Norwegian Block Exchange Leads Norway’s Public Bitcoin Treasury Movement

Norwegian Block Exchange (NBX), a major cryptocurrency exchange and digital asset platform in the Nordic region, has taken a groundbreaking step by holding Bitcoin as part of its corporate assets. This move establishes NBX as the first publicly listed company in Norway to maintain Bitcoin on its balance sheet. It’s a strategic decision that aims to support its core business operations while opening up new avenues for revenue in the evolving digital currency market.

Adding Bitcoin to the company’s treasury is more than just owning digital currency. It reflects NBX’s ambition to stay at the forefront of innovation within digital assets. The company previously launched the world’s first credit card that offers cashback in Bitcoin, a unique product that shows its commitment to pushing boundaries. Incorporating Bitcoin into its balance sheet is a natural progression that will help NBX continue delivering innovative services to its customers.

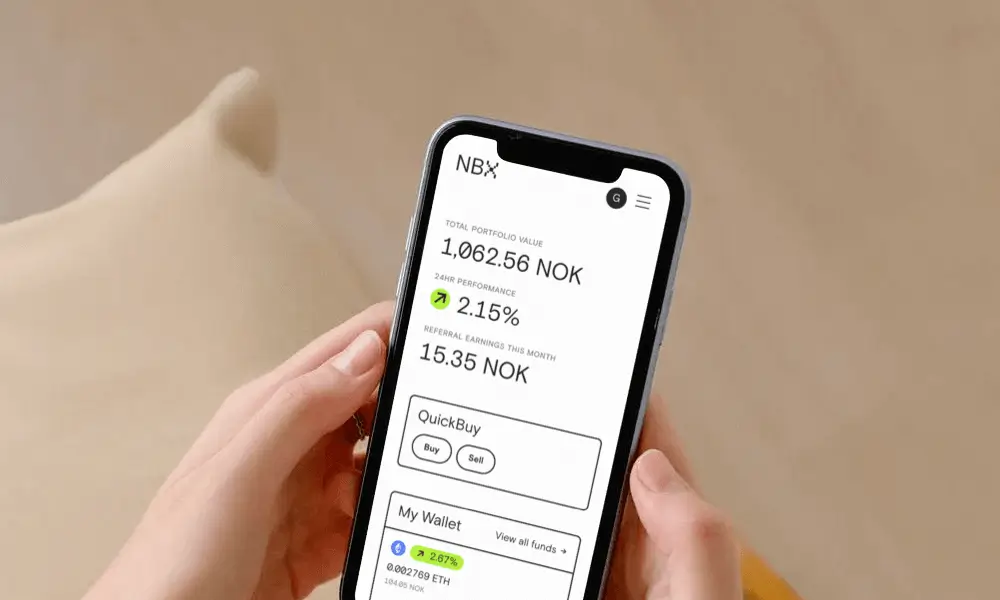

Image 1: NBX platform (Source: NBX)

Building New Financial Products with Bitcoin and Stablecoins

NBX’s strategy involves more than just holding Bitcoin. The company is set to become the only European issuer of USDM, a stablecoin compliant with the MiCA regulations, which will operate on the Cardano blockchain. Stablecoins like USDM are cryptocurrencies designed to keep their value stable, typically tied to a fiat currency such as the US dollar. NBX will use Bitcoin as collateral to back this stablecoin, creating new opportunities to generate income from both Bitcoin and USDM within the Cardano ecosystem.

Currently, NBX has acquired six Bitcoins and plans to increase its holdings to about ten Bitcoins by the end of June. This initial phase will serve as a proof of concept for the company’s Bitcoin treasury strategy. The Bitcoins were loaned from some of the largest holders in the market, and NBX has committed not to sell or short the Bitcoin it holds. This approach indicates a long-term belief in Bitcoin’s value and its importance for the company’s future.

In addition to holding Bitcoin, NBX aims to expand its product offerings by launching Bitcoin-backed loans. This would allow private and corporate customers to borrow funds using Bitcoin as security. It’s part of NBX’s broader goal to grow into a digital asset bank that provides a wide range of financial services centred on cryptocurrencies.

JUST IN: Norwegian Block Exchange becomes the first publicly traded #Bitcoin treasury company in the country pic.twitter.com/kY9KK2VbFi

— Bitcoin Magazine (@BitcoinMagazine) June 2, 2025

Investor Confidence and Market Impact

The news of NBX’s Bitcoin treasury plan was well received by the market. On June 2, the company’s share price surged more than 138%, closing at 0.033 euros ($0.038). While this is below its all-time high of 0.93 euros ($1.06) reached in January 2022, the significant price jump highlights investor enthusiasm and confidence in NBX’s strategy to integrate Bitcoin into its operations.

This move by NBX aligns with a growing trend in Norway and across the globe, where companies are increasingly adding Bitcoin to their balance sheets. A notable example is Aker ASA, a Norwegian industrial holding firm that owns a subsidiary named Seetee, which is dedicated to investing in Bitcoin and other crypto assets. Seetee currently holds over 1,170 Bitcoins, which were acquired at an average price of around $50,200 per Bitcoin and are now valued much higher.

Read Also: Bitcoin’s Next Chapter: Analysts See $150K Ahead Despite Market Dip

Other Norwegian companies are following similar paths. Crypto brokerage firm K33 has announced plans to buy and hold Bitcoin after raising 60 million Swedish krona ($6.2 million). Norway’s sovereign wealth fund, Norges Bank, also holds Bitcoin indirectly through its investments in publicly traded companies.

The trend is not limited to Norway. In Europe, Blockchain Group, a Paris-based crypto firm, saw its share price jump 225% after it started buying Bitcoin. In Indonesia, fintech company DigiAsia Corp experienced a 91% increase in shares following its announcement to raise $100 million to fund Bitcoin purchases. These examples demonstrate how corporate adoption of Bitcoin is influencing stock markets worldwide.

Image 2: NBX trading platform (Source: NBX)

Looking Ahead: Growth and Opportunities

NBX’s decision to establish a Bitcoin treasury is part of a larger plan to position itself as a digital asset bank. The company is actively engaged in discussions with high-net-worth individuals and family offices about raising additional capital to buy more Bitcoin. This influx of funds would allow NBX to expand its Bitcoin holdings and develop new financial services.

By holding Bitcoin and issuing a MiCA-compliant stablecoin, NBX is combining traditional financial tools with innovative digital assets. This approach allows the company to diversify revenue streams and cater to clients who seek exposure to Bitcoin but prefer to invest through publicly listed entities.

NBX also plans to offer secure custody services for Bitcoin, which include insurance and professional management. This is important for private and corporate clients who require safe and compliant storage of their digital assets. Generating yield on Bitcoin through lending and other DeFi (decentralised finance) mechanisms is another key part of the company’s strategy.