In the world of crypto, one phrase gets tossed around with confidence—“trustless systems.” It’s often heralded as a revolutionary feature of blockchain technology, allowing users to transact without needing to trust a central party. But what happens when trustless doesn’t mean trustworthy?

The distinction is more than semantic. While decentralization and smart contracts have transformed how digital economies function, they’ve also introduced new risks, loopholes, and misconceptions. It’s time to ask the hard question: Is crypto really delivering on its promise of integrity—or just shifting the responsibility elsewhere?

The Rise of Trustless Systems in Blockchain

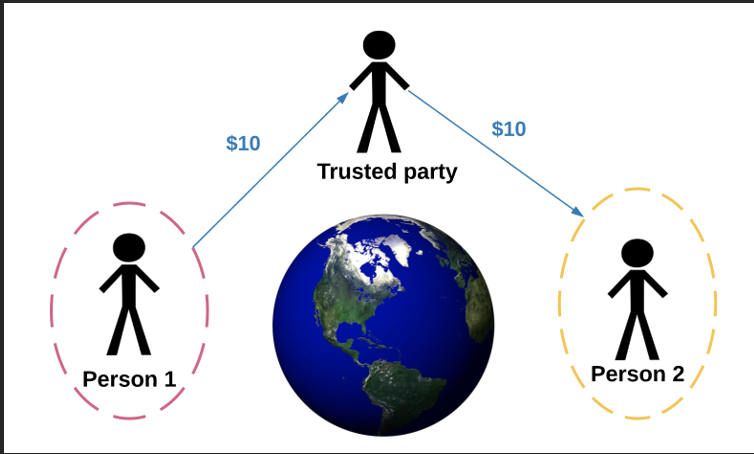

We achieve this aim of trustable system by having an intermediary who can facilitate the transfer of value

When Satoshi Nakamoto launched Bitcoin in 2009, the concept of a trustless system was a core innovation. Instead of trusting a bank or institution, users could rely on cryptographic protocols and a decentralized ledger. Transactions were irreversible, transparent, and immutable—enforced not by people, but by code.

In theory, this structure removed human fallibility and centralized corruption from financial transactions. In practice, however, it simply replaced one form of risk with another. Trustless doesn’t mean infallible.

Trustless ≠ Trustworthy: A Philosophical Divide

At its core, trustless vs trustworthy isn’t just a technological distinction—it’s a philosophical one. A trustless system means no one needs to be trusted for the system to function. A trustworthy system, on the other hand, inspires confidence that it will behave ethically, securely, and fairly—even when stressed.

This philosophical tension came to a head with the Mango Markets exploit in October 2022, where a trader manipulated prices using flash loans and walked away with $110 million—legally allowed by the smart contract. Yet in 2024, a U.S. jury ruled it was still fraudulent. This reveals a gap between legal code (what’s programmed) and moral code (what’s right), one that keeps growing in DeFi.

Crypto’s Trust Problem: The Human Element

Crypto’s reliance on anonymity compounds the issue. Wallets are free to create, so the cost of reputation is nearly zero. Known as the Sybil problem, this allows bad actors to cycle through identities and keep gaming the system.

Telegram channels now coach “airdrop farmers” on how to spin up hundreds of addresses to exploit giveaways. And when a trading strategy implodes, there’s no regulator forcing disclosures. The result? A distorted market dominated by survivorship bias, where only successful strategies appear on leaderboards, masking the countless failures that vanished without a trace.

DeFi promises transparency, but that promise often stops at the surface level.

Hacks, Scams & Exploits: The Dark Side of Decentralization

In 2022, 97% of stolen crypto came from DeFi protocols, up from just 30% in 2020. Even after a 54% drop in reported losses, nearly $2 billion disappeared in 2023 due to hacks, scams, and exploits. That’s not just bad luck—it’s a structural failure.

Attack vectors are diverse: from oracle manipulation (like in the bZx exploit) to thin liquidity spoofing, flash-loan exploits, and wash trading. And because blockchain transactions are public but pseudonymous, forensic auditing is hard—though not impossible.

Smart contracts may execute flawlessly, but their economic context is manipulable. The data feeding into them—like prices from oracles—can be gamed, undermining the integrity of even the best-written code.

Also Read:Ether ETFs Gain Ground as Bitcoin ETFs Struggle with Outflows

Why Transparency Isn’t Enough

Transparency is often touted as blockchain’s superpower. But code can be perfect and still untrustworthy if the data it runs on is flawed or manipulated. Imagine building a skyscraper on sand—it doesn’t matter how solid your blueprint is.

Even protocols with open ledgers fail to surface critical information. Most only highlight the profitable strategies, while losses get quietly buried. There’s no incentive to display blown-up portfolios or failed projects—yet those are essential for risk assessment.

If we truly want trust in technology, we must go beyond transparency and demand accountability.

Designing for Credibility, Not Just Decentralization

So what would a trustworthy blockchain system look like?

Here are some ideas gaining traction among forward-thinking developers:

1. Immutable Scorecards

Every on-chain strategy—win or lose—should be recorded. This evidence-based transparency creates a fairer reflection of performance and risk.

2. Costly Reputation

Reputation should carry a price. Traders could stake capital as a performance bond, only retrievable if their strategies meet transparent benchmarks. This forces “skin in the game” and deters rug-pull artists.

3. Zero-Knowledge Reputation Proofs

With zero-knowledge proofs, users can prove they have a solid track record (e.g., three years of profitable trading) without revealing their identity. It preserves privacy while ensuring credibility.

The Roadblocks: Trade-Offs and Resistance

Implementing these changes isn’t easy. Critics argue that such mechanisms reintroduce centralization or add friction to permissionless systems. But let’s reframe the debate: the real conflict isn’t decentralization vs control—it’s opacity vs evidence.

Just as traditional finance uses SOC-2 audits and capital reserves to build trust, crypto must adopt analogous practices tailored for decentralized contexts. These are not roadblocks—they are foundations for long-term legitimacy.

Toward a More Ethical Blockchain Future

The tools for reform already exist. Blockchain’s public nature means forensic audits and immutable records are more achievable than in any traditional system. But the culture must shift. It’s no longer enough to say, “built on Ethereum”—we must ask, “is it built for adversarial scrutiny?”

This mindset shift is what will allow decentralized systems to move from speculative playgrounds to trustworthy financial infrastructure. Institutional investors, pension funds, and national treasuries won’t stake billions on frog-themed Discord handles and zero-penalty schemes.

Final Thoughts: Trustless Doesn’t Mean No Trust

The crypto community loves to say “code is law.” But law, even when perfect, requires judgment, enforcement, and context. Blockchain doesn’t eliminate the need for trust—it simply changes where that trust is placed.

Rather than blindly chasing decentralization, let’s build for credibility, verifiability, and resilience. Only then can we turn crypto from a volatile experiment into a stable, reliable part of the global financial system.