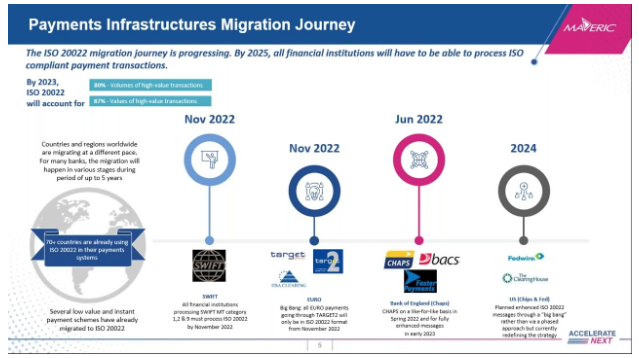

The global banking infrastructure embarks on a new chapter as of November 22nd, 2025: the final step of the SWIFT migration to the ISO 20022 standard for international transactions will be accomplished. This single technological shift has a relevant impact on each and every banking institution.

The above-mentioned development becomes crucial because the new standard will transform meagre MT messages to rich data sets. The secondary effect of this development will be the introduction of tokens and new means of payment through the traditional banking system without facing many hassles.

On 22 November 2025, SWIFT’s ISO 20022 shift brings richer data and smoother pathways for tokenised payments. (Image Source: Cryptonews.net)

What Makes This A Crypto Moment?

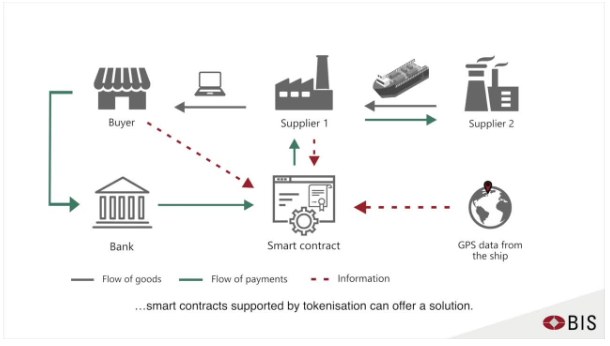

However, the standards of ISO 20022 do not stop at the point of the change of message heads. Payment messages can now be encoded with so many additional attributes. This has solved the puzzle of linking tokens on the blockchain with the requirements of the regulations off the blockchain. In simpler terms, the introduction of the enhancement of the messages has made the adoption of the tokens by the banks rather simpler.

According to SWIFT itself, the transition marks a shift that extends beyond the formats involved. The organisation has been testing shared ledger connections and APIs that integrate ISO 20022 messaging and a ledger component enabling real-time and constant flows. This architecture deliberately considers the incorporation of risk management controls and compliance rules on the transaction rails – the same functionality that the players involved require before engagement at the level of the crypto rails.

This creates a new doorway between two camps that have been speaking past each other for years. One side holds that tokenised securities, stablecoins, and programmable money reside on the blockchain, while the other side holds that the realities of regulatory requirements and settlement necessitate the old guard’s message and controls. ISO 20022 begins the work of turning this ideological divide into engineering tasks. The token identification and stablecoin will be mapped to standard fields. Reconciliation will be built from shared formats. The settlement systemswhether central ledgers or permissioned blockchain technologieswill be able to communicate the same way.

This has already begun. The players transition from pilots to production: banks and custodial institutions develop tokenised money market funds, tokenized treasuries, and tokenized deposits. The large houses form partnerships to develop tokenized liquidity pools and private settlement channels. This is not about token experiments happening in a corner of the financial system but about applications of billions of dollars of institutional assets being represented as tokens being deployed inside existing market structures.

What The ISO 20022 Standard Actually Provides To Tokenised Finance

Begin with the understanding of the data: Under MT messages, banks interact through short touch points. The field-to-meaning association from the ISO 20022 standard allows the tokenized bond coupon instruction to be expressed of the ISIN-like token ID, the holdings’ attestations, the regulatory jurisdiction, and the redemption conditions.

Next comes the business of reconciliation: there’s a need for rapid and precise matching of tokens in digital ledger pages and banking accounts. Metadata reduces the need for manual processing and failed transactions. The banks can optimize KYC/AML verifications at an earlier point in the process and mark tokens accordingly at the moment they move.

Finally, there will be predictable workflows because regulators, custodians, and exchanges can develop rulebooks which point to the same data points across platforms. This predictability will entice banks to custody, clear, and settle tokenized assets rather than consider them novel regulatory grey areas.

prediction markets are basically 0DTEs for everything

hyper-short duration risk, instant settlement, capital-weighted info, and a constant flow of micro-macro signals.

you’re watching the financialization of time happen in real-timeand when RWAs come onchain, this gets even… https://t.co/txqh53MMWp pic.twitter.com/fL8yEChD3N

— probability god (@probabilitygod) November 24, 2025

The Role Of Stablecoins and Their Current Significance

Stable currencies are essentially the value side of the models of tokenized finance. The asset which helps in the conveyance of value from the counterparties at the time of settlement in the short-term fund that you’re tokenizing needs to exist. Regulated stable currencies or bank-backed deposits can be used if the banks trust the model.

However, ISO 20022 assists in the stabilization of the transparency of transactions involving stablecoins through the following: “If the message containing the payment can state ‘this is a regulated, redeemable stable coin issued by X,’ then regulatory compliance software can automatically apply rules along those lines. This reduces the institutional frictions of using stablecoins as rails and will likely lead banks to support them.”

Real-World Signals: Banks Are Already Developing Tokenised Products Today

This is no hypothetical adoption of a new institution. The large financial institutions and the custodians already utilise the concept of tokenized funds and are testing the concept of tokenized settlements. The partnerships under the banner of tokenizing money market funds and the joint initiatives of the custodian banks and the investment banks collectively embody the trend from the Proof of Concept phase to the product phase of the model. This underlines the fact that the timing of the banks through ISO 20022 has nothing academic about it.

Banks are turning tokenized fund pilots into real products, proving ISO 20022’s practical impact. (Image Source: Bank for International Settlements)

Crypto Projects That Currently Enjoy An Advantage In This Regard

This came as no surprise to a number of blockchain initiatives that had envisioned the mapping of their metadata onto the ISO 20022 schemes. Some of the chains advertise themselves as being ISO-compliant and engaging in standardization initiatives. This positioning makes the addition of messaging functionality less of an uphill task and less of a burden for the counterparties when the tokens are onboarded. This will be less of a burden to the banks if the existing token maps to the ISO fields.

A Pragmatic And Not Utopian Future

This should not just be framed as a case of blockchain devouring SWIFT; rather, this enhancement of SWIFT makes the technological hurdles of blockchain-inspired settlement and tokenised assets even smaller to allow access to the existing financial system. Still, expect a hybrid model whereby various forms of central ledgers and/or blockchains and/or tokens will coexist, and there will be a lingua franca in the form of ISO 20022.

SWIFT’s upgrade enables a hybrid system of ledgers, blockchains, and tokens under ISO 20022. (Image Source: CoinSwitch)

Risks And Sticking Points

This is no quick solution: banks must nonetheless upgrade their existing IT architecture and transform their business practices. Those who do not make the grade will suffer only temporary disruptions of their payments. The tokenization initiatives also require legal foundations regarding asset rights and insolvency law.

There’s also a competitive element: the sooner firms can bootstrap ISO-compliant tokenization layers, the quicker they can secure market shares in custody and settlement offerings. This suggests problems of concentration and interoperability that the market will need to address.

What Developers & Product Owners Must Do Next

If you are developing tokenized products, consider the requirements of ISO 20022 as part of the API/data model development itself. The token identification number, the issuers’ information, the investors’ attestations, and the legal wrappers should be mapped to this standard. A tool used for the reconciliation of the states has to be built and has to be able to take in the ISO message and reconcile the states on the blockchain. Lastly, modularity must be built into the product itself. The token ledger must be able to communicate directly with the message processor of the SWIFT type through the clean adapter interface

IF YOU SIT IN BANKING OPERATIONS, then promote the automated parsing of ISO 20022 metadata. Utilize it to expedite the KYC/ AML approval process and minimize the number of exceptions. In addition to this, consider custody models and token custody partnerships because there will be lost pools of fee business lines that fail to tokenize. (fireblocks)

The Reason Why The Retail And Non-Crypto Community Should Care About This

The benefits of tokenization appear to be rapid settlement times, reduced costs of settlement, and liquid markets for non-liquid assets. This could extend to investment vehicles that are partially owned through real estate tokens and fund tokens, enabling immediate settlement at perhaps even lower global transaction costs. The migration to ISO 20022 makes this more likely.

Implementation Playbook: Five-Phase Plays

List all the tokenized products, ledgers, and flows of payments. Identify the list of fields you must transport from the business: token ID, legal entity of the issuer, investor ID, jurisdiction, rules of entitlements, window of settlement, and regulatory flags. Consider the ISO 20022 field sets as a superset: model the data to be cleanly mapped against them.

-

Token Metadata Standardisation

Introduce the concept of the Canonical Token Ids and the legal metadata attached at the point of issuance. All tokens must retain an immutable link to the legal wrapper: prospectus, ISIN-like reference, or trust deed. This allows the same legal fact to be ingested downstream.

-

Implementing Adapters

Don’t break the internal systems. Implement the ISO 20022 adapters to transform the internal notifications to the ISO standard and vice versa. Make the adapters thin and versioned. This will enable you to upgrade the messaging layers without ever being required to change the ledger logic.

-

Reconciliation And Compliance Automated

Directly pass the ISO elements to the reconciliation engines and the AML/KYC processing streams, and also create audit trails along the way from the message creation to the confirmation on the blockchain.

-

Pilot, Iterate, Scale

Start with high volume and low legal risk products: internal cash pools, repo-like products. Later move to custody and customer-facing products when controls are sufficiently reliable to guarantee stable metrics.

Orchestration Layer: Rules Engine + Custody API

Orchestration

These responsibilities must be applied as follows: application of business rules, compliance checks, routing to ledger/square Fiat settlement, reversal of reversals, and notice of counterparties.

Components

Rule engine, reconciliation service, wallet custody connector, settlement gateway.

Ledgers Layers/Levels

On Chain/Centralized ledger

Responsibilities

Representation of token balances, transferring tokens, and reference to the token metadata.

The List Of Attributes

Deterministic transaction history, event hooks for status changes, and custodial action attestations.

Matching The ISO 20022 Elements To The Tokenised Usage Scenarios Examples

/EndToEndId → Maps to the token transfer transaction hash/token reference. This provides end-to-end traceability functionality.

/ → Map to issuance or redemption instruction ID; used to match off-chain instructions

/ → Map to custodian account or investor wallet address; represented by attestation. Never expose raw addresses to third parties; store hashed or ref’d IDs.

/ → To be used for any legal references: prospectus ID, investor declaration, regulatory license number. Model RmtInf as a JSON-like envelope when permitted.

Purpose → To tag the transaction as redemption/coupon, taxes, and/or collateral movement. This helps the automated workflows run faster.

Regulatory flags: Include AML risk score or sanction screen result in a standardised field to enable the counterparty system to automatically reject or accept.

Token Schema: What To Include When Issuing Tokens

Administration

Core: simple and immutable

Ancillary: flexible

Core: tokenID, issuerID, issuanceDate, tokenType – security/utility

Ancillary – mutable but auditable: complianceAttributes: KYC level, restricted investor list; status: active/frozen/redeemed; dividendRules; transferRestrictions

Store the core on-chain or in a tamper-evident register while keeping the sensitive KYC information off-chain and linked through secure hash/pointers.

ISO-Friendly Token Models

Firstly, there will be three workable models:

Tokenized cash equivalents – bank tokens

“Use case: Interbank liquidity, intraday settlement, and treasury pools”

Rationale:

“Why Early Win: low legal complexity;

strong existing demand;

fast reconciliation gains.”

Tokenised short-term funds

Example of usage: tokenized MMFs, repo-style instruments

The Early Win: Rationale

Although the Early Win itself can be achieved through various ways of value delivery, depending on the context of

Sec-T: Tokenised Securities With Custodian Wrappers

Tokenized bonds and stocks were settled through the CSDs and the ledger.

A reason why caution: custody will require legal updates regarding insolvency, the largest long-term benefit.

Regulatory And Legal Checklist

- Legal Ownership Clarity: Check if the legal system defines the ownership of tokenized entities and the model of custody of ownership.

- Insolvency treatment: The rights of beneficiaries in the event of insolvency of the intermediary are clarified.

- Disclosure & prospectus mapping: Verifying that the token metadata has a reference to disclosed legal documents.

- Custody licenses: If required, the custodian should be properly licensed in the jurisdiction.

- AML/KYC controls: Map ISO fields to AML/KYC decisions; require attestation before settlement.

- Tax and Reporting Hooks: Ensure that the messages contain the tags and fields for the automated tax reporting.

- “Data Residency & Privacy”: Sensitive PII data should be kept off the blockchain or encrypted. Messages must be compliant with global data regulations as per the ISO standard.”

Operational Controls & KPIs

Metrics to be measured in pilots:

- Exception rate: ISO message vs. on-chain state. Target <0.5% after stabilization.

- Reconciliation Lag: Reconciliation of the ISO message to the ledger event. Target: For high-value payments: close to real-time, less than 5 minutes.

- AML: false positives – watch out for over-blocking, which will affect flows, and optimize thresholds.

- “Settlement finality time”: The time from instruction until the legal finality of the settlement can be measured. This needs to be compared with the average times of the legacy RTGS and

Security And Governance

Utilize signed non-repudiatory messages: The standard ISO 20022 facilitates the usage of reliable non-rep Ensure the immutability of audit trails through the unification of message logs, logs of enrichments, and ledger events. Separation of duty: A token’s ability to be redeemed must not be in the hands of the same operator who issues the tokens. Instead, multisig or governance can be used. Third-party attestation: One might imagine token custody proof and regular reserve attestation for asset-backed tokens and stablecoins.

ISO 20022 enables secure, auditable token operations with clear governance. (Image Source: Audit Security)

Market Opportunities and Business Models

Custody as a service regarding tokenized assets might enable banks to turn custody margins into token management income. Settlement as a service for marketplaces. It must provide atomic settlement: trade + token move + fiat finality in a single step. Liquidity provision and tokenized repo desks: Pools of tokens imply new short-term liquidity markets. Data Products: Expanded ISO metadata allows the sale of transaction analytics to trading groups and asset management.

prediction markets are basically 0DTEs for everything

hyper-short duration risk, instant settlement, capital-weighted info, and a constant flow of micro-macro signals.

you’re watching the financialization of time happen in real-timeand when RWAs come onchain, this gets even… https://t.co/txqh53MMWp pic.twitter.com/fL8yEChD3N

— probability god (@probabilitygod) November 24, 2025

Risks Deserving of Straightforward Comment

- Cross-border legal mismatch: Jurisdictions treat token ownership differently. Define fallback rules of dispute resolution.

- Operational concentrations: A possible concentration of tokenized custody arrangements necessitates the development of contingency plans regarding decentralised custody arrangements.

- Regulatory fragmentation: The same token will be subject to different rules across nations; expect customized interoperability wrappers.

- Tech debt in adapters: A shoddy translation approach results in slight differences and creates versioned mappings that you regression test each modification.

Also Read: Bitcoin’s Worst Week Since 2022: The Crypto Doom-Loop

Strategic To-Do List: Accomplishing Something This Week

- Set up an ISO field-to-token mapping spreadsheet relevant to your own product.

- Build basic adapters supporting the transformation of the internal transfer action message to the ISO 20022 structured message defining a payment order instruction and vice versa.

- Tabletop exercise: create a simulation of a stuck token transfer message and track the message logs from the ISO level through the orchestration level through the ledger system.

- Discuss regulatory requirements to ensure the token legal wrapper has been made “attachable” as a “resolve-able reference” inside of trade confirmations.

Final Thoughts: What This Will Lead To

The ISO 20022 standard solves no problems. However, this standard does provide leverage. This standard takes the unknown and translates it into a type of engineering project that must comply. This helps proponents of the standard hasten its own adoption in the banking universe because the standard takes the anticipations of the legal and regulatory communities and reduces them to “machine-readable” fields of input. In this regard, the standard provides banks with an opportunity to support tokenized assets that can be managed from the operational level.

This will provide an exciting way to develop markets and trading communities because the standard will provide improved speed, reduced price and increased liquidity to the trading community. The next two years will shape which architecture becomes the winning formula: that which provides the integration of the standard as a type of “translation wrapper” approach and those which develop models of tokens and their legal wrappers consistent with the standard’s structured message objectives. The answer will be found in the ability of the teams to marry the best of legal certainty, clean data models, strong automation, and sensible pilots.

Frequently Asked Questions

- Q: When will the final transition of SWIFT to the new ISO standard occur?

A: The final transition of SWIFT to the new standard will be achieved when the final cut-over occurs on November 22nd, 2025. The old MT message formats will be retired at this time. - Q: Does ISO 20022 displace the use of blockchain?

A: No. The two will continue to co-exist. The standard will achieve standardisation of messaging from financial institutions. Meanwhile, the blockchain will continue to provide the ledger functionality and the tokens. - Q: Which of the existing cryptographies has been “ISO-ed” and readied?

A: This has been achieved for a limited number of existing blockchains and tokens – XRP and Stellar are two examples – which actively discuss the question of their own ISO readiness at this point. - Q: Could the popularization of the “stables” be the result of the upgrade to the new standard?

A: The standard will definitely “reduce the integration frictions” of stables – it will be possible afterwards to enable banks’ usage of stables as a method of purely electronic finality of financial transactions. Mainstream? That’s the regulatory “Hour” of the stables themselves. - Q: What benefits will banks realize from the introduction of the new standard?

A: They will benefit from improved reconciliation, automated flags indicating regulatory compliance and the possibility of quicker finality of transactions – also new business streams from custody and tokenization of assets.