April’s RBA Interest Rate Decision: A Tense Pause

The RBA interest rate decision April 2025 has captured national attention as the Reserve Bank of Australia (RBA) elected to hold the official cash rate steady at 4.35% during its April board meeting. This decision, made against a backdrop of softening retail trade data and rising household financial pressure, underscores the central bank’s cautious approach amidst lingering inflation concerns.

Image 1: Reserve Bank of Australia headquarters in Sydney, where April’s rate decision was made. ( SOURCE: State Library)

Balancing Inflation and Economic Drag

The RBA board continues to navigate a difficult economic path. While headline inflation has eased to 3.8%, underlying cost-of-living pressures remain elevated. This has led many economists to argue that Australia is experiencing a decline in household consumption, which may become more pronounced without fiscal or monetary easing.

Despite growing calls for rate cuts in 2025, the RBA’s April statement reiterated the need to maintain policy settings that anchor inflation expectations without choking off growth. Governor Michele Bullock noted in her remarks that spending and investment levels are not rebounding as quickly as anticipated.

Retail Trade Weakens in April

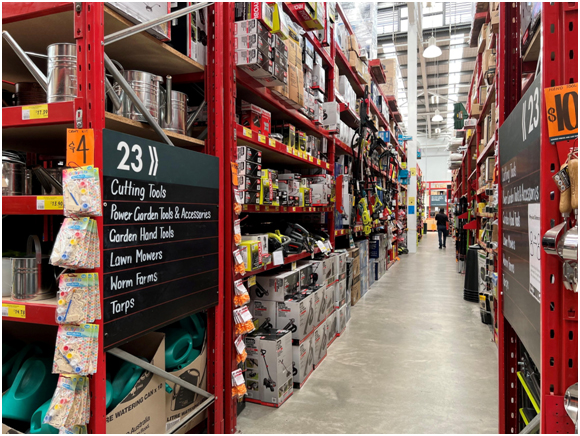

Retail trade data Australia April 2025 revealed a 0.3% monthly contraction, marking the third straight month of decline. This downturn reflects growing consumer caution, particularly in discretionary spending categories like fashion, household goods, and dining. Rising mortgage repayments and rental costs have curbed disposable income, leaving retailers to battle both low foot traffic and margin pressures.

The Australian Retailers Association reacted to April’s results by noting they reflect declining consumer confidence and the ongoing strain on household spending.

Image 2: Empty aisles in a suburban retail store (Source: Reuters)

Household Financial Pressure Escalates

Households across the country are feeling the pinch. According to recent ABS data, over 35% of Australians are now adjusting grocery budgets and postponing major purchases due to economic uncertainty. This financial stress is especially prominent among mortgage holders, who are bearing the brunt of the RBA’s cumulative rate hikes since early 2022.

Community support organisations have reported a rise in financial counselling inquiries, food bank usage, and demand for energy bill assistance in April. These pressures are beginning to influence monetary policy debates more deeply than in prior years.

Image 3: Family in Australia managing finances in response to increasing everyday expenses. (Source: AustralianBroker)

Forecasts and Market Sentiment: When Will Cuts Arrive?

While the RBA held steady in April, analysts remain divided on the timing of the first rate cuts in 2025. Some expect easing to begin as early as July, while others forecast a more prolonged period of caution.

Bond markets have priced in one to two rate cuts by year’s end, but Governor Bullock maintained that ‘policy will remain data-dependent.’ The April board minutes hinted that further tightening is unlikely barring a fresh inflationary surge.

Markets responded with minor shifts, with the ASX 200 inching up 0.4% post-announcement and the Australian dollar holding steady.

Conclusion: A Wait-and-Watch Approach Continues

April’s RBA interest rate decision underscores the complexity of Australia’s economic outlook. The central bank’s current pause signals restraint but leaves the door open for adjustments in either direction. As households and businesses brace for more data in the coming months, the Reserve Bank will remain at the centre of Australia’s ongoing tug-of-war between stabilising inflation and supporting recovery.

With consumer fatigue deepening and trade slowing, all eyes now turn to May and June to see if relief is finally on the horizon.