Samson Mow isn’t just dipping his toes in Europe—he’s diving in headfirst. The Bitcoin advocate and founder of Jan3 is on a mission to get Europe moving on Bitcoin, and he’s wasting no time. After chewing the fat with French MEP Sarah Knafo—no rookie in the crypto game—Mow got the green light to head to France. And from the looks of it, he’s gearing up to light a fire under Europe’s approach to Bitcoin.

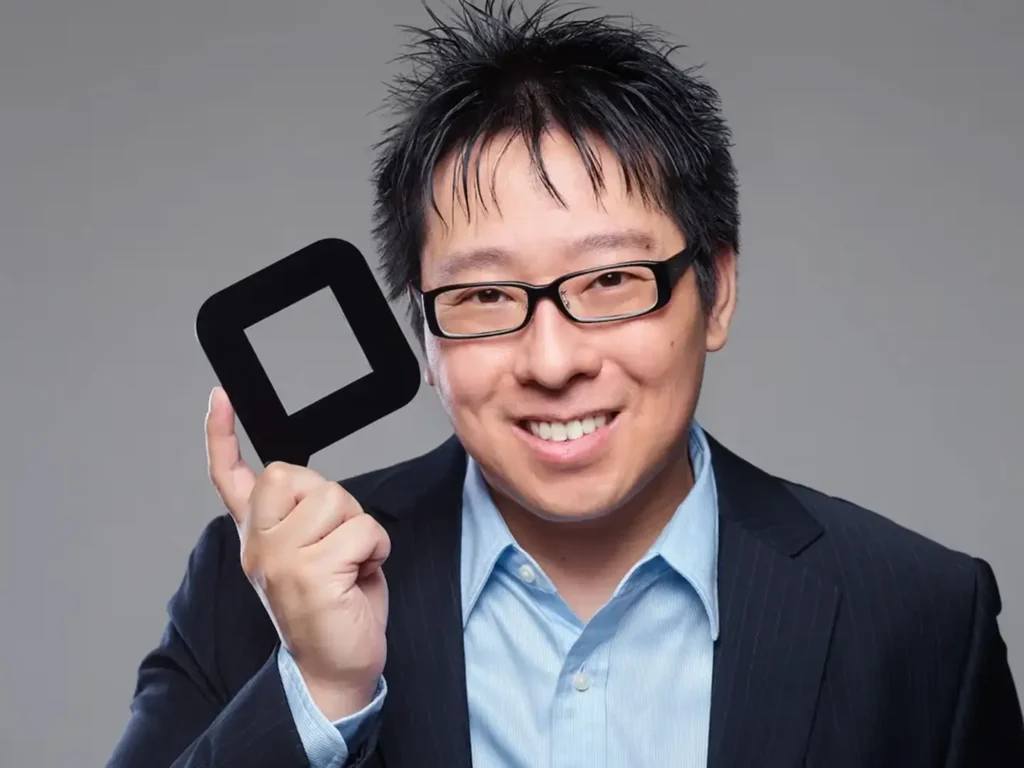

Image 1: Samson Mow (Source: CoinDesk)

This isn’t Mow’s first rodeo. He’s already helped El Salvador put Bitcoin on the map. Now, his sights are set on Europe’s old money crowd, hoping to convince nations to treat Bitcoin like digital gold—stacking it up alongside traditional reserves like foreign currencies and bullion.

His catch-up with Knafo happened during a Bitcoin event in Prague, where both agreed it’s high time France looked seriously at building a Bitcoin safety net. That means laying down smart rules and creating a national stash of Bitcoin to keep for a rainy day.

France Steps Out of the Shadows

While many countries in Europe have been dragging their feet, France seems to be picking up the pace. The crypto drumbeat is growing louder there, and it’s not just private companies making noise. State-supported ventures are finally stepping up to the plate and tossing their hat into the crypto ring.

One clear sign is a Paris-based firm called Blockchain Group recently splashed out about 60 million euros—nearly $69 million USD—on more than 600 Bitcoins. That’s no small change. Their total stash is now pushing close to 1,500 coins, showing they’re not just having a flutter—they’re building a war chest.

And they’re not the only ones betting big. France’s state-backed lender, Bpifrance, is putting its money where its mouth is—setting aside 25 million euros to back digital assets. The money is meant to boost local blockchain startups and push the country to the front of the crypto pack. It’s a strong signal that France isn’t just testing the waters—it’s getting ready to swim with the sharks.

With Knafo extending an olive branch to Mow, France might soon be the first European country to take a serious crack at state-level Bitcoin adoption. If they pull it off, it could set off a chain reaction across the continent.

Europe’s Patchy Record and a Push for Change

Despite Bitcoin’s global rise, Europe has been a mixed bag. Some countries are keen, others are cold, and most are still sitting on the fence. Red tape, unclear rules, and cautious attitudes have made progress slower than a snail on a wet footpath.

Elisenda Fabrega, who handles legal matters at tokenisation platform Brickken, reckons Europe’s corporate world hasn’t warmed to Bitcoin just yet. The issue is foggy regulations and a fear of stepping on the wrong side of the law. Even with the EU’s new MiCA framework now in play, many companies still see crypto as a can of worms.

But that’s exactly where Mow sees his opening. His visit to France might be the first domino to fall. With a helping hand from leaders like Knafo—who knows her way around both politics and Bitcoin—he’s aiming to give crypto a proper seat at the grown-ups’ table.

Samson Mow says he wants “nation‑state #Bitcoin adoption in France—and perhaps all of Europe.”

What would it take for European governments to embrace BTC as a reserve asset?

With which EU country would you start this trend?#Crypto #Bitcoineurope pic.twitter.com/toSmtusSQe

— Cheeky Crypto (@CheekyCrypto) June 22, 2025

France might be the first stop, but Mow’s endgame is much bigger. He’s looking to rally the whole continent, hoping to kick-start a movement where Bitcoin becomes a regular part of national financial planning.

The goal is to turn Bitcoin from a speculative plaything into a rock-solid reserve asset. If enough countries jump on board, it could completely flip the script on how governments manage money. What El Salvador started, Mow wants to see ripple across Europe—from Paris to Prague and beyond.

A Bigger Vision for the Continent

France seems ready to lead the charge. With heavy hitters in government and business both getting behind the tech, the country could be laying the groundwork for a new era. If Mow’s efforts strike the right chord, it won’t be long before other countries start following France’s lead like ducks in a row.

Image 2: (Source: Bitcoinnews)

This shift could be a game-changer. If governments begin stockpiling Bitcoin as a national reserve, it could give the cryptocurrency a credibility boost the likes of which we haven’t seen before. For investors, regulators, and businesses alike, it would be a strong signal that Bitcoin isn’t just a flash in the pan—it’s here to stay.

The dominoes are set, and the first one may have already started to tilt. Between France’s growing appetite for digital assets and Mow’s strategic nudge, Europe’s crypto chapter could soon turn a very important page.

There’s no doubt Mow’s Paris trip could end up being more than just another conference meet-and-greet. With the right support and the right timing, it might spark the beginning of a broader continental shift.

Read Also: Texas Sheriff Cracks Open Bitcoin ATM to Recover Scam Victim’s $25K

France’s willingness to embrace blockchain, coupled with leaders like Knafo putting their weight behind Bitcoin, gives Mow a strong platform. Throw in the EU’s new regulations, and the pieces are starting to fall into place.

It’s still early days, but the tide may be turning. With Mow steering the ship, Europe might be on the brink of something big. If all goes well, what starts in France could snowball into a full-blown Bitcoin movement across the continent.