A new generation of tokenised stocks and tokenised investment products promises lower-cost, 24/7 access to markets and an accompanying battle for who gets to write the rules that safeguard Main Street investors. (Reuters)

Tokenised stocks open 24/7 markets and ignite a fight over investor protections. (Image Source: Fireblocks)

Why This Matters Now

Markets are not just plumbing and prices; they are social contracts. Where the way we mark and transfer ownership is changed, the contract is also changed. Tokenisation does not just shrink a share down into bits: it rearranges who enforces rights, who bears risk and who gets a vote.

The Promise On The Table

Tokenisation proponents say it democratizes finance. You can buy a small piece of an expensive stock, settle trades almost in real time, and trade out of hours. That is appealing to small investors and wealth managers alike: lower fees, immediate settlement and global access. Big index providers and exchanges are already mapping out products and infrastructure to meet demand. (Barron’s)

The Technical Hook: How Tokenisation Works, In Plain And Rapid Terms

Think about a token as a digital receipt stored on a blockchain. That receipt may represent legal ownership, or it may represent a claim to an asset elsewhere. The difference is important. If the token represents legal ownership, it should have rights; voting, dividends, transfers. If it is merely a buyer-issuer contract, the future of the holder is in the hands of the issuer and their conditions.

https://x.com/Alexflexdefi/status/1975547601400312223

Actual Examples And Market Action (Who’s In The Running)

Crypto exchanges and companies — old timers and newcomers alike are racing to list tokenised copies of celebrity stocks and index products. Industry newcomers argue tokenised products bring the market open. Traditional financials and regulators counter that the same tech can destroy investor safeguards if the rulebook does not keep up with the tech. Recent reports show the tokenised stock market changing fast and bringing in investors from the mainstream. (Reuters)

The Central Debate: Who Controls The Rulebook?

This is the philosophical heart of the story. The crypto community insists: “Make new rules that suit the technology.” Traditional finance authorities retort: “Technology cannot override core investor protections.” Regulators and investors now struggle with whether tokenised instruments should be treated as equal to shares in relevant securities law, or separated, possibly with exemptions. The choice reverses whether token holders can enjoy traditional shareholder rights or merely contractual claims against issuers.

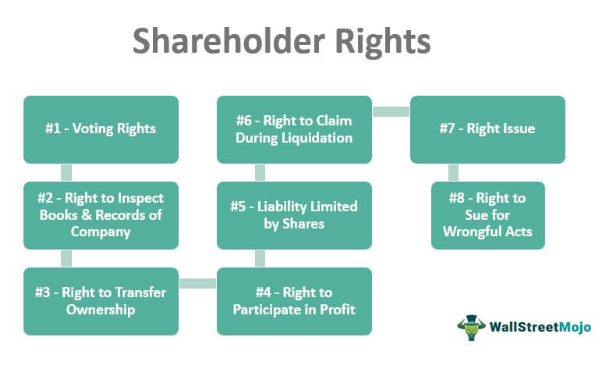

Why Rights: Voting And Dividends; Are The Battleground

Most tokenised stock products have no voting rights, and no direct dividend streams. That changes shareholder economics. If you own a token representing Company X but not voting rights, your stake in the company’s future is zero even if you have the economic gain. That is the source of a philosophical and practical divide between “ownership” and “exposure”. Recent reporting highlights that most token products are more like derivatives than actual equity. (Reuters)

Tokenised stocks drop voting and dividends, reducing ownership to exposure. (Image Source: WallStreetMojo)

Counterparty Risk: The Hidden Tax

If tokens are claims on an issuer’s collateral instead of legal ownership, your risk is based on the creditworthiness of the issuer, custody behavior and legal commitments. That introduces a level of counterparty risk akin to OTC derivatives: in case of issuer default, token holders can end up in line. That risk is usually not visible at the UX layer, where purchasing a token appears to be purchasing a share. Regulators worry that ordinary investors will not value this subtle but significant difference. (Norton Rose Fulbright)

The Regulatory Landscape: Patchwork, Not One-Size-Fits-All

Policy reactions vary. Regulators are urging simplicity by incorporating tokenised assets in existing securities regimes; there is also a call for bespoke rules. United States exchanges and market infrastructure sponsors are submitting proposals to regulators requesting frameworks for trading tokenised securities. In Australia, the government is inviting public input on intended legislation that would bring tokenised custody and digital asset platforms under the financial services regime. Globally, central banks and multilateral institutions release reports and pilot projects that examine tokenisation of deposits and instruments, often highlighting regulation and enforceability. (Politico Pro)

What Markets Could Be Like If Tokenisation Succeeds Without Tight Rules

Envision continuous markets trading full and fractional shares twenty four hours a day across borders and rails. Liquidity divides into on-blockchain pools and off-blockchain ledgers. Retailer involvement rises. But without harmonized regulation, liquidity would fragment too far; price-making would migrate to areas less regulated; and investor recourse would weaken. The result: innovation and new systemically significant risks.

24/7 tokenised markets without rules risk fragmented liquidity and weak protection. (Image Source: The World Economic Forum)

What Markets Might Resemble With A Good Rulebook

If regulators insist on tokenised products ideally being equivalent to legal rights and disclosures, tokenisation could sit alongside investor protection. Technical standards; automatically stored voting rights tokens, dividend solutions on-chain, custodial models that are enforceable would help. The net result: faster markets but still shareholder democracy.

The Players Writing The Battle

Who writes the rulebook is not abstract. It is exchanges, technology firms, lawyers, central banks and securities regulators. Lobbying and public consultations will shape law. Industry lobbies require certainty that allows innovation; exchanges would prefer to give tokenised trading under regulated models; investor lobbies and traditional market-makers require enforceable protection. That institutional competition will determine whether tokenisation strengthens or weakens market democracy. SEC statement on tokenized securities. (SEC)

The User Experience Trap: Convenience Versus Clarity

Token buys are instant via retail apps. But onboarding screens do not usually explain whether your token has voting rights or dividends. That ease is concealing complexity. Forced disclosures and clear labeling with standard terms would limit damage. The consumer protection question is: does your app explain the economic and legal model before you tap buy?

Easy token buys hide missing rights, making clarity just as vital as convenience. (Image Source: Tookitaki)

Easy token buys hide missing rights, making clarity just as vital as convenience. (Image Source: Tookitaki)

A Human Vignette

Picture an ordinary investor: let us call her Aisha, who purchases a tokenised portion of a blue-chip firm because the app guarantees fractional ownership. She likes price action and votes in a celebrity shareholder vote. She finds that she has no right to vote; the token merely monitored price exposure. The disillusionment is intimate. The system-level risk, however, is greater: if lots of small holders act like this, the democratic controls that restrain management are undermined.

The Market Response: Some Companies Announce They Will Issue Rights In Tokens

Not all tokenised items are equal. Some companies build tokens to be symbols of enforceable rights and define custody models that attempt to replicate shareholder entitlements on-chain. Others concentrate more on liquidity and flexibility rather than legal equivalence. This market difference will matter in the coming few months as issuers and exchanges signal which model they follow. (growthturbine.com)

Policy Headlines To Follow

- Major exchange proposals and SEC responses to tokenised securities. Federal Register Nasdaq filing SR-NASDAQ-2025-072. (Federal Register)

• Consultation and proposed regulation in Australia for digital asset platforms and tokenised custody. Australian Treasury consultation. (consult.treasury.gov.au)

• Central bank pilots and multilateral reports into the systemic impact of tokenisation. Reuters coverage and World Economic Forum report. World Economic Forum report. (Reuters)

Technical Mechanics: How Tokenisation Actually Works As Legal Rights

Tokenisation seems simple on an app: purchase a token, gain exposure. In the background, three layers determine whether that token equates to genuine ownership.

First: the veil of law. Some tokens are legal claims; the token is a direct legal claim on a share registered on a transfer agent’s books or in trust. Others are claims under contract; an issuer’s commitment to mirror the stock price. Whether it matters to whether or not a holder may enforce shareholder rights in court.

Second: the custody model. Who is the record custodian (if anybody)? Is it a regulated custodian with segregation and audit, or is it a crypto treasury company keeping a ledger? Poor custody practices increase counterparty risk.

Third: the on-chain mechanics. Token standards, such as ERC-1400 and similar industry frameworks, can be built with transfer restrictions, KYC gating, and dividend-distribution hooks. Standards help, but cannot alone replace legal clarity about ownership. (kaleido.io)

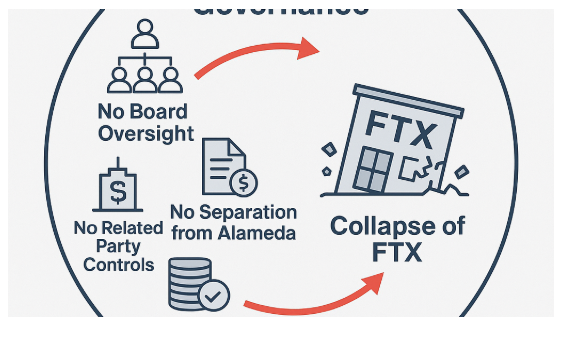

Case Studies That Teach Hard Lessons

FTX and Binance demonstrate two failure modes.

FTX’s collapse showed how highly levered counterparty risk and poor controls erase client claims that nominally resemble ownership. When a platform fails, clients scramble to retrieve assets; a sour reminder that “on-platform” claims are only as solid as the platform’s balance sheet and governance. (Reuters)

Binance’s entry into stock tokens led to regulatory pushback and the halting of such products. Regulators in Europe questioned whether those tokens complied with securities rules and whether they confused customers about ownership and rights. That episode demonstrates how quickly regulatory updates can remove liquidity from token markets. (Reuters)

At the other end, specialist firms such as Securitize build token architectures that aim to replicate shareholder rights and work with regulated custodians and transfer agents. Those implementations point to the regulated-equivalent pathway where tokenisation introduces friction, not frays it. (Securitize)

FTX and Binance show token risks, while Securitize shows a rights-protected path. (Image Source: LinkedIn)

Regulatory Options: Possible Futures, Country By Country

United States; Integration Under Existing Securities Legislation

Large US market participants are now proposing ways to trade tokenised securities on regulated exchanges, and regulators have signaled that relevant securities law still applies even when settlement happens on a blockchain. That makes the likely path one of integration: tokenised securities trade on regulated venues when they map to legal claims and comply with disclosure, custody and reporting rules. See Nasdaq filings and the Federal Register notice. (Listing Center)

European Union; MiCA Plus Supervisory Pressure

The EU’s MiCA regime creates a pan-European framework for many crypto products. While MiCA does not cover every form of tokenised security, the EU’s approach emphasises licensing, transparency and market integrity which pushes token issuers either to comply with securities rules or to sit outside the regulated label. ESMA MiCA resources. (ESMA)

Australia; Bespoke Rules For Platforms And Custody

Australia is moving to draft tailored legislation that captures digital asset platforms and tokenised custody platforms, signalling a path to fold tokenisation into the Corporations Act with specific operational and custody requirements. The consultation material and exposure drafts are live on the Treasury website. Australian Treasury consultation materials. (consult.treasury.gov.au)

India: Constrained But Evolving

India’s regulators and market authorities explore tokenisation, with pilots for real-world asset tokenisation and stricter cybersecurity and market conduct rules under discussion. Many tokenisation projects face legal uncertainty unless they fit within existing regulated frameworks. Expect cautious pilots and formal rules to follow after consultation. King, Stubb & Kasiva insights on tokenisation in India. (King Stubb & Kasiva)

Three Likely Market Outcomes

- Regulated-Equivalent Markets (Best Outcome): Regulators insist tokens map to legal title and platforms meet custody, disclosure and insolvency standards. Tokenisation reduces friction without weakening investor rights. Major exchanges list tokenised shares under strict rules. (Federal Register)

- Broken, Dual Markets (Near Term): A mix of token models appears: some legally equivalent, some contractual. Liquidity fragments across on-chain pools and off-chain markets; retail confusion grows; price discovery becomes uneven. Regulators and exchanges push to reduce the worst consumer risks. Reuters analysis. (Reuters)

- Regulatory Squeeze And Contraction (Worst Case): High-profile failures or sharp regulatory clampdowns shrink the market. Innovation slows and incumbent players reassert control under heavy compliance costs.

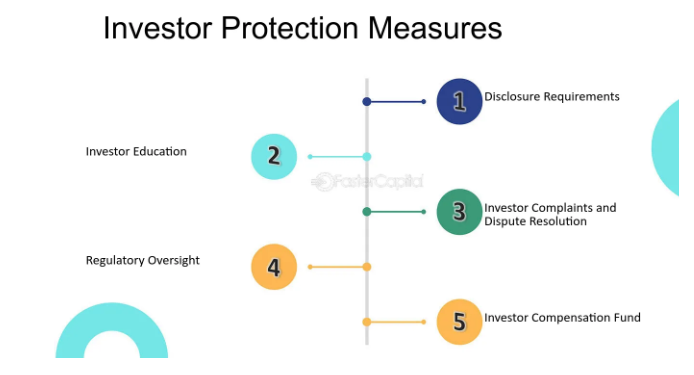

Concrete Investor-Protection Recommendations (What Regulators Should Mandate)

Legal equivalence disclosure. If a product mirrors a stock’s economic exposure but does not transfer legal title, platforms must state that plainly in plain language and before trade execution.

Mandatory custody standards. Custodians and issuers of tokens must be licensed to high standards of segregation and audit. Proof-of-reserves and frequent attestations should be mandated.

On-chain rights mapping. Mechanistic mechanisms should be built into token systems and standards to capture voting and dividend rights. If rights do not pass, documentation must explain how holders can or cannot exercise those rights.

Insolvency clarity. Legislators should clarify whether token holders are shareholders or unsecured creditors upon issuer insolvency. Ambiguity fuels runs and litigation.

Standardised labelling and taxonomy. Create industry labels such as “Legal Title Token”, “Contractual Exposure Token”, and “Synthetic Token” so investors compare like with like.

Cross-border cooperation. Tokens trade globally. Regulators must set cooperative information channels and enforcement to avoid regulatory arbitrage.

Platform market-conduct rules. Treat tokenised-stock trading venues with the same market abuse, reporting and surveillance obligations as exchanges.

These measures reflect current industry and regulator recommendations. (SEC)

Labels, custody, and legal rights are key to protecting token investors. (Image Section: FasterCapital)

Practical Handbook: What A Trader Should Check Today

Inspect prior to buying a tokenised share:

• Documents: does the token signify registered ownership or a contractual right?

• Platform licence: is the issuer or trading platform licenced by a recognised regulator?

• Custody model: Is the underlying asset segregated and held by a regulated custodian?

• Voting/dividend mechanics: can you vote or receive dividends? If not, why?

• Insolvency treatment: do documents explain where you fall in a collapse?

• Transparency: are attestations, audits and proof-of-reserves available?

If the answers are evasive or lost in jargon, treat the token as higher risk. Many reports find tokenised products today often resemble derivatives more than real equity. (Reuters)

More Detailed FAQ: What Readers Keep Asking

Q: Can tokenisation make markets 24/7?

Yes. Blockchains do not sleep. That creates benefits and new risks such as overnight volatility and cross-market arbitrage.

Q: Will tokens let me avoid taxes or regulation?

No. Tax and securities obligations depend on legal character, not the technology. Regulators emphasise substance over form.

Q: Is tokenised share a good retail play?

They can provide access to expensive assets, but retail investors must treat them like any complex product: read the docs, know the rights, and understand counterparty exposure.

Q: Are token standards the same in terms of safety?

Standards differ. ERC-1400 and other security-token frameworks add compliance hooks. Standards help technical interoperability but do not by themselves deliver legal certainty. (kaleido.io)

Q: Will big exchanges list tokenised equities?

Some exchanges propose rules to permit tokenised versions of listed securities. This process requires regulatory approvals, rule filings and technical work. See Nasdaq filings and related SEC materials. (Listing Center)

Q: What is a tokenised stock?

A tokenised share is a crypto token that represents an economic right in a company’s shares. The token may or may not carry legal shareholder rights based on its model.

Q: Do tokenised shares grant me voting rights?

Not always. Some token models pass voting rights on-chain; many do not. Always check the issuer’s legal materials.

Q: Are tokenised shares riskier or safer than usual shares?

They might be lower cost and faster, but they could add counterparty risk if the token is a claim against an issuer rather than legal title. Clarify custody, legal enforceability and disclosure. (Norton Rose Fulbright)

Q: Will regulators ban tokenisation?

Regulators are generally keen to allow tokenisation within rulebooks rather than ban it. The debate is how to map rights and protections onto the technology.

Also Read: The Heist That Backfired: A Tale of Hacker vs. Hacker

Where This War Of The Rulebook Will Be Won Or Lost

The battlefield will be public markets and courts. If exchanges adopt tokenised trading under strict conditions, tokenisation can scale inside the rulebook. If issuers and platforms sell “equivalent” products without legal mapping, regulators and courts will step in after the first major failure. Lobbyists matter, but legal clarity and consumer protection will determine investor confidence.

This is the philosophical question: tokenisation forces us to choose whether convenience trumps civic market rights or whether technology must bend to protect those rights. The future market rulebook will hinge on that choice.

Markets and courts will decide if convenience or investor rights prevail in tokenisation. (Image Source: Union of Arab Banks)

Further On This Subject & Sources

- ESMA: MiCA explainer and implementing measures. (ESMA)

• Nasdaq filings and SEC notices regarding tokenised securities.. (Listing Center)

• Reuters coverage of tokenised stocks and investor-protection concerns. (Reuters)

• World Economic Forum report: Asset Tokenization in Financial Markets. (World Economic Forum)

• Securitize resources and industry papers on tokenised securities. (Securitize)

Final Take: The Human Stake In A Technical Debate

Tokenization promises real benefits: greater access, reduced settlement cost and new products. These benefits are to be weighed against a simple human reality: markets exist to allocate capital fairly and to grant investors a clear stake in firm outcomes. If tokens obscure that stake, people forfeit something more than currency; they forfeit stake in economic citizenship.

Who writes the rulebook? Regulators, judges, exchanges and the market itself will. But so do retail investors and rational institutions through demand, lawsuits and ballots. Demand transparency. Demand plain language. Vote with your money for tokens that deliver what they promise.