Australia’s economic landscape in the second quarter of 2025 presents a nuanced picture. While the nation continues to navigate global economic uncertainties, the latest GDP figures reveal modest growth, underscoring the resilience and challenges within the Australian economy.

Economic Overview

In Q2 2025, Australia’s GDP grew by 0.2% quarter-on-quarter, maintaining the same pace as the previous quarter. On an annual basis, the economy expanded by 1.0%, marking the slowest annual growth since Q4 2020. This steady yet subdued growth reflects the ongoing impact of global economic headwinds and domestic challenges.

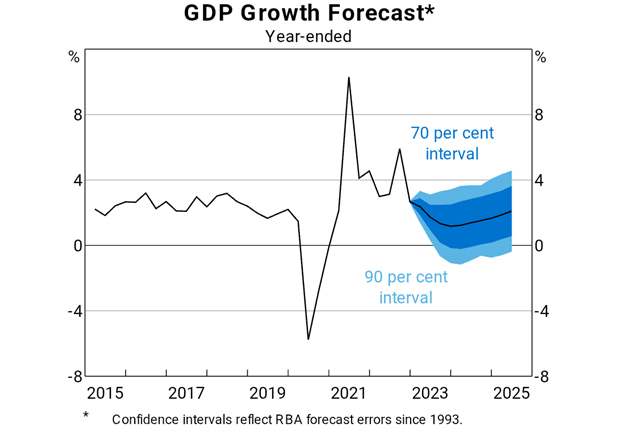

Line graph showing Australia’s GDP growth trends from Q1 2015 to Q2 2025

Sources: ABC; RBA

Sectoral Contributions

Public Sector:

Government spending emerged as a significant driver of growth, increasing by 1.4% in Q2. This uptick is attributed to extended social benefits and infrastructure projects, highlighting the government’s role in sustaining economic activity during uncertain times.

Private Consumption:

Conversely, private consumption declined by 0.2%, the steepest drop in nearly three years. Factors such as elevated borrowing costs, sticky inflation, and a rise in unemployment contributed to reduced household spending, particularly in discretionary areas like transport services.

Fixed Investment:

Fixed investment contracted by 0.1%, marking the third consecutive quarterly decline. This trend indicates cautious business sentiment amid economic uncertainties and tighter financial conditions.

Trade Balance:

Australia’s trade position offered a modest lift this quarter, as outbound shipments of goods and services edged higher while inbound imports recorded a slight dip, improving the overall net export balance. This improvement in the trade balance provided a modest boost to overall economic growth.

Productivity and Labor Market

Construction workers operating machinery at a large infrastructure project in Australia. Source: LinkedIn

Productivity remains a concern, with a 0.6% decline in Q2, continuing a troubling trend of negative productivity growth. This persistent issue clouds the inflation outlook and underscores the need for structural reforms to enhance efficiency and competitiveness.

Australia’s job market is beginning to lose steam, with the latest figures showing a modest uptick in unemployment, now hovering around 4.2%. Despite strong job creation in recent months, the increasing labor supply is gradually outpacing demand, indicating a shift towards a more balanced employment landscape.

Inflation and Monetary Policy

Credit: Shutterstock

Inflation has eased from post-pandemic highs, dropping to 2.8% year-on-year in Q3 2024. Still, price tensions remain, especially in domestically driven areas of the economy that aren’t influenced by international trade. The Reserve Bank of Australia (RBA) remains cautious, recently reducing the cash rate by 25 basis points to 3.85% to support economic activity while monitoring inflationary trends closely.

Global Influences and Outlook

Global economic factors, including trade tensions and geopolitical uncertainties, continue to impact Australia’s economic performance. The OECD has revised its forecast for Australia’s GDP growth to 1.8% in 2025, down from an earlier prediction of 1.9%, citing global volatility and domestic structural challenges.

Looking ahead, economists anticipate moderate growth, with projections of 1.6% in 2025, gradually increasing to 2.3% and 2.7% in the subsequent years. This outlook is supported by expected improvements in household spending, real wage gains, and ongoing government initiatives aimed at bolstering economic resilience.

Conclusion

Australia’s Q2 2025 GDP figures reflect a delicate balance between resilience and vulnerability. While government spending has cushioned the economy against global shocks, the decline in private consumption and investment highlights underlying weaknesses. Addressing productivity challenges and fostering private sector growth will be crucial for sustainable economic recovery. As the nation navigates an evolving global landscape, strategic policy measures and structural reforms will play pivotal roles in shaping Australia’s economic future.