Ramelius and Spartan branded drill rig at Dalgaranga site. Image: Spartan Resources

Ramelius Resources is nearing the completion of its targeted takeover of Spartan Resources on a deal valuing the group at about $2.4 billion and making it one of Australia’s most geared mid-tier gold producers. Subject to final approval and integration planning across Western Australian assets, the Ramelius Spartan transaction now teeters on the brink of completion—awaiting shareholder votes and regulatory milestones to be completed.

The deal combines two well-performing ASX-listed gold stars during a period when bullion prices are still elevated, capital is on the move into scale producers, and Australian miners are looking for operating synergies to counteract labour and energy cost pressure.

What’s Locked In So Far

Ramelius has achieved the key pre-conditions:

- Scheme booklet filed and court consideration ongoing.

- Independent expert advice in favor of the transaction as “fair and reasonable” to Spartan shareholders (subject to record date market conditions).

- ASX share suspension windows scheduled around the scheme implementation timeline to facilitate transition.

- Board recommendation restated (unless a better proposal is received) by Spartan directors.

As the scheme vote looms near, investor focus now turns to deal ratio economics and how rapidly Ramelius will be able to roll Spartan’s high-grade portfolio, particularly the Dalgaranga gold project, into a larger production growth strategy.

Deal Structure: Ramelius Resources Acquisition Terms

Image: Spartan Resources

Under the proposed merger, Spartan shareholders are offered a combination of Ramelius shares and cash, designed to preserve upside to the gold price while providing transaction value immediately. The top-line enterprise value of around $2.4 billion (combined) captures rolling spot gold assumptions and balance sheet contributions, including Spartan’s cash, project inventory, and optionality of exploration.

The offer compares well to recent WA gold blends, especially considering the grade profile of Spartan’s Never Never deposit (within the Dalgaranga camp) and Ramelius’ proven processing and operating capability across Mt Magnet and Edna May.

Combined Gold Inventory: 12.1Moz and Increasing

On a consolidated basis, the combined portfolio will be expected to contain a combined gold resource in the range of 12.1 million ounces (including measured, indicated, and inferred categories on group assets). Resource updates continue, but initial modelling indicates:

| Asset Cluster | Key Deposits | Approx. Contained Gold (Moz)* | Strategic Note |

| Dalgaranga | Never Never, Gilbey’s North extensions | Growing high-grade core | Fastest return on mine spend |

| Mt Magnet | Multiple underground / open pit satellites | Mature production hub | Processing backbone |

| Edna May | Underground growth optionality | Lower grade, scale leverage | Blends feed in price swings |

| Exploration | Early-stage WA & regional targets | Pipeline upside | Organic growth driver |

*Company and analyst blended estimates; subject to formal JORC updates.

Why Dalgaranga Matters

Credit: yuda chen/Shutterstock.

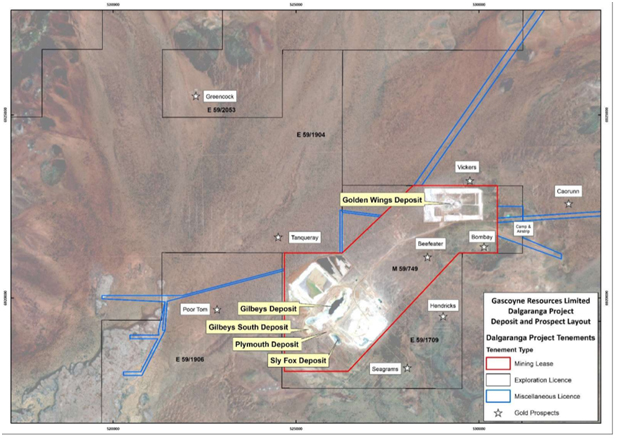

Spartan’s Dalgaranga gold project—and within it, ultra-high-grade Never Never discovery—is the gem of the transaction. Drilling to date has consistently returned thick high-grade intercepts under existing infrastructure. Ramelius believes it can draw upon its underground mining skills and processing capacity discipline to accelerate ore conversion and extend mine life beyond existing Spartan aspirations.

Shorter haul distances, fixed site facilities, and the re-sequence flexibility of cutbacks mean Ramelius ought to be able to compress development lead times—Spartan’s growth story into earlier cash flow.

Project Location

Source: Mining Data Online

Cost Synergies and Operating Leverage

This is not a cost cut-and-burn acquisition. Instead, Ramelius is looking for:

- Processing efficiencies from optimizing mill blends right across its WA footprint.

- Shared technical teams for resource modelling, mine planning, and geotech.

- Discipline on capital spend—funding spend on the highest margin ounces first.

- Centralisation of consumables and contracting out procurement to hedge against inflation in diesel, explosives, and reagents.

- Management guidance is for medium-term reductions in AISC when the portfolio is optimized, but near-term integration expenditure will temporarily push up unit costs.

Market Context: Gold Still Holding High Ground

Gold is comfortably oversold in Australian dollars, selling at comfortably over A$3,500/oz in recent quarters and creating a cushioning revenue buffer while labor costs continue to rise. Mid-cap Australian producers which grow by consolidation are gaining fresh fund interest because they can level grade volatility, hedge less, and keep production flexibility across price cycles.

The Ramelius Resources grab for Spartan land is exactly there in that trend: accumulate the assets, consolidate camp infrastructure, and repair ounces while the gold window is open.

Also Read: Speakman Wants AI in Schools. Here’s What That Means for NSW

Investor Reaction: Uptake Building Ahead of Vote

Institutional holders are strongly biased to vote in the affirmative in the initial market chatter. The scrip component is appealing to long-term investors who want continued exposure to the WA gold belt. Spartan retail investors value the merit of merging with a cash-generating operator with a more robust balance sheet and operating team.

The trading volatility in the short term will be on scheme record dates and ASX share suspension dates, but brokers indicate that Ramelius paper will settle effectively following implementation.

What to Watch Next

Key Milestones on the Deal Path

| Date / Phase | Expected Event | Why It Matters |

| Court 1 Hearing | Scheme booklet approval | Clears docs to shareholders |

| Spartan Shareholder Vote | Scheme meeting | Must pass thresholds |

| Court 2 Hearing | Final orders | Legally enacts scheme |

| ASX Suspension | Spartan trading halt | Transition to Ramelius register |

| Implementation Date | Issue of Ramelius shares | Deal completion & integration start |

Beyond the Deal: Growth Strategy on Day One

Upon completion of the Ramelius Spartan deal, investors can expect to see:

- The consolidation of production profiles across WA with staged growth.

- Mine sequencing updated to include higher-grade Dalgaranga feed in first priority.

- Groupwide review of exploration budgets—drilling targets where grade upside can make a difference.

- Review of capital management, including dividend policy, reinvestment split, and balance sheet guardrails.

Final Take

The planned Ramelius Resources takeover of Spartan Resources is more than consolidation; it’s a scale reset for an Australian mid-tier that wants to match up with bigger domestic peers. With a close to $2.4 billion transaction value, a 12.1Moz combined gold inventory, and a growth camp led by Dalgaranga, the combined group can deliver better free cash flow, optionality, and relevance in a volatile commodity cycle.

If shareholders support it—as initial indications do point they will—Western Australia gains another blue-chip to its gold portfolio.