What drove DroneShield to record highs?

DroneShield Ltd (ASX: DRO) surged 6.7 % to close at A$4.97, marking its fourth consecutive all‑time high. The price rally came a day after DroneShield announced a major manufacturing expansion to meet increasing demand for its counter-drone systems.

With tensions skyrocketing in the world, more so because of the ongoing matters in Ukraine and the Middle East, countries are throwing money at anti-drone technology. DroneShield is being seen as the frontrunner for defence partners around the world.

The shares in the company have rallied by over 420% this year-to-date. Such gains are a testament to the strong market confidence in its long-term vision, versatility, and scope.

How critical is the expansion plan?

The new 3,000 m² Australian factory to be established in Alexandria triples in size the company’s footprint of manufacturing, thus giving new capacity to handle extended quantities and bigger contracts. In special awareness, with its existing 2,530 m² facility in Pyrmont, this will soon give it a twofold production and R&D and manufacturing capacity of 5,530 m².

Forecast for annual production is estimated at A$900 million by mid-2026, flexing to A$2.4 billion by the year’s end, should the need arise. This reflects the rising urgency among global defence customers for DroneShield’s products.

According to CEO Oleg Vornik, such expansions must be ahead of record order volumes. Geopolitical unrest has seen demand for integrated, rapidly deployable counter-drone systems surge to unprecedented heights. Manufacture of high-end components at Alexandria means less offshore supply dependence for DroneShield.

Why is global demand growing rapidly?

Drone use in modern warfare has suddenly increased significantly over the past years, particularly in active zones of conflict. The current wars in Ukraine and the Middle East have shown the devastation that drones can cause, from observation to dropping bombs.

As the governments boost defence budgets, the demand for drone-detection and neutralisation tools skyrockets. Operations by DroneShield that stand in a league of their own detect, track, and disable drones, using radiofrequency or AI-based analytics.

The company recently secured a landmark deal to the tune of A$61.6 million with a major European military client. The single contract outstripped the firm’s 2024 revenue estimate of A$57.5 million. This contract is indeed indicative of how essential its products have become to modern warfare.

Demand is increasingly rising not only in Europe but North America, the Middle East also, as well as in Asia-Pacific. The formation of the DroneShield multi-domain portfolio that can intersect with national defence systems gives this company a leg-up in the market.

View this post on Instagram

How big is DroneShield’s global pipeline?

By mid-2025, DroneShield was operating a huge sales pipeline worth A$2.34 billion. Europe is currently the fastest-growing market in drone countermeasures, as several NATO-aligned governments rush to enable such capabilities. With a whopping jump from last year, the company is set to have contracted revenues of A$94.4 million in 2025.

In response to this surge, DroneShield was able to raise another capital infusion of A$29.4 million in June 2025. Such funds are being used in scaling up its technical teams, manufacturing facilities, and strategic partnerships with defence primes.

The company is working on increasing its reseller and integrator network to speed up market entry into the highly-regulated defence sector. This situation creates a good market to tap into right now, with DroneShield standing to benefit very well by producing internally as well as globally co-producing.

What does this mean for investors?

DroneShield stands at a fourth all-time price high and is a testament to the confidence in its demonstrated direction and capability, and how a niche defence technology company has been brought right into the centre of global conflict preparedness.

Investors are just not looking at revenue growth-marketing for view-but are looking for additional commercialization and long-term scalability. As the company expands its research and development in addition to manufacturing capacity, it is ensuring it does not miss any imminently put out-to-tender defence contracts, which are increasingly becoming urgent and colossal.

In terms of financial strength, DroneShield boasts a strong cash position of A$196.8 million going into April 2025. This liquidity can avail the company of considerable agility as it executes with a view to weather possible shocks in the global supply chain dynamics or changes in regulations.

On the other hand, it is important to keep in mind that defence is among the most resilient categories of expenditure, often shielded from the storm of economic slowdowns. Hence, that makes DroneShield a very attractive stock for both institutional and retail investors.

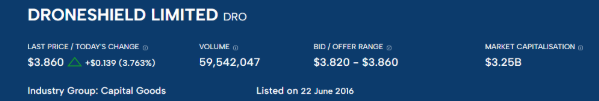

DroneShield Ltd Company Share Details

Can this growth be sustained?

When DroneShield goes through this fast-growing stage, it must now look into scale issues without affecting the quality of products or their delivery time to clients. The success of its expansion in Alexandria shall be fundamental in this regard.

Competition also exists from American and Israeli defence tech firms, and just so DroneShield remains ahead of the curve, it must keep innovating, especially with AI, data fusion, and multi-sensor integration.

But real defence makes one suspect this is more than a passing boom. The world is moving into a new age in which drones will be a dominant form of warfare. And with changing threats, DroneShield’s importance is sure to grow much further.

Continued expansion will rely on execution, timely deliverability, and the kind of transformation needed in active combat zones. All that, however, seems to be within the grasp of their current successful momentum, spotted through a meticulous, well-thought-out approach.

Also Read: Meta Plans ‘Hundreds of Billions’ in AI Data Centres Push

Final Thoughts

This latest bullish stock rally of DroneShield came in its fifth consecutive all-time high. With ramping up R&D and manufacturing capabilities coupled with closing major defence contracts, the company is positioned for an influx of globalised operations. Any conflict in Ukraine or the Middle East simply accentuates the urgency of this company’s offerings, with governments now investing heavily in counter-drone technology. Hence, DroneShield unequivocally provides innovation coupled with volume.