability.

RBNZ holds rates at 3.25%, offering near-term support to NZD amid global uncertainty.

Will NZD/USD break below 0.6000?

That is a question most traders are caught pondering. As for now, the bearish pressure on NZD/USD is expected to keep it below 0.6000, a crucial support zone.

An intraday break below this floor may take the price down to find support at 0.5970, followed by 0.5935. If the USD stays resilient or risk aversion steps up, the pair will most likely break down. But there’s also room for a hawkish RBNZ or disinflationary stats from the U.S. to prevent such declines.

Meanwhile, the market awaits further direction from this week’s US CPI report. A weak inflation print would quickly rekindle talk about Fed cuts and weigh on the USD.

What could lift NZD/USD above 0.6045?

If risk sentiment is turned positive, especially as issues with trade tensions start to ease, the NZD/USD pair could rally back.

A break above the 0.6045 resistance could open a pathway higher to 0.6072 and 0.6100. Any dovish remarks by Fed officials or soft economic data could weigh on the USD. This would bring the Kiwi enough strength to break through those resistance levels.

Further, investors would watch Chinese import data since China is New Zealand’s largest trading partner. Any pick-up in the Chinese economy could be positive for Kiwi exports and currency.

Investors’ outlook: Is the Kiwi still attractive?

Despite the recent market losses, NZD is still viewed as an attractive proposition for yield seekers.

New Zealand’s 3.25% OCR rate remains amongst the higher interest rates set by central banks in the developed world. This yield differential provides medium-term support for conflicts against the NZD/USD.

Key Investor Metrics:

- NZD/USD range: 0.6000 to 0.6070

- Immediate support: 0.6000; 0.5970

- Upside resistance: 0.6045; 0.6072

- RBNZ hold: Reinforces yield stability

- US Fed odds: No rate cut expected until Q4, 2025

As long as the RBNZ remains steady and American data stay mixed, the pair could remain rangebound.

However, a break below 0.6000 could send the investor sentiment into a sharp bearish tilt. Meanwhile, easing inflation in the U.S. or better data emanating from China can push NZD/USD beyond 0.6045.

Also Read: Bitcoin Hits $112K: What’s Fueling This Recent Surge?

Final Take

NZD/USD is pressured yet resilient. A strong greenback, bearish Fed rate hike odds, and fresh trade messes weigh on Kiwi strength. However, the RBNZ kept rates on hold, while some strong local data, mainly jobs numbers, provided vital support.

For now, the NZD/USD keeps the red above the 0.6000 level. Now, the next forthcoming weeks will be crucial. Expect U.S. CPI figures, risk-on-off vibes and comments from both central banks.