The global cryptocurrency markets started the session on the back foot as the overall mood in the market turned to the risk-off side. In this wave of news about cryptocurrencies, XRP had a tough time keeping its levels despite the good news around ETF inflows.

The market participants were very careful since the uncertainty over the Federal Reserve’s actions was larger than the optimism coming from the institutions. The price of XRP is telling us that the market is being held back by the fear of a negative macroeconomic scenario, and at the same time by the hopes of those positive structural changes.

Global crypto markets weakened as XRP struggled despite positive ETF inflows.

What Is Driving The XRP Price Update?

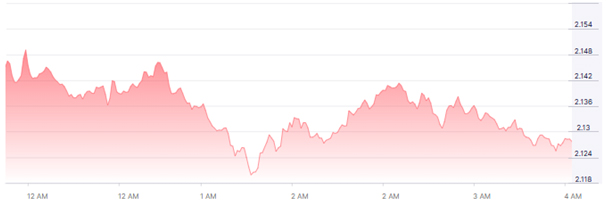

According to the most recent XRP price update, the coin closed at $2.1083 after a lightning-fast fall of 4.94% in a single trading day. The sell-off was triggered by the increasing supply of fears over US economic data delays, and the changing expectations around Fed policy.

The odds for a cut in the December meeting dropped from 50.1% to 32.8%, which in turn created a wider risk-off attitude. Investors have withdrawn their money from high-volatility assets such as cryptocurrencies, which has also made it hard for XRP. The mining of short-term negative sentiment directly impacted the analysis of XRP’s market.

Although altcoins usually have a strong response to the flow of liquidity, XRP underwent further pressure due to the weakening of retail interest, which was coupled with the taking of profits near the resistance levels.

How Does Ripple Cryptocurrency News Reflect ETF Developments?

The ripple cryptocurrency news cycle is a clear reflection of the market’s major contradiction. Although the price action was not strong, one of the XRP-linked spot products, XRPC, saw net inflows of about US$13 million in just one day.

This indicated that the institutions were getting aware of XRP and starting to consider it as an investment asset. Nevertheless, the inflow was not sufficient to counterbalance the macroeconomic pressure coming from all directions. Currently, in the XRP market analysis, ETF developments keep on being a medium-term catalyst, not a short-term driver.

The traders are looking for Franklin Templeton and Bitwise, the more established issuers, to get the go-ahead to launch their spot XRP ETFs. The creation of these ETFs could result in a huge rise in exposure and liquidity on the regulated platforms.

Ripple cryptocurrency news shows US$13 million XRPC inflows despite weak prices.

Federal Reserve Uncertainty Is Adding Pressure

The uncertain economic situation in the US is the main reason for the digital assets market to be in this situation that as the Fed’s wait-and-see approach regarding inflation and the postponement of US economic data releases have more or less made global investors hesitant.

The delay in the US jobs report release for October also contributed to the uncertainty in the market. In such a scenario, risk assets suffered capital outflows. XRP followed the pattern as traders moved money to safer instruments.

This trend supports the ongoing XRP market analysis, which is already saying that macro conditions are still the most important reason for short-term price movement. Until the Fed gives a clearer signal, volatility will likely remain high.

Institutional Adoption Could Strengthen XRP Outlook

Even though there is a temporary dip in the market, institutions are still a main part of the long-run XRP narrative. The discussion about the digital currency XRP and its possibility to become a part of the treasury reserves has caused a stir and caught the eye of, among other things, new Ripple cryptocurrency news.

Some businesses have already regarded cryptocurrencies as a way to diversify their assets. If the interest grows, then eventually, the profile of XRP demand might be strengthened. Furthermore, new spot ETF approvals could lead to traditional finance players getting easier and wider access to the market.

This change in the market structure is likely to lead to a more favourable medium-term XRP market analysis, particularly when the macro environment becomes less challenging.

Institutional interest supports long-term XRP narrative despite temporary market weakness.

What Do Technical Levels Indicate Right Now?

Technical indicators reveal a lot about the XRP price update. The next level, which is the support of US$2.00, is the immediate support, followed by a stronger support at US$1.90. If the price falls below these two levels, there will be a risk of more considerable corrections.

Resistance is in place at US$2.20, US$2.35, and US$2.50, as far as the upside is concerned. The cryptocurrency is also under the influence of the 50-day EMA at US$2.4547 and the 200-day EMA at US$2.5520.

The current bearish bias is confirmed by this positioning. A bullish scenario would emerge with the recovery above US$2.20 if it happens along with the support of volume and positive sentiment.

XRP Faces Risks And Opportunities Ahead

The perspective for XRP is still aligned with the chances and risks. First, among the risks, there are still the macroeconomic uncertainty, investors’ carefulness, and the regulatory bottlenecks, and they are the main worries. The postponement of Ripple’s US-chartered bank license has plunged the company into uncertainty regarding its long-term structural expansion.

On the contrary, ETF inflows, participation of institutional investors, and bettering of the Federal Reserve’s policy could be among the factors that support a rebound in the demand for cryptocurrencies. Presently, the analysis of the XRP market places the maintenance of the price level above US$2.00 as the most important factor for the formation of a medium-term bullish pattern. In the event of a future ETF launch triggering a steady stream of capital inflows, we could see the XRP price update reflecting the renewed strength toward US$2.50 and over.

Thus, while the short-term volatility is still in the picture, the wider ripple of cryptocurrency news has not ceased to support a cautiously optimistic medium-term view. It will be the balance between macroeconomic pressures and inflows that will dictate the next major trend phase for XRP. Traders and investors are advised to keep monitoring the developments in regulations, the approvals of ETFs, and the support levels in order to smoothly navigate through the ever-changing market landscape.

Also Read: XRP Bullish Breakout Gains Momentum As ETF Launch Nears And Market Awaits $3 Target

FAQs

Q1. What is the current XRP price update trend?

The prevailing trend of the present XRP price update is that of a short-term weakness triggered by macro uncertainty, despite the support of ETF inflows to a certain extent.

Q2. Why is Ripple cryptocurrency news focused on ETF inflows?

ETF inflows are an indication of the increased interest on the part of institutional investors, which in turn can lead to the demand, liquidity, and long-term price stability of XRP becoming greater, more liquid, and more stable.

Q3.Which levels are critical for XRP traders?

Support levels of US$2.00 and US$1.90 are the key ones, while resistance is at US$2.20, US$2.35, and US$2.50.

Q4 How important is XRP market analysis for investors now?

XRP market analysis is extremely important considering the high volatility caused by global macro factors and the like.