2025 is a watershed year for the crypto world. What had previously been driven by speculation is turning into an area driven by adoption in real-world applications, institutional demand, and utility-based use cases. The forces behind this trend are real-world asset (RWA) tokenisation, growing adoption of AI-enabled blockchain architectures, and the explosive growth of stablecoins in global finance.

Instead of being viewed as a risk, crypto is increasingly being seen as a part of the new financial paradigm.

: true alpha : AI × Crypto

ZK and privacy have been core to crypto’s evolution.

but in 2025 to push the evolution of blockchain

“True alpha” lies in the convergence of AI and crypto.The logic is simple:

AI without crypto risks becoming centralized, non transparent, and… https://t.co/Shyh2cP1rm pic.twitter.com/GRkFMjL6UT

— G9D 運 (❖) (@Gh9st999) August 21, 2025

Tokenisation Replaces Traditional Assets with Digital Ones

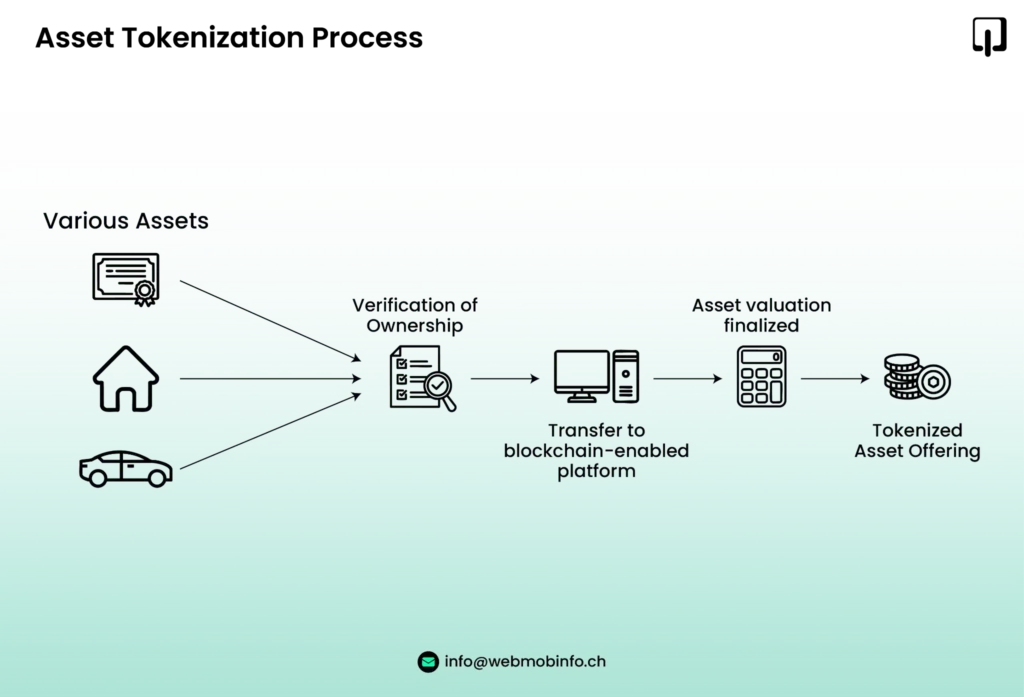

Tokenisation is revolutionizing access to traditional assets. From property and private debt to commodities like gold and oil, these assets are now being tokenized to be sold on blockchain exchanges.

Turning traditional assets digital — property, private debt, gold, and oil are now traded as tokenised assets on blockchains ( Image Source: Webmob Software Solutions )

Fractional ownership dispenses with the requirement of vast sums of money from investors. Having an interest in an office building or a portion of a stock commodity is as simple as buying a share online. This is making markets available to retail investors previously closed to them.

Demand is institutionally driven. With Bitcoin and Ethereum exchange-traded funds (ETFs) now listed, asset managers are racing to take tokenised products to market. These tokens dissolve the lines between conventional finance and decentralised platforms, opening up a new world of liquidity and efficiency.

Tokenisation is more than a technical development—it is reshaping how value moves across borders and bringing crypto further into mainstream finance.

AI and Blockchain: Heaven-made for Efficiency and Safety

Artificial intelligence has turned into a concrete asset of the blockchain universe. In 2025, Artificial intelligence assumes an active role in ensuring compliance, monitoring, and efficiency in crypto activities. Intelligent algorithms now analyze transactions in real-time and trigger alerts on probable threats even before they exist. AI algorithms also fine-tune decentralized finance (DeFi) portfolios by predicting risk and adjusting automatically.

There is a basic shift with decentralised Artificial intelligence (DeAI). Unlike centralised AI models that are bound to be untransparent, DeAI is based on blockchain technology, hence making output transparent and traceable. This network reduces dependence on individual actors and enhances accountability in the network.

To consumers, that means more secure and dependable platforms. For institutions, it means that blockchain is now ready to deliver the high expectations of global regulators. The combination of blockchain and Artificial intelligence is, therefore, a cornerstone to building trust and scalability for the industry.

Artificial intelligence has no future without blockchain technology – Article by @michaelh_0g on Crypto .news. Key takeaways:

→ Artificial intelligence + Blockchain = Symbiosis

Artificial intelligence lowers the cost of intelligence to zero, while blockchain lowers the cost of coordination to zero. Together, they unlock powerful new… pic.twitter.com/kQuV0efm0m— Elisha (Ø,G) (@ghcryptoguy) August 18, 2025

Stablecoins Take Centre Stage in Global Payments

Though Bitcoin and Ethereum usually dominate the headlines, stablecoins are beginning to break out as the true Crypto Adoption heavyweights. Stablecoins such as USDC and PayPal’s PYUSD, backed by regulated reserves, are being increasingly used for payrolls, supplier invoices, and cross-border remittances.

Their attraction is stability, speed, and price. To businesses, they release them from currency volatility nightmares. To emerging market economies, they’re a secure and stable place to hold unproven domestic currencies.

Stablecoins are overtaking Bitcoin and Ethereum convincingly in overall daily transaction volume. They’ve moved beyond a niche product to lifeblood infrastructure for digital currency, bridging the old world to blockchain technology.

From Speculation to Utility

The crypto narrative has shifted. Earlier, the emphasis was on sensational price action and speculation. Today, it is on utility and use.

Tokenisation is turning old illiquid assets into liquid ones. Artificial intelligence is turning compliance and efficiency into a reality. Stablecoins are turning seamless cross-border payments into reality. All these put together are turning crypto into an inherent part of global finance and not some alternative system.

This maturity is such that crypto can no longer try to cling to the fringes—it’s becoming integral to financial infrastructure.

Institutional Adoption Speeds Up

Not only are retail consumers making maturity of the crypto market a reality, but also institutional giants. Banks, asset managers, and hedge funds are adopting tokenised platforms in order to diversify offerings and bring on new clients. Payment processors and fintech companies are incorporating stablecoins into regular transactions.

Regulators are catching up as well. Governments are developing more open guidelines to foster innovation and defend consumers. This duet is building confidence and fuelling adoption.

For crypto old timers, this is vindication of months of work and stamina. For new investors, it dispels uncertainty, so crypto markets do not so much appear to be such a high-risk gamble but rather an actual opportunity.

The New Face of Digital Finance

The crypto narrative for 2025 is one of growth. The sector is transforming into a multi-dimensional ecosystem driven by tokenisation, the adoption of AI, and the use of stablecoins.

It is no vision of the future—this is already here. Assets are tokenised, compliance is automated, and money is moving across borders faster than ever.

Crypto is no longer knocking on the door to enter the world financial system—it’s already inside. And with maturity comes not only stability but also possible wider acceptance, more trust, and sustained growth.

2025 could be the year stablecoins fundamentally reshape global payments.

McKinsey’s new report reveals shocking growth: transaction volume up 10x in 4 years.

Daily volumes could hit $250B in 3 years – bigger than major card networks.

Thread on what this means @ahier… pic.twitter.com/8URqUpadKb

— Monica Jasuja (@jasuja) August 20, 2025