The year 2025 thus became a watershed moment in crypto regulation in Canada. The Royal Canadian Mounted Police (RCMP) carried out the first-ever seizure of digital assets worth more than C$56 million. This resulted in the shutdown of the TradeOgre exchange, which for years had been operating without registration. This 2025 RCMP crypto seizure thus puts into focus the greater regulatory stranglehold being placed on crypto operators in Canada.

2025 marks a watershed in Canadian crypto regulation as the RCMP seizes C$56M and shuts TradeOgre

Why Was The Tradeogre Exchange Shut Down In Canada?

TradeOgre was targeted after being found to have never registered as a money services business with FINTRAC. Canadian law requires all exchanges to comply with stringent financial compliance requirements. TradeOgre is alleged to have not carried out customer identity checks, opening the door to money laundering and other illegal financial activities.

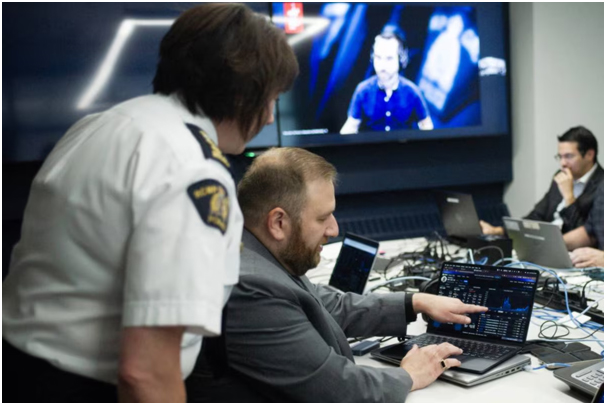

The RCMP’s Money Laundering Investigative Team (MLIT) took the lead after Europol alerted it in June 2024. During the investigations, they found out there were huge flows of transactions through Bitcoin, XRP, Ethereum, Litecoin, and Tron. Disregarding those safeguards, millions went through the exchange unchecked.

More than just placing a regulatory warning on it, this Canadian crypto exchange closure was a direct attack on platforms that plainly ignored Canadian financial laws.

How Did The RCMP Crypto Seizure 2025 Unfold?

The investigation, carried out over a number of months, placed international cooperation at its centre. Europol first alerted the Canadian police about TradeOgre’s suspicious activities, after which the RCMP initiated a domestic inquiry under the supervision of MLIT.

Following extensive circuit tracing, suspending accounts and wallet collections belonging to the platform proceeded. This seizure of assets worth over C$56 million encompassed assets in hot and cold wallets.

Also known as the largest crypto seizure in Canadian history, officials said this action might serve to deter unregistered exchanges from doing business in Canada. It was also an explicit confirmation of Canadian willingness to join global AML efforts.

RCMP probe into TradeOgre began after Europol alert, with months-long inquiry under MLIT.

What Are The Legal Consequences For Unregistered Platforms?

The 2025 RCMP crypto seizure sends out a clear warning to operators running without registration. Canadian regulators have emphasised that registration with FINTRAC is non-negotiable. AML checks and KYC must be carried out as well.

Authorities said it could be possible that the TradeOgre operators might be charged under federal financial crime laws, and in case of conviction, penalties may include large fines and even jail time. Legal experts are of the opinion that this case will set a precedent for other enforcement actions.

Expect Canadian regulators to increase in 2026 their scrutiny and demand better compliance standards from the entire sector. This could encourage big exchanges to become more transparent while forcing smaller platforms to fold or shift elsewhere.

Could The Tradeogre Shutdown Affect Other Canadian Exchanges?

With TradeOgre’s closure as a precedent, larger enforcement action may begin to unfold. Other platforms without FINTRAC registration could similarly come under investigation. Likely, enforcement agents will first target exchanges that have comparatively high transaction volumes or cross-border transactions.

This means there is a higher risk of sudden disruptions of service for users. Investors, therefore, should be encouraged to set their funds in licensed platforms with due compliance to regulations. Short-term flexibility may possibly be reduced because of the TradeOgre case, but long-term trust is likely to grow because of it.

Canada shutting down a crypto exchange shows that Canada is serious about global compliance standards. Such an enforcement is expected to colour and influence how other jurisdictions might treat unregistered platforms in the coming years.

FINTRAC may target high-volume or cross-border unregistered crypto platforms next.

What Does The RCMP Crypto Seizure 2025 Mean For Investors?

The critical lesson for Canadian crypto investors comes from the event. Assets on unlicensed exchanges face material risk. Once the regulators intervene, assets can remain frozen indefinitely while users are left trying to recover their losses.

Industry experts predict that cases such as these will foster a quicker development towards regulated exchanges, with investors aiming to select platforms that demonstrate transparency, identity verification, and clear security assurances.

Although it may appear as though the crackdown is harsh, analysts feel it could help put the Canadian crypto industry in a better position. By lessening exposure to illicit activities, the regulators would effectively safeguard legitimate investors and enable institutional adoption.

Future Outlook: Compliance and Stability in Canada’s Crypto Market

The breaking of the TradeOgre case marks a major milestone in the digital asset landscape of Canada. Authorities stress that they are for crypto innovation but against it without proper legislation. The RCMP crypto seizure 2025 clearly indicates a path accepting rigid oversight.

Looking forward, some in the industry believe that new frameworks should be developed to include more stringent rules that also cover foreign exchanges whose clients may be located in Canada. Others say Canada would adopt the MiCA regulations of Europe and ensure the application of standardised practices independently of regulation.

The way forward would largely be pitched broadly between innovation and accountability. Exchanges are gambling with what little is left of their survival on transparency. For investors, remaining cautious and doing due diligence will go a long way.

Also Read: Australia Crypto Regulations 2025: A New Era of Compliance and Growth

FAQs

- What is the RCMP crypto seizure 2025?

It is a reference to the Royal Canadian Mounted Police (RCMP) seizing digital assets with an estimated value exceeding C$56 million, leading to the shutdown of TradeOgre.

- Why did authorities go after TradeOgre?

The exchange was not registered with FINTRAC and refused to carry out proper identification procedures; they were in noncompliance with Canadian laws.

- How much money was seized in Canada’s biggest cryptocurrency operation?

Authorities seized more than C$56 million-worth of cryptocurrencies, including Bitcoin, XRP, Ethereum, Litecoin, and Tron.

- What does this mean for Canadian crypto users?

It highlights the risks of using unregistered exchanges. Users may lose funds if platforms are closed by regulators.