In a groundbreaking turn of events, SharpLink Gaming, a digital sports betting and affiliate marketing firm, has unveiled plans to acquire up to $1 billion worth of Ethereum (ETH). This isn’t a marketing gimmick or an abstract crypto flirtation—it’s a fully-fledged strategy, backed by a formal SEC filing, market-shaking stock activity, and a leadership overhaul involving one of Ethereum’s own co-founders.

While some analysts cheer the move as visionary, others sound cautionary notes. Regardless, the crypto and gaming industries are watching closely. Here’s a deep dive into this bold pivot—why it matters, what it signals, and how it could reshape the corporate use of digital assets.

SharpLink shakes the industry with a bold $1B Ethereum play ( Image Source: Binance )

A Strategic Ethereum Bet—Not a Speculative Gamble

SharpLink is not making a minor investment; it’s diving headfirst into the blockchain arena.

According to the company’s recent SEC filing, it aims to raise up to $1 billion through a new share offering—with the primary intent of purchasing ETH. This decision echoes the playbook of MicroStrategy’s infamous Bitcoin accumulation, but with a twist: instead of Bitcoin, Ethereum takes center stage.

This move reflects a strategic pivot toward ETH as a core treasury asset, and not just a speculative vehicle. As Ethereum solidifies its place in Web3 infrastructure—from decentralized finance (DeFi) to NFTs and smart contracts—SharpLink’s move signals a fundamental shift in how corporations view blockchain utility.

The Lubin Factor: Ethereum’s Co-Founder Joins SharpLink

If the ETH purchase wasn’t enough to grab headlines, SharpLink upped the ante by naming Joseph Lubin—co-founder of Ethereum and CEO of ConsenSys—as its new Chairman of the Board.

This is more than just a symbolic appointment. Lubin brings heavyweight blockchain expertise, deep ties to the Ethereum developer ecosystem, and a strategic vision that aligns with decentralization. His presence implies that SharpLink’s commitment to Ethereum runs deeper than financial speculation—it’s about building infrastructure on-chain.

Expect Lubin’s influence to shape everything from smart contract integration and layer-2 adoption to regulatory navigation. It also signals potential synergy between SharpLink’s digital marketing capabilities and Ethereum’s decentralized potential.

Lubin joins SharpLink to drive its Ethereum vision ( Image Source: CoinDesk )

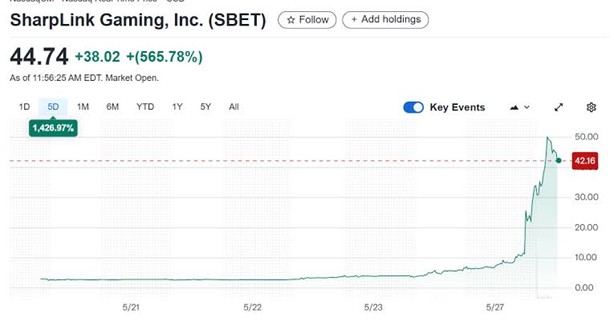

The Market Reacts: SharpLink’s Stock Soars Over 1,000%

The financial markets responded swiftly—and emphatically.

SharpLink’s stock (NASDAQ: SBET) surged more than 1,000% within days of the announcement. Even more striking, the company saw a 7,200% increase in trading volume, showcasing massive investor interest from both retail and institutional players.

This isn’t just about hype. Investors seem to view SharpLink’s ETH strategy as a legitimate and forward-looking move, suggesting confidence in Ethereum as not only a digital asset but a corporate resource—akin to cash reserves or tech infrastructure.

SharpLink stock skyrockets over 1,000% after Ethereum move ( Image Source: CoinCentral )

Why Ethereum, and Why Now?

So, why bet big on ETH?

Ethereum has evolved far beyond its origins as a platform for decentralized applications. With its transition to Proof of Stake, growing ecosystem of layer-2 scaling solutions, and central role in DeFi, ETH has emerged as a utility-driven asset.

From a strategic perspective, Ethereum offers a unique value proposition: it’s programmable money, a foundation for digital innovation, and increasingly viewed as a productive asset in the same way cloud credits or software licenses are.

By allocating significant capital to ETH, SharpLink signals that it sees Ethereum as essential infrastructure for its gaming and marketing future—not merely a speculative hedge.

Blockchain Gaming Begins: Stake in CryptoCasino.com

SharpLink isn’t just buying Ethereum—it’s beginning to build on it.

In a parallel move, the company acquired a 10% stake in Armchair Enterprises, the operator of CryptoCasino.com. This UK-based Web3 gaming platform supports multiple cryptocurrencies, including ETH, and offers blockchain-based betting services.

This deal gives SharpLink a foot in the door of decentralized gaming, with the potential for deeper involvement in ETH-powered platforms. If developed strategically, it could place SharpLink at the forefront of a new category: a hybrid gaming affiliate platform running on Ethereum infrastructure.

Rob Phythian: The “Michael Saylor” of Ethereum?

Comparisons are already being made between SharpLink CEO Rob Phythian and MicroStrategy’s Michael Saylor, who famously turned his company into a Bitcoin powerhouse.

While Saylor’s vision revolved around BTC as a digital store of value, Phythian appears to be pioneering a new corporate model—one anchored on Ethereum. With Lubin by his side, Phythian may be positioning SharpLink to become the first large-scale ETH-native corporation.

The implications? Other fintech firms, gaming outfits, or even media companies might consider Ethereum as part of their own treasury and operations strategy.

Rob Phythian earns the title “Ethereum’s Saylor” with bold $1B ETH move ( Image Source: The Business Journals )

The Risks Behind the Reward

Of course, there’s no such thing as a risk-free crypto play—especially at this scale.

Regulatory Hurdles

SharpLink’s own SEC filing acknowledges the uncertainty surrounding ETH’s regulatory classification in the U.S. Should Ethereum be labeled a security, compliance challenges could emerge crypto, particularly regarding reporting standards and taxation.

Volatility

Ethereum’s price history is volatile, and a $1B position is a massive exposure. A market downturn could affect SharpLink’s balance sheet and investor sentiment significantly.

Competition from CBDCs

Central bank digital currencies (CBDCs) are gaining traction globally. As these government-backed currencies roll out, Ethereum’s long-term dominance as a decentralized financial layer may face institutional competition.

Despite these risks, SharpLink appears undeterred—leaning fully into its Ethereum-first vision.

Ethereum in Affiliate Marketing: A New Model?

Traditionally, SharpLink has focused on affiliate marketing for sports betting—a sector defined by high transaction volumes, trust issues, and rapid payments.

Integrating Ethereum could revolutionize that space. Imagine:

- Smart contracts handling referral commissions automatically

- On-chain performance tracking

- ETH-based payouts replacing fiat transactions

- Decentralized identity solutions ensuring user verification

All of this could lead to lower fees, faster settlement times, and higher transparency—key improvements in a competitive marketing sector.

Welcome to Corporate Crypto Strategy 2.0

SharpLink’s move reflects a broader shift in how companies interact with digital assets. We’re entering the era of Corporate Crypto Strategy 2.0, where crypto isn’t just a speculative asset class—it’s a functional business tool.

The new blueprint? Use crypto for:

- Operational efficiency

- Financial diversification

- Technology enablement

- Brand innovation

Ethereum fits this model well—serving not only as a reserve asset, but as the technical foundation for future products.

Could Ethereum Become the Next Corporate Reserve Standard?

Back in 2021, Bitcoin made its debut on corporate balance sheets. Now, in 2025, Ethereum is staking its claim.

With upcoming upgrades like proto-danksharding, zero-knowledge proofs, and rollup enhancements, Ethereum is becoming more scalable, cost-effective, crypto and enterprise-friendly.

If SharpLink’s Ethereum bet succeeds, it could serve as a proof of concept—encouraging a wave of similar corporate strategies that treat ETH not just as an investment, but as core infrastructure.

Final Take: Is SharpLink the First Domino?

SharpLink may be on the verge of making history.

By aligning its leadership, treasury strategy, and product roadmap around Ethereum, the company is creating a new model for what a crypto-native corporation could look like.

If successful, it may inspire similar moves across the fintech, gaming, and marketing sectors. The sharp surge in stock price, the appointment of a blockchain pioneer, and the integration of Web3 gaming all point to a single conclusion:

SharpLink isn’t just betting on Ethereum—it’s building a future with it.

Whether you’re a blockchain developer, an investor, or just someone watching the next big financial shift, this move is worth your attention. Because if SharpLink’s gamble pays off, it won’t just change how companies invest—it could redefine how they operate.