Image Courtesy: iStock

Image Courtesy: iStock

Executive Summary

The March 2025 quarterly rebalance of the S&P/ASX indices produced a notable re-shuffle for resource stocks: a clutch of gold-focused companies — producers, developers and explorers — were promoted into the S&P/ASX 300 index effective prior to market open on 24 March 2025. Index membership matters: inclusion pulls in passive flows, raises liquidity and raises corporate profile, and for small and mid-cap miners the impact can be material in both the near term (liquidity + repricing) and long term (research coverage, broader investor base). This article examines the gold names added to the ASX 300 in 2025, profiles each company (assets, FY25 numbers, resources/reserves and market metrics), shows the likely near-term market dynamics created by inclusion, and concludes with investor takeaways and risk considerations.

Primary source for index changes: the S&P Dow Jones Indices March 2025 announcement (effective prior to the open on 24 March 2025) lists the companies added to the S&P/ASX 300. (S&P Dow Jones Indices)

The miners we cover here (all added as part of that March rebalance) are:

- Ora Banda Mining Ltd (ASX: OBM) — producer.

- Pantoro Gold Ltd (ASX: PNR) — producer.

- St Barbara Ltd (ASX: SBM) — producer.

- Catalyst Metals Ltd (ASX: CYL) — developer with >1 Moz reserves.

- Southern Cross Gold Consolidated (ASX: SX2) — explorer / developer (Sunday Creek).

- Turaco Gold Ltd (ASX: TCG) — West Africa developer (Afema resource).

- WIA Gold Ltd (ASX: WIA) — explorer (Namibia/Côte d’Ivoire).

- Tribune Resources Ltd (ASX: TBR) — small producer via EKJV; attributable production in Q4.

- Santana Minerals Ltd (ASX: SMI) — developer (Bendigo-Ophir resource).

(Those tickers are explicitly included in the S&P/ASX 300 changes notice from S&P. The S&P notice is the authoritative record of the March 2025 changes. )

Daily charts for selected ASX gold miners like Northern Star Resources (NST), De Grey Mining (DEG), Capricorn Metals (CMM), etc.)

Interpretation: Visual trends across key gold stocks suggest varied trajectories—some trending upward amid sector momentum.

Why Index Inclusion Matters For These Gold Miners

Source: iStock

Source: iStock

Index inclusion is far from cosmetic. Here’s how joining the ASX 300 typically affects a miner:

- Immediate passive inflows — index-tracking funds must buy newly included stocks to match the index. The inflow size depends on the stock’s weight in the index and the AUM that tracks the benchmark. Because the ASX 300 includes many ETFs and institutional mandates, even small companies can see tens to hundreds of millions of dollars flow in at rebalancing windows. S&P’s rebalance notices (quarterly) are the trigger.

- Liquidity uplift & spread compression — more institutional interest and ETF inclusion generally increases daily turnover and narrows bid–ask spreads, making it easier for bigger funds to accumulate positions without as much market impact. Industry notes on ASX rebalances consistently point to these dynamics.

- Higher scrutiny & coverage — inclusion draws broker research, corporate governance scrutiny and investor relations focus: companies listed in the ASX 300 receive more attention and — in some cases — higher valuations if the market believes fundamentals support it.

- Potential volatility before/after rebalance — markets often “front-run” or “fade” index-driven flows: some traders buy ahead anticipating passive demand; others sell into the passive-buying window. This creates trading opportunities but can also produce short-term volatility.

For the gold miners added in 2025, these forces interacted with operational momentum: record production in some (Ora Banda), resource upgrades in others (Catalyst, Turaco), and re-listings/mergers that expanded capitalization (Southern Cross). The result: an unusually gold-heavy cohort moving into the ASX 300 at once.

Company-by-Company Deep Dive (profile, metrics, and context)

“Note on the data in the tables and charts: market-cap snapshots are taken from public finance pages around mid-2025 / Aug 2025 snapshots where noted (links in each subsection). Production numbers use FY25 or June 2025 quarter releases where available (company reporting and quarterly ASX releases). All key claims are footnoted to the original company or S&P announcement.”

1) Ora Banda Mining (OBM) — growth-through-operations and cash flow

Snapshot: Ora Banda delivered a breakout operational year in FY25, driven by strong output at Davyhurst / Riverina and two underground operations (Riverina and Sand King). The company reported record FY25 production of 92,399 ounces (including attributed ounces) and ended the year with a strong cash balance (c. A$84.2m reported) after heavy capital investment and development. This performance positioned Ora Banda as one of the largest producing companies among the new ASX 300 entrants.

Key metrics (selected)

- FY25 production (incl. attributed ounces): 92,399 oz. (listcorp.com)

- Cash (end-June 2025): ~A$84.2m (post-investment). cdn-api.markitdigital.com

- Market-cap snapshot (public finance pages): ~A$1.38b. (Yahoo Finance)

Why inclusion makes sense: OBM’s step-up in production and cash generation moved it into the market-cap and liquidity band that S&P uses for ASX 300 consideration — the company now looks more like a mid-tier gold producer than a microcap explorer. Added to the ASX 300 list on 24 March 2025.

2) Pantoro Gold (PNR) — high-grade Norseman operations, low AISC

Snapshot: Pantoro’s Norseman operations delivered a strong FY25 finish. The June quarter (Q4) alone produced 25,417 oz at an impressive AISC of A$1,991/oz, with quarterly EBITDA of A$80.4m and a full-year EBITDA of A$196.4m reported in their Q4 presentation. Pantoro’s FY25 total production was reported in trade media at ~84,536 oz for the full year; that figure aligns with the quarter runs and Pantoro presentations. The combination of scale, strong margins and robust cash generation explains Pantoro’s move into the ASX 300. (Kalgoorlie Miner)

Key metrics (selected)

- Q4 FY25 production: 25,417 oz. (LISTCORP.)

- FY25 total (reported in summary press): ~84,536 oz. (Kalgoorlie Miner)

- AISC (Q4): A$1,991/oz. (LISTCORP.)

- Market-cap snapshot (public finance pages): ~A$1.73b. (Yahoo Finance)

Context: Pantoro’s Norseman asset base (Scotia, OK underground and surrounding ore sources) provides an organic growth runway and a margin profile that positions it well among ASX mid-caps. Inclusion reflects both the production step-up and the market cap criteria. (pantoro gold)

Also Read: Vault Minerals and Pantoro Gold End FY25 on Strong Q4 Performance

3) St Barbara (SBM) — Stabilisation And Project Optionality

Snapshot: St Barbara is a well-known gold producer with assets including Simberi (PNG oxide operations) and Australian operations (historically Leonora assets). FY25 was a year of recovery and project work: FY25 gold production from Simberi was 51,168 oz (within revised guidance) though at relatively high AISC (Simberi oxide AISC in FY25 near A$4,582/oz per releases). The company reported FY25 financials and project studies that underpin future optionality (including a Simberi sulphide expansion project and other processing hub studies). St Barbara’s profile and market cap made it a natural addition to the ASX 300. (St. Barbara Ltd.)

Key metrics (selected)

- FY25 Simberi production: 51,168 oz.

- FY25 Simberi AISC: ~A$4,582/oz (Q4 data).

- Market-cap snapshot: ~A$325m (public finance snapshot). (Stock Analysis)

Context: St Barbara’s inclusion reflects the company’s scale and the fact that it is an established producer with growth options — the market typically rewards such latitude in project optionality through index inclusion and improved coverage.

4) Catalyst Metals (CYL) — resources and development momentum

Snapshot: Catalyst is more a developer than a high-production name — but it has a significant reserve/resource base. Public figures from Catalyst’s resource page show Ore Reserves at ~1,015 koz and Total Mineral Resources at ~3,409 koz (combined 3.4Moz), supported by the Plutonic, Trident and Marymia assets in Western Australia. A reserve base of that size and an active development plan makes Catalyst a natural mid-cap candidate. Inclusion in ASX 300 reflects resource scale, capitalization and the company’s development programs.

Key metrics (selected)

- Reported Ore Reserves: ~1,015 koz (group). (catalyst metal)

- Reported Total Mineral Resources: ~3,409 koz (~3.4 Moz). (catalyst metal)

- Market-cap snapshot: ~A$1.7–1.8b (public finance pages). (Morningstar)

Context: Catalyst’s inclusion is not about immediate scale production in FY25 but about a reserve/resource platform and development plan that lifted its market capitalization and liquidity into the ASX 300 bracket. For investors that prefer project leverage to rising gold prices, Catalyst offers exposure to a multi-million-ounce resource base.

5) Southern Cross Gold Consolidated (SX2) — new ASX listing & rapid capitalization

Snapshot: Southern Cross Gold is the combined entity (after a merger/listing transition) that controls the high-grade Sunday Creek gold-antimony project near Melbourne (Victorian goldfields). The company’s CHESS Depositary Interests (CDIs) commenced trading on the ASX (ticker SX2) in January 2025 and the company was included in the S&P/ASX indices effective 24 March 2025. Its market capitalization grew quickly following the listing and merger activity, which is typical for newly-listed resource companies that consolidate assets and show a clear growth plan.(Southern Cross Gold)

Key metrics (selected)

- Operational focus: Sunday Creek Gold-Antimony project (Victoria).

- Market-cap snapshot: ~A$1.7b (public finance pages snapshot). (Market Index)

Context: Southern Cross is a classic example of a company that scaled via consolidation and a dual-listing route, then attracted index inclusion after the ASX listing and market-cap rise. While still at an earlier stage of asset development relative to big producers, inclusion gives it instant access to large passive pools and institutional inventory for future capital moves.

6) Turaco Gold (TCG) — West African resource bulk

Snapshot: Turaco is a West African-focused explorer/developer with a flagship Afema project. The company announced a 2.52 Moz gold resource at Afema — a material discovery for a single project — which, combined with market interest in African projects, drove capitalization ahead of index inclusion. Turaco’s market-cap snapshot places it as a mid-tier resource developer within the new ASX 300 cohort.

Key metrics (selected)

- Afema resource (reported): ~2.52 Moz Au.

- Market-cap snapshot: ~A$541m.

Context: A multi-million-ounce resource in West Africa naturally draws capital — index inclusion signals the market’s recognition that Turaco has scaled beyond microcap status. For investors, Turaco offers resource leverage with the country/regional and execution risks associated with African projects.(turacogold)

7) WIA Gold (WIA) — Explorer With Discoveries

Snapshot: WIA Gold (formerly Tanga Resources) has been rapidly growing its exploration footprint with promising discoveries (notably Kokoseb in Namibia) and has a larger market cap — placing it into ASX 300 territory. WIA is primarily an exploration/near-development play; inclusion implies sufficient market capitalization and liquidity metrics.

Key metrics (selected)

- Operational focus: Kokoseb (Namibia) and West African licences. (LISTCORP.)

- Market-cap snapshot: ~A$426m (public finance snapshot). (Yahoo Finance)

Context: Explorers with step-change drilling success can see rapid re-ratings; the S&P inclusion reflects WIA’s market cap and trading profile rather than huge current production. Inclusion should help WIA attract institutional investors if the company can demonstrate clear paths to resource growth and de-risking.

8) Tribune Resources (TBR) — joint-venture production and steady output

Snapshot: Tribune participates in the East Kundana Joint Venture (EKJV) and derives production via JV milling arrangements. For the June 2025 quarter the combined Rand & Tribune campaign produced 8,916 oz and Tribune’s share of June quarter production was 6,687 oz (attributable). That recurring production base, while smaller than the large producers, establishes Tribune as a steady small-producer and supports index inclusion once market cap and free float meet S&P criteria.

Key metrics (selected)

- June 2025 quarter attributable production: 6,687 oz (Tribune share). (ASX ANNOUNCEMENT)

- Market-cap snapshot: ~A$247m (public finance snapshot). (Trading Economics)

Context: Tribune’s inclusion demonstrates that even modest producing companies, when paired with solid JV arrangements and predictable output, can qualify for index inclusion once capitalization and trading metrics align.

9) Santana Minerals (SMI) — Bendigo-Ophir resource & development path

Snapshot: Santana Minerals is a precious-metal developer focused on the Bendigo-Ophir project in New Zealand where it has reported a large resource (~3 Moz by some analyst estimates) and a development timetable aimed at turning that resource into a producing asset. The company’s resource base, plus strong market interest, pushed its capitalization high enough for ASX index inclusion in March 2025.

Key metrics (selected)

- Potential project resource (analyst/initiating reports): ~3 Moz (project-level resources reported in initiation notes / PFS-level material). (Santana Minerals)

- Market-cap snapshot: ~A$508m (public finance snapshot). (Yahoo Finance)

Context: Santana represents the developer-with-large-resource archetype: lots of upside if development is successful, but execution and permitting risk are the main dials. Inclusion to the ASX 300 tends to make it easier for such companies to raise capital far more efficiently.

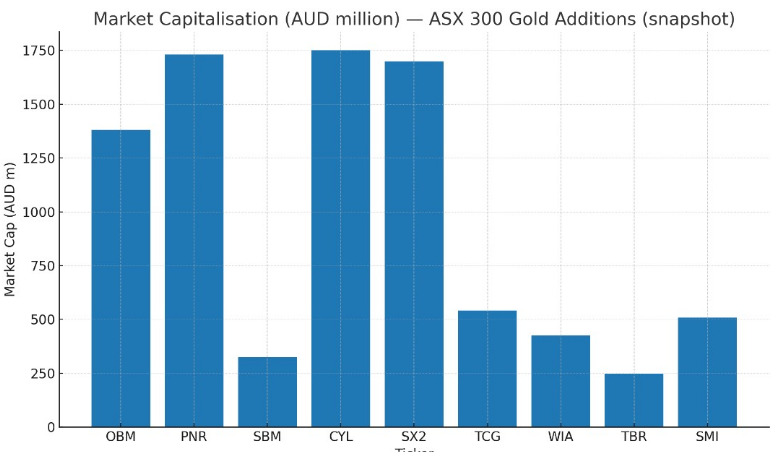

Visual summary

Market-cap snapshot (AUD million) — quick visual of market cap spread across the nine ASX 300 gold additions (sourced from public finance pages).

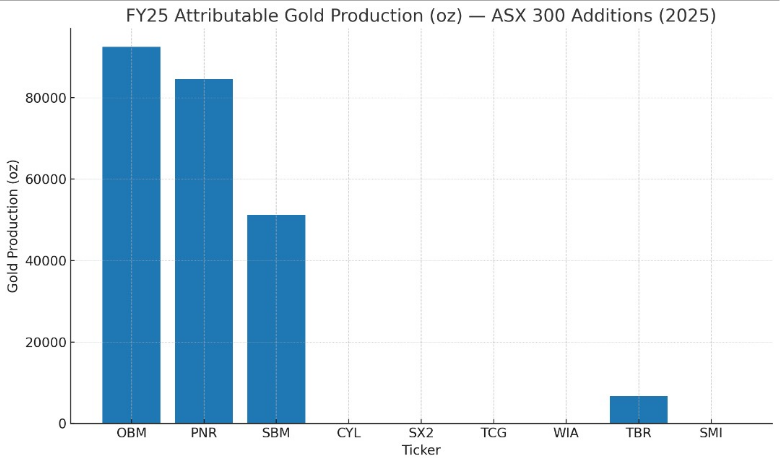

FY25 attributable production (oz) — shows which of the new entrants are established producers (Ora Banda, Pantoro, St Barbara, Tribune) and which are developers/explorers (Catalyst, Southern Cross, Turaco, WIA, Santana). Production data and quarterly reporting are cited in each profile above.

FY25 attributable production (oz) — shows which of the new entrants are established producers (Ora Banda, Pantoro, St Barbara, Tribune) and which are developers/explorers (Catalyst, Southern Cross, Turaco, WIA, Santana). Production data and quarterly reporting are cited in each profile above.

Comprehensive Table: ASX 300 Gold Sector Dynamics in 2025

| Company / Entity | ASX Ticker | Event / Context | Relevance to ASX 300 |

| Greatland Resources | — | Acquired Telfer & Havieron, strong cash flow | Listed mid-2025, joined ASX 300 |

| Ramelius / Spartan (merger) | RML / SRS | A$2.4 b merger to become major pure-play gold producer | May affect market cap rankings |

| Northern Star Resources | NST | Leading ASX gold producer | Core ASX 300 constituent |

| Evolution Mining | EVN | Mid-tier producer with multiple operations | Stable ASX presence |

| Valuation metrics | — | Top-quartile yields, hedging wind-down | Suggests sector upside |

Also Read: First Gold Poured at Murchison as Meeka Starts New Chapter

What to expect next: market mechanics and likely medium-term outcomes

- Passive flows + liquidity — expect passive buying around rebalance windows; for some of these mid-cap names that can mean price support and a narrowing of bid/ask spreads. Historically, this effect is most visible around the first quarter after inclusion when ETFs rebalance.

- Re-rating potential for producers — companies that combine production scale, improving AISC and positive cash flow (e.g., Ora Banda, Pantoro) are likely to attract more active managers on top of ETF flows. If production and costs keep improving, those names can re-rate multiple times.

- Funding tailwinds for developers — developers (Catalyst, Turaco, Santana, Southern Cross) typically get easier access to equity or project financing after index inclusion, which reduces dilution risk and accelerates project timelines if management acts decisively.

- Short-term volatility & trading patterns — watch for “index replay” patterns: price runs ahead of rebalance announcements, then some profit-taking, then a second leg as ETFs continue to buy over days/weeks.

Risks and Caveats (What Can Go Wrong)

- Operational setbacks — miners and developers face execution risk (ramp-up delays, grade issues, weather/heritage permitting). St Barbara’s FY25 Simberi disruptions and subsequent guidance revisions are an example.

- Permitting and jurisdictional risk — Turaco (West Africa) and Santana (New Zealand) have country-specific permitting and infrastructure risks that can delay development.

- Gold price sensitivity — while many of these companies are insulated by strong margins, a sustained pullback in the gold price would pressure high-cost producers more (St Barbara’s higher AISC profile is an example).

- Index flow reversal risk — if index-tracking assets reweight or flows reverse (outflows from commodity or country ETFs), that can exacerbate short-term volatility.

Practical Investor Checklist (How To Approach The New ASX 300 Gold Cohort)

- Separate producers from developers — producers (Ora Banda, Pantoro, St Barbara, Tribune) can be valued on cash flow, AISC and reserve life; developers/explorers (Catalyst, Turaco, Southern Cross, WIA, Santana) require a resource-to-production roadmap and clear funding plans.

- Watch the next two quarters of production/quarterlies — for producers, consecutive quarters of stable-to-lower AISC and consistent production growth are the clearest sign the company will realize multiple expansion.

- Track corporate actions enabled by inclusion — placements, institutional share purchases, or new offtake/processing agreements are common after index inclusion as companies and their advisers capitalize on the higher demand backdrop.

- Factor in resource rehypothecation & JV dynamics — several of the companies rely on JV processing (Tribune & EKJV) or processing tolling (Mungari) — understand how entitlements and recovery rates affect attributable output.

Conclusion — a repositioning of the ASX gold map in 2025

The March 2025 S&P/ASX rebalance introduced a concentrated block of gold companies into the ASX 300 — a mix of producers with strong FY25 outputs (Ora Banda, Pantoro, St Barbara, Tribune) and resource-rich developers/explorers (Catalyst, Turaco, Southern Cross, WIA, Santana). For investors, this cohort offers both immediate cash-flow stories and longer-term resource optionality. Inclusion to the ASX 300 accelerates liquidity and raises the stakes — for corporate management (delivering the production and development outcomes) and for investors (watch re-rating, but account for operational risk).

Also Read: Australia’s Rare Earth Advantage: How ASX-Listed Companies Are Securing Global Supply Chains