The US Securities and Exchange Commission has approved generic listing standards under which exchanges can list eligible commodity-based exchange-traded products, including particular crypto ETFs, far more rapidly than previously. The change dispenses with the lengthy, case-by-case approvals for products satisfying the new requirements and de facto opens the gates to new spot, multi-coin, and theme crypto ETFs to launch onto exchanges. (SEC)

Issuers and exchanges may now go from filing to listing in a quarter of the time previously required, a shift that market participants believe will transform months-long backlogs for regulatory approval on qualified products into weeks. That will make a difference: product choice, fee competition, and access are soon to be accelerated. (Reuters)

SEC approval streamlines crypto ETF listings, cutting waits from months to weeks (Image Source: UNLOCK Blockchain)

What changed, in plain English

Up to now, all but a few of the crypto ETF proposals landed on a gradual, custom treadmill: every new fund that would trade usually had a single SEC review and comment period. The SEC’s new generic listing approach replaces that for eligible commodity-based ETPs. Exchanges that are Standard-compliant can list qualifying products without individual Commission approval for each listing. The result is speed and breadth.

That is not a free pass. Products must go through clear tests on custody, market surveillance, liquidity, and the nature of underlying markets. If a fund fails those tests, then the old application process remains. The difference is who does the testing in advance, the exchange, and how quickly a compliant product can be brought live. (JD Supra)

Why this is a watershed

The SEC’s previous waivers to spot-bitcoin and spot-ether products already signaled demand and usability. Advisory firms and fund trackers saw stable flows following those products’ rollout, and exchanges tested options and derivatives on those tickers. The new standards advance it one step further: instead of a few specialist listings, dozens of funds might spring up in a matter of days, like funds wrapping multiple coins or focusing on themes. (Reuters)

Figures follow the leader: digital-asset funds saw huge inflows this month, with Bitcoin and Ethereum as leaders, and assets under management edged toward multi-billion-dollar figures, proof that managers see as real investor demand to access. (CoinShares)

Who gets out of the gate first, issuers and exchanges to follow

Big asset managers already running successful spot products will scramble to add to their menus: additional fee tiers, additional custodians, and faster product launches by established players. Crypto-native boutiques and managers will try niche, them, and multi-coin ETFs to attract trader and retail interest. The big exchanges, NYSE Arca, Nasdaq, and Cboe, now have a vehicle to sanction these products in the generic umbrella. (Reuters)

Major asset managers and crypto-native firms race to launch new ETFs, with NYSE Arca, Nasdaq, and Cboe ready to list under the SEC’s new framework. (Image Source: CryptoSlate)

Watch for two dynamics:

- Commoditisation of basic exposures (bitcoin/ether) with lower fees and competing custodians.

- Experimentation with baskets and sector ETFs that target smart-contract platforms, layer-2, and infrastructure tokens. (ETF Database)

The kinds of ETFs you’ll see first

Expect a tiered rollout:

- Single-asset spot ETFs — additional variants of bitcoin and ether, often differing by custodian or fee. (Reuters)

- Multi-coin large-cap ETFs — index-based funds bundling multiple leading tokens in one ticket (a simple first example has already launched). (ETF Database)

- Thematic or sector ETFs — funds that classify tokens by their application (DeFi, smart contracts, layer-2s). These follow once liquidity and surveillance guardrails are up. (Reuters)

- Niche or test products — small, riskier baskets piloting demand; these will undergo more intensive testing by exchanges for custody and liquidity.

An example from the real world: multi-crypto on the move

Among the first real products of the new paradigm is the launch of a multi-crypto ETF that holds a basket of the largest tokens in one fund. That product provides investors with diversified crypto exposure in one ticker without private keys or wallets. Grayscale’s multi-asset ETP already transitioned to exchange listing under such rules, showing the concept and giving other managers a blueprint to follow. (Grayscale Funds)

The SEC just changed the game.

Grayscale’s Digital Large Cap Fund was approved for trading. It holds BTC, ETH, XRP, SOL… and ADA.

This not only gives traditional investors exposure to ADA, but also sets the stage for future ADA-focused ETFs under the new framework. The path… pic.twitter.com/XeVlCVpKlq

— Lucas Macchiavelli (@LucasMacchia2) September 18, 2025

Market mechanisms — flows, liquidity, and price influence

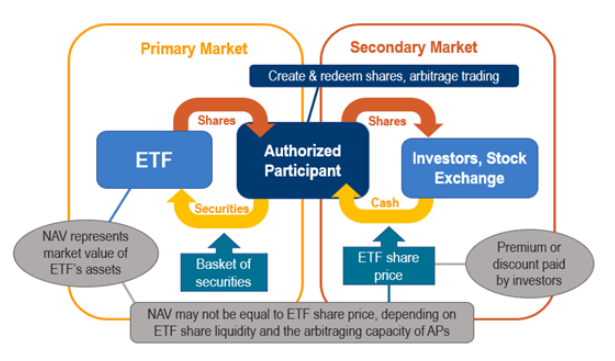

ETFs reshape market infrastructure. When investors buy an ETF, authorized participants build shares by bringing in cash in exchange for the underlying assets (or redeeming). That move puts big institutional flows directly into the spot markets, and that gives liquidity and, at times, drives prices of the underlying coins upward. Classic dynamics since the first U.S. approvals of spot-bitcoin demonstrate these forces at work.

This week’s data supports the fact: digital-asset products welcomed nearly US$2 billion of inflows over the past few weeks, driven by bitcoin and ether, evidence that investors still find ETFs an excellent on-ramp. More ETF products will multiply the flows and provide market depth for large-cap tokens. (CoinShares)

ETFs channel billions into spot markets, boosting liquidity and often lifting coin prices, with Bitcoin and Ether leading recent inflows. (Image Source: Ultimus Fund Solutions)

Custody, audits, and the “real plumbing”

Speed matters, but so does security. Exchanges and the SEC require institutional custody, reserve audits, and market-surveillance arrangements. That is the “plumbing” that investors cannot see but must believe in: cold storage, insured custodians, independent attestations, and unambiguous redemption procedures. Issuers will differentiate on transparency here; funds with regular on-chain attestations and secure custody arrangements that are transparent will earn retail trust. (SEC)

The Aussie spin — what is this good for Australian investors

Australia already has listings of crypto ETPs and ETFs, and ASIC knows well how listings of ETPs and crypto assets should be managed. Australian domestic issuers and bourses will be watching the U.S. playbook intently: Australian managers will rename or reimagine products in a few instances, SMSF trustees will test whether ETF wraps offer better compliance than coins in direct custody, and advisers will update suitability guidance to clients. ASIC and ASX reports indicate the same guardrails, disclosure, monitoring, and protection of investors, which is the SEC’s focus. (ASIC)

Indeed, Aussie investors can access global listings through broker platforms, and local issuers may strike back with further ASX-listed crypto ETFs targeting SMSFs and retail investors. Ad campaigns and education campaigns will grow as product ranges increase. (HUDSON Financial Partners)

Australia eyes U.S. crypto ETF moves as ASIC and ASX set guardrails, with local issuers poised to expand offerings for SMSFs and retail investors. (Image Source: Crypto News Australia)

Risks that aren’t disappearing

A more rapid listing path does not remove inherent crypto risks:

- Volatility: ETFs don’t get rid of surprising price movements.

- Liquidity mismatch: Baskets may be made up of small tokens with shallow markets.

- Custodial counterparty risk: Audits and insurance minimize but do not eliminate risk.

- Regulatory changes: Authorities will impose controls or limit distributions.

Issuers and regulators must take disclosure and investor education to the top of the agenda as product proliferation gathers speed. (SEC)

What must advisers and retail investors do today?

- Read the prospectus — check if the ETF has spot assets, futures, or a combination.

- Check custody and audit practices — trusted custodians, regular attestations, and insurance matters.

- Size allocations for risk — treat crypto ETFs as high-volatility components of a diversified portfolio.

- For SMSFs: verify ASX/Cboe admission rules and how the ETF fits trustee investment policies. (ASIC)

Short Q&A (FAQs you’ll hear right now)

Q: Does the SEC’s move mean all cryptocurrencies will be ETF-eligible?

A: No. Eligibility will be based on liquidity, regulated trading facilities, custody, and surveillance arrangements. Bitcoin and Ethereum remain the best bet; other tokens must be up to scratch.

Q: Will these ETFs be safer than buying on an exchange?

A: ETFs provide regulated custody and reporting that reduces some operational risks. But they don’t remove market risk or assure price collapses. Read fund disclosures. (JD Supra)

Q: When will we actually see new products trade?

A: Issuers and exchanges are listing and converting products today; some funds will list in weeks following the new rules, with a larger wave in the next quarter. (Reuters)

A human snapshot

Imagine a Sydney-based mid-career financial planner updating model portfolios. Her choices were limited until recently: some ASX crypto ETPs, direct exchange access, or nothing. She now has a list of regulated ETFs based on plain custody and reporting tracks. For people who want high-risk exposure to cryptocurrency but not wallet management, the choice is now no longer “do you want crypto?” but “how much?”

That subtle shift makes it easier to have the conversation about diversification and documentation, and that is where the policy shift kicks in. (HUDSON Financial Partners)

A Sydney financial planner now weighs not if clients want crypto, but how much, thanks to regulated ETF options simplifying access (Image Source: ASX)

Brief recapitulation (two lines).

SEC approval of generic listing standards removed a major procedural barrier and significantly simplified the taking on of qualifying crypto ETPs by exchanges. That single change changes timelines, economics, and product strategy across the market. (SEC)

Detailed snapshot of data: flows, AUM, and what the figures mean now

Inflows of assets offer the most direct short-term evidence that demand is genuine. Global digital-asset products saw some US$1.9 billion of net inflows in a recent week, CoinShares reports, with gains spearheaded by bitcoin and ether and total AUM coming in at about US$40.4 billion year-to-date. That level of weekly inflow is the sort of juice, channeled through ETFs, that can drive order books deeper and make new-product launches economically sustainable. (CoinShares)

In ETF territory, spot Bitcoin products already have significant asset bases managed under their umbrellas; having scaled products available is a template and commercial incentive for other issuers to issue similar wrappers on other tokens. Flow numbers and AUM growth indicate to us that investors are not only inquisitive, they’re getting capital deployed. (The Block)

Look here in the data:

- Sustained weekly inflows (multiple consecutive weeks) suggest long-term holders, not short-term speculators.

- The concentration of AUM across a limited number of issuers suggests whether the market remains winner-take-most or becomes less so for new participants.

- Relative altcoin inflows (Solana, XRP, Cardano) into altcoins indicate demand outside BTC/ETH. CoinShares metrics this week reverse flows into SOL and XRP, as well as BTC/ETH.

Digital asset investment products saw US$1.9B of inflows last week@Bitcoin led the inflows with US$977M. @ethereum also benefited, at US$772M in inflows. Other notable inflows came from @solana with US$127.3M and XRP (@Ripple) at US$69.4M.

+ US$1.8B

+ US$51.6M

+… pic.twitter.com/0O1iHmFTmj— CoinShares (@CoinSharesCo) September 22, 2025

Short-, medium-, and medium-to-long price scenarios (realistic, modelled thinking)

I will describe three possible scenarios and the reasons each could correspond; these are scenario analyses, not forecasts.

Scenario A — The Liquidity Lift (Weeks → Months)

When ETF flows are steady, APs buy underlying coins to build out shares. That, in turn, buying increases spot liquidity and can put positive price pressure on top tokens. In the current inflow regime, that is most likely to happen in the near term. Market depth for top-cap tokens increases; spreads decrease. CoinShares’ recent inflows are in line with that configuration. (CoinShares)

Scenario B — Rotation & Selective Compression (Months)

As increasing numbers of thematic and multi-asset ETFs are launched, funds migrate from one-asset tickets into concentrated baskets. Bet on relative outperformance within high-performing baskets, and relative underperformance in omitted tokens. Liquidity for low-cap tokens may remain precarious; their ETFs will have broader bid–ask spreads and can experience NAV vs market-price slippage if authorized participants cannot swap underlying liquidity cost-efficiently.

Scenario C — Overheating & Volatility Spikes (Macro-sensitive)

When macro shocks (rate surprises, geopolitical risk) coincide with concentrated fast ETF flows, price volatility explodes. ETFs do not eradicate market or leverage risk; they simply change the vehicle of access. Scale redemptions can force ETFs to sell underlying securities at untimely prices, amplifying moves in thin markets.

Why they matter: ETF mechanics mechanize flows and speed them up. An orderly inflow environment enhances orderly liquidity; surprise stops enhance disorder. Creation/redemption math translates ETF flows nearly directly into demand for the underlying; that’s the structural shift this regulation tech creates.

Market structure: plumbing mechanics changing how crypto trades

Three plumbing shifts are most important.

- Institutionalise flows: Authorised Participants (APs). APs enable the connection of ETF share creation with spot markets. APs must possess large OTC and exchange relationships to trade large blocks without disrupting markets too much.

- Market surveillance & arbitrage squeeze spreads. Since ETPs are exchange-traded on regulated exchanges, market makers are able to arbitrage mispricing between venues quickly, compressing spreads to large tokens. That benefits institutional traders and lowers transaction costs.

- Derivatives and options are more fungible. ETFs provide exchange-listed standardized instruments that can be used as underlying for option strategies. As more ETFs list, options desks will write around them, and that is risk-management tools summed up.

These structural changes favor tokens with good underlying liquidity and reasonable custody solutions.

Crypto ETFs are reshaping market plumbing: APs link ETF flows to spot markets, arbitrage narrows spreads, and ETFs fuel new options strategies, favouring liquid tokens with solid custody (Image Source: Coin Bureau)

Winners and losers — who wins and who might get squeezed

Think of winners as having scale, compliance readiness, and network effects; losers have the opposite.

Probable winners

Large incumbents (large asset managers) with solidly established ETF distribution and custody partners — they grow quickly and reduce fees. They win by bundling distribution and trust into well-respected brands.

Custodians and institution-level custodial providers — insured, audited custody needs grow. These partners have fee revenue and strategic value.

Market makers and APs that are currently serving spot and OTC crypto desks — they generate creation/redemption fees and arbitrage returns.

Deep liquidity tokens (BTC/ETH + top L1s) — they will be part of a lot of the early ETFs and get direct buying flows. CoinShares’ flow data show SOL and XRP already drawing investor interest, together with BTC/ETH.

Future losers

Small retail-only platforms based on retail trading fees without institutional custody arrangements can have market share taken from them by regulated exposure provided by ETFs.

Illiquid mid-cap tokens — apart from issuers- will try to push thinly traded tokens into ETFs, and the NAV and trading price differences can be negative for holders.

DIY custody providers (one of the self-custody education proposals) will have slower adoption by investors who would desire a regulation wrapper ETF. That’s not the end of the market; it’s an alignment of customer segmentations.

#CRYPTO MINUTES – 24.09.2025$BTC ETF Flows Net Inflow : -$103.8M

⚡️ 7-day Avg : $59.9M$ETH ETF Flows Net Inflow : -$140.8M

⚡️ 7-day Avg : $48.6MTOP GAINERS: $ASTER, $IMX, $QNT, $FLR, $SKY

TOP LOSERS: $HYPE, $HASH, $M, $SOL, $WLFI

Morgan Stanley will begin offering… pic.twitter.com/P3ZGbBkt2k

— Chris (@christradesxyz) September 24, 2025

Points of friction, operational and legal, that will slow adoption

The generic listing standards aside, there’s still friction.

Cross-border distribution rules. US-listed ETFs cannot be sold offshore per se without regulation in each location; Australian distribution channels and platforms must screen suitability. Consult ASIC and ASX guides for listing and disclosure rules. (ASIC)

Tax treatment ambiguity. Different locations have different treatment of crypto capital gains and ETF gains. Advisers must consider tax implications for SMSFs and retail clients.

Custody & insurance caps. Custodians will not necessarily cover every risk or have the same attestation rhythm. Product trusts publishing on-chain reserve attestations and third-party audits will be more reliable. (SEC)

Practical playbook — how different market participants ought to act now

Retail investors: favor disclosures reading. Look for custodial specificity, fee tables, and the spot vs futures status of the ETF holding. Size exposure wisely.

Financial planners: update risk templates and suitability questions. Document the rationale for a crypto exposure, and inform clients about ETF mechanics (creation/redemption, tracking error).

Institutional investors: perform operational due diligence on AP channels, custodians, and the redemption process. Stress-test liquidity assumptions in multi-coin baskets.

Australian SMSF trustees: ensure ASX admission and domestic product structure if you prefer ASX-listed ETPs – refer to INFO 230 and ASX compliance notices on ETP admission. (ASIC)

Also Read: IOTA Cloud Mining Profitability 2025: Unlock Stable Crypto Income for BTC, ETH & DOGE Holders

Publisher-ready FAQ package (brief, clear answers)

Cut and paste this box exactly for use in a newsroom sidebar.

Q1 — What did the SEC change?

A: The SEC sanctioned generic listing standards so exchanges can list eligible commodity-based ETPs (digital-asset ETPs included) without specific SEC approval on a product-by-product basis. (SEC)

Q2 — Are other crypto ETFs coming?

A: Yes — issuers are filing and changing products. Industry reporting expects a flood of launches in the weeks and months to come. (Reuters)

Q3 — Are ETFs safer than buying on an exchange?

A: They offer regulated custody, reporting, and investor protections that many retail exchange products do not. But there is volatility and market risk. Read prospectuses. (SEC)

Q4 — Can Australians buy U.S.-listed crypto ETFs?

A: Australian investors will have access to US listings via international brokerages, but local regulation will cover advice and distribution. Local investors will have access to ASX-listed products.

Q5 — Will altcoins be included?

A: The gate will be opened to regulated, liquid altcoins, but with conditions on custody, surveillance, and liquidity. Early adopters will opt for established large-caps.

Q6 — How will ETFs impact on-chain activity?

A: ETFs allocate capital in custodial channels rather than on-chain retail wallets, so on-chain retail flows can decline even as institutional holdings rise.

Q7 — What must advisers disclose?

A: Suitability, volatility, custody risk, fee structure, and tax treatment. Always include the ETF prospectus and AUM figures.

Conclusion: where to watch next

Utilize H3 under flows for subtopics: coin-level flows; issuer concentration; AUM trends.

Data and chart ideas (editor note)

If you print this article, include two charts:

Weekly net flows (global digital-asset products) highlight the recent $1.9bn inflow week and a rolling twelve-week trend. (Source: CoinShares).

Spot Bitcoin ETF AUM leaderboard — stacked bar chart of leaders and AUM. (Source: The Block/fund data). (The Block)

A simple-to-read table of “ETF mechanics” (steps for creation/redemption) helps to make it more accessible to newbies.

Last strategic conclusions (3 plain points)

- It is not make-up; it is architecture. Accelerated listing rules bring the industry from bespoke approvals to scale.

- Big flows track transparency. Rising weekly inflows and growing AUM add up to capital coming into ETFs — but distribution will dictate prices and liquidity.

- Due diligence is the competitive edge. Custody, audit transparency, and distribution channels decide whose issuers have shelf space in portfolios.

Closing note: where we are heading next

Position yourself for a crazy quarter. Track filings, first-day volumes, and AP commentary. I can: (a) scale this down into newsroom size with charts and captioned images, (b) create an ASX/SMSF compliance checklist for advisers in Australia, or (c) build slide-ready talking points for use in client briefings if that suits you. If you’d rather have it in the newsroom style, just specify which voice channel to mimic (e.g., right-of-center business daily, tech-focused crypto blog, or mass-market Australian corporate magazine) and I’ll produce the publish-ready article with suggested charts and captioning.