St George Mining Limited (ASX: SGQ) (“St George” or “the Company”) has taken a bold step forward in the critical minerals space, announcing the commencement of a large-scale drilling campaign at its 100%-owned Araxá Niobium-REE project in Minas Gerais, Brazil. This marks the Company’s inaugural drilling initiative at Araxá following its acquisition of the project in February 2025.

More than 10,000 metres of drilling is planned, encompassing auger, reverse circulation (RC), and diamond drilling methods. The campaign is set to span 12 to 16 weeks, with three rigs at site. Drill samples will be regularly dispatched to ALS Brazil for laboratory assays, with initial results expected on a rolling four-week basis.

Auger drilling in progress at the Araxá Project. [St George Mining Limited]

According to Executive Chairman John Prineas, “We are delighted to have started our first phase of drilling at the Araxá Project. The Project has already delivered more than 500 intercepts of high-grade rare earths and niobium from past drilling, and we expect to add significantly to this tally by the time we complete our 10,000m drilling campaign.”

John Prineas, John Dawson, and Thiago Amaral examining the ongoing auger drilling operations. [St George Mining Limited]

Unlocking a High-Grade Opportunity

What sets the Araxá project apart is the presence of high-grade mineralisation that begins right from surface. Previous drilling has identified outstanding intercepts including 43 metres at 1.5% Nb₂O₅, 60 metres at 11.1% TREO, and 45 metres at 14.4% TREO. These results are not only promising in terms of grade but also highlight the potential for a low-cost, open-pit mining operation.

St George aims to expand high-grade zones previously discovered and to explore areas not yet covered by resource estimates, particularly those below 100 metres from surface.

“The Araxá Project has many competitive advantages that make it a stand-out project in the rare earths and niobium space,” Mr. Prineas noted. “Mineralisation starts from surface and is free-digging, supporting a potential low-cost open-pit mining operation. The Project is in an established mining region with well-understood permitting and environmental management.”

John Prineas at the Araxá site reviewing samples collected from the auger drilling. [St George Mining Limited]

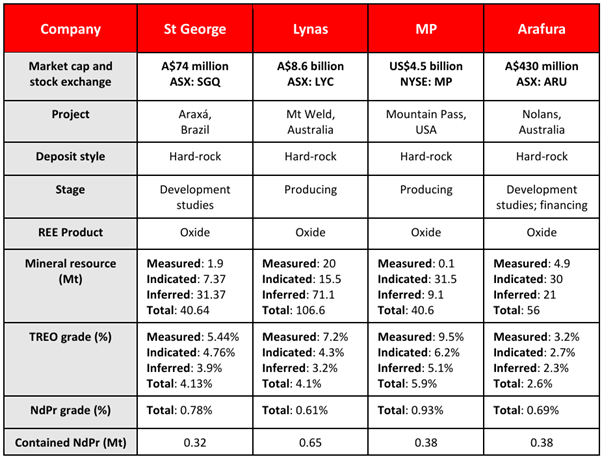

Globally Significant Resource Already Defined

St George has already announced a JORC-compliant Mineral Resource Estimate (MRE) for Araxá, which underscores the project’s global importance. The rare earth resource stands at 40.64 million tonnes at an average grade of 4.13% TREO. The niobium resource is equally substantial at 41.2 million tonnes grading 0.68% Nb₂O₅. The contained TREO of 1.7 million tonnes includes 320,000 tonnes of NdPr at a high grade of 0.78% NdPr, critical for permanent magnets used in electric vehicles and wind turbines.

This resource compares favourably with major global projects. For context, the Mt Weld mine in Western Australia, operated by Lynas Rare Earths, has a total resource of 106 million tonnes at 4.1% TREO. Araxá’s similar grade with substantial tonnage positions it among the world’s most prospective hard-rock rare earth deposits.

“At a time when global economies are scrambling to establish new supply chains for critical metals, particularly magnet rare earths, Araxá is an enviable development opportunity,” Mr. Prineas stated.

Comparison of key metrics across major hard-rock rare earth projects, highlighting St George’s Araxá Project alongside industry leaders Lynas, MP Materials, and Arafura. The table outlines market capitalisation, resource size, project stage, and key rare earth grades, with Araxá demonstrating strong NdPr content and competitive TREO grades. [St George Mining Limited]

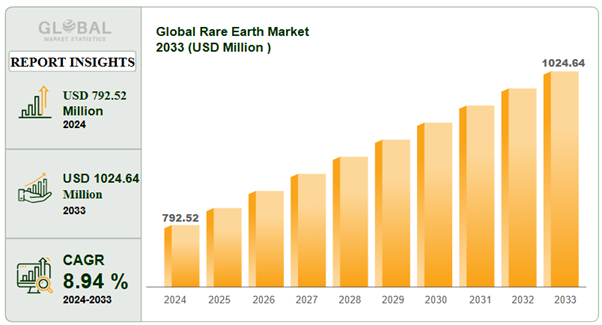

Strengthening Market Demand for Critical Minerals

The timing of this development is significant. The global rare earths market, currently valued at USD 792.52 million in 2024, is projected to grow to more than USD 1,024.64 million by 2033. This expansion reflects a robust compound annual growth rate (CAGR) of 8.94% between 2025 and 2033.

Similarly, the niobium market is gaining momentum. In 2024, it was valued at USD 2.8 billion and is forecast to reach USD 4.5 billion by 2033, representing a CAGR of 6.5% starting from 2026. Niobium’s unique strength and corrosion resistance properties make it an essential component in high-performance steel used across construction, aerospace, military hardware and automotive industries.

With China currently controlling more than 70% of global rare earth supply, projects like Araxá are increasingly viewed as vital to establishing alternative, diversified sources.

Projected growth of the global rare earth market from USD 792.52 million in 2024 to USD 1,024.64 million by 2033, reflecting a compound annual growth rate (CAGR) of 8.94%. [Global Market Statistics]

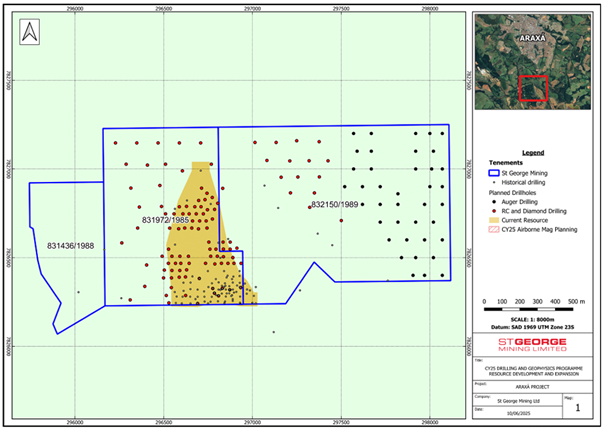

Advanced Exploration Strategy in Place

In addition to the major drilling program, St George is also launching a high-resolution drone-based airborne magnetic survey. The survey will cover the entire project area with flight lines spaced at 25 metres, providing ultra-detailed magnetic data. This information will be used to refine the geological model and identify further targets for follow-up drilling.

The Company has identified auger drilling as a key initial step, focusing on the outer areas of the tenement that have not yet been explored. RC and diamond drilling will follow shortly, concentrating on resource expansion and upgrading inferred resources to indicated classification.

The Company stated in its release that the results will help enhance the geological model of the carbonatite-hosted mineralisation at Araxá and support the identification of new targets for future drilling.

Top-down map of the project area displaying the locations of planned drill hole sites. [St George Mining Limited]

Strategic Positioning in Brazil’s Mining Heartland

Located adjacent to CBMM’s world-leading niobium operations, the Araxá project benefits from an established mining ecosystem. Infrastructure, skilled workforce availability, and governmental support for exploration and development make Minas Gerais a prime location.

St George has already negotiated favourable access arrangements and is working closely with Brazilian authorities to navigate environmental and municipal zoning requirements. The Company has engaged the leading Brazilian environmental adviser – Alger Consultoria – and maintains confidence in its environmental strategy.

Investor’s Outlook: SGQ’s Performance on the ASX

From an investor’s standpoint, St George (ASX: SGQ) has shown a strong recent performance that reflects growing confidence in the Araxá project.

As of 11 June 2025, share price of St George stands at $0.028. The stock has posted a 27.27% increase over the past week, with a year-to-date gain of 12%. Over the last year, St George has also outperformed the broader ASX 200 index by 1.01% and its sector peers by 17.11%.

St George’s market capitalisation currently sits at AUD 74.8 million, with over 2.67 billion shares on issue. The Company’s exploration success and resource expansion potential offer considerable upside.

The Company’s stock price has shown positive performance across all timeframes. [Market Index]

Conclusion: Araxá Positioned for Global Impact

St George’s launch of a major drill campaign at Araxá represents a critical step toward unlocking a globally significant source of rare earths and niobium. With strong fundamentals, promising geology, and rising global demand, the project holds substantial promise for both the Company and the broader critical minerals market.

As Mr. Prineas concluded, “Araxá is in pole position to deliver sustained value for St George shareholders.”

With strategic planning, a solid resource base, and favourable macroeconomic trends, St George’s Araxá project is fast emerging as a cornerstone in the next generation of critical minerals supply chains.