The World’s Next Resource Rush

Source: Getty Images

It isn’t coal. It isn’t oil. And it isn’t even iron ore — although that stone constructed modern China’s cities and fueled Australia’s previous great mining boom.

The new global competition is for something much less apparent: the green metals that enable clean energy. Lithium to hold electricity in a battery. Nickel and cobalt to stabilize and protect those batteries. Rare earths to rotate the magnets within windmills and electric vehicles.

Unlike previous booms, this is not simply about excavating holes and sending cargoes to whoever offers the highest payment. It’s a geopolitical race. It’s about who gets to command the supply of the materials that will determine if the world achieves its climate targets — or not.

And this is where Australia’s ASX-listed miners and Canada’s TSXV-listed explorers enter the stage. These two stock exchanges, worlds apart geographically, have unbeknownst to many, become the staging grounds of choice for mining companies in pursuit of the clean energy metals of the future.

Sydney and Toronto-based investors aren’t merely wagering on geology in the ground. They’re influencing the direction of the global energy transition.

Why Green Metals Matter So Much

Source: Getty Images

Step back with us. What is so special about these “green metals”?

The Electric Vehicle Factor

An electric vehicle may appear stylish and minimalist alongside a petrol version — no fuel tank, no exhaust pipe. But beneath the bonnet, the contrasts are astronomical. Six times the mineral input is needed for an EV compared to a normal car. That’s because its beating heart is the battery pack, a slab of cells weighing hundreds of kilograms.

- Lithium is the primary constituent of the cathode.

- Nickel increases the energy density so your EV will travel farther per charge.

- Cobalt makes the battery more stable and fires less likely.

- Graphite creates the anode, where the charge is stored.

Without these, an EV is nothing more than a metal body.

Renewable Power Needs – A Closer Look

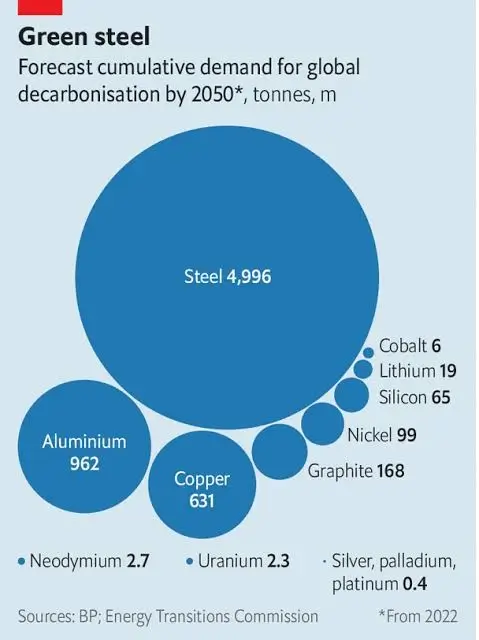

As we speak of the clean energy transition, it is easy to imagine wind turbines spinning elegantly, solar panels shining in sunlight, and shiny EVs gliding silently through city streets. But behind this vision is a very different reality: an enormous demand for raw materials.

A conventional gas-fired power plant primarily requires concrete for foundations, steel for structures, and turbines for conversion. After you construct it, the raw material demands are relatively upfront and known.

Renewables are a different beast. Take wind power for instance. Modern turbines — especially offshore ones that can be taller than the Eiffel Tower — rely heavily on rare earth permanent magnets. These magnets, made from neodymium, praseodymium, and dysprosium, are what allow turbines to convert wind into electricity efficiently. Without them, we’d be left with bulkier, less efficient designs.

Now move to solar. Although panels themselves employ materials such as silicon and silver, the actual mineral intensity appears when you scale up. Constructing large solar farms calls for aluminium for frames, copper for cables, and more and more use of rare earth elements in high-efficiency inverters.

But maybe the single largest game-changer is energy storage. A fossil fuel power plant stores its energy in the fuel itself — gas, coal, or oil. Renewables don’t have that option; they require batteries to offset intermittency. And batteries — for both grid-scale storage and electric vehicles — are voracious guzzlers of lithium, cobalt, nickel, and manganese.

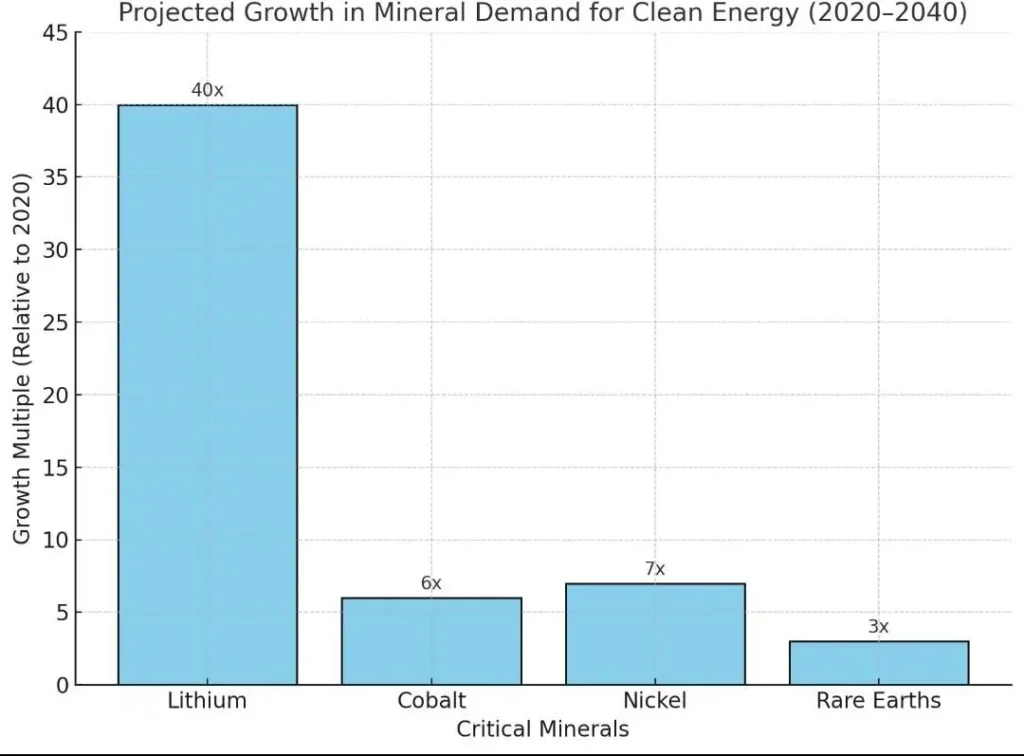

- The International Energy Agency (IEA) has sounded the alarm:

- Demand for critical minerals might quadruple by 2040.

- Demand for lithium alone might rise 40 times over, with most coming from EVs and battery storage.

- Demand for cobalt and nickel might triple, and rare earth needs for magnets might rise sevenfold.

This isn’t a “green tweak” of current supply chains — it’s an entire rewiring of the world economy. Mining, refining, and supply chains will all have to scale and diversify. And already, pressure is beginning to manifest: lithium prices surged wildly from 2021 to 2022 as EV adoption ramped up, and cobalt mining remains haunted by ethical and geopolitical concerns given its concentration in the Democratic Republic of Congo.

Australia’s ASX: The Powerhouse of Green Metals Supply

Australia’s mining legacy has always been considerable — from Pilbara iron ore to Bowen Basin coal. But in the age of clean energy, it’s the green metals ASX entities driving the trend.

Lithium: Australia’s Crown Jewel

Australia is already the world’s largest lithium producer, accounting for nearly half of global supply. The nation’s Pilbara region has emerged as a lithium powerhouse, with entities such as:

- Pilbara Minerals (ASX:PLS), which runs the enormous Pilgangoora project.

- Allkem (ASX:AKE), with Australian and Argentine lithium assets.

- Mineral Resources (ASX:MIN), offsetting its iron ore business with lithium.

These green metals ASX players aren’t merely exporting raw spodumene anymore. They’re heavily investing in downstream processing — transforming ore into battery-grade lithium hydroxide. That’s where the real value adds up.

Read More About Australia’s ASX Listed Companies Securing Global Supply Chains

The downstream move is supported by government incentives, such as the A$2 billion Critical Minerals Facility, to see Australia capture a larger share of the battery supply chain.

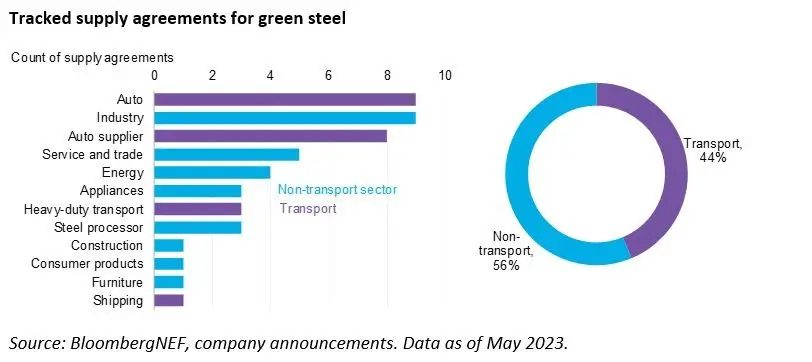

Nickel and Cobalt: The Comeback Kids

Nickel has cycled through boom-and-bust before. But the EV revolution has breathed new life into it. Western Australia is home to some of the planet’s richest nickel sulphide deposits, with IGO Limited (ASX:IGO) and BHP (ASX:BHP) pouring billions to expand production.

Cobalt, typically a by-product of nickel, is becoming more precious due to the fact that more than 70% of global supply is found in the Democratic Republic of Congo. For automakers, that sets alarm bells ringing regarding ethical sourcing. Australian projects provide a lower-risk, ESG-compliant option.

Rare Earth Mining: Breaking China’s Grip

If there’s any sector where Australia punches above its weight, it’s rare earths. Lynas Rare Earths (ASX:LYC) is the sole large-scale producer outside China. Its WA-based Mount Weld mine is world-class, and its Malaysian processing plant feeds Japanese and US producers clamouring to diversify away from Beijing.

Other ASX juniors are lining up as well: Arafura Rare Earths (ASX:ARU) is advancing the Nolans Project in the Northern Territory, and Hastings Technology Metals (ASX:HAS) is progressing in Yangibana.

For Australia, rare earths aren’t merely a business — they’re a strategic asset.

Policy Tailwinds

The Albanese government has officially made critical minerals a priority of national significance. Money is pouring into processing centers, R&D, and infrastructure. There’s even speculation about building Australia up as a “renewable energy superpower”, not only through green hydrogen but through its critical minerals endowment.

Green metals ASX companies are therefore receiving unprecedented interest from international investors.

Canada’s TSXV: The World’s Junior Mining Incubator

While producers and near-producers run the ASX, the TSXV (Toronto Venture Exchange) is all exploration. It’s where early-stage explorers raise small amounts to pursue the next big discovery.

And in the case of green metals, the TSXV is abuzz.

Canadian Shield Lithium

Canada is not short on hard rock lithium deposits. The provinces of Quebec, Ontario, and Manitoba are experiencing a boom in exploration.

- Frontier Lithium (TSXV:FL) is developing a high-potential project in Ontario.

- Critical Elements Lithium (TSXV:CRE) is after spodumene in Quebec.

Policy is supportive as well. Ottawa has designated critical minerals as a mainstay of its industrial strategy, connecting it to its EV manufacturing plans in Ontario. TSX Ven

Cobalt Revival

It’s appropriate that there is a town in Canada literally named “Cobalt.” A former silver boomtown, it gained notoriety as a place of cobalt mining. TSXV mining companies are now reviving that reputation. First Cobalt (TSXV:FCC) is constructing North America’s first cobalt refinery, making Canada a producer for US gigafactories.

That’s key to diversifying out of Congo, where human rights issues haunt supply chains.

Rare Earth Explorers

Rare earths are also part of the TSXV narrative. Ucore Rare Metals (TSXV:UCU) is developing new separation technologies. Appia Rare Earths (TSXV:API) has discovered one of the largest potential deposits in Saskatchewan.

These projects might be smaller than Lynas in size, but they’re strategically important for North American supply chains.

Why the TSXV Matters

It is easy to ignore the TSX Venture Exchange (TSXV) since, superficially at least, many of its constituent companies seem tiny, risky, and frequently pre-revenue. To the naked eye, they seem little more than exploratory hopefuls drilling holes in Canada’s remotest reaches. But that is to miss the larger picture. Nearly all of today’s world mining giants—those that now produce lithium for EV batteries, nickel for stainless steel, and rare earths for wind turbines—were once in exactly the same position as these juniors.

The TSXV is more than a stock exchange; it’s a platform for discovery and innovation. By funding early-stage miners, it makes possible the risky but necessary activity of exploration. Without this phase, there would never be new discoveries, and the clean energy revolution would stall for lack of key raw materials. It’s like the incubator in which tomorrow’s producers are spawned, tested, and proven or culled.

For investors, the TSXV presents a rare opportunity to get in on the ground floor of what may prove to be the next big mining success story. While not all juniors succeed, those that do have the potential to grow into multi-billion-dollar companies, generating massive value in the process. More significantly, for the world in general, the TSXV ensures that there is a constant stream of new discoveries of lithium, cobalt, copper, and rare earth that continue to flow into development. And with the way critical in the need for green metals has now become, this pipeline is not just valuable—it’s vital.

Comparing ASX and TSXV: Different but Complementary

When it comes to mining finance, the Australian Securities Exchange (ASX) and the Toronto Venture Exchange (TSXV) may look like rivals at first glance. After all, both exchanges attract hundreds of junior mining companies looking to raise money for exploration. But dig deeper, and you’ll see they actually play complementary roles in building the global supply chains for rare earths, lithium, cobalt, and other critical minerals.

1. Scale: Producers vs. Explorers

ASX (Australia):

The ASX hosts some of the globe’s most mature critical mineral producers. Pilbara Minerals, Lynas Rare Earths, and IGO Limited are not merely names in documents—they deliver tonnes of product that directly go into EV batteries, magnets, and renewable energy initiatives across the globe. They operate on a big scale, revenue-driven, and well-established across the world.

TSXV (Canada):

The TSXV, on the other hand, is often where the story begins. Most companies here are pre-revenue explorers—lean teams with promising drill results and ambitious plans. While they don’t yet produce, they provide the pipeline of discoveries that, if successful, eventually graduate to larger exchanges or become buyout targets for majors.

Chart: Scale Difference (Producers vs Explorers)

| Exchange | Typical Company Stage | Example Companies | Output Status |

| ASX | Established producers | Pilbara Minerals, Lynas | Active global suppliers |

| TSXV | Early-stage explorers | Frontier Lithium, Canada Rare Earths | Mostly pre-revenue |

2. Focus: Regional Strengths

Each of the exchanges has its own “sweet spot” for critical minerals.

ASX:

Australia is endowed with world-class lithium (spodumene), rare earth, and nickel deposits. The ASX mirrors this natural bounty. There is a high degree of awareness among investors here about lithium mining economics and a willingness to support large-scale developments.

Canadian explorers on the TSXV generally aim at cobalt, lithium stage-one projects, and uranium. Canada’s sparsely explored northern territories mean that small companies can claim ground, raise little money, and begin drilling. Investors in the TSXV are willing to take on more risk, staking their bets on discoveries that could be years away from production.

Chart: Regional Strengths

| Exchange | Strong Mineral Focus | Why It Matters |

| ASX | Lithium & Rare Earths | Anchors global EV & magnet supply chains |

| TSXV | Cobalt & Early Lithium | Adds diversity and feeds early exploration pipeline |

3. Role: Muscle vs. Ideas

If the ASX is the muscle, then the TSXV is the brainstorming lab.

- ASX’s Role: Offers the financial muscle for companies ready to scale. Investors here seek near-term cash flow and long-term growth.

- TSXV’s Function: Provides the concepts and opportunities—fresh finds that later may be acquired by an ASX-listed major or grown into mid-tier producers.

Collectively, they are like two cogs within the same motor, pushing ahead the clean energy revolution. Without explorers, producers would eventually be out of new sources. Without producers, explorers would have no destination for their finds.

Chart: Roles in the Mining Ecosystem

| Role | ASX Contribution | TSXV Contribution |

| Exploration Ideas | Limited | Strong focus |

| Production Muscle | Strong | Minimal |

| Global Supply Impact | High, immediate | Future-oriented |

4. A Global Ecosystem in Action

One of the biggest underrated things is how interdependent these trades are:

- A number of TSXV companies end up dual-listing on the ASX (or even listing on the TSX main board) once they require larger funding rounds.

- On the other hand, some ASX companies venture into Canada and leverage Canadian investor demand for early-stage risk.

- Foreign investors tend to diversify their bets across both markets, using ASX as their “stable growth” bucket and TSXV as their “high-risk, high-reward” bucket.

This cross-pollination lessens the world’s dependence on China’s dominance of rare earth and lithium, creating a more diversified, stronger supply chain for the clean energy future.

To Simplify-

Consider the ASX and TSXV as various legs of a relay race. The TSXV explorers receive the baton first, run ahead with new discoveries, then pass it on to ASX-listed producers with endurance and capital to bring the project to the finish line. Neither can win the race by themselves—but collectively, they’re invincible.

The Roadblocks Ahead

The tale isn’t one of perfection. Green metals ASX and TSXV miners alike are up against a steep hill.

- Processing bottlenecks: China continues to hold sway over refining. Until Australia and Canada ramp up, they’ll be stuck as raw exporters.

- Environmental scrutiny: Mining for lithium or rare earths isn’t without consequence. Communities are calling for tighter ESG commitments.

- Capital intensity: Mines can take a decade or more to build, at costs in the billions. Exploration is cheap; production is not.

- Geopolitics: The US, EU, and China are all competing for influence. ASX and TSXV companies will find themselves navigating not just markets, but diplomacy.

Looking Forward: The Green Metals Playbook

The transition to clean energy is not negotiable. Net zero ambitions won’t be achieved without gargantuan new supplies of lithium, nickel, cobalt, and rare earths.

- Australia’s green metals ASX producers will remain pre-eminent in output, supported by huge reserves and capital markets.

- Canada’s TSXV miners will supply the discovery pipeline, pumping new projects into the system.

- Combined, they’ll be the Western world’s best hope to counterbalance China’s dominance.

For investors, it’s not another mining cycle. It’s a generation change. For policymakers, sovereignty is as important as climate. And for regular Australians and Canadians, it’s the opportunity to watch their nations at the center of a revolution across the world.

Conclusion: A Marathon, Not a Sprint

The green metals rush has arrived. In contrast to the fossil fuel booms of the past, this one isn’t a matter of burning up resources — it’s a matter of constructing a low-carbon future.

Australia’s ASX-listed miners and Canada’s TSXV-listed explorers are not just businesses; they’re the masterminds of tomorrow’s energy system. Whether they succeed or fail will set the pace — and the terms — on which the world decarbonises.

The stakes are higher than ever. But with the green metals TSXV and ASX mining leaders of the pack, the road to a clean energy future is just that little bit more feasible.