What Will We Cover:

- What’s New:

Miners everywhere are quickly embracing sustainable electric mining equipment on global operations. It’s not just about climate commitments—it’s also cost-cutting and boosting efficiency.

- Core Focus Areas:

- Zero-emission loaders crowding out diesel in underground mines

- Battery recycling relieving the burden on virgin material

- Closed-loop metals reuse establishing a mining circular economy

- Why It Matters:

Closed-loop supply chains and cleaner fleets can lower the carbon footprint of the industry by as much as 50% by 2040, with potential operating cost savings of billions of dollars.

Image Credit: Maksim Safaniuk/Shutterstock.com

Image Credit: Maksim Safaniuk/Shutterstock.com

A Turning Point for Mining

Mining has been “energy intensive” from its very inception. For decades, diesel trucks, loaders, and diggers burned millions of litres of fuel at a cost as well as an environmental cost. The International Energy Agency (IEA) estimates that mobile equipment comprises nearly 40% of mine-site carbon emissions.

But in 2025, the play is evolving. Companies are investing in green electric mining equipment not only to tick ESG boxes but also to build leaner, forward-looking operations. What’s new now is the integration—equipment, data platforms, and recycle streams are being integrated to build self-sustaining systems.

The Rise of Zero-Emission Loaders

Source: MDPI

Source: MDPI

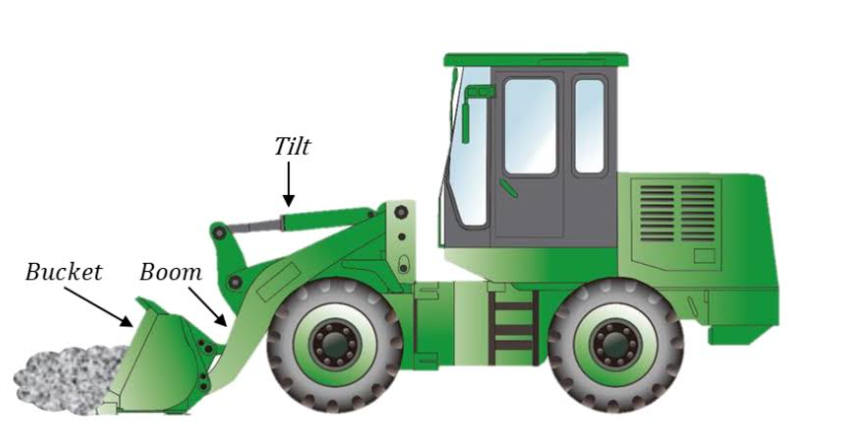

The most concrete evidence of change is the application of zero-emission loaders in underground mines. They do more than cutting carbon—they address an age-old ventilation, and safety and cost issue.

Transitioning to battery-electric vehicles (BEVs) from diesel at Canada’s Borden Mine, dubbed as the world’s first all-electric underground mine, lowered ventilation energy needs by 50%.

Sandvik’s LH518B loader operates with an 18-tonne capacity without turning to diesel particulates, and reduces the build-up of heat inside tunnels.

Sandvik’s LH518B battery-electric loader. Credit: Sandvik Mining and Rock Technology

Sandvik’s LH518B battery-electric loader. Credit: Sandvik Mining and Rock Technology

Epiroc’s ST14 Battery Loader provides a 14-tonne capability with its fast battery exchange technology, removing downtime previously requiring miners hours a week.

Source: Epiroc Group

Source: Epiroc Group

It means cleaner air, less health hazard to workers, and cost savings potentially reaching tens of millions annually for miners.

Battery Recycling: Closing the Resource Gap

Electric mining relies extensively on critical minerals such as lithium, nickel, and cobalt. Purely relying on new extractions threatens to cause another supply shortage. It is for this reason that battery recycling is becoming more and more of a cornerstone of sustainable mining practice.

- Wood Mackenzie estimates that more than 1.2 million tonnes of retired EV batteries will be present for recycling in 2030 worldwide. Recycling the metal from waste streams not only lowers the environmental footprint but also smoothes supply.

- Rio Tinto has partnered with US recyclers to recover cobalt and nickel for retreading mining equipment.

- Fortescue Metals is constructing a WA pilot plant capable of processing 3,000 tonnes of batteries annually, with recovery rates of to 95%.

It is part of an even larger vision: toward a circular supply chain where tomorrow’s fleets are fueled by yesterday’s batteries.

Closed-Loop Metals Reuse: Beyond Batteries

The talk does not end with batteries. Closed-loop metal recycling is being applied to obsolete equipment, steel carcasses, and even mine waste. Sweden’s Boliden extracts 30,000 tonnes of copper a year from old electronics.

Australian miner BHP is researching how to recycle tailings into cement feedstocks, cutting down on waste while creating new sources of revenue.

In the outside world, that translates into metals from retired mining fleets never ending up in the scrap heap—but being melted, washed, and recycled, and sent back.

Economic and Environmental Payoffs

Shifting to sustainable equipment is not just an environmental gesture. It makes cold business sense:

| Factor | Diesel Fleet | Electric Fleet (with closed-loop) |

| Fuel/Energy Cost | High (volatile prices) | Lower, predictable electricity costs |

| Ventilation (underground) | 30–50% of operating cost | Reduced by 40–60% |

| Maintenance | Frequent engine servicing | Fewer moving parts, less wear |

| Lifecycle metals use | Linear (extract-use-dispose) | Circular (reuse-recycle) |

IEA projections suggest that integrating electrification, recycling, and reuse could save the global mining industry US$50 billion annually by 2040, while cutting emissions by almost half.

Where It’s Happening

- Australia: Gold Fields is testing BEV trucks at its Granny Smith mine.

- Canada: Vale has already deployed over 40 BEVs at Sudbury.

- Chile: Codelco is testing hybrid trucks in the Atacama desert.

What used to be trial-and-error is now growing. Experts expect 60% of new underground mining machinery sold to be electric by 2035.

Challenges Ahead

No transition is ever smooth:

Carbon intensity of batteries – if power grids are coal-heavy, battery manufacture is emission-intensive.

Patchy recycling – only below 10% of Australia’s lithium-ion waste is currently processed locally.

Higher capex – BEVs still cost 20–40% more to purchase, although lifecycle economics give them fair due.

All of that aside, the world is changing fast—and all for the better.

Closing Thought

From zero-emission loaders to the recycling of batteries and closed-loop metal recycling, mining is being reinvented as something different. For decades, the industry has been lampooned as a high-polluter. Today, through sustainable electric mining gear, it can be a decarbonisation and efficiency pioneer.

Early-mover companies not only will create their ESG brand but also will enjoy reduced expenses and greater resilience. In mining, where dollars and tonnes matter, that advantage can be a make-or-break situation.