Bitcoin reached a new all-time high of over US$125,000, driven not by retail froth but by a surge of institutional money pouring into exchange-traded products. Digital-asset funds, meanwhile, record a weekly net inflow of about US$5.95 billion, indicating that large, managed money is now powering price action (Reuters).

This twin moment; funds from the past into ETFs and regulatory change in Europe is the tipping point of the day. Brussels’ European Securities and Markets Authority (ESMA) is urging to centralise the regulation of exchanges and cross-border crypto business, suggesting public authorities now wish markets to act more like conventional finance than a decentralised experiment (Financial Times).

In other words: the market is aging, asset managers. The rulebooks are belatedly catching up at the national level. That tug of war of interest; regulators, traders, custodians, and asset managers is reconfiguring how blockchain creates value and society manages risk.

Wall Street jumps in, Bitcoin soars, Europe tightens rules: crypto matures. (Image Source: TheStreet)

Snapshot: What Happens When ETFs And Regulation Collide

As institutional products increase at a rapid pace, the plumbing matters. ETFs add more systematic paperwork, mandates and custody agreements; they also put power in the hands of a concentrated group of managers and custodians. That concentration changes liquidity, settlement timing and who bears counterparty risk.

Last week’s record inflows are the new normal: large buckets of capital invest in crypto through the same pipes that they invest in stocks and bonds. That has implications for price discovery and where the attention is not on code itself but on custodians, auditors, trustees and exchanges (CoinShares Research Blog).

Right now we got innovations like ETFs

They bring a lot of liquidity into the market

But the problem with such liquidity:

– it moves slow between assets

– it tends to stay static in one assetSo fast rotations between alts that we actually need – ETFs don’t provide pic.twitter.com/qIfYO4g4NX

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) September 30, 2025

Why The Numbers Are More Than An Investor Headline

US$5.95bn is not an inconsequential amount of money. It’s a structural shift in demand and in liquidity-providing institutions.

ETFs first convert latent demand into dispatchable allocation for pension plans, endowments and multi-asset mandates. When it’s possible to purchase “bitcoin” via an ETP alongside equities within the same custody framework, allocation committees no longer consider crypto as out-of-the-box and start to model it like any other asset class.

Second, counterparties concentration changes. Rather than tens of retail wallets distributed across exchanges and cold storage, enormous holdings are with a small number of custodians and authorized participants. Those counterparties become systemically important, precisely the counterparties regulators are concerned about in stressed markets (CoinShares Research Blog).

Market Mechanics: How ETF Inflows Drive Price

ETFs must purchase the underlying to satisfy investor subscriptions. Authorized participants make the large OTC purchases when billion-dollar-size blocks become available and exchange the Bitcoin for ETF custody. That totals up to pull from the spot market and reduced exchange spot availability, a straightforward supply/demand push higher.

At scale, it also removes public order book liquidity. Trading desks must seek out blocks in miners, long-term investors, or OTC markets all of which magnifies price movement as demand goes up. Short version: ETFs change who is investing and how they are investing (CoinShares Research Blog).

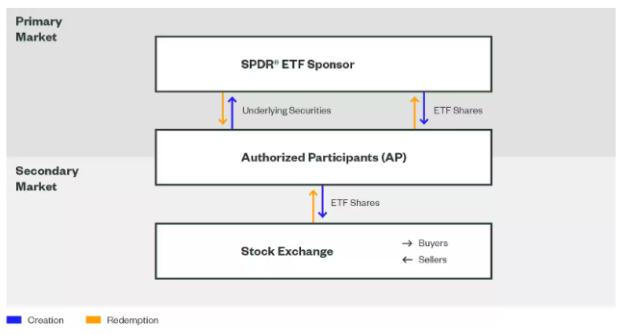

ETF inflows drain supply and tighten liquidity, driving Bitcoin prices higher. (Image Source: State Street Investment Management)

Regulation: Why ESMA’s Decision Is Important (And Why It’s Happening Now)

ESMA thinks that Europe needs a common supervisory approach to avoid fragmentation and deliver cross-border consistency. If crypto markets become true global capital markets i.e., with cross-border trading, clearing, and custody then a patchwork of national regulators might not spot systemically risky threats or create regulatory arbitrage (Financial Times).

For business, centralisation has two consequences. An EU-wide regulator can mean a more level playing field of rules and easier pan-European supply. But national hubs, smaller-scale finance centres that had set up home bases in crypto see threat to business models and jobs. It is this tension that ensures the debate will be political, rather than technical.

ESMA calls for EU-wide crypto rules to curb risks and reshape business. (Image Source: RATING EVIDENCE GmbH)

On-chain Vs Off-chain: The True Buyer Is A Mystery. The Evidence Is Contradictory And Illuminating

On-chain metrics show fewer, but larger, deposits to custodial wallets in recent months; exchange net flows show more coins leaving exchanges than arriving. Those are all consistent with institutions coming into long-term custody, rather than short-term trade. Institutional viewers and data feeds all point the same way: now market structure is moving towards an asset with growing allocation by long-term holders and institutional wallets (Glassnode Insights).

But note the proviso. Large off-chain trades and OTC desks will not at all be visible in public mempools; they will be visible as altered inventory in custodians and allocation changes of liquidity provision. That very opacity is why auditors, proof-of-reserves practices and formalised custody standards are ever more necessitated as flows increase.

What It Does To Risk And Resilience

- Concentration risk of custody. Some custodians now have massive institutional deposits. System failure, cyberattack or regulatory action against any one of them can spread through ETFs, asset managers and underlying exchanges (CoinShares Research Blog).

- Dependence on market-making. Primary source of liquidity to market-makers and OTC desks covering ETFs. When they exit in distress, volatility can surge.

- Regulatory spillover. ESMA’s centralisation drive means regulators want to manage cross-border concerns, national spill-over, not just. That changes cross-border product mix by companies (Financial Times).

Custody concentration and regulatory shifts raise systemic risk and reshape markets. (Image Source: Carnegie Endowment for International Peace)

Market Voices (Synthesised, Evidence-based)

Regulatory reports and market studies drive the agenda: managers report investors want wrapped regulated products and low custody costs, analysts report macro and safe-haven flows show interest, regulators report fragmentation risk grows with market globalization. Not hype, data-driven: record weekly ETF and ETP inflows, custody for institutions on the rise, and public policy development (MarketWatch).

Where Early Cracks Appear To Surface: Live Exposures To Monitor

- Proof-of-reserves in focus: With large pools under custody, markets demand open reserve proofs for ETFs and custodians. Poor auditing standards leave reputational and legal exposure.

- Settlement mismatch: ETFs are within market hours, but crypto markets trade 24/7. That mismatch can leave ETFs vulnerable to overnight gaps and liquidity mismatches during geopolitical shocks.

- Regulatory arbitrage: Some ETPs go through non-EU jurisdictions or non-EU custodians. ESMA’s centralisation will try to blunt it, but the execution will be key.

Brief Case: Why A Pension Or Sovereign Board Would Today Invest A Slice In Bitcoin

Pension boards like simplicity, custody and regulation. ETFs provide a regulated, auditable way of gaining exposure. With allocation committees using for instance inflation hedging and diversification benefit, available ETPs reduce implementation friction so real money invests faster than before.

That institutional action changes the narrative: Bitcoin is not just a retail speculation play but now an investable product for portfolios. And with that, responsibility: better governance, custody, and quarterly reporting.

How ETFs Quite Literally Get Bitcoin Off The Street And Into Institutions’ Pockets

ETFs don’t wave magic wands at the price. They move the plumbing.

An ETF sponsor has a connection with authorized participants (APs) , typically large broker-dealers or market makers, that create and redeem ETF shares in the primary market. To create, an AP delivers a “creation basket” (typically the underlying asset) to the ETF custodian; the ETF delivers the AP shares. For redemption, it is the reverse. That is the initial conduit whereby ETF buying is translated into physical Bitcoin spot market purchase outright (ICI).

That’s the physical world knock-on. Institutional investors placing billions of dollars’ worth of ETF shares are causing APs to go out and source correlated Bitcoin. That demand typically flows through OTC desks and mega-custodians rather than public exchange order books. The result: on-exchange positions run off, OTC volume and custodian balances rise, and the market gets tighter underpinning higher prices for as long as it does. Glassnode and other on-chain exchange providers indicate exactly that trend: coins in exchanges going down and in custodials going up (Glassnode).

A second factor is relevant to risk: ETFs trade for trading hours on exchanges, but Bitcoin trades 24/7. ETFs subsequently experience settlement and NAV calculation frictions if large moves happen when the market is closed. That timing mismatch provides room for gaps, volatility and stressed liquidity, risks pension funds and trustees will soon be disputing (SSGA).

ETFs pull Bitcoin into custody, tighten supply, lift prices, and add timing risks. (Image Source: WallStreetMojo)

Case Study 1: Canada’s Purpose ETF: Custody Legitimacy

Canada’s Purpose Bitcoin ETF was thesis one: investors will accept a wrapped product if custody is reputable. It launched in 2021 and drew massive day-one volumes and legitimacy by pre-announcing institutional custodians and sub-custodians. The lesson: product structure and custody conversation outweigh promotion (Purpose Investments).

That lesson is repeated. Institutional investors require legal certainty, reserve-backed audited accounts and a strong custodian chain. When ETFs deliver that, boards and CIOs can sign off on allocations without having to construct bespoke custody arrangements.

Case Study 2: The U.S. Spot ETF Launch And The Tectonic Shift

The US sign-off on spot Bitcoin ETPs in January 2024 is a structural advance. It converts Bitcoin from a product traded on largely crypto platforms to one traded on pension portfolios and mainstream broking platforms. The precedent is robust: regulators effectively legitimize the view that mainstream financial markets can cope with native crypto assets if custody, disclosures and market surveillance are up to the relevant standards (SEC).

That regulatory uptake creates scale. And scale creates concentration: fewer custodians, APs and market-makers are needed to global Bitcoin liquidity.

The Regulatory Environment: Where Europe, The US And The UK Stand Today

- Europe will centralize regulation. ESMA is spearheading the extension of regulation of exchanges and cross-border crypto business as a way to limit fragmentation and improve market integrity for the entire single market. That move aims to prevent regulatory arbitrage among member states and also to bring supervision to a single level for systemic crypto institutions. Brussels sells that as risk reduction and market-making. But smaller hubs worry about being price-takers for national authorities with greater influence (Financial Times).

- The U.S. strategy is distinctive: the SEC authorized spot ETPs yet has an aggressive enforcement policy and market surveillance and disclosure focus. The U.S. strategy couples liberal access with forceful enforcement (SEC).

- The UK encourages hybrid approach: FCA consults on applying existing handbook requirements to crypto businesses, with the expectation of equivalence to traditional markets but protection of consumers against high-risk products. That is a practical, incremental bringing of crypto into mainstream financial regulation (FCA).

- Short version: Europe wants one regulator; America opens products but with conditions; the UK would prefer to bring crypto into existing scaffolding of regulation. All change where companies domicile and how they build cross-border ETFs.

Europe centralises, the US enforces, the UK integrates reshaping firms’ strategies. (Image Source: Cointribune)

Proof-of-reserves, Audits And Trust: The New Hygiene Factors

Institutional large flows are a hygiene issue. Proof-of-reserves, cryptographic or audit-based assurance custodians have coins in reserve which are claimed to be held going from niche demand to mainline expectation. Experience of FTX and other defaults necessitates auditors, asset managers and regulators demanding good, verifiable proofs and third-party audits. Markets are placing a higher premium on transparency. Those companies that do not offer open, audited reserves lose investor access very quickly (Merkle Science).

That tension expresses itself in action: independent verification, multi-custodian arrangements, and more robust KYC/AML processes are a marketing pull for any ETF sponsor that wants to win institutional mandates.

Interview Plan: Who To Speak To And Why

Targets

- ETF managers and product specialists (BlackRock, Fidelity, specialist ETP sponsors)

- Custodians (BitGo, Coinbase Custody, Cidel, bank custodians)

- Regulators (ESMA policy team, SEC ETF division, FCA crypto leads)

- On-chain researchers (Glassnode, CoinShares analysts)

- OTC desks and market-makers

Sample Questions

- To ETF managers: “How do you manage creation/redemption in 24/7 price action?”

- To custodians: “What are the mitigants against concentrated operational failure?”

- To regulators: “What are the triggers for ESMA centralising supervision, and how will cross-border enforcement work?”

- To on-chain analysts: “What on-chain metrics best capture institutional custody flows today?”

These interviews will provide gravity and weight to the piece; real voices to bring the data to life.

Data Appendix & Graphs To Include

- Price chart (Oct 1–Oct 10, 2025) w/ATH indicator: puts rally into context (Reuters/MarketWatch).

- Weekly net inflows bar chart (CoinShares weekly flows) shows the ~US$5.95bn peak (CoinShares Research Blog).

- Exchange supply vs custodian holdings (Glassnode): graphical proof of decreasing exchange inventories and growing custodial positions (Glassnode).

- Sankey of custody flows: shows APs, OTC desks, custodians, ETFs and exchanges. Useful for explaining the plumbing.

- Regulatory map: ESMA centralisation plan vs SEC and FCA stances.

FAQ: Brief, Clear, Informative Responses

Q: Will ETFs make Bitcoin safer for all investors?

A: ETFs enhance access and visibility but focus custody risk. Safety is enhanced if custodians and audits are institutional grade (Purpose Investments).

Q: Can ETFs cause a huge sell-off?

A: Yes. ETFs function both ways. Large redemptions compel APs to sell the underlying, which has a double effect on downside movement if liquidity evaporates. Market-makers and OTC desks step in then (SSGA).

Q: Do on-chain metrics suggest institutions have long-term?

A: On-chain signals, declining exchange balances and larger transfers to custodian addresses suggest larger, longer-term holdings. But OTC opacity means we interpret hints, not certainties (Glassnode).

Q: What will ESMA centralisation do to firms?

A: It raises the compliance bar and reduces arbitrage across EU member states. Small states can try to resist, but firms get more coherent, pan-EU rules if ESMA gets the reform through (Financial Times).

Q: Is $125K shift sustainable?

A: That will depend on the continued flows and macro environment. Large inflows shrink spot supply and support prices; reverse flows, and volatility follows (CoinShares Research Blog).

Q: Do ETFs carry systemic risk?

A: They can, if custodians/approved participants roll-over exposure and auditing/custody standards are lax. ESMA’s effort indicates regulators do take that seriously (Financial Times).

Q: Will centralised regulation kill decentralisation?

A: Not necessarily. Centralised control moves the institutional veil over decentralised protocols but not on-chain consensus. It does move market incentives and legal frameworks.

Also Read: The Heist That Backfired: A Tale of Hacker vs. Hacker

Three Potential Future Possibilities

- Institutional Normalisation (base case): ETFs and custodial standardisation mature; flows continue; crypto is a part of mainstream finance with proper audits and market surveillance. This trajectory locks in liquidity in the long run.

- Regulatory Choke (risk scenario): centralised regulation increases compliance costs and pushes liquidity to non-compliant nodes or off-exchange decentralised venues. Fragmentation returns across borders.

- Bifurcated World (hybrid scenario): institutional investors use Regulated ETFs and there are parallel decentralised markets operating in tandem. Price action shows two pools of liquidity with periodic spillovers.

There are winners and losers in each scenario: permissioned custodians, APs and mature exchanges are winners with Normalisation; permissionless protocols and fast-shifting offshore platforms are the winners with Regulatory Choke.

https://youtu.be/uQy-TfVC3ZQ

Conclusion: The Current Inflection Point In A Paragraph

We are seeing the transition happen now. The $125K high and nearly US$6bn of weekly inflows is the crossover point at which institutional demand recasts Bitcoin’s market dynamics. Regulators push back in response, trying to recast decentralized rails as regulated, auditable systems. The narrative being written is political, legal and financial not just technical. Your narrative needs to show how every stakeholder, regulator, analyst, custodian, fund manager redefines “decentralised” when there is serious money on the table.