UXLINK, the Web3 social platform, suffers a catastrophic multisignature-wallet hack from September 22–24, 2025. Hackers exploit admin-level permissions, mint an enormous amount of UXLINK tokens (estimates vary between billions and trillions), and drain cryptocurrency reserves — estimates of value stolen vary across trackers and press reports but are in the multi-million-dollar range. The token implodes, exchanges, and the team intervene to lock up funds, and the project suggests audits and a token migration plan to establish a fixed supply. (Bitget)

UXLINK hack mints trillions, drains millions, crashes price; team plans audits and token migration (Image Source: Securelist)

What happened, the short version

An attacker gains admin privileges to UXLINK’s multisig wallet and uses them to mint unauthorized tokens and drain funds from the project treasury. The immediate outcome: a devastating sell-off, massive token issuance that will destroy scarcity, and market chaos as the token collapses. Follow-up reporting brings another strange twist: the exploiter has some of the loot phished by a second phishing attack, making one crime a two-stage epic. (Bitget)

Timeline and technical breakdown

- 22 September 2025 (approximate): Exploit occurs, attacker exploits multisig or admin key vulnerability to mint tokens and drain funds. On-chain observers begin tracking the flows. (CryptoPotato)

- Several hours later: Project and blockchain observers contact exchanges; some freeze a portion of the stolen funds. Public announcements begin being made by forensic trackers and the project. (Crypto Briefing)

- Within 24–48 hours: Reports differ on the size. Some forensic feeds monitor around US$11.3 million withdrawn from the treasury; other composite chain tracing and reporting reflect higher converted figures or alternative valuations, with coverage showing up to ~$30 million as the impact of the exploit is tallied. (CryptoPotato)

- Next day: The exploiter partially realizes gains on exchanges — then, in a twist of irony, a second secondary phishing scam steals some of the exploiter’s ill-gotten tokens. Investigators and on-chain detectives comb over the flows as the UXLINK team suggests a token migration and audit. (Crypto Briefing)

Sept 22, 2025: UXLINK hack drains $11M–$30M; next day, hacker gets phished as team plans audits and migration (Image Source: MDPI)

Sept 22, 2025: UXLINK hack drains $11M–$30M; next day, hacker gets phished as team plans audits and migration (Image Source: MDPI)

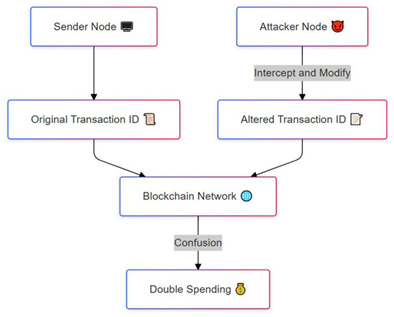

How the exploit worked (simple terms)

UXLINK uses a multisignature wallet for project treasury management. Multisig needs more than one private key to sign transactions — a typical guardrail. Either the attacker exploited a bug in the multisig contract or acquired enough signing keys or admin interfaces to pose as an authorized signer. That privilege enables them to invoke minting functions and approve transfers that ought to be rejected, minting new tokens and transferring funds to off-chain addresses. The on-chain signature trail and instant trades into other tokens show the classic pattern of an opportunistic attack. (Bitget)

Scale of the damage — numbers and why they vary

Headlines are confusing. There are some auditors and bloggers who mirror the on-chain drain for around US$11.3m in treasury value drained. Other paths and chain-tracing cumulative report total on-chain token inflation as astronomically high — 1 billion to 10 trillion UXLINK tokens produced in some traces of transactions — and cashed out portions of that supply in ETH or stablecoins, whose values fluctuate as the market sells them off. In short, stolen nominal tokens are enormous; convertible value fluctuates based on how much the thief cashes out and when. (CryptoPotato)

Why the discrepancy? Crypto forensics will generally report raw on-chain transactions, while press valuations try to assign USD value at conversion points. Price slippage in bulk dumps and partial exchange freezes yields different dollar-amount totals.

ALERTOur system has detected $11.3M in suspicious transactions involving @UXLINKofficial

An ETH address executed a delegateCall, removed the admin role, and called “addOwnerWithThreshold” before transferring $4M $USDT, $500K $USDC, 3.7 $WBTC, and 25 $ETH.

All USDC/USDT were… pic.twitter.com/fkHwygOHkD— Cyvers Alerts (@CyversAlerts) September 22, 2025

The market reaction — price, liquidity, and fear

Within hours of breaking news, UXLINK’s market cap collapses. The token drops 70%–90% on some feeds as the market digests both the hack and the surprise dump of freshly printed supply. Liquidity dries up on most DEX orderbooks; centralised exchange markets crater or are frozen. Those who sell early crystallise a loss; others who cannot unwind sit over near-valueless balances. (CryptoPotato)

GM degens

Woke up to chaos $UXLINK got absolutely rekt, down >80%

The attacker exploited a vulnerability to mint billions of new tokens on UXLINK.

Supply went from 1 billion >10 trillion.And the plot twist?

the hacker themselves got phished shortly after and got hacked. pic.twitter.com/WTxbMrFPvn

— Valle ✈️ TOKEN2049 SINGAPORE (@cryptovalle0) September 23, 2025

The twist: hacker-on-hacker crime

In a role reversal twist, the initial exploiter is exploited. The trackers report that the attacker is then a phishing victim, losing a portion of the freshly minted coins to a second malicious entity. This twist complicates recovery chances: stolen coins then move again through mixers or to wallets of opportunistic scammer entities. The outcome: one additional broken chain to follow, but also more addresses available for potential freezing by exchanges that are working with the team. (Cointelegraph)

UXLINK’s quick response

The project publicly discloses, requests exchanges to freeze suspicious funds, and calls for a security audit on an alternative token smart contract. UXLINK team announces a token migration timeline to a new fixed-supply smart contract and promises compensation mechanisms for affected stakeholders — though details and timing are subject to change in the ongoing forensic analysis. The team’s public channels include audit confirmations and a migration roadmap. (X (formerly Twitter))

Who gets hurt — users, liquidity providers, and the protocol

Retail holders hardest hit: wallets with UXLINK tokens lose value severely.

- Liquidity providers and DEX stakers suffer impermanent loss and sticky positions in shrinking pools.

- Third-party integrators (wallets, indexers, and payments integrations) suffer reputational loss and must patch trust gaps.

- The project team suffers governance and credibility loss; future fundraising and ecosystem partnerships are harder.

The technical solution is straightforward in comparison to the social and behavioral damage — user trust loss — with a much longer recovery period.

Holders, LPs, integrators, and the team all suffer; but lost trust hurts most.(Image Source: tastycrypto)

The forensic and legal aspect

On-chain data enables investigators to trace the money, but attribution remains challenging. Exchanges can freeze assets when funds flow into accounts within their control; law enforcement can target centralized off-ramps. On-chain mixers and cross-chain bridges make recovery more difficult. That there is a phishing loss on the hacker provides investigators with a second trail to pursue — a curse and blessing. Expect a mix of civil actions, regulatory filings, and law-enforcement requests as the dust settles. (CoinStats)

Security takeaways — governance, multisig hygiene, and audits

There are some hard lessons that this event teaches treasuries and builders:

- Multisig is not a silver bullet. Governance, key management, and signing procedures must be bulletproof.

- Least privilege is crucial. Admin keys with mint or modify supply functionality are high-risk and need additional checks.

- Regular audits and bug bounties reduce attack surface, but don’t eliminate human error or new exploits.

- Emergency procedures and insurance — quick response, good exchange relationships, and insurance coverage greatly reduce damage.

Industry observers comment that the alleged “decentralisation” projects with centralized admin function are still open to the conventional centralized attack vectors. (Cointelegraph)

Multisig isn’t foolproof; limit admin keys, audit often, respond fast, and insure, centralised controls still expose risks. (Image Source: glair.ai)

How recovery would be accomplished — token exchange, clawback, and payment

UXLINK’s public roadmap mentions a token migration: a new fixed-supply contract and exchange rendering minted tokens useless. In practice, token swaps place the burden of recovery in exchanges’ hands to map old-to-new balances and in the project team’s hands to fund compensation pools. Exchanges can refuse to support swaps after KYC and proof, or refuse them altogether. Even in a migration, dump sellers will rarely be compensated. Real remediation is most likely to be a mix of technical patches, legal action, and negotiated compensation. (crypto.news)

Practical guidance for holders and traders (what to do now)

- Do not click suspicious links. Scammers spring up after major hacks.

- Check official channels. Follow UXLINK’s audited announcements for swap instructions. Confirm contract addresses via the project’s verified handles.

- If you’re listed on an exchange, follow their guidance. Exchanges often publish how they’ll handle token migrations or freezes.

- Record losses. Save screenshots and transaction IDs for insurance or legal claims moving forward.

- Do not fall for “recovery” scams. Thieves are dumping the stolen community — real recovery is from the project, auditors, and exchanges, not from unknown wallets.

Avoid scam links, follow UXLINK’s official updates, heed exchange guidance, document losses, and ignore fake “recovery” offers (Image Source: Identity Guard)

Bigger picture — trust, regulation and the next wave of defences

Such hacks as UXLINK’s deepen policymakers’ calls for more custodial requirements, more disclosure requirements, and stronger consumer protections for cryptocurrency markets. The incident sparks controversy on how decentralised projects manage centralised levers, and whether regulatory regimes should mandate minimum treasury-security requirements for projects that run public treasuries. Expect other calls for minimum security certifications and potentially insurance-backed listing requirements for leading tokens to return. (Cointelegraph)

Quick FAQs (publish-ready)

Q: Was my wallet hacked?

A: The hack was on the project multisig treasury; there is no public report of UXLINK affecting individual non-custodial user wallets. Always be careful, never store, and always verify your wallet keys.

Q: Can exchanges reverse the minting?

A: Exchanges can freeze funds that come into contact with their accounts. They cannot reverse on-chain mint operations; mitigation is usually done in swaps, freezes, and coordinated recovery efforts.

A: It depends on the community, trade sponsorship for a migration, and if the team follows through with compensation and audits. Reputation is hard to regain.

Q: What is the “hacker phished” accusation?

A: Several trackers suggest the attacker themselves were later targeted by a phishing attack that stole some of the stolen tokens — a dirty second-order theft that disperses the trail.

Deep forensic snapshot — how chain analysis stitches it all up

Blockchain forensics is transaction archaeology: every step leaves publicly visible records. Investigators follow where a multisig contract is making mysterious calls (a delegateCall or admin change), then follow token mints and sends to swap contracts, DEX liquidity pools, and centralised exchange (CEX) deposit addresses. This pattern of transactions reveals both the on-chain strategy of the attacker and where exchanges come in next. Various forensic teams follow the same pattern for UXLINK: an admin-level transaction deleting governance guards, large-scale minting of UXLINK, and immediate swapping to ETH and stablecoins. (ForkLog)

Individual traces are:

- delegateCall-type contract calls granting the attacker owner privileges. (AInvest)

- Minting transactions with a new supply record (numbers tracked by analysts of up to ~10 trillion), followed directly by DEX sells and swaps. (news)

- Transfers to ETH and stablecoins (e.g., swaps of thousands of ETH funneled through several wallets). (Bitget)

Those footprints enable investigators to see the timing of the hack, wallets that moved funds, and the first hops to cash out — all critical when working with exchanges and law enforcement. (Unchained)

ALERTOur system has detected $11.3M in suspicious transactions involving @UXLINKofficial

An ETH address executed a delegateCall, removed the admin role, and called “addOwnerWithThreshold” before transferring $4M $USDT, $500K $USDC, 3.7 $WBTC, and 25 $ETH.

All USDC/USDT were… pic.twitter.com/fkHwygOHkD— Cyvers Alerts (@CyversAlerts) September 22, 2025

The technical root cause — multisig vulnerabilities and delegateCall risk

Multisigs reduce single-point failure risk — but only if implementers eliminate risky admin vectors. In the case of UXLINK, publicly available histories and vendor documentation disclose a delegateCall or other contract function that permits a calling contract to execute code in the multisig’s context, enabling an owner change or threshold change. If an attacker can successfully exploit that pattern, then, in effect, they are an approved signer and can proceed to mint or transfer tokens. Security observers highlight this as a type of exposure that can be prevented when governance processes and calls for upgrading are left exposed.

Practical lesson: “multisig” isn’t stronger than its weakest contract flow or key management practice. Products with on-chain admin powers that can create or change supply must reduce or even eliminate such powers from regular multisig flows.

UXLINK’s hack shows multisigs fail if upgrade powers stay open — secure admin functions and minimise contract risks. (Image Source: Live Bitcoin News)

What the bad actor did on-chain — swaps, routes, and value

Reports concur on a trend: newly minted UXLINK is put into DEX pools and bridges, where arbitrage and slippage try to trade newly minted tokens for liquid cash. Different sources monitor conversions of some thousands of ETH in value and astronomical stablecoin values. For instance, forensic reports indicate the attacker selling UXLINK for a total of approximately 6,700 ETH across multiple trades (a total most sources quote at approximately US$28m at the time of swap), and other streams report treasury draws of newly listed mixed assets to the tune of approximately US$11.3m. (Bitget)

Chain analysis also reveals common laundering patterns: quick splits to multiple addresses, DEX interactions with low slippage pools, and transit via privacy-oriented mixers or cross-chain bridges. This fragmentation not only makes them difficult to recover in the short term but also leaves behind multiple points of contact where exchanges can still collaborate to freeze funds. (MEXC)

$UXLINK HACK DETECTED

Within hours, attackers drained millions from the wallets controlled by the team.

The wallets tell the story:

Key wallet movements in the first 24 hours:

• 0xde153534428aae1269adc1459ebbe78ba0ea92a2

~$4M USDT, $500K USDC, 3.7 WBTC, 25 ETH… pic.twitter.com/NpbZyX5jnJ

— Crypto Jargon (@Crypto_Jargon) September 23, 2025

The ironic secondary theft — the attacker gets phished

Sometimes the initial exploiter is also a victim. Several reports suggest the attacker loses a portion of the profits a few hours later to a second phishing attack (reported in varying and contradictory figures as tens of millions of dollars’ worth), which puts the funds yet again into different attacker-held accounts. That both divides the trail and creates additional addresses that might be frozen if they came into contact with regulated exchanges. It also shows how criminal actors are exposed to opportunistic copycats right after a hack. (Cointelegraph)

For an investigator, the phishing loss is double-edged: broader distribution makes it harder to trace, but additional public swaps and deposits give exchanges more touchpoints for intervention.

Exchange cooperation and rapid containment

The fastest path to on-chain harm containment typically goes through exchanges. It has been reported that several exchanges immediately froze tainted deposits and halted trading for addresses associated with the UXLINK drain, limiting further on-ramps and reducing the convertibility of the attacker. UXLINK itself says it is working together with major exchanges and security firms in an effort to coordinate freezes and follow flows. Those collaborative efforts likely explain why reporting shows an $11.3m number (direct treasury drain) and greater swap figures — some converted funds never actually leave exchange custody, in fact.

This kind of coordination is required when a project proposes a token swap; exchanges must maintain old balances against new ones or allow a migration in order for remediation to take place.

Token migration, contract replacement, and realities of a swap

UXLINK team confirms a new contract deployment and a scheduled migration to a fixed-supply token that makes the minted supply valueless — a typical remediation route after inflation attacks. Practically, a migration involves:

- A new contract address and audited code confirmed.

- Exchange support to re-map custodial balances and finish the swap.

- Transparency of communications and KYC-friendly processes to prevent scammers from pretending to be the migration operator.

Even with coordination, not all holders are made whole. Long-term holders who sold out during the crash lose out; holders who rode through via a coordinated exchange can recoup some, subject to the project’s compensation fund and exchange cooperation. Remediation also raises tricky governance questions: do token holders vote on the migration, or does the team act by emergency fiat? That governance tension then usually becomes the next crisis point for struggling projects. (Medium)

UXLINK launches fixed-supply token; migration aids recovery but leaves governance tensions (Image Source: Tokeny)

Compensation and legal recourse — who, and how?

Situations for compensation typically have a series of levers:

- Exchange clawbacks — when money ends up in exchange accounts, exchanges will occasionally freeze withdrawals and work with legal teams to claw back funds that were stolen. That path relies on the cooperation of the exchange and local law enforcement. (Unchained)

- Insurance — some projects or custodians are insured against specific attack vectors; payouts differ according to policy terms. Insurance does not usually cover governance or developer error. (OneSafe)

- Project funds — a compensation fund can be funded by the community out of treasury reserves or future token issuances. That approach dilutes existing holder value and puts pressure on governance. (Binance)

- Civil and criminal pursuit — police can chase on- and off-ramps; civil action can chase compensation. These channels are recreational and random. (TradingView)

There are disadvantages to both channels. Historically, a portion of stolen value is reclaimed by victims; the remainder is laundered through mixers or traded before legal recourse can catch up.

Forensic visualisation editors need to include

If you’re posting this article, insert three on-chain illustrations to allow readers to understand the mechanics:

- Flow chart of timeline — mark the initial multisig call, mint transactions, and initial swaps (timestamped). (Source: on-chain trace from Cyvers/CoinGecko forensic feeds.)

- Cluster map of addresses — nodes for wallets that had stolen tokens sent to them, colored to reflect whether funds were sent to a known exchange. (Source: forensic provider exports.)

- Swap ladder — a small table where numbers are converted to ETH/USDC at each hop and the USD value at swap time. (Source: DEX logs and block explorers.)

The visuals help both technical and non-technical readers visualize just how quickly value is moved in such attacks.

What security teams must adapt now?

The UXLINK incident sheds some light again on some absolutes for all treasuries:

- Remove or segregate minting authorities from regular admin flows. (OneSafe)

- Guard multisig implementations against upgradeable call vector (delegateCall abuse) attacks. (AInvest)

- Perform continuous, adversarial red-teaming exercises — not point-in-time testing. (Medium)

- Have exchange relationships and an incident-proven playbook established (freeze contacts, forensic vendors, lawyers).

Best practices from these projects reduce the risk of catastrophic governance failure.

The regulatory and market implications — bigger picture

These examples fuel policy debate. Regulators and exchanges call for more stringent listing requirements and clearer custodial disclosures for projects running public treasuries. There will be calls for:

- Minimum security standards for on-chain treasury functions. (OneSafe)

- Further controls over mint-capabilities on top platforms. (Binance)

- More disclosure of admin keys and upgradable contract functionality pre-listings. (AInvest)

For markets, catastrophic failures obliterate retail demand in the near term but also create an appetite for “institution-trusted” products — ETF wrappers and custody products that minimize direct exposure to project governance risk.

Bigger picture: exploits drive calls for stricter listings, treasury security, admin key transparency, and safer institution-led products (Image Source: Medium)

Full FAQ pack — publication-ready

Q: Did the breach attack user wallets?

A: There was no public info that non-custodial user wallets had been compromised; the attack was on the multisig treasury of the protocol. Users are still advised to check all official announcements and not click on recovery links.

Q: How much was stolen?

A: On-chain forensic feeds show around US$11.3m sent directly from the treasury; swap volumes and the conversions therein provide higher headline numbers (records of estimated conversions of up to US$28–30m). Exact numbers vary by methodology and point of valuation.

Q: Can exchanges reverse on-chain transactions?

A: No. Exchanges can freeze balances on their platform and withhold withdrawals. They cannot reverse on-chain mints or transfers. Recovery is reliant on cooperation and enforcement through the law.

Q: Will the token survive inflation and swap?

A: Survival is reliant on exchange support for a migration, the willingness of the community to accept a new token, and the project’s ability to pay compensation. Reputation damage makes it a hard climb. (Medium)

Q: What do affected holders need to do right away?

A: Remain on confirmed channels, avoid third-party “recovery” assurances, retain receipts for transactions in case of claims, and follow official swap instructions closely.

Final analysis — the industry lesson in one paragraph

The UXLINK exploit is a textbook case of how compromised implementation and on-chain admin control bring systemic risk: a single exploit both inflates supply and liquidates treasury assets within the space of a few hours, and the effects ripple out across DEXs, CEXs, and community governance. That the attacker himself had just been compromised by a phishing attack is an almost cosmic personal twist, but it doesn’t change the underlying lesson — projects must remove unnecessary mint and admin privileges, multisig-deploy securely, and incident playbooks with exchanges and law enforcement before funds ever move. The road to trust restoration is lengthy; containment, carefully screened migration, and open, transparent remediation are the goals now.