Image: iStock

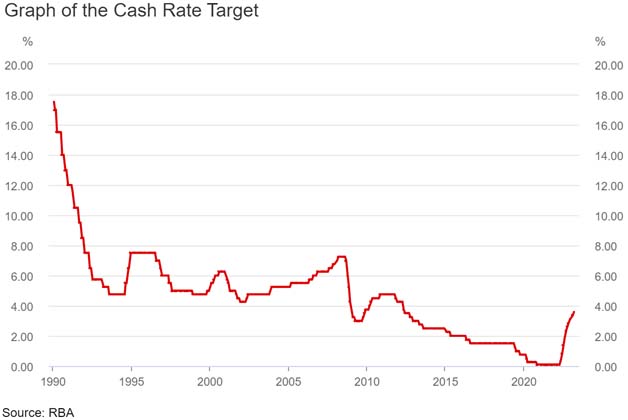

When the Reserve Bank of Australia (RBA) signaled on Tuesday that it was cutting the cash rate to 3.6 per cent, the Sydney room of financial journalists descended into a hush that preceded its usual beat by a solitary beat. It was the third rate cut of 2025, a obvious indication the central bank is piloting hard in the direction of monetary easing as the economy falters to pick up steam.

For mortgagee holders, the move could not have come any sooner.

Why the RBA Moved Again

Source: RBA

Officially, the RBA described the decision as reflecting “slowing household demand, weaker business investment and a moderation in inflationary pressures.” Simply put, the economy has been soft. GDP growth is below trend, wages are not rising quickly enough, and the housing market—historically a bulwark of consumer confidence—has slowed in Sydney, Melbourne and Brisbane.

The headline inflation rate has fallen to 3.2 per cent, its lowest since late 2021. That has provided the RBA with scope to move away from its previously hawkish bias. For Governor Michele Bullock, the math appears to be that restoring more confidence to the household sector is a better risk than encouraging another housing boom.

Borrowers Get Breathing Space

For a household with a $600,000 mortgage, Tuesday’s rate reduction translates into monthly repayments dropping by up to $185, assuming banks pass on the full amount. The catch? Lenders do not always play ball.

The Australian Bankers Association has already called on members to “assist customers through a tough economic period,” but experts caution that the bulk of the reduction may not filter down. Previous cycles indicate that while big four banks tend to pass on 70–90 per cent of an RBA action, smaller lenders will sometimes retain more to cushion margins.

Nevertheless, even a partial pass-through is a relief. Following three consecutive years of unrelenting rate rises to 2022–23, several borrowers were facing rises in repayment of over $1,200 a month. For them, the recent reduction is like the first genuine respite.

Also Read: Speakman Wants AI in Schools. Here’s What That Means for NSW

Mortgage Savings and Household Spending

The Treasury modelling of the government indicates that if all three reductions of 2025 are passed on entirely, typical households might be saving $4,000 annually compared to where they were at the top of the tightening cycle.

Consumers will be hoping that those savings add up to more spending. Department stores and supermarkets have seen flat volumes of sales since Christmas, and consumer confidence indexes are still well in negative territory. “Households remain cautious,” says Westpac chief economist Sarah Tan. “A few hundred dollars a month difference makes a difference, but it doesn’t take away years of cost-of-living hardship.”

Investors Divided on the Move

Financial markets responded in a mixed way. The ASX 200 briefly surged before closing unchanged, with traders balancing the benefit for retailers and property trusts against the squeeze on bank profits lower rates could impose.

The Australian dollar dipped to US 64.9 cents, which shows investors who park capital in Australian assets face decreased yields. Exporters were pleased with the fall, with resource companies indicating it would boost competitiveness. For regular Australians booking a European summer, however, it is going to cost more to travel.

Critics Say Risks Are Mounting

Not everybody is smiling. Some economists criticize the RBA for cutting too much.

“Once you enter down this road, it’s difficult to get off,” cautioned previous RBA board member Ian Harper on television. He observed that Australia’s productivity growth is weak, and monetary easing can’t reverse that. “We risk price-inflating house prices again without alleviating the structural constraints restricting the economy.

The Housing Industry Association responded by saying that new home approvals have dropped almost 25 per cent year-on-year, and reduced interest rates are required to stimulate building when housing supply is seriously tight.

The Bigger Picture

Credit: Brendon Thorne/ GettyImages

The international context does count too. The US Federal Reserve is still holding back, leaving its policy rate higher than 4 per cent, while the European Central Bank has signaled reductions by the end of the year. Australia leading the pack among peers may keep pressure on the dollar for the next few months, making the RBA’s battle to contain imported inflation even harder.

In the meantime, families are not running to claim victory. A Finder survey last week indicated that 62 per cent of mortgage holders remain “very concerned” they could not meet repayments, despite rate cuts being included.

What Happens Next?

The big question is whether Tuesday’s cut is the final one for a while or simply another move in a longer sequence of easing. Markets are wagering on at least one further cut by December, taking the cash rate toward 3.25 per cent.

If that happens, the total savings for families would exceed $6,000 annually on average loans. But as Governor Bullock reminded reporters: “Monetary policy can support the economy, but it cannot substitute for productivity-enhancing reforms.”

Translation: don’t look for cheap money alone to address the country’s issues.

The Takeaway

For now, at least, Australia’s third 2025 rate cut is a lifesaver for borrowers who’ve been hanging on by their fingernails during the worst mortgage cycle in a generation. Whether it leads to a revival in consumer spending or just allows households to keep the lights on will be the tale to follow over the next few months.