St George Mining Limited (ASX: SGQ) (“St George Mining” or “the Company”) has initiated a comprehensive geophysical program at its 100%-owned Araxá Niobium and Rare Earths (REE) Project in Brazil. This move marks a significant step forward for the Company as it seeks to define new zones of high-grade mineralisation and support its upcoming resource expansion drilling campaign.

With just 10% of the Araxá tenement tested by drilling to date, the integration of advanced airborne and ground-based surveys will provide critical subsurface insights. These data sets are expected to underpin the next stage of exploration and potentially lead to a major increase in the project’s mineral resources.

“We are excited to kick off these advanced geophysical programs at Araxá. The tight line spacing and innovative techniques being deployed are a step-change in the resolution quality of our datasets,” said Mr. John Prineas, Executive Chairman of St George Mining.

Figure 1: At Araxá, Mr. John Prineas is holding samples from the auger drilling.

Survey Details: Precision and Innovation

The high-resolution airborne magnetic survey, spanning 270 flight kilometres, uses drone-mounted sensors with 25-metre line spacing to maximise detail across target areas. Complementing this, a LiDAR (Light Detection and Ranging) survey will provide a refined digital elevation model for geological interpretation.

Figure 2: The first drone flight signals the beginning of the airborne magnetic survey at the project site.

Later in July, the Company will begin a ground-based passive seismic survey (HVSR method) on a 50m x 50m grid. The HVSR (Horizontal-to-Vertical Spectral Ratio) method uses ambient seismic noise to map subsurface geology without active sources. This will map depth to fresh basement rock and weathering profiles, an important boundary that influences the distribution and intensity of mineralisation. This approach is cost-effective, quick to deploy over large areas, and offers detailed insights that improve drilling decisions and resource planning.

“The new surveys are designed to provide detail on the lateral and depth potential of the mineralised system,” said Mr Prineas. “With less than 10% of the project area effectively tested by drilling and very limited drilling beyond 100m from surface, the new geophysical dataset will give invaluable information for exploration targeting and resource definition drilling.”

Exceptional Historical Grades Highlight Untapped Potential

Previous drilling at Araxá has delivered some of the most exciting intersections seen in niobium and REE exploration globally, including:

- 20m @ 2.4% Nb₂O₅ from surface, including 10m @ 3.2% from 2m

- 60m @ 11.1% TREO from surface, including 30m @ 16.9% TREO from 27.5m

- 13m @ 2.8% Nb₂O₅ from 20m, including 1.2m @ 8.3%

- 45m @ 14.4% TREO from 15m, including 7.5m @ 31.5% from 40m

These intercepts will now be further investigated through the geophysical and drilling campaigns.

Araxá’s Mineral Resource Estimate: A Strong Foundation

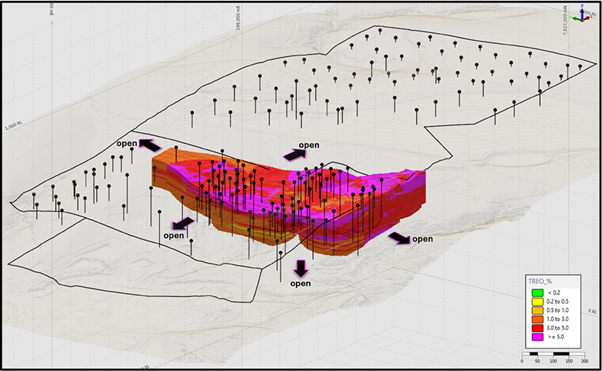

The April 2025 JORC-compliant Mineral Resource Estimate (MRE) has already confirmed Araxá’s status as a globally significant deposit:

Niobium (cut-off: 0.2% Nb₂O₅):

- Total: 41.2Mt @ 0.68% Nb₂O₅

- Measured: 1.90Mt @ 1.19%

- Indicated: 7.37Mt @ 0.93%

- Inferred: 31.93Mt @ 0.59%

Rare Earth Oxides (cut-off: 2% TREO):

- Total: 40.6Mt @ 4.13% TREO

- Measured: 1.90Mt @ 5.44%

- Indicated: 7.37Mt @ 4.76%

- Inferred: 31.37Mt @ 3.90%

Market Dynamics: Niobium and REOs See Global Upswing

The timing of SGQ’s Araxá development could not be better. According to recent forecasts, the niobium market is projected to grow from 117.45 kilotons in 2025 to 188.47 kilotons by 2030, reflecting a CAGR of 9.92%. The steel industry remains a major driver, but new applications in next-gen EV batteries are gaining traction. Industry leaders such as CBMM and Toshiba are collaborating to incorporate niobium into high-performance battery systems.

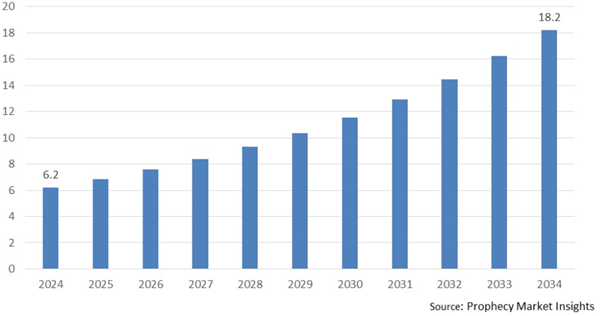

Meanwhile, the Rare Earth Oxides (REO) market is set to expand from US$6.2 billion in 2024 to US$18.2 billion by 2034 (CAGR 12.6%). These oxides are essential in electric vehicles, clean energy, electronics, defence, and aerospace, making their supply and development strategic imperatives for global economies.

Figure 4: Market value of Rare Earth Oxides from 2024-2034 (in billion USD) [Source: Prophecy Market Insights]

Resource Expansion Drilling Underway

Alongside geophysics, the Company has launched a 16-week, 10,000m drilling campaign. This includes auger, reverse circulation, and diamond drilling methods. Initial assay results are expected in July and will guide the next phase of exploration.

To maintain the highest data integrity, the Company is applying rigorous QAQC protocols, including Certified Reference Materials (CRMs), duplicates, blanks, and independent laboratory verification through ALS and SGS.

Executive Commentary

“With JORC defined resources for rare earths and niobium at Araxá that are already globally significant in terms of volume and grade, this modern geophysical program promises to provide the basis to further unlock substantial value at the project by identifying additional high-grade zones of mineralisation,” said Mr Prineas.

“We are also looking forward to starting to announce the assay results from the current drilling program.”

Figure 5: The field team is operating auger drilling in Araxá.

Investor’s Outlook

Investor sentiment around St George Mining Limited (ASX: SGQ) remains strong, fuelled by the project’s scale, favourable market conditions, and early exploration success. The stock is trading near the top of its 52-week range and is attracting above-average trading volumes.

Stock Performance (as of 12:30 pm, 2 July):

- Current Price: $0.037

- Market Cap: $98,894,430

- 1 Week: +19.35%

- 1 Month: +54.17%

- 2025 YTD: +48.00%

- 1 Year: +37.04%

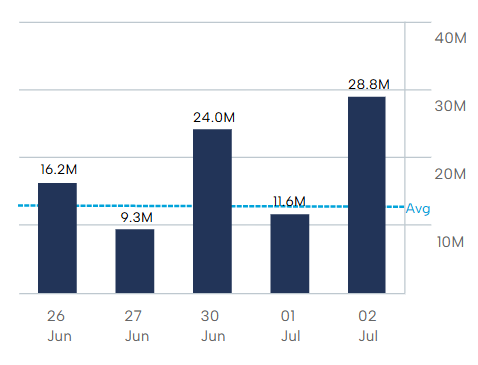

5-Day Trading Volume:

- 26 June: 16.2 million

- 27 June: 9.3 million

- 30 June: 24.0 million

- 1 July: 11.6 million

- 2 July: 28.8 million (highest daily volume)

Figure 6: Trading volume of SGQ stock in the last 5 days (with the highest today) [ASX]

With the groundwork being laid for major discoveries, SGQ is positioning itself as a serious force in the global critical minerals space. The next round of assay results and geophysical interpretations could act as key catalysts, drawing further attention from institutional investors and industry observers alike.

Read Also:/electric-vehicles-and-ai-the-intersection-of-auto-and-tech

Disclaimer