Nvidia announces a US$5 billion equity stake in Intel and a broad partnership to co-design PC and data-centre chips, a surprise move that redraws the global semiconductor battle line and takes markets by surprise. The news comes as Beijing is speeding up its quest for tech independence, summoning home local firms from some Western AI chips, and Washington is doubling down on its own domestic industrial policy. The acquisition and the geopolitical response together speed up an unraveling divergence in the world’s chip supply chains. (NVIDIA Newsroom)

Nvidia’s $5B stake in Intel heats up the AI chip wars as China doubles down on its drive for tech independence (Image Source: Techmeme)

Why it matters now

It is not a typical capital market transaction. Nvidia’s investment in Intel is a strategic realignment: one of the largest GPU vendors formally climbs into bed with one of the largest x86 CPU vendors to push combined platforms for artificial-intelligence workloads and next-generation PCs. And China openly accelerates the attempts to replace foreign chips with Chinese chips — an agenda which will change where and how the world buys compute power. Both technologies together alter incentives for cloud providers, governments, and vendors. (NVIDIA Newsroom)

The top-line deal, facts at a glance

Nvidia will invest US$5 billion in Intel common stock at US$23.28 per share and will work with Intel to deliver multiple generations of novel data-centre and PC solutions. The partnership will unite Nvidia’s GPU and interconnect technology with Intel’s CPUs and x86 ecosystem. Markets respond quickly: Intel shares surge in pre-market trade while Nvidia sees muted price action as investors digest the strategic pivot. (NVIDIA Newsroom)

A human story behind the memo

Senior executives refer to the partnership as pragmatic. Nvidia CEO Jensen Huang pitches the deal as “merging” GPU and CPU technologies to offer more integrated computing stacks to enterprise purchasers. For Intel, the vote of confidence from a tech giant follows a rough stretch, and after unusual public urging from the US government, which recently converted CHIPS Act-related investment into an equity stake in a bid to create domestic capability.

The significance of the impression: private-led investment and public backstop underscores how chips have become a strategic battleground for shareholders and states. (Reuters)

Nvidia calls the Intel deal a practical move to merge GPU and CPU power, while US backing shows chips are now a battleground for business and governments alike (Image Source: Asia Tech Review)

What the companies will actually make

According to Nvidia’s press release, Intel will make x86 system-on-chips with Nvidia RTX GPU chiplets on multiple PCs, and both will work together on generational platforms for data centres.

The step is an indicator of tighter hardware-software co-design, CPU and GPU as one rather than discrete units, that has the potential to revolutionize how OEMs and hyperscalers define machines. Both companies report that they will have multiple generations of products from the union, although rollout plans are unclear. (NVIDIA Newsroom)

Near-term impact and market reaction

Markets interpret the announcement as a vote of confidence in the Intel turnaround. Pre-market trading records double-digit gains on Intel stocks in response to the news, representing relief by investors and the potential for new demand for systems built by Intel. The ripple does not leave anyone out: contract manufacturers and suppliers update demand estimates, and chip-foundry strategy deliberations gain momentum. Analysts cite how the deal will pinch AMD and Taiwan’s TSMC by changing customer loyalty and product roadmaps. (Barron’s)

$NVDA invests $5B in $INTC at $23.28/share

Market reaction:

Intel +32% premarket

NVIDIA +3.27%

AMD -5%The deal structure:

• NVIDIA taking minority stake, no board seat

• Co-developing x86 CPUs for NVIDIA data centers

• Intel building x86 SOCs with integrated RTX graphics

•… pic.twitter.com/vn0BgosUxU— Balvinder Kalon (@BalvinderKalon) September 18, 2025

The geopolitical backdrop — Washington and Beijing both move

This deal does not take place in a vacuum. Earlier this year the US attempted to convert CHIPS Act grants to an almost-10% stake in Intel as part of a wider industrial policy effort to revive US manufacturing and take control of strategic supply chains. Meanwhile, Chinese regulators demonstrate a harder line towards imports of certain Western AI chips and are backing local chip champions with state capital and industrial programs for self-sufficiency. The result is a more politicized semiconductor sector, where policy and strategy are as valuable as engineering. (Reuters)

Beijing’s reaction — a new wave of tech-sovereignty push

Chinese regulators have already compelled leading tech firms to halt the purchase of some Nvidia chips — a drastic measure that betrays fear of strategic dependence on foreign chips. State-backed investors and corporate sponsors such as Huawei, meanwhile, forge ahead with homegrown AI processor architectures and “supernode” labs to weave hundreds of domestic chips into colossal clusters. Beijing’s message is clear: Fewer foreign bottlenecks in the compute stack are preferable. (Reuters)

Beijing tightens chip rules, pushes Huawei and state-backed firms to build homegrown AI processors and clusters, aiming to cut foreign reliance (Image Source: BBC)

Who wins and who loses

Winners:

- Intel — gains fresh capital, credibility and a means of getting its CPUs integrated into future systems. (NVIDIA Newsroom)

- Nvidia — has tighter hardware connections to x86 platforms and less customer frictions when they desire integrated stacks. (NVIDIA Newsroom)

- US industrial policy — gains a case study in public+private action to maintain chipmaking competitiveness. (Intel Corporation)

Losers or at risk:

- Firms such as AMD and certain foundries will face increased competition or shifting customer loyalties. (Reuters)

- Chinese purchasers of US chips — will face political pressure if regulators instruct them to go elsewhere than Western suppliers. (Reuters)

What it implies for foundries and supply chains

The partnership does not immediately change who makes what. Nvidia has long relied on dedicated foundries such as TSMC to produce GPUs; the agreement specifically rules out Intel’s foundry business from up-front collaboration. But it does lay the foundation for co-design of architectures that shapes patterns of demand: if Intel makes more x86+GPU SOCs to order, that will change patterns of volume in packaging, interconnects and memory buying – terrain where geopolitics already presents risk. (Reuters)

The deal leaves Nvidia’s chips with TSMC for now, but co-design with Intel could shift demand across packaging, memory, and supply chains already strained by geopolitics (image Source: KAP Limited)

The China factor — fast followers and national champions

China has long invested in chip independence. Recent announcements from domestic players, plus new state funds and R&D budgets, show the country accelerating a decades-long strategy to build a parallel supply chain. Huawei’s newly public roadmap for Ascend series chips and its “Atlas” supernode platforms underline how domestic designs can scale through software and system integration rather than raw process-node primacy alone. That matters since scale and architecture decisions can blunt an exporter’s advantage even when the silicon is several generations old. (Reuters)

Regulation and antitrust risks

Both sides are under scrutiny. In China, regulators have raised antitrust flags on Nvidia’s past acquisitions and now are warning companies off from buying certain chips. In the US, government ownership of Intel increases political leverage and trade-off potential for foreign sales. Cross-licensing, favoritism agreements, or exclusionary agreements will draw competition authorities’ and policymakers’ attention on both sides of the Pacific.

China declares: NVIDIA violated anti-monopoly laws after conducting ‘preliminary probe’

Shares drop about 2% in pre-market trading & US stock index futures pared gains

US chipmaker acquired bunch of high-tech companies before

China’s voice matters for US giants, after all pic.twitter.com/BE26uovhBv

— RT (@RT_com) September 15, 2025

For hyperscalers and enterprise buyers

Hyperscalers desire supply and predictable performance. For suppliers, the transaction can simplify procurement when x86+GPU systems are consolidated and meet performance and cost targets. Customers, however, will balance vendor lock-in, supply risk, and geopolitical risk: China-based entities will trade technical specifications for regulatory direction; global entities will plan contingencies against fractal supply chains.

Brief tech aside: What is an x86 RTX SOC?

An x86 RTX system-on-chip integrates Intel general-purpose CPU cores and Nvidia GPU chiplets and bridges them. The goal: lowered power, lower size and more integrated software optimization of workloads that mix general compute and special-purpose acceleration. For PC makers and OEMs, it simplifies board design complexity and lowers latency between processor domains. For data centers, it translates into denser and more power-efficient machine designs — if performance and cost thresholds are met. (NVIDIA Newsroom)

Strategy and signalling — why Nvidia might be making this move

Strategically, Nvidia benefits from maintaining its GPU ecosystem at the leading edge as computing paradigms shift. By aligning with Intel, Nvidia benefits from closer integration on the dominant CPU architecture in enterprise computing — and it hedges against fragmentation should geopolitics ever limit cross-border sales or supply chains. It also acquires influence in a major CPU vendor, makes roadmaps converge, and reduces friction to customers.

The policy challenge: public money and private bets

The nearly-10% US government stake in Intel — converted from CHIPS Act funding — and Nvidia’s private investment in total illustrate how public policy and private capital can clash or intersect around strategic industries.

That raises questions of governance: how will governments balance national security interests and fairness in the market? How will companies and regulators make product decisions with priorities on both sides of the Pacific? Additional hearings, filings and diplomatic negotiation can be anticipated as these tensions unfold.

Another way of looking at this is that NVIDIA, which is entirely dependent on the federal government to access certain large export markets, put $5bn into a partially government owned company pic.twitter.com/xXUb5w5jN9

— Matthew Zeitlin (@MattZeitlin) September 18, 2025

What investors and operators should watch for next

- Product roadmaps — announcements suggested several generations but not specific ship dates; watch watch road-maps and OEM commitments.

- Regulatory filings — antitrust or national security reviews that may have conditions. (The Wall Street Journal)

- Foundry actions — in the event that Intel does indeed manufacture Nvidia chips, that changes TSMC’s role; no plans yet for using Intel’s foundry. (Reuters)

- China’s industrial policy — cycles of investment, IPOs and regulatory guidance will tint the pace of local substitution. (Reuters)

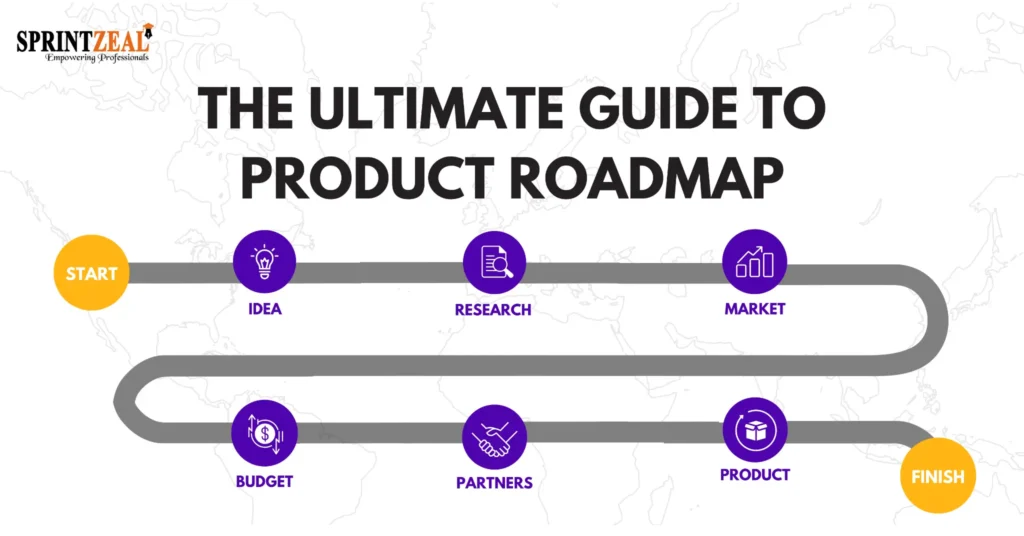

Investors should track product roadmaps, regulatory reviews, potential Intel foundry use, and China’s shifting industrial policies shaping chip competition (Image Source: Sprintzeal.com)

Voices from the marketplace

Commentators see the announcement as a win for Nvidia and a lifeline for Intel. Others worry the move accelerates bifurcation: two competing ecosystems may emerge — one based on Western suppliers and policy and the other on Chinese national champions and domestic procurement rules. Executives on both sides rhetorically call for dialogue, but technology and trade competition is razor-sharp.

The decision signals a tactical recalibration by Beijing, which is now concentrating its regulatory firepower on Nvidia, the world’s most valuable chipmaker, as a point of leverage in US-China negotiations https://t.co/dEqtt7hm4O pic.twitter.com/CQra9Pignk

— Financial Times (@FT) September 18, 2025

Also Read: Strive Completes Merger and Raises $750 Million for Bitcoin Strategy Financing

A note to crypto and blockchain developers

For blockchain companies and crypto projects that rely on GPU compute, the acquisition is indirectly applicable. Supply dynamics for GPUs — and the degree to which geopolitical prohibitions affect availability — dictate cost and availability for computation-heavy activities such as model training or running zk-rollups and SNARK proving systems. Developers can diversify procurement channels and expect scattered hardware availability by geolocation.

Frequently Asked Questions (FAQs)

Q: Is Nvidia buying into part of Intel or is it simply taking a strategic investment?

A: Nvidia is investing US$5 billion in Intel common stock and entering into a joint venture to co-develop PC and data-centre products — a clear equity stake and strategic alignment. (NVIDIA Newsroom)

Q: Will Nvidia start making CPUs?

A: No. The news is that Intel is going to make x86 system-on-chips with Nvidia GPU chiplets integrated inside; it doesn’t make Nvidia a foundry or Intel the exclusive maker of Nvidia GPUs. Foundry status quo for now, at least. (NVIDIA Newsroom)

Q: Is China banning Nvidia chips?

A: Chinese authorities also recently urged top technology companies to halt the purchase of certain Nvidia chips, including the RTX Pro 6000D model, as Beijing speeds up a self-reliance push — a major signaling move that contributes to market access complexity in China.

Q: What is the role of the US government?

A: America has invested CHIPS Act funds in an almost 10% ownership stake in Intel, showing policy favoritism for keeping chip capacity and control onshore. That public investment introduces a geopolitical factor into private investment.

Q: What is next to be done by the buyers?

A: Major buyers and cloud providers need to track product roadmaps, diversify supply where feasible, and model procurement scenarios based on regional constraints as well as vendor partnerships. Companies need to speak to suppliers to obtain information on delivery risk.

Bottom line

Nvidia’s US$5 billion wager on Intel is not just bigger than cash: it is a technical, political and strategic thrust that compels integration up and down the compute stack as powerful states seek to localise strategic technology.

It forms a more complex, more disputed terrain in which engineering choices, market strategy, and geopolitics intersect. The message to industry players is to prepare for fragmentation, to invest in technical alliances where they provide advantage, and to treat supply chains as an asset and not a commodity. (NVIDIA Newsroom)