After months of internal wrangling and backroom discussions, the White House will release a highly anticipated crypto policy paper that may shape the very future of US finance. The report, concluding a six-month government review, will be expected to present a more cohesive approach to regulating digital assets, one that would balance both innovation and investor protection goals.

The move would also pave the way for the way the global economy interacts with digital money, starting with the world’s largest economy.

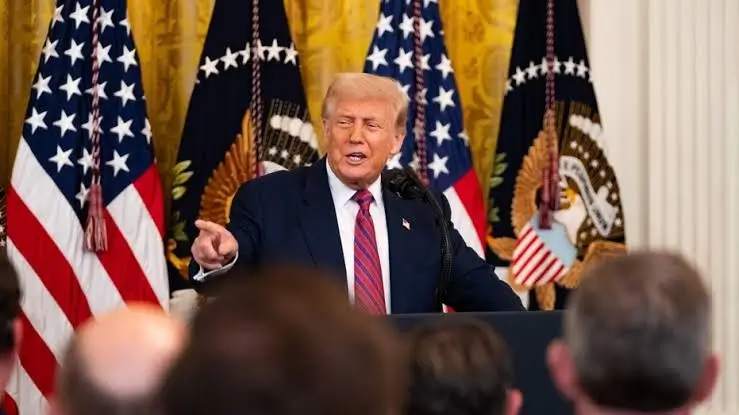

White House Crypto Roadmap Signals Major Turn in U.S. Financial Policy ( Image Source: Fox Business )

Why It Matters Now

The dramatic expansion of cryptocurrencies in recent years has put regulation in its rearview mirror, with the United States having a patchwork of legislation. While states have made their own rules and federal regulators have sent mixed messages, crypto companies and investors have been flying blind.

This upcoming report will straighten that out. According to government officials, the framework will address key concerns including:

- Introducing common standards for digital asset trading

- Closing loopholes and gaps in regulation

- Facilitating financial innovation within a secure environment

- Safeguarding retail and institutional investors

For the very first time in history, the federal government seems set to release guidance capable of generating long-term growth without compromising the underlying tech of the blockchain industry.

A Turning Point for Regulation

The best part of the report is how the crypto exchanges and digital asset platforms are required to do business where and how under U.S. jurisdiction. Rather than the usual reactive mode, where companies are fined once they have breached obscure rules, proactive compliance is recommended in the report.

Industry players believe this can minimize volatility and increase confidence, especially with the more conservative traditional financial institutions that have been slow to accept digital assets.

“Regulatory clarity builds investor confidence,” argues James Ellison, a fintech policy analyst. “If the White House issues viable proposals, the U.S. can anticipate a wholesome influx of institutional capital within the next two quarters.”

UPDATE: The U.S. #WhiteHouse will release its first major #crypto policy report on July 30, redefining stablecoin regulations, agency oversight, and exploring a strategic$BTC Reserve—marking a bold step in federal $crypto governance.

☝️Plus, President $Trump has already… pic.twitter.com/lh75KlZhzw

— COACHTY (@TheRealTRTalks) July 30, 2025

Towards Integration, Not Only Oversight

While regulation and compliance ride the lead, the report does not stop there. It also discusses bringing digital currencies, particularly Bitcoin, within national financial policy.

This also entails evaluating the possible effect of blockchain currencies on central banks’ role, public payment infrastructure, and even on sovereign debt management. Although a step on releasing a U.S. Central Bank Digital Currency (CBDC) is not within the near future, this report lays the groundwork for further strict debate about money digitalisation.

Global Implications

Whatever is enacted in Washington has a way of not remaining in Washington, especially where regulation of finance is concerned. And as the United States approaches making a decision regarding digital currencies, others will be bound to follow.

A number of countries such as the United Kingdom, Singapore, and Canada have been demanding globally harmonized standards for regulation of digital assets. An existing and robust U.S. framework can serve as a model to reduce regulatory fragmentation across borders.

“America is a big shaper of global financial policy,” states London-based blockchain strategist Amira Kapoor. “If they are willing to be open and international collaboration, it will likely spur other jurisdictions to fall into line.”

Optimistic but Cautious Industry Reactions

Crypto industry reaction is cautious but optimistic. Some fear that excessive regulation will freeze out innovation, while others see it as a welcome step toward legitimizing the industry.

Ethereum co-founder Vitalik Buterin already expressed that regulation is not evil in itself, but uncertainty regarding its enforcement is what destroys it. He is not the only voice within the ecosystem to express that they do not want crackdowns but fairness and consistency.

Large crypto players Coinbase and Kraken are reportedly preparing to align their activities with the suggestions in the report. That is to say, they’re preparing to increase compliance personnel as well as product tailoring in support of future regulatory needs.

Also Read: Ethereum Institutional Buying Frenzy Spells New Era for Crypto Investors

What This Means to Retail Investors

Retail investors and recreational traders may not notice differences immediately. Your preferred exchange will appear and function just the same, but internally, things will be more closely tracked. This may lead to:

- More visible token classification

- More transparent trading terms

- More education on crypto rewards and risks

- Better practices in consumer protection

It may also mean that mass market financial institutions, like your bank or investment broker, will begin to offer crypto-related products more institutionalized.

The Road Ahead

This first report is only the starting point of what will undoubtedly be a multi-year effort. It lays the ground for congressional debate, further rule-making by the federal agencies, and maybe new legislation.

But for an industry as likely to warp the law, this is real progress. The U.S. government isn’t quite ignoring the crypto revolution anymore, it’s trying to steer it.

You may be a developer working on the next big blockchain app or a retiree looking to read up on digital assets, the future of finance is altering. And with the White House leading the conversation, the rules of engagement are finally starting to take shape.